How to Prevent Money Laundering in UAE with a Community-Based Approach

Money laundering is a global problem that affects the financial industry and the economy of countries around the world. It is a serious criminal offense that involves the transfer of illegally obtained funds through legitimate channels. Like any other countries, the United Arab Emirates (UAE) is affected by money laundering activities. In this blog, we will discuss money laundering in the UAE and how Tookitaki's community-based approach can help prevent it.

What is Money Laundering?

Money laundering is the process of disguising the proceeds of illegal activity as legitimate funds. It is often associated with organized crime, drug trafficking, human trafficking, terrorism financing, and other criminal activities. Money launderers use a variety of techniques to conceal the origin and ownership of the illegally obtained funds, making it difficult for law enforcement agencies to detect and prosecute them.

Money laundering involves three stages: placement, layering, and integration. In the placement stage, the launderer introduces the illegal funds into the financial system. In the layering stage, the launderer moves the funds through a series of transactions to obscure their origin and ownership. In the integration stage, the launderer reintroduces the funds into the legitimate economy.

Money Laundering in the UAE

The UAE is a major financial center in the Middle East and attracts significant foreign investment, making it vulnerable to money laundering activities. The country has taken several steps to combat money laundering, including enacting laws and regulations to prevent and detect it.

The UAE's financial regulatory authority, the Central Bank of the UAE, has issued guidelines for financial institutions to detect and prevent money laundering. The guidelines require financial institutions to implement anti-money laundering (AML) and know-your-customer (KYC) policies, conduct customer due diligence, and report suspicious transactions to the authorities.

In addition to the regulatory framework, the UAE has established a Financial Intelligence Unit (FIU) to receive, analyze, and disseminate suspicious transaction reports. The FIU works closely with law enforcement agencies to investigate and prosecute money laundering activities.

Tookitaki's Community-Based Approach to AML

Tookitaki is a Singapore-based fintech company that provides AML and fraud detection solutions to financial institutions. The company's community-based approach to AML is designed to enhance the effectiveness of AML programs by leveraging the collective intelligence of the financial community. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work together to address the shortcomings of siloed systems in the fight against money laundering.

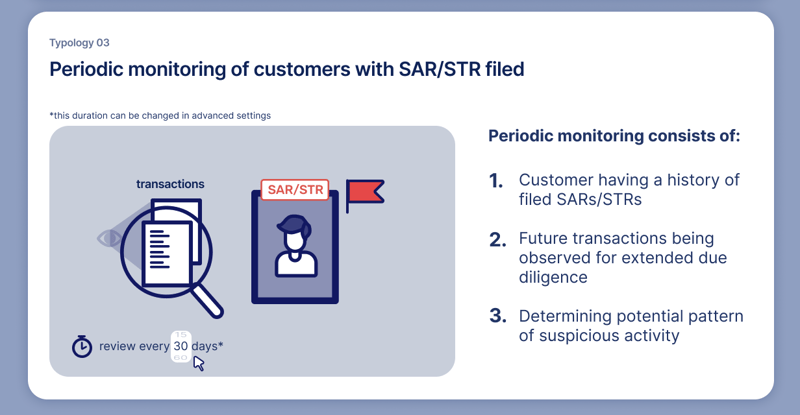

Tooktiaki’s approach starts with our AFC ecosystem which is a community-based platform to share information and best practices in the fight against financial crime. The AFC ecosystem is powered through our Typology Repository which is a live database of money laundering techniques and schemes called typologies. These typologies are contributed by financial institutions, regulatory bodies, risk consultants, etc around the world by sharing their own experiences and knowledge of money laundering. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes.

A typology from the repository is pictured below:

The AMLS, on the other hand, is a software deployed at financial institutions, which collaborates with the AFC Ecosystem through federated machine learning. The AMLS extracts the new typologies from the AFC Ecosystem and executes the typologies at the customers' end, ensuring that their AML programs stay ahead of the curve.

Tookitaki's community-based approach to AML is particularly effective in the UAE, where financial institutions operate in a highly interconnected environment. By collaborating and sharing information, financial institutions can enhance the effectiveness of their AML programs and prevent money laundering activities. The AFC Ecosystem offers the following benefits:

Expert Networking: Join a community of financial institutions, regulatory bodies, and risk consultants who share knowledge and experiences to combat financial crime.

Stay Ahead of Trends: Access the latest money laundering techniques and schemes, updated regularly, in the Typology Repository.

Uncover Hidden Risks: The community-based platform provides access to information and best practices to help financial institutions find previously unknown risks.

Make Compliance a Strategic Advantage: Stay ahead of the curve with up-to-date information on financial crime, and turn compliance into a competitive advantage.

Final Thoughts

Tookitaki's community-based approach to AML is a powerful tool that can help prevent money laundering activities in the UAE. By creating a network of financial institutions that share information and collaborate to detect and prevent money laundering activities, Tookitaki's solution enhances the effectiveness of AML programs and makes it more difficult for money launderers to operate in the country.

As the UAE continues to develop as a major financial center in the Middle East, it is essential that financial institutions embrace the future of financial crime prevention with Tookitaki's AFC Ecosystem and book a demo for AMLS.

Anti-Financial Crime Compliance with Tookitaki?