As one of the world's premier financial hubs, Singapore is not immune to the global problem of money laundering. Despite stringent anti-money laundering (AML) regulations, illicit funds continue to flow through financial systems, casting a shadow over the integrity and security of the nation's financial institutions. The sophistication of these illicit activities often outpaces traditional detection methods, necessitating advanced solutions to combat this financial crime effectively. Money laundering erodes trust in financial institutions and threatens Singapore's reputation as a safe and transparent place to do business.

Enter Tookitaki, a leader in the realm of AML compliance software whose mission is to make regulatory compliance seamless and effective. Tookitaki has developed an innovative end-to-end AML compliance solution designed specifically to address the complex and evolving landscape of money laundering. Using advanced technologies, Tookitaki's AML solution empowers financial institutions to detect suspicious activities more precisely, reduce false positives, and ensure stringent regulatory compliance. This blog will delve into the many advantages of Tookitaki’s end-to-end AML compliance solution for Singaporean financial institutions, illustrating how this state-of-the-art solution transforms the fight against money laundering in the region.

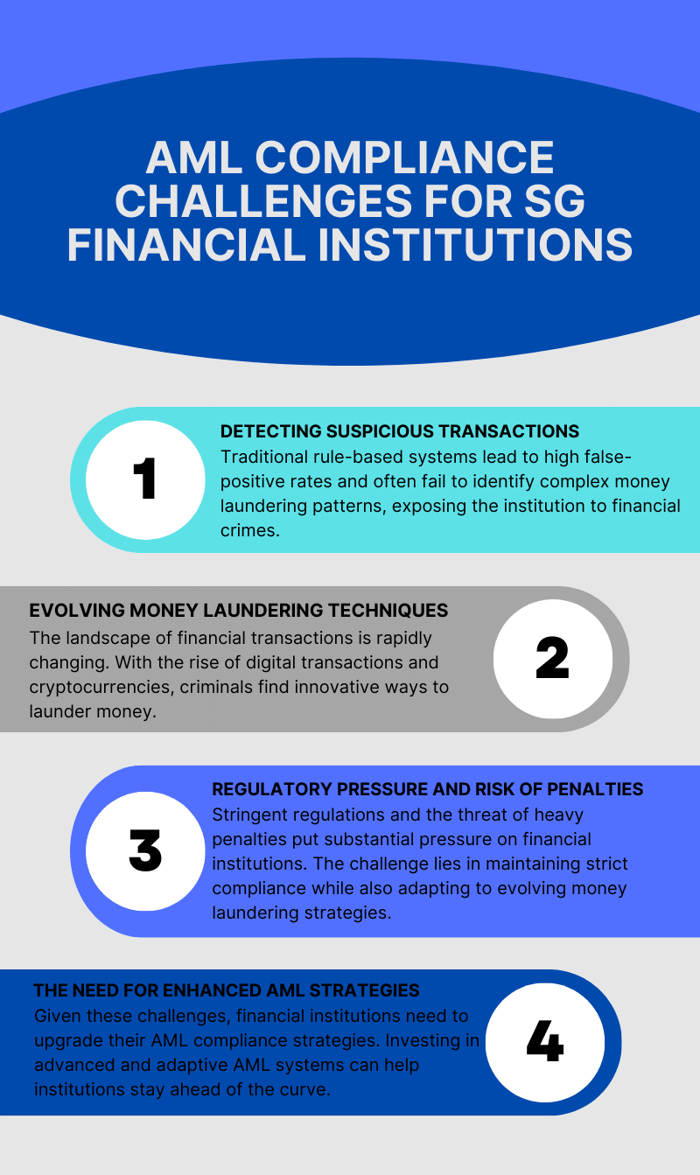

Overview of AML Compliance in Singapore

Regulatory Landscape for Financial Institutions

Singapore is known for its robust and comprehensive regulatory framework, primarily overseen by the Monetary Authority of Singapore (MAS). The country's strong commitment to maintaining its reputation as a secure financial hub has led to strict anti-money laundering (AML) and countering the financing of terrorism (CFT) rules and regulations.

All financial institutions operating in Singapore are expected to comply with these regulations, which involve conducting customer due diligence, maintaining accurate records, and reporting suspicious transactions promptly. Financial institutions are also expected to have robust internal policies, procedures, and controls in place to mitigate money laundering and terrorist financing risks. Non-compliance can lead to severe penalties, including substantial fines and loss of business licenses.

Tookitaki’s End-to-End AML Compliance Solution

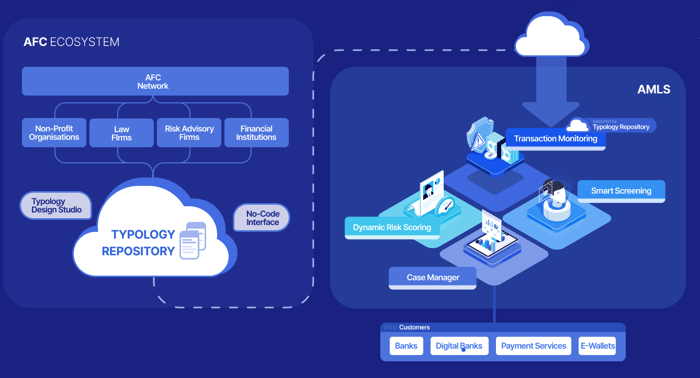

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's Anti-Money Laundering (AML) Suite and Anti-Financial Crime (AFC) Ecosystem work in tandem to address the limitations of siloed systems in combating money laundering. The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime.

The AMLS is a software solution deployed at financial institutions. It is an end-to-end operating system that modernises compliance processes for banks and fintechs. The AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML programs remain cutting-edge.

How Tookitaki’s Solution Differs from Traditional AML Compliance Solutions

Tookitaki's AMLS and AFC Ecosystem differ from traditional AML solutions in two key ways: a unique community-based approach and the innovative use of federated machine learning.Traditional AML solutions often operate in silos, relying on each financial institution's data and expertise to detect and prevent financial crimes. Tookitaki, on the other hand, brings together a community of financial institutions, regulatory bodies, and risk consultants in its AFC Ecosystem, creating a collective knowledge base and promoting collaboration in the fight against financial crime.

This community-based approach allows Tookitaki to develop a comprehensive Typology Repository, a living database of money laundering techniques and schemes that is continuously updated with the latest information from the AFC Ecosystem. This ensures that Tookitaki's clients can access the most current and relevant data to combat money laundering effectively.

Additionally, Tookitaki leverages federated machine learning to bridge the gap between the AFC Ecosystem and the AMLS deployed at financial institutions. Instead of sharing sensitive data, federated learning allows the AMLS to access the latest typologies from the AFC Ecosystem and execute them locally at the client's end. This unique integration enables financial institutions to stay ahead of the curve and maintain cutting-edge AML programs while preserving data privacy and security.

Advantages of Tookitaki’s End-to-End AML Compliance Solution

Efficiency in Identifying Suspicious Transactions

Tookitaki’s end-to-end AML solution greatly enhances the efficiency of identifying suspicious transactions. By leveraging sophisticated machine learning algorithms, the system can analyze vast amounts of transaction data and identify complex patterns and anomalies that may indicate illicit activity. The ability to process and analyze large datasets at high speed enables financial institutions to rapidly detect potential money laundering threats and take appropriate action, giving them a crucial edge in the battle against financial crime.

High-quality Alerts and Improved Accuracy

One of the greatest advantages of Tookitaki’s solution is its ability to significantly reduce false positives, a common issue with traditional AML systems that often leads to unnecessary investigations and drains resources. By using advanced machine learning techniques, Tookitaki’s system improves alerts' accuracy, ensuring compliance teams focus their efforts on genuine risks. This saves valuable time and resources and improves the effectiveness of AML operations.

Enhanced Regulatory Compliance and Risk Management

Tookitaki’s solution aids financial institutions in maintaining robust AML compliance. Its comprehensive approach, which encompasses transaction monitoring, customer risk rating, sanctions screening, and more, ensures that all aspects of AML compliance are covered. Furthermore, the system's machine learning capabilities allow it to adapt to changing regulations and emerging laundering tactics, thereby ensuring that institutions remain compliant amidst evolving regulatory landscapes.

Additionally, Tookitaki’s solution enhances risk management by providing clear, actionable insights into potential risk areas. Its advanced analytics capabilities offer a holistic view of an institution's risk profile, enabling the development of more effective risk management strategies and better decision-making. Ultimately, this can contribute to improved institutional reputation, customer trust, and peace of mind for stakeholders knowing that their institution is well-protected against financial crime.

Case Study: Deploying AMLS for Streamlined Transaction Monitoring in a Next-Gen Digital Bank, Singapore

The Challenge

A next-gen digital bank launching its services in Singapore met with a significant roadblock - timely compliance with the Monetary Authority of Singapore's (MAS) regulations, specifically Anti-Money Laundering (AML) requirements. The task entailed speedy onboarding of new transaction monitoring scenarios and adapting to the ever-changing regulatory landscape and AML patterns.

The Solution

The digital bank took a proactive approach by deploying Tookitaki's Anti-Money Laundering Suite (AMLS) for Transaction Monitoring. This platform enabled building a robust transaction monitoring solution tailored to the bank's needs.

The AMLS was set up to monitor more than 20 typologies, including but not limited to Current Account Savings Account (CASA), lending, payment, and Small and Medium-sized Enterprise (SME) banking. A crucial aspect of the solution was the provision of a streamlined system for investigation and reporting.

The Results

The AMLS Transaction Monitoring platform deployment resulted in comprehensive risk coverage, ensuring 100% compliance with MAS's AML requirements. The new system proved to be extremely efficient, reducing the time to onboard new scenarios by approximately 50%. Moreover, the centralization of case management facilitated faster and more effective investigations, providing an all-around solution to the bank's initial challenges.

How Tookitaki’s Solution Meets the Unique Needs of Singaporean Financial Institutions

Tookitaki understands that each financial institution has its unique needs and challenges. For Singaporean financial institutions, the city-state's status as a major global financial hub presents specific challenges, such as a high volume of cross-border transactions and an elevated risk of exposure to international financial crime.

Tookitaki's solution is designed to tackle these challenges head-on. Its ability to process and analyse vast amounts of data suits institutions handling a high volume of transactions. Moreover, its robust risk rating system and adaptive learning capabilities enable it to identify evolving trends in money laundering, effectively mitigating the risk of exposure to international financial crime.

Additionally, Tookitaki's solution is scalable and flexible, meaning it can be adapted to fit institutions of different sizes and types, from large multinational banks to smaller local banks and non-bank financial institutions. This versatility makes Tookitaki's solution a highly effective tool for a broad range of Singaporean financial institutions.

Harnessing the Power of Tookitaki's AML Solution: A Final Review and Way Forward

Tookitaki's end-to-end AML Compliance Solution offers a dynamic and robust approach to mitigating the risk of money laundering for financial institutions in Singapore. Its ability to efficiently identify suspicious transactions, reduce false positives, and enhance regulatory compliance and risk management, positions it as an indispensable tool in the modern financial landscape. Customised to align with Singaporean regulations and uniquely tailored to address the challenges faced by Singaporean financial institutions, Tookitaki's solution is a game-changer in the fight against financial crime.

The journey to robust, efficient, and effective AML compliance begins with a single step - embracing innovative solutions. Financial institutions in Singapore are urged to consider the vast benefits of integrating Tookitaki's AML compliance solution into their risk management strategies. Embarking on this transformative journey with Tookitaki not only enhances the integrity and resilience of your institution but also contributes significantly to the broader goal of safeguarding Singapore's financial system. Connect with the Tookitaki team today to learn more about how this cutting-edge solution can revolutionise your approach to AML compliance.

Anti-Financial Crime Compliance with Tookitaki?