Role of AFC Ecosystem in Protecting Malaysia's Financial System

As a global financial hub and rapidly growing economy, Malaysia has faced its share of financial crime challenges. Money laundering, terrorist financing, and other financial crimes have been a constant threat to the stability and integrity of the country's financial system. High-profile scandals such as 1MDB have also brought international attention to the need for robust financial crime prevention measures in Malaysia.

Protecting Malaysia's financial system and economy from financial crime is of paramount importance. Effective prevention and detection of financial crimes safeguard the nation's financial stability and reputation, attract foreign investments, and promote sustainable economic growth. It is crucial for financial institutions to have strong compliance programs in place that can effectively identify, monitor, and manage financial crime risks.

Tookitaki's AFC Ecosystem is a comprehensive and advanced platform designed to help financial institutions in Malaysia effectively combat financial crimes. By leveraging a community-based approach, Tookitaki's AFC Ecosystem enables financial institutions to efficiently detect and prevent financial crimes, streamline compliance processes, and reduce overall risk exposure. In this blog, we will explore the role of Tookitaki's AFC Ecosystem in protecting Malaysia's financial system and economy and how it can contribute to a safer and more secure financial landscape.

Malaysia's Regulatory Landscape for Financial Crime Prevention

Key regulations and agencies in Malaysia

In Malaysia, the main regulatory body overseeing the financial system is Bank Negara Malaysia (BNM), which acts as the country's central bank and regulator. The Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) is the primary piece of AML/CFT legislation in Malaysia, defining the offences of money laundering and terrorism financing and outlining measures that financial institutions must take to detect and prevent these criminal activities. The National Anti-Financial Crime Centre (NAFCC) Act, which came into force on January 2, 2020, introduced a statutory definition of financial crime in Malaysia. The NAFCC is responsible for coordinating efforts to combat financial crime in the country.

In addition to the legislative framework, Malaysia's regulatory landscape is shaped by various megatrends and the need for collaboration among regulators and financial institutions. This includes fostering a better understanding of the risks posed by financial crimes and adopting innovative approaches to combat them.

Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) measures

Malaysia's regulatory landscape for financial crime prevention is constantly evolving to address the growing challenges posed by financial crimes such as money laundering, fraud, and corruption. To effectively combat money laundering and terrorism financing, Malaysia has adopted various AML/CFT measures as outlined in the AMLA. Some of these measures include customer due diligence (CDD), ongoing monitoring, record-keeping, and reporting of suspicious transactions to the relevant authorities. Financial institutions must also conduct risk assessments and implement appropriate internal controls and compliance programs to mitigate the identified risks.

Compliance requirements for financial institutions

Financial institutions in Malaysia must comply with a range of regulatory requirements to prevent financial crimes. Some of these requirements include:

- Implementing effective AML/CFT programs that include risk assessments, internal controls, and compliance policies and procedures.

- Conducting customer due diligence (CDD) to establish and verify customer identities and monitor ongoing relationships.

- Regularly screening customers against sanctions lists and reporting any matches to BNM.

- Monitoring transactions and activities to detect and report suspicious transactions to the relevant authorities.

- Maintaining adequate records of customer information, transactions, and compliance activities for a specified period.

Failure to comply with these requirements can result in severe penalties, reputational damage, and increased regulatory scrutiny for financial institutions.

Understanding Tookitaki's AFC Ecosystem

Tookitaki's Anti-Financial Crime (AFC) Ecosystem is a community-driven platform that fosters collaboration, knowledge sharing, and the development of innovative strategies to combat financial crimes in Malaysia. The AFC Ecosystem brings together financial institutions, regulatory bodies, and risk consultants, creating a collective knowledge base to stay ahead of emerging threats and improve the overall effectiveness of anti-financial crime efforts.

Features of Tookitaki's AFC Ecosystem

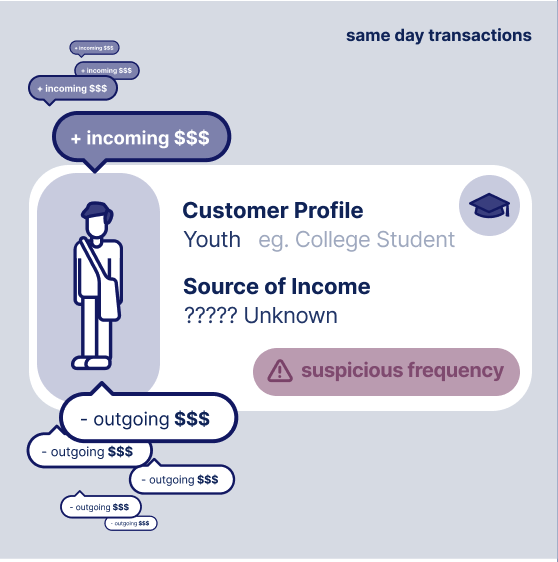

- Typology Repository: At the heart of the AFC Ecosystem is the Typology Repository, a living database of financial crime techniques and schemes. This repository is continuously updated with the latest insights from the ecosystem's participants, ensuring that financial institutions have access to current and relevant data. A graphical representation of a typology is shown below.

- Federated Machine Learning: Tookitaki utilizes federated machine learning to bridge the gap between the AFC Ecosystem and its proprietary Anti-Money Laundering Suite (AMLS) deployed at financial institutions. This innovative approach allows the AMLS to access the latest typologies from the AFC Ecosystem and execute them locally without sharing sensitive data, ensuring data privacy and security.

- Collaboration and Knowledge Sharing: The AFC Ecosystem promotes collaboration and knowledge sharing among its participants. Financial institutions can contribute their experiences and insights, helping to shape the development of more effective anti-financial crime strategies.

Addressing Financial Crimes in Malaysia

- Enhanced Detection and Prevention: By implementing Tookitaki's AFC Ecosystem, financial institutions gain access to the latest typologies and schemes, enabling them to identify and prevent financial crimes effectively. This access results in improved detection accuracy and a more robust anti-financial crime program. The proactive approach helps organizations avoid emerging threats and maintain compliance with regulatory requirements.

- Adaptation to Emerging Threats: The AFC Ecosystem's adaptive learning capabilities allow financial institutions to stay ahead of evolving criminal methodologies and emerging threats. This proactive approach enables organizations to respond to new challenges and maintain compliance with regulatory requirements.

- Reduction in False Alerts: Tookitaki's advanced technology, combined with insights from the AFC Ecosystem, helps minimize false positives, allowing financial institutions to focus their resources on high-risk cases. Reducing false alerts leads to more efficient compliance processes and lowers operational costs. Moreover, the use of federated machine learning enables organizations to access updated information without sharing sensitive data, ensuring data privacy and security.

- Strengthening Malaysia's Financial System: The AFC Ecosystem fosters a collaborative environment, promoting knowledge sharing and best practices among financial institutions, regulatory bodies, and risk consultants. This collaborative approach enables the development of more effective anti-financial crime strategies and allows organizations to learn from one another's experiences. By participating in the AFC Ecosystem, financial institutions can contribute to and benefit from the collective knowledge of industry experts, strengthening their own anti-financial crime efforts and contributing to a more secure financial system in Malaysia..

In summary, Tookitaki's AFC Ecosystem is crucial in addressing financial crimes in Malaysia. Financial institutions can better detect and prevent financial crimes by fostering collaboration, leveraging advanced technology, and staying ahead of emerging threats, contributing to a more secure and robust financial system.

Securing Malaysia's Financial Future with Tookitaki's AFC Ecosystem

Tookitaki's AFC Ecosystem plays a crucial role in protecting Malaysia's financial system and economy from financial crime risks. The platform in collaboration with Tookitaki's advanced technology helps financial institutions enhance their detection and prevention capabilities, streamline compliance processes, and foster collaboration among stakeholders. As a result, adopting Tookitaki's AFC Ecosystem can significantly contribute to a more resilient and secure financial landscape in Malaysia.

Financial institutions in Malaysia should consider being part of Tookitaki's AFC Ecosystem to bolster their financial crime prevention efforts. Embracing innovative approaches not only improves their ability to detect and prevent financial crime but also keeps them in line with the evolving regulatory landscape and industry best practices. We encourage financial institutions in Malaysia to explore the benefits of Tookitaki's AFC Ecosystem and consider how it can support their financial crime prevention strategies.

For more information on Tookitaki's AFC Ecosystem and how it can support your organization's financial crime prevention efforts, please get in touch with us. Our team of experts is available to answer your questions and discuss how our solutions can help protect your business and contribute to a safer financial landscape in Malaysia.

Anti-Financial Crime Compliance with Tookitaki?