Money Laundering in South Africa: The Power of Information Sharing

Money laundering, the process by which criminals disguise the illegal origins of their wealth and protect their asset bases, poses a significant risk to the economic and political stability of countries and their social fabric. This clandestine act continues to evolve, with perpetrators adopting increasingly sophisticated methods to bypass traditional detection measures. In this blog, we delve into the state of money laundering in South Africa, exploring the importance of and barriers to effective information sharing in this context and how modern solutions like Tookitaki's Anti-Financial Crime (AFC) Ecosystem can facilitate this process to curb the tide of financial crime.

According to the Global Financial Integrity report, South Africa loses approximately $10 billion per year due to illicit outflows, a substantial portion of which can be attributed to money laundering. Additionally, the country is ranked 70th out of 180 on the Corruption Perceptions Index by Transparency International, which suggests a significant prevalence of corruption and financial crime.

Money laundering in South Africa is not just an economic concern but has widespread societal implications. It can destabilize the financial system, exacerbate income inequality, and undermine social and political institutions. Addressing money laundering is not merely a financial imperative; it's a moral and social one too. In order to tackle this pressing issue effectively, the need for robust and cutting-edge solutions cannot be overstated. This blog aims to shed light on these aspects, focusing on the potential of information sharing in strengthening anti-money laundering efforts and how Tookitaki's AFC Ecosystem can serve as a crucial tool in this fight. Stay with us as we navigate this complex landscape, exploring the challenges and solutions at hand.

The Current State of Money Laundering in South Africa

The reality of money laundering in South Africa is a somber tale that warrants our undivided attention. This illicit activity remains a persistent issue, leaving lasting effects on the nation's economic integrity and social stability.

South Africa has seen numerous high-profile cases demonstrating this problem's extent. One case that made international headlines involved the notorious Gupta family, who were accused of siphoning billions of Rand from state coffers, exploiting public resources, and employing complex money laundering schemes to mask their activities. These allegations, though not isolated incidents, exemplify the far-reaching tentacles of money laundering and its intersection with systemic corruption in the country.

The methods employed in money laundering are increasingly sophisticated and multi-layered, making them hard to detect and even harder to prosecute. Common tactics include trade-based laundering, where trade transactions are manipulated to disguise the movement of money; layering, where illicit funds are concealed through complex layers of financial transactions; and the misuse of digital currencies, a recent trend that capitalizes on the anonymity of these platforms.

The impact of money laundering extends far beyond the financial realm. From an economic perspective, money laundering can distort market competition, compromise financial institutions, and deter foreign investment, which can stifle economic growth and development. The World Bank has warned that these activities could even lead to a country's financial crisis if left unchecked.

In a societal context, money laundering facilitates and perpetuates crime and corruption. Providing a safe haven for the proceeds of crime incentivises criminal behaviour, which undermines public trust in institutions, exacerbates social inequality, and hampers the nation's progress towards its developmental goals.

Furthermore, the ramifications of money laundering aren't confined within South Africa's borders. Given the interconnected nature of the global financial system, money laundering threatens regional and international financial stability, creating a domino effect that can impact economies worldwide.

The Power of Information Sharing

In the face of growing financial crime, particularly money laundering, the role of information sharing cannot be underestimated. A comprehensive and transparent exchange of information can bridge gaps in understanding, identify new patterns, and expedite the detection of illicit activities.

At its core, information sharing in the context of anti-money laundering (AML) involves the exchange of data among various stakeholders. This can include financial institutions, regulatory bodies, law enforcement agencies, and even across different countries. The type of information shared could range from suspicious activity reports, typologies or methods used in money laundering to trends and new schemes being observed.

The primary goal is to enhance collective knowledge and leverage it for proactive risk mitigation. It can help identify new threats, anticipate criminal shifts in methodology, and contribute to the overall efficacy of AML efforts. By combining insights, institutions can stay one step ahead, preventing rather than just detecting illicit financial activity. This is not just beneficial at an individual level, it significantly strengthens the broader financial system, making it more resilient to criminal threats.

An example of successful information sharing can be seen in the European Union. The 5th Anti-Money Laundering Directive of the EU mandates financial institutions to share data related to suspicious transactions across member states. The goal is to foster a united front against financial crime across the continent.

Barriers to Effective Information Sharing in South Africa

Despite the proven benefits of information sharing in the battle against money laundering, several barriers in South Africa hinder its effective implementation.

- Firstly, privacy laws and concerns around data protection can sometimes inhibit the seamless exchange of information. Banks and other financial institutions are rightfully cautious about sharing customer data due to regulations such as the Protection of Personal Information Act (POPIA), which places stringent controls on the processing and disseminating personal information.

- Secondly, there's a technical challenge. Financial institutions often operate on different technological platforms, making sharing and interpreting data across these disparate systems difficult. This lack of standardization and interoperability impedes the efficient exchange of critical anti-money laundering information.

- Lastly, there are organizational and jurisdictional silos. Financial institutions, regulatory bodies, and law enforcement agencies often operate in silos, which can create a fragmented approach to tackling money laundering. Moreover, cross-border information sharing is challenging due to differences in laws, regulations, and protocols across countries.

Overcoming these barriers requires a multi-faceted approach. Legal clarity around data privacy laws, specifically in the context of AML activities, can reassure institutions about the legality and security of information sharing. Technological solutions can help address interoperability issues. Adopting standard data formats and protocols and investing in shared digital platforms can significantly improve the ease and speed of data exchange.

Introducing Tookitaki's AFC Ecosystem

In our quest to overcome the barriers to effective information sharing, an innovative solution has been making strides in this field: Tookitaki's Anti-Financial Crime (AFC) Ecosystem.

What is Tookitaki's AFC Ecosystem?

Tookitaki's AFC Ecosystem is a community-based platform designed to facilitate seamless information sharing in the fight against financial crime. It provides an interactive and collaborative space for financial institutions, regulatory bodies, and risk consultants worldwide to share their knowledge and experiences.

The Typology Repository and AFC Network

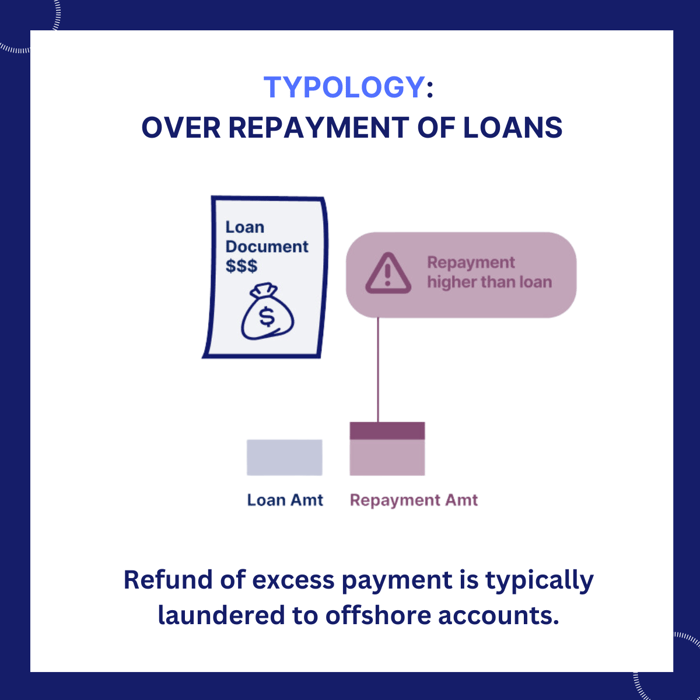

At the heart of this ecosystem lie two main components: the AFC Network and the Typology Repository. The AFC Network is a global network of subject matter experts who contribute the latest typologies—essentially, methods used in financial crime. These experts provide real-time insights into emerging trends and patterns, enhancing the community's collective intelligence.

The Typology Repository, on the other hand, serves as a vast federated database of money laundering patterns. This exhaustive, ready-to-use database is contributed to and validated by experts from around the globe, encompassing a broad range of typologies from traditional methods to emerging trends.

A pictorial representation of a typology is shown below.

Features and Benefits of Tookitaki's AFC Ecosystem

The AFC Ecosystem offers a range of features designed to facilitate the creation, sharing, and use of typologies.

- The Typology Database, part of the Typology Repository, is a readily accessible source of rules and typologies. It's regularly updated with emerging trends, breaking down informational silos with its federated structure.

- The Typology Developer Studio provides a 'No Code' drag and drop interface for rule creation, decoupling rules from threshold values, and automatically converting them to risk indicators or rules.

- Further, the ecosystem allows for efficient management of typologies. Users can categorize typologies under various themes like business lines or geography for easy search and download. Parameters of typologies can be edited and reconfigured based on individual needs.

- Importantly, the AFC Ecosystem is privacy-protected. It only contains typology parameters and doesn't store any personally identifiable information (PII) or sensitive client data.

The benefits of using Tookitaki's AFC Ecosystem are substantial. By fostering an expert community and providing access to a vast, regularly updated typology database, it empowers institutions to stay ahead of emerging financial crime trends. The result is enhanced risk detection, robust compliance, and the ability to turn these into a strategic advantage in the business landscape.

Tookitaki's AFC Ecosystem is not just a technological solution; it's a community-driven initiative geared towards strengthening the global fight against financial crime. By enhancing the power of information sharing, it opens up new opportunities for collaborative, proactive, and effective AML efforts.

How Tookitaki's AFC Ecosystem Can Help South Africa

Given the current state of money laundering in South Africa and the associated challenges, Tookitaki's AFC Ecosystem presents a highly relevant solution. This community-based platform has the potential to address South Africa's specific money laundering issues in a number of ways.

- Addressing Data Privacy and Technical Challenges: Tookitaki's AFC Ecosystem has been designed with a focus on privacy protection. Its operations rest on patterns and typologies, not personal or sensitive data. This means that South African financial institutions can leverage its database without compromising on customer confidentiality or infringing upon the stringent requirements of the POPIA.

- Breaking Down Silos: The AFC Ecosystem helps break down organizational and jurisdictional silos, one of the key barriers to effective information sharing in South Africa. By facilitating interactions among a global network of experts, it encourages a unified approach to combating money laundering. The ecosystem provides a space where various stakeholders - financial institutions, regulators, law enforcement, and more - can connect and collaborate.

- Staying Ahead of Emerging Threats: South Africa, like any other country, faces the challenge of keeping up with the evolving tactics of money launderers. The AFC Ecosystem can prove instrumental in this respect. Its Typology Repository is regularly updated with emerging trends and methods, equipping users with the knowledge they need to stay one step ahead.

By enhancing the accessibility and usability of shared information, the AFC Ecosystem can significantly strengthen South Africa's defences against money laundering. As more South African entities participate in this global community, the region's collective intelligence against financial crime will grow stronger, contributing to safer financial systems and more secure society.

Leveraging Information Sharing for a Financially Secure Future

The battle against money laundering is a global challenge that requires our collective effort and intelligence to overcome. A crucial part of this fight lies in information sharing - the ability to pool knowledge on illicit financial behaviours, methodologies, and trends. With this knowledge, we can react to money laundering activities and proactively prevent them. South Africa, grappling with significant money laundering concerns, stands to benefit immensely from enhancing information-sharing mechanisms. In this context, innovative solutions like Tookitaki's Anti-Financial Crime (AFC) Ecosystem present a significant opportunity.

By fostering a global network of experts and providing a comprehensive, ever-evolving database of typologies, the AFC Ecosystem can help South African institutions stay one step ahead of financial criminals. It offers the ability to circumnavigate barriers of data privacy and technical challenges while breaking down informational and organizational silos. As more South African stakeholders join this ecosystem, we expect to see a growth in collective intelligence and a strengthening of the country's defences against financial crime. This, in turn, will contribute to a more secure financial system and a safer society.

We invite all anti-financial crime experts, risk consultants, regulators, and financial institutions to explore the potential of Tookitaki's AFC Ecosystem. Join us in this global, collaborative initiative to stay ahead of financial crime trends, uncover hidden risks, and turn compliance from a necessity to a strategic advantage.

Anti-Financial Crime Compliance with Tookitaki?