Future of Financial Crime Prevention in Indonesia: Tookitaki's Vision

The fight against financial crime is an ongoing battle, and one that is becoming increasingly complex as criminals adapt to new technologies and regulatory environments. In Indonesia, financial institutions are under increasing pressure to comply with stringent regulations and ensure they are doing everything possible to prevent financial crime. That's where Tookitaki comes in - a trailblazer in the fight against financial crime with a unique approach that sets it apart from traditional solutions. In this blog, we will explore Tookitaki's vision for the future of financial crime prevention in Indonesia and how their Anti-Financial Crime (AFC) Ecosystem is helping financial institutions stay ahead of the curve in the fight against financial crime.

AML Compliance in Indonesia

Having a history of being in the Financial Action Task Force (FATF) blacklist, Indonesia has steadily improved its approach to anti-money laundering (AML) and counter-terrorist financing (CTF). The country hopes to become a full member of the FATF with various laws and regulations in place.

FATF Membership Status

As of February 2023, Indonesia has completed the stage of mutual evaluation review as a requirement for full FATF membership, and the FATF discussed and adopted the mutual evaluation report of Indonesia. The mutual evaluation concluded that Indonesia has a strong legal, regulatory and institutional framework, resulting in robust technical compliance in a number of areas.

There are various laws and regulations in place to combat money laundering and terrorist financing, such as Law No. 3 of 2011, Law No. 5 of 2018, Law No. 8 of 2010, and Law No. 9 of 2013. The Bank of Indonesia has also issued specific regulations, including Regulation No. 14/27/PBI/2012 for Commercial Banks to implement Anti-Money Laundering and Combating the Financing of Terrorism Programs, as well as Regulation No. 19/10/PBI/2017 which outlines the "Anti-Money Laundering and Prevention of Terrorism Financing for Non-Bank Payment System Service Provider and Non-Bank Currency Exchange Service" Procedure. Additionally, strict guidelines exist for the implementation of Know Your Customer (KYC) standards.

Complex challenges, such as increased digitalization of services, growing amounts of data, and a surge in regulatory pressure, accentuate the pressure on financial institutions to implement effective AML compliance systems. Non-compliance with AML regulations in Indonesia can result in fines of between IDR10 billion and IDR100 billion and prison sentences of up to 20 years.

Read More: A Guide to AML in Indonesia

Traditional Solutions and Their Limitations

Traditional solutions for financial crime prevention, such as rules-based platforms, have been the norm for decades. However, these systems have limitations that have hindered their effectiveness in combating money laundering. One of the main limitations is their siloed nature, which makes it difficult for institutions to have a comprehensive view of their transactions and customers. This lack of visibility makes it challenging to detect and prevent financial crimes, as it can result in false alerts or missed risks.

Furthermore, traditional solutions often lack collaboration capabilities, which prevents financial institutions from sharing information and best practices to stay ahead of evolving threats. This can also result in a reactive approach to financial crime prevention, rather than a proactive one.

Finally, rules-based platforms are limited by their reliance on predefined rules, which can lead to high false positive rates and inefficiencies. This means that financial institutions have to allocate significant resources to investigate these alerts, which can result in an increase in operational costs.

Tookitaki's AFC Ecosystem

Tookitaki's AFC Ecosystem is a unique and innovative approach to fighting financial crime. Unlike traditional solutions that rely on siloed systems and rules-based approaches, the AFC Ecosystem is a community-based platform that leverages the knowledge and experience of financial institutions, regulatory bodies, and risk consultants from around the world.

At the heart of the AFC Ecosystem is the Typology Repository, a live database of money laundering techniques and schemes contributed by the community. These typologies cover a wide range of methods, from traditional techniques such as shell companies and money mules to more modern schemes like digital currency and social media-based fraud.

The Typology Repository serves as a valuable resource for financial institutions looking to stay ahead of the curve in the fight against financial crime. By drawing on the collective knowledge and experience of the community, institutions can access a wealth of information and best practices that can help them identify and prevent new and emerging threats.

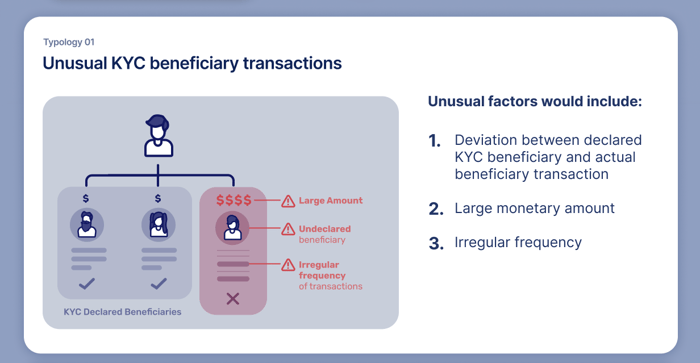

A typology from the repository is pictured below:

The community-based approach of the AFC Ecosystem offers several key benefits over traditional solutions. By fostering collaboration and knowledge-sharing among institutions, the platform encourages a more holistic and effective approach to financial crime prevention. This approach also helps to break down silos and create a more integrated approach to risk management, reducing the potential for blind spots and gaps in coverage.

Overall, Tookitaki's AFC Ecosystem represents a significant step forward in the fight against financial crime, offering a collaborative and innovative approach that helps institutions stay ahead of the curve and protect against emerging threats.

How the AFC Ecosystem Helps in Fighting Financial Crime

The community-based approach of the AFC Ecosystem provides several benefits to financial institutions. Firstly, it allows for a more comprehensive view of the financial crime landscape, enabling financial institutions to identify and mitigate risks more effectively. Secondly, the community-based approach encourages collaboration and the sharing of best practices, which can help institutions uncover previously unknown risks.

The AFC Ecosystem is closely integrated with Tookitaki's Anti-Money Laundering Suite (AMLS), which is deployed at financial institutions. The AMLS extracts new typologies from the AFC Ecosystem and executes them at the customer's end, ensuring that their AML programs stay ahead of the curve.

This federated machine learning approach has several advantages over traditional rules-based systems. Firstly, it minimizes the number of false alerts generated by the AML program, reducing the workload for compliance teams. Secondly, it allows for a more dynamic and adaptive approach to AML, as the AMLS is constantly learning from the new typologies added to the Typology Repository.

Moving Forward: Embracing the Future of Financial Crime Prevention

By leveraging the collective knowledge and experience of the AFC community, financial institutions can stay ahead of evolving threats and regulatory changes. The connection between the AFC Ecosystem and AMLS ensures that financial institutions can extract the latest typologies and execute them at their end, keeping their AML programs ahead of the curve.

We urge financial institutions in Indonesia to embrace the future of financial crime prevention with Tookitaki's AFC Ecosystem and book a demo for AMLS. With its community-based approach, federated machine learning, and comprehensive suite of solutions, Tookitaki is the future of financial crime prevention. Contact us today to learn more.

Subscribe to Our Newsletter