The financial landscape in Thailand has been rapidly evolving, with contactless payments becoming increasingly popular among consumers. This shift towards cashless transactions can be attributed to factors such as the widespread adoption of smartphones, improved internet connectivity, and a growing demand for seamless, frictionless payment experiences. As a result, various mobile wallets, digital banks, and contactless cards have emerged to cater to this demand, fueling the growth of the contactless payments market in the country.

While the rise of contactless payments brings numerous benefits, such as increased convenience and speed of transactions, it also presents new challenges in the form of financial crime risks. Fraudsters and money launderers constantly adapt their techniques to exploit vulnerabilities in the digital payment ecosystem. This makes it crucial for financial institutions, payment service providers, and other stakeholders to implement robust Anti-Money Laundering (AML) and compliance solutions to effectively detect, prevent, and combat financial crimes in this fast-growing sector. This blog will discuss how Tookitaki's innovative AML solutions can help stakeholders in Thailand's contactless payment landscape keep up with the evolving risks and regulatory requirements.

Contactless Payments Landscape in Thailand

Major players in the market

The contactless payments market in Thailand is characterized by a diverse range of players, including traditional banks, fintech companies, and global payment giants. Some of the key players in the market include PromptPay, a national mobile payment platform launched by the Central Bank of Thailand, and mobile wallets like TrueMoney, Rabbit Line Pay, and AirPay. International payment providers such as Visa, Mastercard, and UnionPay have also introduced contactless cards and payment solutions in the country, further expanding the options available to Thai consumers.

Adoption rate and trends

The adoption of contactless payments in Thailand has grown steadily over the past few years, with consumers increasingly opting for digital transactions over cash. The COVID-19 pandemic has further accelerated this shift, as people sought safer, contact-free methods of payment to minimize the risk of infection. A growing preference for e-commerce and the Thai government's push for a cashless society has also contributed to the rising adoption rate of contactless payments. With mobile and internet penetration rates continuing to rise, the popularity of contactless payments in Thailand is expected to only grow in the coming years. The availability of diverse payment methods has also driven the preference for digital and contactless payments. TrueMoney, for example, accounted for 16.8% of preferred payment methods in Thailand due to its lower acceptance fees compared to debit and credit card transactions.

Regulatory environment

As the contactless payments landscape in Thailand continues to expand, the regulatory environment has also evolved to address the associated risks and challenges. The Bank of Thailand (BOT) plays a crucial role in overseeing and regulating the country's payment systems, ensuring their stability, efficiency, and security. Key regulations governing the contactless payments sector include the Payment Systems Act, which aims to promote the development of efficient payment systems and protect consumer interests, and the Electronic Transactions Act, which provides a legal framework for electronic transactions and digital signatures.

Recent regulatory developments include the introduction of standardized QR codes for mobile payments, stricter licensing requirements for e-payment service providers, and the establishment of a regulatory sandbox for testing and refining innovative financial technologies. These efforts aim to strike a balance between fostering innovation in the contactless payments sector and safeguarding consumers and businesses against fraud, money laundering, and other financial crimes.

Challenges and Risks of Contactless Payments

Fraud and money laundering risks

As contactless payments continue to gain popularity in Thailand, the risk of fraud and money laundering activities also increases. Cybercriminals are becoming more sophisticated in exploiting vulnerabilities in contactless payment systems, employing tactics such as data breaches, card cloning, and phishing attacks. Money launderers may also use contactless payments to move illicit funds across borders or disguise the origins of their proceeds, making it challenging for financial institutions to detect and prevent these criminal activities.

Evolving regulatory requirements

The rapid growth of contactless payments in Thailand has led to an ever-changing regulatory landscape as authorities strive to keep pace with technological advancements and mitigate potential risks. Financial institutions and payment service providers must continually adapt to new regulations and guidelines, which can be both time-consuming and resource-intensive. Moreover, non-compliance can result in substantial fines and reputational damage, making it essential for businesses to stay up-to-date with the latest regulatory requirements and implement effective compliance programs.

Maintaining customer trust and security

As the use of contactless payments expands, maintaining customer trust and ensuring the security of their transactions is crucial for the sustained growth of this market. Consumers need to feel confident that their personal and financial information is well-protected when using contactless payment methods. Therefore, financial institutions and payment service providers must invest in robust security measures, such as encryption, tokenization, and multi-factor authentication, to safeguard customer data and prevent unauthorized access. Furthermore, educating consumers about the safe use of contactless payments and promoting awareness of potential risks can help foster trust and confidence in this increasingly popular mode of transaction.

Tookitaki's AML Suite for E-Wallets and Digital Banks

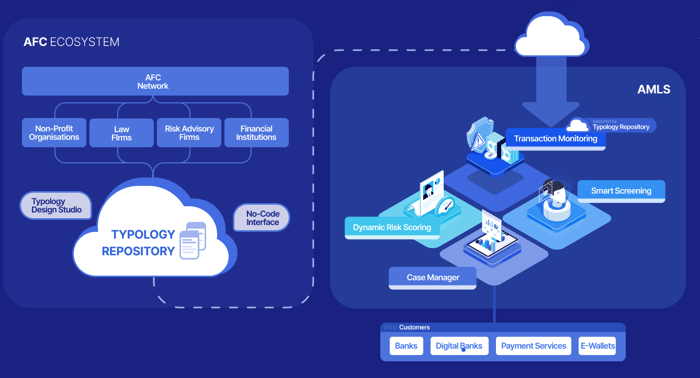

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work in tandem to address the limitations of siloed systems in combating money laundering.

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is our Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AMLS is a software solution deployed at financial institutions. It is an end-to-end operating system that modernises compliance processes for banks and fintechs. The AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML programs remain cutting-edge.

How Tookitaki's Technology Addresses Compliance Challenges

Tookitaki's technology goes beyond traditional rule-based systems by using a pattern-based detection approach to identify and predict financial crimes. This enables digital banks and e-wallet providers to detect suspicious activities more accurately and effectively while reducing false positives. The technology also enhances the Customer Due Diligence (CDD) process, streamlining the onboarding experience for both the provider and the user.

By implementing Tookitaki's AML compliance solutions, digital banks and e-wallet providers can enjoy several benefits, including:

- Improved regulatory compliance: Tookitaki's solutions ensure that financial institutions remain compliant with AML regulations, reducing the risk of fines and reputational damage.

- Enhanced risk management: The advanced analytics capabilities of Tookitaki's technology help digital banks and e-wallet providers better identify and manage potential risks associated with their services.

- Increased operational efficiency: Automating various compliance tasks leads to cost savings and improved operational efficiency.

- Greater customer trust: Secure onboarding processes, coupled with robust AML measures, contribute to building user trust and confidence in the e-wallet provider's services.

Implementing Tookitaki's AMLS positively impacts the onboarding process and user experience for e-wallet providers in several ways:

- Streamlined onboarding: Tookitaki's real-time prospect screening and prospect risk scoring solutions help mitigate AML risks while onboarding new customers, providing a faster and more seamless experience.

- Enhanced detection and management: The AMLS help de-risk business with a 360-degree dynamic risk view of customers. Its integrated transaction monitoring, smart screening, customer risk scoring and case management modules provide fast-growing e-wallets complete control of their AML risks.

- Reduced friction: By minimizing false positives and automating compliance tasks, Tookitaki's solutions help reduce friction in the onboarding process, leading to increased user satisfaction.

Implementing Tookitaki's AML Suite in Thailand's contactless payment ecosystem helps financial institutions streamline their compliance processes, reducing the burden of false positives and the operational costs associated with managing AML programs. The improved efficiency saves time and resources for e-wallets and digital banks and allows them to focus more on their core business operations and customer experience.

Navigating the Future of Contactless Payments in Thailand

In the rapidly evolving world of contactless payments, it is crucial for financial institutions in Thailand to stay ahead of financial crime trends. By proactively addressing potential risks and vulnerabilities, they can safeguard their businesses, customers, and the integrity of the overall financial ecosystem.

Tookitaki's AML Suite plays a vital role in enhancing the safety and security of the contactless payments ecosystem in Thailand. By offering advanced detection and prevention capabilities, fostering collaboration among stakeholders, and reducing compliance costs, Tookitaki's solution ensures that financial institutions can effectively combat financial crimes and maintain customer trust.

If you are a financial institution operating in Thailand's contactless payment market, now is the time to explore the benefits of implementing Tookitaki's AML Suite. By taking advantage of this cutting-edge technology and joining the collaborative AFC Ecosystem, you can strengthen your defences against financial crime and contribute to a safer and more secure financial landscape in Thailand. Don't wait – book a demo today to learn more about how Tookitaki's AML Suite can revolutionize your compliance processes and protect your business from financial crime.

Anti-Financial Crime Compliance with Tookitaki?