Thailand's financial industry plays a crucial role in the country's economy. As the sector continues to grow and evolve, so does the need for effective anti-money laundering (AML) compliance. With increased international trade and the rapid expansion of digital transactions, Thailand has become a target for money launderers looking to exploit the system.

In this article, we will explore the importance of AML compliance in Thailand's financial industry, the challenges faced by financial institutions, the role of technology in AML compliance, and best practices for tackling money laundering. Finally, we will explain how Tookitaki's AML solutions can help financial institutions to ensure regulatory compliance.

Regulatory Framework for AML in Thailand

Key Legislation and Regulators

Anti-Money Laundering Act (AMLA)

Thailand's primary legislation governing AML is the Anti-Money Laundering Act (AMLA), which was first enacted in 1999 and has since been amended multiple times to align with international standards. The AMLA establishes the legal framework for preventing and suppressing money laundering activities and sets out the responsibilities and requirements for reporting entities, including financial institutions.

Bank of Thailand (BOT)

The Bank of Thailand (BOT) is the country's central bank and the main regulator responsible for overseeing the financial sector. The BOT issues guidelines and regulations related to AML compliance for banks and other financial institutions, ensuring they adhere to domestic and international standards.

Office of the Securities and Exchange Commission (SEC)

The Office of the Securities and Exchange Commission (SEC) regulates the capital market in Thailand, including securities companies, asset management companies, and other market participants. The SEC is responsible for implementing and enforcing AML compliance measures in the capital market, working closely with the BOT and other relevant authorities.

AML Requirements for Financial Institutions

Customer Due Diligence (CDD)

Financial institutions in Thailand must perform Customer Due Diligence (CDD) for all customers, including verifying their identity and understanding the nature and purpose of their business relationship. Enhanced Due Diligence (EDD) is required for high-risk customers, such as politically exposed persons (PEPs) and those with complex business structures.

Transaction Monitoring

Financial institutions must monitor customer transactions to detect any unusual or suspicious activities. This includes setting up internal systems to flag potentially high-risk transactions and conducting ongoing monitoring to ensure that customer activities align with their risk profiles.

Reporting Suspicious Activities

In accordance with the AMLA, financial institutions are required to report any suspicious transactions or activities to the Anti-Money Laundering Office (AMLO), Thailand's Financial Intelligence Unit (FIU). This includes transactions that appear to have no apparent lawful purpose, are inconsistent with a customer's known business activities, or involve large sums of money.

Record-Keeping

Financial institutions must maintain records of customer identification documents, account files, and transaction records for a minimum of five years. This is essential for facilitating investigations and prosecutions of money laundering cases, as well as ensuring compliance with AML regulations.

AML Challenges in Thailand's Financial Industry

Money Laundering Risks and Vulnerabilities

Thailand's financial industry faces several money laundering risks and vulnerabilities, including the country's extensive informal economy, cash-intensive industries, and the prevalence of corruption. These factors create opportunities for money launderers to infiltrate the financial system, making it essential for financial institutions to remain vigilant and proactive in their AML efforts.

Technological Advancements and Digital Transactions

The rapid growth of digital transactions in Thailand, driven by fintech innovation and increased internet penetration, has created new avenues for money laundering. Criminals are exploiting digital platforms to conduct illegal activities, such as using cryptocurrencies to facilitate cross-border money transfers. Financial institutions must adapt their AML compliance programs to keep pace with these evolving threats.

International Regulatory Pressure

As a member of the Financial Action Task Force (FATF), Thailand is under increased international scrutiny to ensure that its financial system is not exploited for money laundering or terrorist financing. Failure to maintain robust AML compliance measures can have negative consequences for the country's financial industry, such as reputational damage and reduced access to international markets.

The Role of Technology in AML Compliance

Automation and Artificial Intelligence

Technological advancements have led to the development of innovative solutions that can help financial institutions streamline their AML compliance efforts. Automation and artificial intelligence (AI) can assist in reducing the workload and increasing the accuracy of CDD and transaction monitoring processes. By leveraging these technologies, financial institutions can more effectively identify suspicious activities and reduce the risk of money laundering.

Data Analytics and Risk Assessment

Data analytics plays a crucial role in AML compliance, allowing financial institutions to better understand and assess the risks associated with their customers and transactions. Advanced data analytics tools can help institutions identify patterns and trends that may indicate money laundering activities, enabling them to take appropriate action and mitigate risks.

Integration with Existing Systems

To maximize the benefits of technology in AML compliance, financial institutions must ensure that their technological solutions can be seamlessly integrated with existing systems and processes. This will enable them to leverage the full potential of these tools and enhance their overall compliance efforts.

Best Practices for Tackling Money Laundering in Thailand's Financial Industry

Adopt a Risk-Based Approach

Financial institutions should adopt a risk-based approach to AML compliance, which involves assessing the money laundering risks associated with their customers, products, and services, and implementing appropriate controls and measures to mitigate these risks. This approach enables institutions to allocate their resources more effectively and focus on areas with the highest risks.

Foster a Culture of Compliance

A strong culture of compliance is essential for the successful implementation of AML measures in financial institutions. This includes ensuring that employees at all levels understand the importance of AML compliance and their role in preventing and detecting money laundering. Providing ongoing training and support can help to reinforce this culture and promote adherence to AML regulations.

Collaborate with Industry Stakeholders and Regulators

Collaboration between financial institutions, regulators, and other industry stakeholders is crucial for tackling money laundering in Thailand's financial industry. By sharing information and best practices and engaging in public-private partnerships, these parties can work together more effectively in combating money laundering and strengthening the financial system's integrity.

Tookitaki's AML Solutions

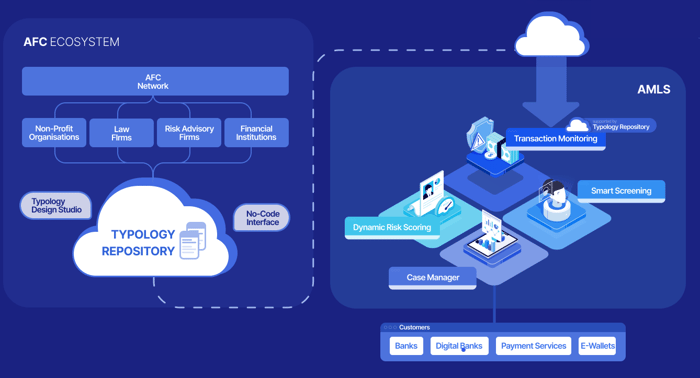

Founded in 2015, Tookitaki aims to create safer societies by tackling the root cause of money laundering. As a global leader in financial crime prevention software, the company revolutionises the fight against financial crime by breaking the siloed AML approach and connecting the community through its two distinct platforms: the Anti-Money Laundering Suite (AMLS) and the Anti-Financial Crime (AFC) Ecosystem. Tookitaki's unique community-based approach empowers financial institutions to effectively detect, prevent, and combat money laundering and related criminal activities, resulting in a sustainable AML program with holistic risk coverage, sharper detection, and fewer false alerts.

The AMLS is an end-to-end operating system that modernises compliance processes for banks and fintechs. In parallel, the AFC Ecosystem serves as a community of experts dedicated to uncovering hidden money trails that traditional methods cannot detect. Powered by federated machine learning, the AMLS collaborates with the AFC Ecosystem to ensure that financial institutions stay ahead of the curve in their AML programs.

The AMLS includes several modules such as Transaction Monitoring, Smart Screening, Dynamic Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML, including detection, investigation, and reporting.

Final Thoughts

As Thailand's financial industry continues to face money laundering risks and challenges, it is more important than ever for financial institutions to maintain robust AML compliance programs. By leveraging technology and adopting best practices, institutions can better protect themselves and the wider financial system from money laundering threats.

Tookitaki's AML solutions can help financial institutions in Thailand enhance their AML compliance efforts by providing advanced technology for transaction monitoring, risk assessment, and screening. These solutions can improve the efficiency and effectiveness of AML processes, helping institutions better identify and mitigate money laundering risks.

Don't miss the opportunity to see how Tookitaki's AML solutions can help your financial institution in Thailand strengthen its AML compliance efforts. Schedule a demo with Tookitaki today and discover the benefits of adopting innovative AML technology.

Subscribe to Our Newsletter