As the digital banking landscape continues to evolve in the Philippines, financial institutions are increasingly adopting modern technology to ensure secure transactions and robust regulatory compliance. In this article, we will discuss the current state of digital banking in the Philippines, the challenges and opportunities in the sector, and how Tookitaki is playing a crucial role in promoting compliance in digital banking through its innovative solutions.

The State of Digital Banking in the Philippines

Growth of digital banking and FinTech sector

Over the past few years, the Philippines has seen rapid growth in digital banking and the FinTech sector. With a growing smartphone penetration rate and increasing internet users, digital financial services are becoming more accessible to the country's population. This has led to a surge in online transactions, mobile banking, and digital wallets, providing consumers with convenient and secure ways to manage their finances.

Government Initiatives to Promote Digital Banking

The government has also been supportive of the digital banking revolution in the Philippines. The Bangko Sentral ng Pilipinas (BSP), the country's central bank, has introduced several initiatives to encourage digital banking, such as the National Retail Payment System (NRPS) and the Philippine EFT System and Operations Network (PESONet). These platforms aim to create a safe, efficient, and reliable electronic retail payment system, promoting cashless transactions and reducing the reliance on cash.

Consumer Adoption and Behavior

Filipinos are embracing digital banking at an unprecedented rate. According to a 2020 study by the BSP, 51.2% of Filipino adults now own a bank account, and 25.2% of these accounts are digital. The same study reported that 20.1% of adult Filipinos use electronic payments, up from just 1% in 2013. This rapid adoption can be attributed to the growing awareness of the benefits of digital banking, such as convenience, security, and cost savings.

Challenges and Opportunities in the Philippine Digital Banking Landscape

Regulatory hurdles and security concerns

As digital banking grows in popularity, financial institutions face several regulatory challenges. Ensuring compliance with Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations is crucial to maintaining the financial system's integrity. With cybercrime on the rise, digital banks must also implement robust security measures to protect customer data and transactions from fraud and cyberattacks.

Financial inclusion and accessibility

One of the primary objectives of digital banking in the Philippines is to promote financial inclusion, particularly for the unbanked and underbanked population. More than 40% of the adult population in the Philippines remains unbanked, primarily due to rural areas' lack of access to financial services. Digital banking offers an opportunity for these individuals to access financial services, promoting economic growth and reducing poverty.

Digital transformation and integration of legacy systems

Financial institutions in the Philippines face the challenge of integrating digital banking services with their existing legacy systems. This requires significant investment in technology infrastructure, staff training, and process re-engineering. However, the potential benefits of digital transformation, such as improved operational efficiency, cost reduction, and better customer experience, make it a worthwhile endeavour for banks.

Role of Tookitaki in Promoting Compliance in Digital Banking

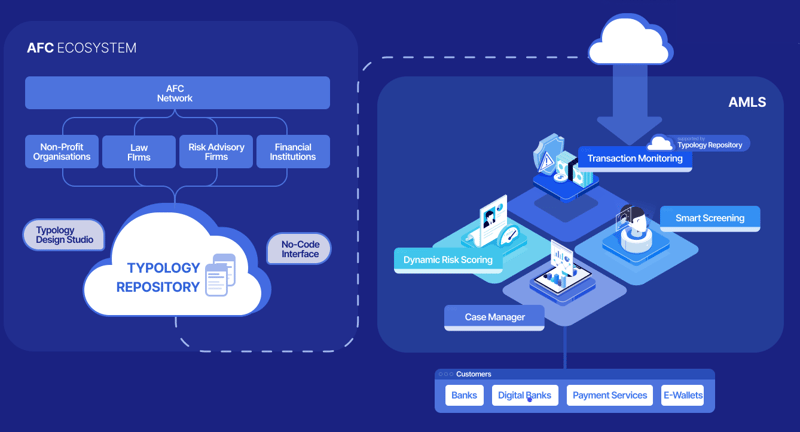

Tookitaki, founded in 2015, is revolutionizing financial crime detection and prevention for banks and fintechs through its two distinct platforms: the Anti-Money Laundering Suite (AMLS) and the Anti-Financial Crime (AFC) Ecosystem. The company's unique community-based approach addresses the silos used by criminals to bypass traditional solutions, resulting in a sustainable AML program with holistic risk coverage, sharper detection, and fewer false alerts.

The AMLS is designed to be a one-stop-shop for financial institutions looking to meet their AML compliance requirements. With the AMLS, financial institutions can reduce the number of false positives, increase the number of true positives, and ultimately improve their overall compliance posture. Our platform is highly configurable, allowing it to be tailored to the specific needs of each financial institution.

About the AFC Ecosystem

The AFC Ecosystem is a separate entity that aims to discover hidden money trails of criminals. The ecosystem is a body of experts covering the entire spectrum of money-laundering, enabling financial partners to uncover money trails not discoverable by today's standards. It is designed to work alongside the AMLS to provide a comprehensive solution for financial institutions.

One of the key features of the AFC ecosystem is the Typology Repository. This is a database of money laundering techniques and schemes that have been identified by financial institutions around the world. Financial institutions can contribute to the repository by sharing their own experiences and knowledge of money laundering. This allows the community of financial institutions to work together to tackle financial crime by sharing information and best practices.

A typology is a specific money laundering technique or scheme. By sharing typologies in the repository, financial institutions can learn about new and emerging threats, and adapt their AML programs accordingly. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes.

Tookitaki's AMLS and AFC Ecosystem provide financial institutions with a comprehensive solution for detecting and preventing financial crime. By leveraging advanced technologies such as machine learning and community-based approaches, Tookitaki's platforms offer several key benefits that can help financial institutions improve compliance and prevent financial crime.

Supporting the Digital Transformation of Financial Institutions in the Philippines

Tookitaki's innovative AMLS and TRM solutions are well-suited to address the compliance challenges digital banks face in the Philippines. By providing cutting-edge technology and expert guidance, Tookitaki enables financial institutions to streamline their AML/CFT processes, reduce operational costs, and improve their overall risk management.

As more banks in the Philippines embark on their digital transformation journey and challenger banks emerge, Tookitaki's solutions can play a critical role in ensuring that these institutions maintain the highest standards of regulatory compliance while also delivering a seamless and secure banking experience for their customers.

Final Thoughts

The future of digital banking in the Philippines is bright, with significant growth potential and opportunities for financial institutions to expand their services and reach new customers. However, banks must also navigate the challenges of regulatory compliance, security, and digital transformation to ensure the long-term success of their digital banking initiatives.

Tookitaki's unique platforms, the AMLS and the AFC Ecosystem, are well-equipped to support financial institutions in the Philippines as they embrace digital banking and strive to maintain robust compliance standards. By leveraging Tookitaki's cutting-edge technology and first-of-a-kind community based approach, digital banks can enhance their risk management, reduce operational costs, and provide customers with a secure, reliable digital banking experience. Book a demo to learn more about Tookitaki's tailored solutions for digital banks.

Anti-Financial Crime Compliance with Tookitaki?