New York State Department of Financial Services and Its Role in AML

The New York State Department of Financial Services (NYSDFS) is a department of the US state government. It is responsible for regulating the state’s financial services and products, including those subject to the New York insurance, banking and financial services laws. It is headquartered in New York City and has offices across the state.

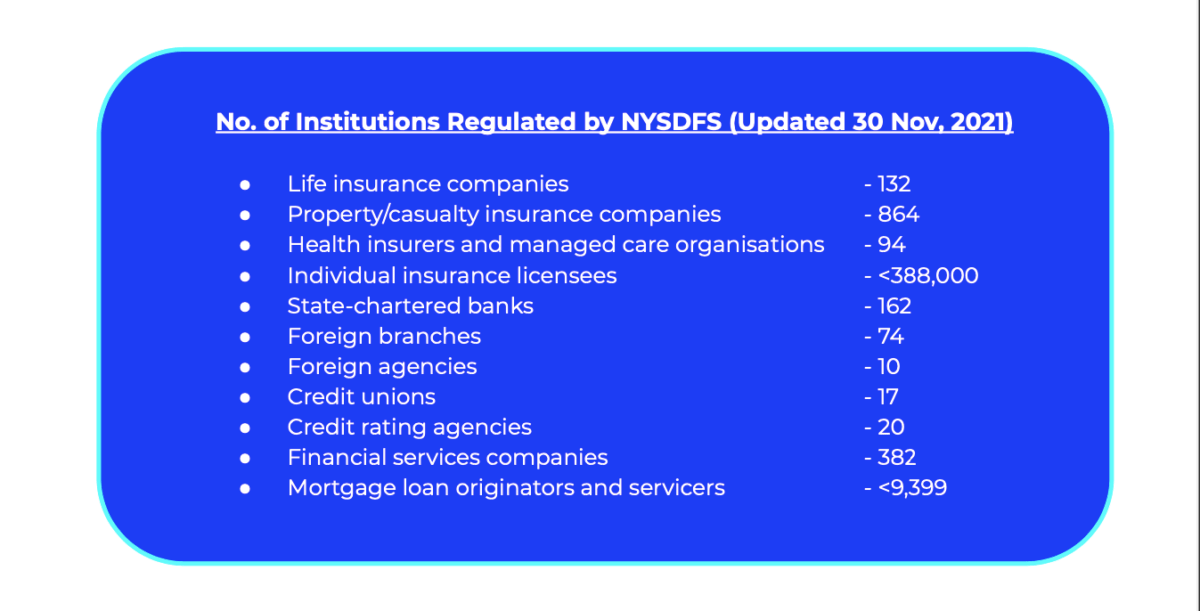

The department was created in October 2011, merging the New York State Insurance Department and the New York State Banking Department. The NYSDFS regulates a wide range of financial institutions. According to the NYSDFS, it regulates “nearly 1,800 insurance companies with assets of $5.5 trillion and more than 1,400 banking and other financial institutions with assets totaling more than $2.9 trillion”, as of December 31, 2020.

What does the NYSDFS do?

NYSDFS is responsible for regulating all state-licensed and state-chartered banks, credit unions, and mortgage bankers and brokers. All mortgage loan servicers operating in the state must be registered or licensed by the regulator.

Furthermore, the department oversees all insurance companies operating in New York, licenses all of the budget planners, finance agencies, check cashers, money transmitters, and virtual currency businesses operating in the state. It also investigates and prosecutes insurance and financial crimes such as fraud and money laundering, collaborating with law enforcement and regulatory agencies at the federal, state, county, and local levels.

What are the divisions of the New York State Department Of Financial Services?

The following are the five divisions of the New York State Department Of Financial Services:

- The Insurance Division

- The Banking Division

- Financial Frauds and Consumer Protection Division

- Capital Markets Division

- Real Estate Division

What are the responsibilities of NYSDFS?

The NYSDFS states its mission is “to reform the regulation of financial services in New York to keep pace with the rapid and dynamic evolution of these industries, to guard against financial crises and to protect consumers and markets from fraud.”

The department looks after the state’s Insurance Law and Banking Law and acts on any violations. It is mandated to take any actions necessary for:

- Strengthening the growth of New York’s financial industry and promote its economic development through “judicious regulation and vigilant supervision”

- Ensuring the “continued solvency, safety, soundness and prudent conduct” of the institutions that provide financial products and services

- Ensuring “fair, timely and equitable fulfillment of the financial obligations” of these institutions

- Protecting users from financially impaired or insolvent providers of financial products and services

- Encouraging “high standards of honesty, transparency, fair business practices and public responsibility”

- Eliminating financial fraud, other criminal abuse and unethical conduct in the industry

- Educating and protecting consumers and ensuring that they are provided with timely information to make responsible decisions about financial products and services.

NYSDFS and money laundering

Financial institutions under the New York Banking Law are mandated to have AML transaction monitoring and screening programmes in compliance with the state’s regulations. These institutions are also required to establish risk-based AML compliance programmes to ensure that the state’s financial institutions are not abused for criminal activities.

In 2016, the NYDFS adopted Part 504, a risk-based anti-terrorism and anti-money laundering regulation. It requires regulated banks, check cashers and money transmitters to maintain effective AML compliance programmes enabling monitoring of transactions and preventing sanctions violations.

In connection with AML compliance, financial institutions in New York have the following obligations:

- Monitoring customers’ transactions by employing a risk-based approach

- Ensuring compliance with the Federal AML rules including the Bank Secrecy Act

- Creating internal controls to combat money laundering and terrorist financing

- Having robust Office of Foreign Assets Control (OFAC) sanction screening programmes

- Reporting suspicious activities to authorised units

- Employing an AML compliance officer or money laundering reporting officer (MLRO) to oversee the AML compliance programme.

Examples of regulatory actions by NYSDFS related to AML compliance

The following are some of the examples of regulatory actions on its subject institutions related to AML compliance:

- In August 2014, the NYSDFS ordered Standard Chartered Bank to pay a US$300 million fine to settle allegations that the bank failed to detect potentially suspicious transactions at its New York branch.

- In April 2020, the NYSDFS entered into a consent order with Industrial Bank of Korea and its New York branch under which the bank will pay fines totaling US$35 million for violations of New York Bank Secrecy Act (BSA) and AML laws.

- In April 2019, the NYSDFS fined UniCredit Group US$405 million for violations of sanctions laws that involved billions of dollars in illegal and non-transparent transactions to clients in countries subject to sanctions, including Cuba, Iran, Libya, Myanmar and Sudan.

- In April 2019, the NYSDFS and the Office of the Manhattan District Attorney fined Standard Chartered Bank $463.4 million for violating sanctions laws that concealed illegal financial transactions clients engaged in with Iran and other sanctioned countries.

How can Tookitaki help financial institutions in New York?

A fast-growing Regtech company, Tookitaki has developed an end-to-end AML compliance platform called the Anti-Money Laundering Suite (AMLS). It offers multiple solutions catering to the core AML activities such as transaction monitoring, name screening, transaction screening and customer risk scoring. Powered by advanced machine learning, AMLS addresses market needs and provides an effective and scalable BSA AML compliance solution.

To learn more about our AML solution and its unique features that help financial institutions in New York to enhance their risk-based AML compliance programmes, book a meeting with one of our experts here.

Anti-Financial Crime Compliance with Tookitaki?