Anti-money laundering (AML) laws and regulations are essential for ensuring financial integrity, security, and stability. The government has implemented several AML laws and regulations in Thailand to prevent money laundering, terrorist financing, and other financial crimes. This blog post provides an overview of Thailand's AML laws and regulations, the regulatory bodies responsible for enforcing them, and the penalties for non-compliance.

AML Laws and Regulations in Thailand

Thailand's AML laws and regulations include the Anti-Money Laundering Act B.E. 2542 (1999), the Counter-Terrorism Financing Act B.E. 2559 (2016), and the Financial Institutions Business Act B.E. 2551 (2008). These laws aim to prevent and detect money laundering, terrorist financing, and other financial crimes by requiring financial institutions to implement AML programs, conduct customer due diligence (CDD), and report suspicious transactions to regulatory authorities.

In 1999, the Anti-Money Laundering Act (No. 6) B.E. 2565 (2022) was enacted to eradicate illegal activities' funding in Thailand, including drug trade, corruption, and fraud. The Act has undergone recent revisions to align it with global Anti-Money Laundering legislation standards. The King revised the Act's modifications with Parliament's advice and consent in late 2022, and they were published in the Government Gazette on October 24th, 2022. Under Thai law, the Act's revisions became effective 60 days later, on December 23rd, 2022.

The key areas of the Act that have been amended are the provisions protecting the injured party's rights for predicate offences that have suffered damages to life, body, mind, freedom, health, or reputation and the rights of the property beneficiary requested by the Public Prosecutor.

The regulatory bodies responsible for enforcing Thailand's AML laws and regulations include the Anti-Money Laundering Office (AMLO), the Office of the Narcotics Control Board (ONCB), and the Counter-Terrorism Financing Office (CTFO). These agencies work together to investigate and prosecute AML violations, impose sanctions and penalties, and promote public awareness of AML issues.

Non-compliance with Thailand's AML laws and regulations can result in severe penalties, including fines, imprisonment, and revocation of business licenses. Financial institutions must take proactive steps to ensure compliance with AML laws and regulations to avoid these consequences.

AML Compliance Challenges for Businesses in Thailand

Money laundering poses a significant risk for businesses in Thailand, with non-compliance leading to severe legal and financial consequences. One of the significant challenges for businesses is the complexity and constantly evolving nature of AML regulations in Thailand. It is also difficult to track high-risk customers manually due to the large volume of data that must be analysed. Inefficient communication channels among different departments, lack of training, and insufficient resources also contribute to the challenges businesses face in achieving AML compliance.

The Role of Technology in AML Compliance for Businesses in Thailand

Technology is changing AML compliance, providing businesses with efficient and effective tools to detect and prevent money laundering activities. Machine learning algorithms and artificial intelligence can be used to analyse vast amounts of data in real time, identify patterns, and detect unusual behaviour that could indicate potential money laundering activities. This technology also automates AML compliance tasks, enabling businesses to comply with regulations without adding extra resources.

Moreover, technology gives businesses a centralized and comprehensive view of all their data, facilitating cross-functional collaboration and providing real-time insights into customer activities. This helps businesses to identify high-risk customers and transactions, allowing them to take preventive measures to avoid non-compliance.

By embracing technology to enhance AML compliance, businesses can improve their risk management strategies, protect their reputation, and avoid financial penalties.

How Tookitaki's AML Solutions Can Help Thailand

Tookitaki's AML solutions offer a comprehensive approach to AML compliance that leverages advanced technology, federated learning, and machine learning algorithms. These solutions help financial institutions automate AML processes, streamline compliance workflows, and reduce false positives and false negatives.

Tookitaki's solutions can help financial institutions in Thailand comply with AML laws and regulations by transaction monitoring, automating customer due diligence, and detecting suspicious activities. The solutions can also provide customised risk assessments, alerts, and reports to support AML compliance efforts and facilitate regulatory reporting.

Tookitaki's AML solutions offer a powerful tool for financial institutions in Thailand to enhance their AML compliance programs and reduce the risk of AML violations. By leveraging Tookitaki's advanced technology and expertise, financial institutions can improve their AML capabilities and protect their businesses from reputational, financial, and regulatory risks.

Tookitaki's AML Solutions for Businesses in Thailand

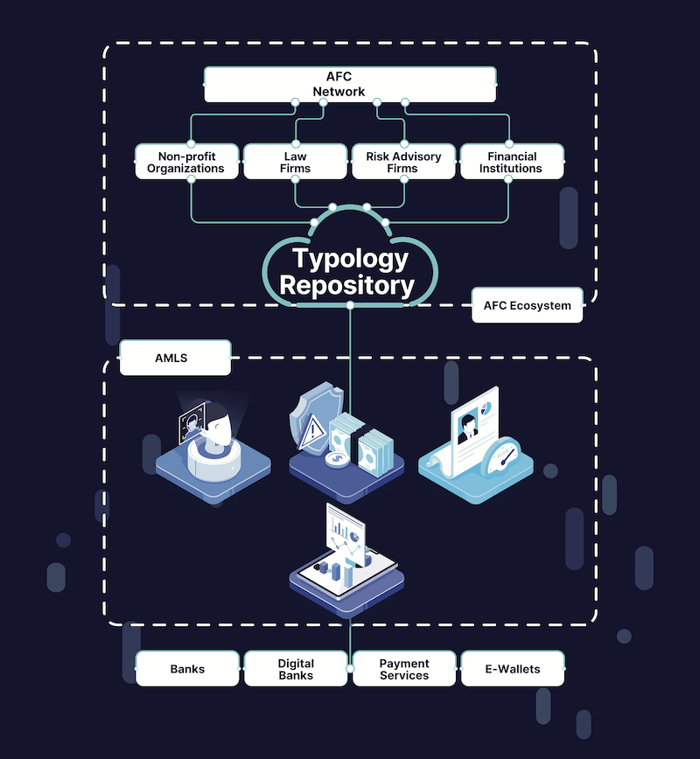

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. Tookitaki’s two platforms: the Anti-Money Laundering Suite (AMLS) and the Anti-Financial Crime (AFC) Ecosystem, work in tandem to address the limitations of siloed systems in combating money laundering.

The AFC Ecosystem

The AFC Ecosystem is a community-based platform that facilitates the sharing of information and best practices in the battle against financial crime. Powering this ecosystem is our Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AFC Ecosystem consists of two main components: the AFC Network - a global network of subject matter experts who contribute the latest typologies, and the Typology Repository - the largest federated database of money laundering patterns, contributed and validated by experts.

The Typology Repository is an exhaustive, ready-to-use database from which typologies can be searched and integrated into AMLS with a single click. The database operates solely on patterns and does not store any data, ensuring full privacy protection. Using a user-friendly interface, network members can easily create and share their typologies with each other without compromising any customer information.

The AMLS

The AMLS is an end-to-end operating system that modernises compliance processes for banks and fintechs. AMS is redefining how the financial service industry thinks about and approaches AML compliance. It is an award-winning, self-adaptive machine learning solution that helps FIs to build a comprehensive risk-based anti-money laundering compliance program. It is an enterprise-wide solution built around three core modules: screening, risk scoring and transaction monitoring.

The AMLS platform has a modular design and consists of the following modules.

- Smart Screening

- Prospect Screening

- Name Screening

- Transaction Screening

- Dynamic Risk Scoring

- Prospect Risk Scoring

- Customer Risk Scoring

- Transaction Monitoring

- Case Manager

Benefits of Implementing Tookitaki's AML Solutions

Implementing Tookitaki's AML solutions can provide several benefits for businesses in Thailand. One of the key benefits is increased efficiency. Tookitaki's solutions can automate many of the manual processes involved in AML compliance, such as transaction monitoring and sanctions screening. This can free up compliance teams to focus on higher-value tasks, such as investigating and resolving alerts.

Tookitaki's solutions can also help businesses reduce costs associated with AML compliance. By automating many processes, companies can reduce their reliance on manual labour, which can be expensive. In addition, by identifying and flagging suspicious transactions more accurately, Tookitaki's solutions can help reduce false positives, which can be costly to investigate.

Additionally, The AFC ecosystem provides a platform for financial institutions to share knowledge and collaborate on fighting financial crime. The Typology Repository, for example, allows institutions to share information on common money-laundering techniques and typologies, making it easier to detect and prevent such activities.

Finally, implementing Tookitaki's AML solutions can help businesses improve their risk management capabilities. By identifying potential AML risks more accurately and efficiently, companies can take proactive measures to mitigate these risks and prevent financial losses, regulatory penalties, and reputational damage.

Enhancing AML Compliance Efficiency: Tookitaki's Solutions for Businesses in Thailand

In conclusion, AML compliance is critical for businesses operating in Thailand to avoid penalties and reputational damage. However, achieving compliance can be challenging due to the complex regulatory environment and limitations of traditional approaches. Technology, such as Tookitaki's AML solutions, can help businesses in Thailand achieve AML compliance efficiently and effectively.

Tookitaki's AML solutions provide businesses with real-time transaction monitoring, data analytics, and AI-powered risk assessments, enabling them to detect and prevent potential money laundering activities. Implementing Tookitaki's AML solutions can increase efficiency, reduce costs, and improve risk management.

To learn more about Tookitaki's AML solutions and how they can be implemented to achieve efficient and effective AML compliance, businesses in Thailand are encouraged to book a demo and explore the benefits of utilizing cutting-edge technology to meet their AML compliance needs.

Anti-Financial Crime Compliance with Tookitaki?