The Role of AFC Ecosystem in Combating Money Laundering in Thailand

In the global financial landscape, money laundering has consistently been a formidable adversary, creating an opaque layer that shrouds illicit activities and undermines the integrity of financial institutions. Thailand's financial institutions have not been exempt from this pervasive issue, grappling with the complexities and ramifications of money laundering incidents. As these institutions strive to uphold their commitment to transparency and ethical financial practices, the urgency to adopt innovative strategies in the fight against money laundering has never been more critical.

Navigating the turbulent waters of financial crime demands a collaborative approach that transcends individual institutions' boundaries. This is where the Anti-Financial Crime (AFC) Ecosystem comes into play. The AFC Ecosystem is a dynamic, community-based platform that facilitates sharing information and best practices in combating financial crime. This powerful platform, enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, houses a living database of money laundering techniques and schemes - the Typology Repository.

The AFC Ecosystem plays a pivotal role in enhancing the resilience of Thailand's financial institutions against money laundering. Promoting a collaborative approach and leveraging advanced technologies, it fosters a climate of knowledge-sharing and collective learning. With the AFC Ecosystem, financial institutions can draw from a vast pool of insights, ensuring their anti-money laundering (AML) programs are always ahead of the curve. By continually adapting to emerging trends and threats, the AFC Ecosystem serves as a vigilant guardian, fortifying Thailand's financial institutions in their ongoing fight against money laundering.

The State of Money Laundering in Thailand

Overview of Money Laundering Situation in Thailand

Thailand, like many countries worldwide, faces a significant challenge in combating money laundering. As a growing financial hub in Southeast Asia, the country's financial system is an attractive target for criminal organizations and individuals looking to launder illicit funds. Money laundering activities in Thailand are sophisticated and varied, encompassing everything from traditional methods like structuring and trade-based laundering to more modern techniques involving digital currencies and online platforms.

Thailand's government and financial institutions have made significant strides in bolstering their Anti-Money Laundering (AML) capabilities. However, the constantly evolving nature of money laundering techniques requires a proactive and dynamic approach to prevention.

Impact of Money Laundering on Thailand's Financial Institutions

The impact of money laundering on Thailand's financial institutions is multifaceted and significant. Firstly, financial institutions that unwittingly facilitate money laundering face severe regulatory penalties, which can be financially crippling. In addition to regulatory fines, these institutions may suffer reputational damage, which can lead to customer trust and business loss.

Secondly, money laundering can distort economic growth and financial stability. Large scale money laundering can create asset bubbles, lead to misallocation of resources, and fuel economic instability.

Lastly, money laundering poses a significant risk to the integrity of Thailand's financial institutions. It undermines their role as trusted stewards of customer funds and can erode public trust in the financial system. This is particularly concerning as trust is critical to any successful financial system. For these reasons, combating money laundering is a top priority for Thailand's financial institutions.

Understanding the AFC Ecosystem

Delving into the AFC Ecosystem

The Anti-Financial Crime (AFC) Ecosystem is a revolutionary approach to combatting financial crime, designed to foster collaboration and knowledge sharing across a network of stakeholders. It is not just a technology or a tool, but a vibrant community that brings together financial institutions, regulatory bodies, and risk consultants. The AFC Ecosystem aims to create a unified front against financial crime, leveraging shared experiences and insights to develop effective prevention strategies and techniques.

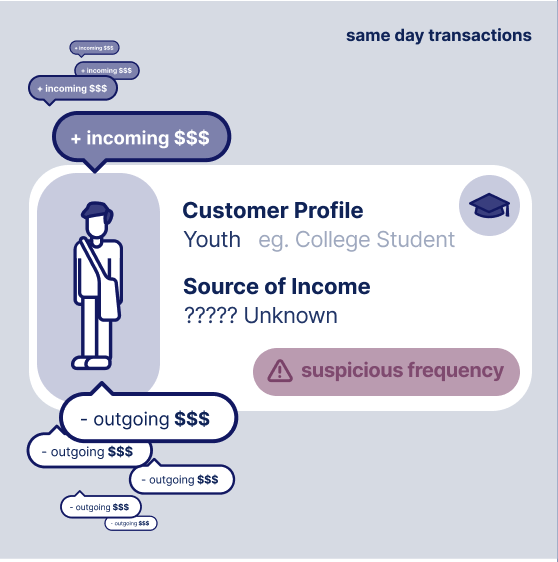

The Typology Repository, a living database of money laundering techniques and schemes, anchors the AFC Ecosystem. This repository, continually enriched by the contributions of community members, provides an invaluable resource for keeping abreast of both traditional and emerging money laundering methods.

A graphical representation of a typology within the Typology Repository is shown below.

Key Components of the AFC Ecosystem

- Community of AML Experts: The AFC Ecosystem is made up of a community of experienced AML professionals. These professionals collaborate and share insights, contributing to the development of effective AML strategies.

- Typology Repository: The heart of the AFC Ecosystem is the Typology Repository. This living database holds a wealth of information on money laundering techniques and schemes. The repository is continually enriched by the collective experiences and knowledge of the community, ensuring it remains current and relevant.

- Federated Machine Learning: The AFC Ecosystem utilizes federated machine learning to ensure the confidential sharing of insights. This innovative approach allows the AFC Ecosystem to extract new typologies from the community while preserving the privacy and security of member data.

How AFC Ecosystem Helps Combat Money Laundering

The Role of the AFC Ecosystem in Detecting and Preventing Money Laundering

The AFC Ecosystem plays a vital role in detecting and preventing money laundering, providing an advanced and collaborative platform for knowledge sharing and best practices. With its Typology Repository at the core, the AFC Ecosystem harnesses the collective experiences and expertise of financial institutions, regulatory bodies, and risk consultants globally. This collaborative approach helps unearth both conventional and emerging money laundering tactics, strengthening AML defences across the board.

The AFC Ecosystem also leverages federated machine learning, which allows for exchanging typologies without sharing sensitive data. This capability enhances participating organisations' detection and prediction capabilities, allowing them to stay ahead of evolving financial crime threats and adapt their AML programs accordingly.

Key Features and Benefits of Tookitaki's AFC Ecosystem

Tookitaki's AFC Ecosystem offers several key features and benefits that address the challenges in Thailand's financial crime landscape:

- Enhanced Detection Accuracy: The AFC Ecosystem helps financial institutions improve their detection accuracy and maintain robust AML programs by providing access to up-to-date typologies.

- Reduction in False Alerts: The AFC Ecosystem's insights, combined with Tookitaki's innovative technology, minimize false positives and allow financial institutions to focus on high-risk cases, reducing operational burden.

- Adaptive Learning: Federated machine learning enables the integration of Tookitaki's AMLS with the AFC Ecosystem, ensuring that AML programs remain adaptive and up-to-date with emerging trends and regulatory changes.

- Streamlined Compliance Processes: The AFC Ecosystem supports the modernization of compliance processes, resulting in faster response times and better alignment with evolving regulations.

- Improved Collaboration: The community-based approach fosters collaboration and knowledge sharing among financial institutions, regulatory bodies, and risk consultants, creating a cooperative environment in the fight against financial crime.

The Path Forward: Strengthening Defences Against Money Laundering

In conclusion, the AFC Ecosystem's role in combating money laundering is instrumental. By harnessing collective knowledge, fostering collaboration, and leveraging advanced technologies, the AFC Ecosystem empowers financial institutions with a dynamic, proactive, and evolving approach to their AML strategies. It has become a critical tool in the fight against money laundering in Thailand and globally.

Tookitaki's innovative solutions, including its Anti-Money Laundering Suite (AMLS), add significant value to the AFC Ecosystem. By integrating with the AFC Ecosystem, Tookitaki's AMLS can extract and execute new typologies at the client's end, ensuring that their AML defences remain at the cutting edge of the fight against financial crime.

For financial institutions in Thailand grappling with money laundering, it's time to consider Tookitaki's solutions. By integrating Tookitaki's AMLS and joining the AFC Ecosystem, these institutions can strengthen their defences against financial crime, ensure regulatory compliance, and secure their reputation in the financial landscape. Reach out to Tookitaki today and take the first step towards a more secure financial future.

Anti-Financial Crime Compliance with Tookitaki?