The Different Types of Money Laundering Techniques Used in Thailand

Money laundering is a critical issue in Thailand, posing significant challenges to the country's financial stability, integrity, and reputation. As a major regional hub for trade, finance, and tourism, Thailand is particularly susceptible to money laundering activities, which often involve organized crime, drug trafficking, and other illicit activities.

Understanding the various money laundering techniques used in Thailand is crucial for financial institutions, regulators, and law enforcement agencies in their efforts to combat financial crime. By staying informed about the latest methods employed by criminals, these stakeholders can better develop and implement effective anti-money laundering (AML) measures, thereby safeguarding the integrity of the country's financial system and mitigating the risk of financial crime.

This article aims to provide an overview of the different types of money laundering techniques commonly used in Thailand. It aims to raise awareness about these methods and emphasize the importance of staying vigilant against financial crime. Additionally, this blog will introduce Tookitaki's Anti-Financial Crime (AFC) Ecosystem, an innovative solution that can help financial institutions in Thailand strengthen their AML programs and effectively combat money laundering activities.

Common Money Laundering Techniques in Thailand

Money laundering techniques in Thailand are varied and complex, evolving over time to keep up with the ever-changing financial landscape. Some common techniques include trade-based money laundering (TBML), cash smuggling, real estate transactions, shell companies and nominee structures, cryptocurrency and digital assets, and hawala and alternative remittance systems.

Trade-based money laundering (TBML)

Trade-based money laundering (TBML) is a prevalent technique in Thailand, involving the manipulation of trade transactions to move illicit funds across borders. Criminals exploit the complexity of international trade, using methods such as over- and under-invoicing, multiple invoicing, and misrepresentation of goods to disguise the origin and movement of their illicit proceeds.

Cash smuggling

Cash smuggling, also known as bulk cash smuggling, is a common method used by criminals to move large amounts of cash across borders undetected. This technique involves physically transporting cash, often through the use of cash couriers or hidden compartments in vehicles, to evade the scrutiny of customs and financial institutions.

Real estate transactions

Real estate transactions are often used as a means to launder money in Thailand. Criminals purchase property with illicit funds, effectively integrating these proceeds into the legitimate financial system. In some cases, criminals may use intermediaries or shell companies to conceal their identities and the true source of their funds.

Shell companies and nominee structures

Shell companies and nominee structures are popular methods used by money launderers in Thailand. These entities have no real business operations but are used to hold assets and facilitate transactions that obscure the true ownership of funds. Nominee directors and shareholders can be employed to further distance the actual beneficial owner from the company and its financial dealings.

Cryptocurrency and digital assets

As cryptocurrencies and digital assets become more widespread, these financial instruments have increasingly been exploited for money laundering purposes in Thailand. Criminals can use digital currencies to move and store funds anonymously, making it difficult for authorities to trace the origins and beneficiaries of transactions.

Hawala and alternative remittance systems

Hawala and alternative remittance systems are informal money transfer networks outside the traditional banking system. While these systems can provide essential financial services in some regions, they are also vulnerable to exploitation by money launderers. In Thailand, criminals may use hawala networks to transfer funds across borders without detection, taking advantage of these systems' lack of regulation and oversight.

An Overview of Thailand's AML Regulatory Regime

Thailand's Anti-Money Laundering Office (AMLO) is the key agency responsible for enforcing anti-money laundering and counter-terrorism financing laws. The country's legal framework primarily consists of the Anti-Money Laundering Act B.E. 2542 (1999) (AMLA), which has been amended over time to address evolving money laundering practices.

The Financial Action Task Force (FATF) has reported that Thailand has made good progress in addressing technical compliance deficiencies, improving its ratings on recommendations 13, 16, 19, and 20 from Partially Compliant to Largely Compliant. However, there are ongoing investigations into Thai banks for anti-money laundering, as highlighted by the FinCEN Files, which revealed transactions covering combined amounts of $41.31 million in four Thai banks.

Challenges in Combating Money Laundering in Thailand

Evolving Money Laundering Techniques

Criminals constantly adapt and refine their money laundering techniques to avoid detection and stay ahead of law enforcement efforts. This makes it difficult for authorities to keep up with the latest methods and trends, and it requires continuous monitoring and updating of measures to combat money laundering activities effectively.

Regulatory and Legal Framework

While Thailand has made progress in addressing technical compliance deficiencies, the country's regulatory and legal framework needs to be continuously improved to comply with international standards. This includes issuing new regulations and guidelines with specific and complex requirements for reporting entities to comply with, ensuring strict law enforcement.

Cross-border and Regional Complexities

Thailand's geographical location in the heart of Southeast Asia presents challenges in combating money laundering. The country shares borders with several other nations, making it vulnerable to cross-border criminal activities. Transnational organized crime, including narcotics trafficking, is a significant source of money laundering in Thailand, and the country must collaborate with its neighbours to effectively tackle this issue.

Technological Advancements and Emerging Risks

As technology advances, new risks and opportunities for money laundering emerge. Digital currencies and online financial platforms can be exploited by criminals for illicit purposes, making it challenging for law enforcement agencies and financial institutions to detect and prevent money laundering activities. Authorities must adapt to these technological advancements, develop innovative solutions to address emerging risks and maintain the financial system's integrity.

Tookitaki's AFC Ecosystem: Addressing Money Laundering in Thailand

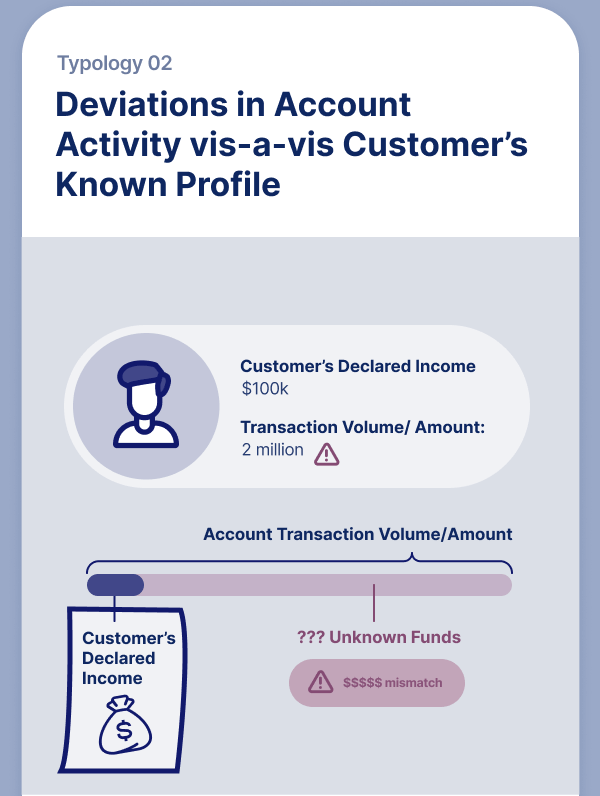

Tookitaki's Anti-Financial Crime (AFC) Ecosystem is a community-based platform that brings together financial institutions, regulatory bodies, and risk consultants to share information, best practices, and experiences in the fight against financial crime. At the heart of the AFC Ecosystem is the Typology Repository, a database of money laundering techniques and schemes continuously updated to encompass a broad range of typologies, from traditional methods to emerging trends.

A graphical representation of a typology within the Typology Repository is shown below.

Key Features and Benefits of Tookitaki's AFC Ecosystem

Tookitaki's AFC Ecosystem offers several key features and benefits that address the challenges in Thailand's financial crime landscape:- Comprehensive Typology Repository: The AFC Ecosystem's Typology Repository ensures that financial institutions have access to the latest money laundering techniques and schemes, enabling them to identify better and address risks.

- Enhanced Detection Accuracy: The AFC Ecosystem helps financial institutions improve their detection accuracy and maintain robust AML programs by providing access to up-to-date typologies.

- Reduction in False Alerts: The AFC Ecosystem's insights, combined with Tookitaki's innovative technology, minimize false positives and allow financial institutions to focus on high-risk cases, reducing operational burden.

- Adaptive Learning: Federated machine learning enables the integration of Tookitaki's AMLS with the AFC Ecosystem, ensuring that AML programs remain adaptive and up-to-date with emerging trends and regulatory changes.

- Streamlined Compliance Processes: The AFC Ecosystem supports the modernization of compliance processes, resulting in faster response times and better alignment with evolving regulations.

- Improved Collaboration: The community-based approach fosters collaboration and knowledge sharing among financial institutions, regulatory bodies, and risk consultants, creating a cooperative environment in the fight against financial crime.

How Tookitaki's AFC Ecosystem Addresses the Challenges in Thailand's Financial Crime Landscape

Tookitaki's AFC Ecosystem is well-suited to address the challenges in Thailand's financial crime landscape, including evolving money laundering techniques, regulatory and legal framework changes, cross-border complexities, and emerging risks due to technological advancements.

- Evolving Money Laundering Techniques: The AFC Ecosystem's Typology Repository keeps financial institutions informed about emerging money laundering techniques, enabling them to adapt their AML programs accordingly.

- Cross-border and Regional Complexities: The community-based approach allows for knowledge sharing and collaboration between institutions in Thailand and those in other countries, fostering a more comprehensive understanding of cross-border and regional money laundering risks.

- Technological Advancements and Emerging Risks: The integration of Tookitaki's AMLS with the AFC Ecosystem through federated machine learning ensures that AML programs remain adaptive and responsive to emerging risks and technological advancements.

In short, Tookitaki's AFC Ecosystem offers a powerful solution to the challenges faced by Thailand in the fight against money laundering. By fostering collaboration, providing access to up-to-date typologies, and leveraging innovative technology, the AFC Ecosystem empowers financial institutions to effectively detect, prevent, and combat money laundering and related criminal activities.

Empowering AML Programs: Why Financial Institutions in Thailand Should Explore Tookitaki's Offerings

In conclusion, staying informed about money laundering techniques is crucial for financial institutions in Thailand to combat financial crime effectively. As money laundering techniques evolve, financial institutions must adapt their AML programs to maintain compliance and protect their businesses from potential risks.

Financial institutions in Thailand should consider exploring Tookitaki's offerings to strengthen their AML programs. By adopting Tookitaki's AFC Ecosystem and AMLS, institutions can benefit from enhanced detection accuracy, reduced false alerts, streamlined compliance processes, and improved collaboration in the fight against financial crime. By embracing Tookitaki's innovative approach, financial institutions can ensure they have the most advanced tools and knowledge at their disposal to effectively detect, prevent, and combat money laundering in Thailand.Tookitaki's AFC Ecosystem is a game-changer in the battle against money laundering in Thailand. By fostering collaboration, providing access to an up-to-date Typology Repository, and leveraging innovative technology, the AFC Ecosystem empowers financial institutions to effectively detect, prevent, and combat money laundering and related criminal activities. This innovative solution addresses the unique challenges faced by Thailand's financial crime landscape and helps institutions stay ahead of the curve.

Anti-Financial Crime Compliance with Tookitaki?