The Role of AFC Ecosystem in Fighting Money Laundering in Singapore

Singapore has faced increasing money laundering challenges in recent years due to its thriving financial sector and strong global connectivity. As a leading financial hub, Singapore's commitment to combating money laundering is vital to maintain its reputation and the stability of its financial industry. In this article, we will discuss the role of Tookitaki's Anti-Financial Crime (AFC) Ecosystem in addressing the money laundering challenges faced by Singapore's financial institutions. We will also explore the significance of the AFC Ecosystem in combating money laundering and enhancing compliance with Singapore's regulatory landscape.

Singapore's Regulatory Landscape

Regulatory bodies overseeing AML efforts in Singapore

The primary regulatory bodies responsible for overseeing anti-money laundering (AML) efforts in Singapore are the Monetary Authority of Singapore (MAS) and the Commercial Affairs Department (CAD) of the Singapore Police Force. These bodies work together to develop and enforce AML regulations and policies, ensuring that financial institutions in Singapore remain vigilant and proactive in identifying and mitigating money laundering risks.

AML laws and regulations applicable to financial institutions

Financial institutions in Singapore are subject to various AML laws and regulations, including the MAS Notice 626 on AML and Countering the Financing of Terrorism (CFT), the Corruption, Drug Trafficking, and Other Serious Crimes (Confiscation of Benefits) Act (CDSA), and the Terrorism (Suppression of Financing) Act (TSFA). These laws and regulations require financial institutions to implement robust AML/CFT programs, conduct customer due diligence, and report suspicious transactions to the relevant authorities.

The importance of staying ahead of the curve in AML compliance

With the rapid evolution of financial technology and the increasing sophistication of money laundering techniques, it is essential for financial institutions in Singapore to stay ahead of the curve in AML compliance. Implementing innovative solutions like Tookitaki's AFC Ecosystem can help institutions better identify and mitigate money laundering risks while ensuring compliance with the evolving regulatory landscape.

Tookitaki and the AFC Ecosystem

Tookitaki is a global leader in financial crime prevention, dedicated to building a safer and more secure world through innovative technology, strategic collaboration, and a distinctive community-based approach. Since its inception in 2015, it has been on a mission to transform the battle against financial crime by dismantling siloed AML approaches and uniting the community through its groundbreaking Anti-Money Laundering Suite (AMLS) and AFC Ecosystem.

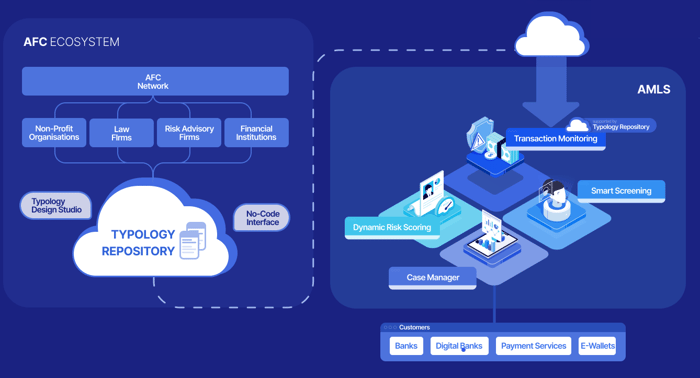

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is our Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AFC Ecosystem is comprised of carefully vetted and experienced AML experts. Each member undergoes a thorough selection process to ensure that they have the knowledge, skills, and background required to contribute effectively to the community.

How the AFC Ecosystem Enhances Tookitaki's AMLS

AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML programs remain cutting-edge. The AMLS is designed to be flexible and customizable, allowing you to adapt the system to your specific needs while benefiting from the collective knowledge of the AFC Ecosystem.

Instead of sharing sensitive data, federated learning allows the AMLS to access the latest typologies from the AFC Ecosystem and execute them locally at the client's end. This unique integration enables financial institutions to stay ahead of the curve and maintain cutting-edge AML programs while preserving data privacy and security.

The AFC Ecosystem's members play a crucial role in uncovering hidden money trails that traditional methods may not detect. The AFC Ecosystem board carefully reviews new scenario suggestions from the members. Only approved scenarios are incorporated into the ecosystem, ensuring that financial institutions that are part of the network benefit from the most effective strategies without worrying about inadequate coverage.

Benefits of the AFC Ecosystem

Improved accuracy and efficiency in AML detection

By leveraging the collective expertise of the AFC Ecosystem, Tookitaki's AMLS can significantly improve the accuracy and efficiency of AML detection. This enhanced capability allows financial institutions in Singapore to identify and mitigate money laundering risks more effectively, ultimately strengthening their AML programs.

Reduced false positives and enhanced risk management

Integrating the AFC Ecosystem into Tookitaki's AMLS helps reduce false positives and enhance risk management. By tapping into the knowledge and experience of the AFC Ecosystem's experts, Tookitaki's AMLS can more accurately identify genuine money laundering risks, enabling financial institutions to focus their resources on the most significant threats.

Streamlined compliance with Singapore's AML regulations

As financial institutions in Singapore face an evolving regulatory landscape, the integration of the AFC Ecosystem into Tookitaki's AMLS can help streamline compliance with the country's AML regulations. By staying ahead of the curve in AML compliance, financial institutions can minimize the risk of regulatory penalties and protect their reputation in the market.

Greater adaptability to emerging threats and trends

The AFC Ecosystem's collaborative approach and the use of federated machine learning enable Tookitaki's AMLS to adapt more quickly to emerging threats and trends in money laundering. This adaptability ensures that financial institutions in Singapore remain vigilant and proactive in their efforts to combat financial crime.

Final Thoughts

The importance of a strong AML program in Singapore cannot be overstated, given the country's status as a leading financial hub and its commitment to maintaining the integrity of its financial system. The AFC Ecosystem plays a pivotal role in enhancing Tookitaki's AMLS, enabling financial institutions in Singapore to stay ahead of the curve in their AML programs.

By integrating the AFC Ecosystem into their AML efforts, financial institutions can benefit from improved accuracy and efficiency in AML detection, reduced false positives, enhanced risk management, streamlined regulatory compliance, and greater adaptability to emerging threats and trends. To learn more about how Tookitaki's AMLS and the AFC Ecosystem can help your organization combat money laundering and ensure compliance with Singapore's AML regulations, book a demo today.

Anti-Financial Crime Compliance with Tookitaki?