In the dynamic and evolving world of finance, Singapore stands as a beacon of progress and integrity. As one of Asia’s primary financial hubs, the city-state continually grapples with the complexities of maintaining robust anti-money laundering (AML) measures. The landscape of AML detection in Singapore is one marked by the desire to safeguard its financial institutions from the risks of illicit transactions and the reputational damage of financial crimes.

The importance of efficient AML detection cannot be understated. With increasing digitalization and sophistication in financial crimes, regulatory bodies and financial institutions are in a perpetual arms race with money launderers and fraudsters. Enhanced AML detection protects these institutions and fortifies Singapore's reputation as a secure and trustworthy financial market.

Leveraging machine learning capabilities, it offers a unique approach to monitor, detect, and report suspicious activities more accurately and efficiently. Not only does it help to eliminate false positives that have long plagued traditional systems, but it also uncovers hidden risks, providing a comprehensive and proactive defence against money laundering. This groundbreaking software redefines the face of AML detection in Singapore, playing a pivotal role in making the financial system safer and more reliable. Stay tuned as we delve deeper into how this is being achieved.

The Need for Revolutionizing AML Detection

Despite their usefulness, Traditional AML detection methods come with challenges that often hamper their effectiveness. They typically rely heavily on rule-based systems that generate a multitude of alerts, a significant percentage of which are false positives. This leads to an unnecessary allocation of resources towards investigating these false alerts, which could otherwise be focused on legitimate threats.

Moreover, these conventional methods may lack the capability to adapt to emerging forms of financial crime, as money launderers constantly devise novel tactics to circumvent detection. This limitation underscores the need for change in current AML detection strategies. The ever-evolving nature of money laundering and the associated risks require a more dynamic, intelligent, and proactive approach.

Enter the transformative power of technology. In an era characterized by advancements in artificial intelligence and machine learning, it is only logical to harness these tools to address the limitations of traditional AML detection methods. With its ability to learn from data and improve over time, machine learning provides a robust platform to address the complexities and dynamism of financial crimes.

With these advanced technologies, it's possible to analyze vast amounts of data with unprecedented speed and accuracy, uncovering patterns and correlations that might elude manual analysis or rule-based systems. In the context of AML detection, this means fewer false positives, the detection of sophisticated laundering schemes, and a significant improvement in the overall efficiency of compliance operations.

In this shifting landscape, Tookitaki’s AML Transaction Monitoring Software is at the forefront, demonstrating the immense potential of technology to transform AML detection. By marrying cutting-edge machine learning with deep regulatory knowledge, it offers a dynamic solution that addresses the limitations of traditional methods while optimizing the capabilities of AML compliance. The need for a revolution in AML detection has been recognized, and Tookitaki is driving that change in Singapore.

How Tookitaki is Leading this Revolution

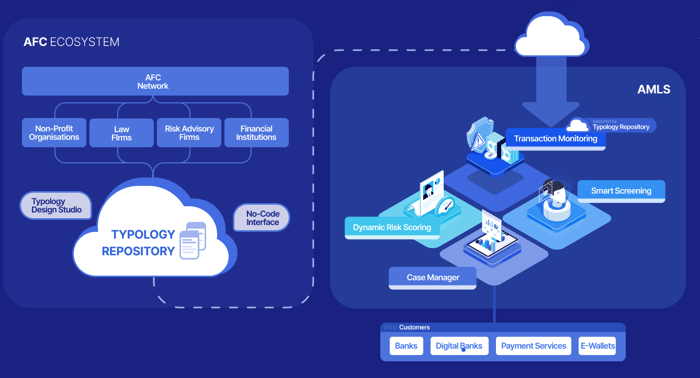

Founded in 2015, Tookitaki is on a mission to create safer societies by tackling the root cause of money laundering. As a global leader in financial crime prevention software, the company revolutionizes the fight against financial crime by breaking the siloed AML approach and connecting the community through its innovative AML Suite and Anti-Financial Crime (AFC) Ecosystem. Its unique community-based approach empowers financial institutions to effectively detect, prevent, and combat money laundering and related criminal activities, resulting in a sustainable AML program with holistic risk coverage, sharper detection, and fewer false alerts.

The AML Suite is an end-to-end operating system that modernises compliance processes for banks and fintechs. In parallel, the AFC Ecosystem serves as a community of experts dedicated to uncovering hidden money trails that traditional methods cannot detect. Powered by federated machine learning, the AMLS collaborates with the AFC Ecosystem to ensure that financial institutions stay ahead of the curve in their AML programs.

At the heart of this transformation is Tookitaki's AML Transaction Monitoring Software, an embodiment of innovation and efficiency in the sphere of AML compliance. This software is designed to break the limitations of traditional AML solutions by providing a comprehensive and dynamic approach to detecting money laundering activities.

One of the standout features of Tookitaki’s AML Transaction Monitoring Software is its utilization of an industry-first typology repository. This provides a platform to comprehend and respond to the full spectrum of laundering typologies, ensuring absolute risk coverage. Its built-in sandbox environment is another unique facet, allowing financial institutions to test and deploy new typologies in days rather than months - a speed unheard of in conventional systems.

Automated threshold tuning, an integral part of Tookitaki’s software, reduces manual effort in threshold tuning by a staggering 70%. This paves the way for more efficient allocation of resources. Additionally, the software's superior pattern-based detection technique sheds light on real-world red flags, revealing suspicious cases undetected by primary systems and serving as a second line of defence for financial institutions.

Tookitaki further enriches its monitoring prowess by offering secondary scoring of transaction alerts, categorizing them into L1, L2, and L3 levels. This feature optimizes the investigative process by allowing investigators to focus on high-risk alerts.

Tookitaki’s AML Transaction Monitoring Software, with its state-of-the-art technology and groundbreaking features, is driving the revolution in AML detection in Singapore. By providing comprehensive, efficient, and dynamic solutions to money laundering threats, Tookitaki is indeed leading the way in transforming the AML landscape.

Looking Ahead: The Future of AML Detection in Singapore

In summary, the landscape of AML detection in Singapore is in the midst of a substantial transformation spurred by the innovative tools and approaches offered by Tookitaki’s AML Transaction Monitoring Software. By combining the power of artificial intelligence, machine learning, and an extensive typology repository, Tookitaki's solution addresses the limitations of traditional methods and proactively adapts to the evolving world of financial crime.

As we look to the future, the potential for AML detection in Singapore with the continued use of Tookitaki’s software is bright. The promise of more effective risk detection, efficient alert management, and a robust second line of defence against new threats will redefine the standards of AML compliance in the city-state. Singapore's financial institutions stand to benefit greatly from these advancements, ensuring a safer and more transparent financial environment for all.

Take the Next Step with Tookitaki

Now is the perfect time to step into the future of AML detection. Whether you’re eager to learn more about Tookitaki’s AML Transaction Monitoring Software or ready to see it in action, we invite you to reach out. Our team is more than happy to provide further information, answer your queries, or arrange a demo of our cutting-edge solution.

Embrace the revolution in AML detection. Discover how Tookitaki’s innovative software can elevate your compliance processes and safeguard your institution against financial crime. Contact us today, and let's make the future of AML detection in Singapore a present reality.

Anti-Financial Crime Compliance with Tookitaki?