Financial Crimes Enforcement Network (FinCEN): What You Need to Know

Being the world’s largest economy and one of the biggest hubs of international trade and finance, the United States is impacted by a multitude of financial crimes. The Financial Crimes Enforcement Network (FinCEN) plays a major role in safeguarding the country’s financial system from illicit use and promoting national security.

The government bureau has domestic and international operations, networking with law enforcement agencies, the regulatory community and the financial services community. Its prime goal is to prevent and punish criminals who are involved in money laundering, terrorist financing and other financial crimes.

What is FinCEN?

FinCEN is a bureau of the US Department of the Treasury that collects and analyses information about financial transactions in the country to combat domestic and global money laundering, terrorist financing, and other financial crimes.

What is The Purpose of FinCEN?

According to FinCEN, its mission is “to safeguard the financial system from illicit use, combat money laundering, promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.” The agency does the following in order to fulfil its mission:

- Receiving and maintaining data on financial transactions from the subject institutions

- Analysing and disseminating that data for law enforcement purposes

- Cooperation with counterparts in other countries and international organisations

The Bank Secrecy Act and FinCEN

The Bank Secrecy Act or BSA is the first and most comprehensive Federal anti-money laundering and counter-terrorism financing (AML/CFT) statute of the United States. Under the BSA, the Secretary of the Treasury issues regulations mandating banks and other financial institutions to take a number of measures against financial crime. These institutions will have to establish anti-money laundering (AML) programmes and file reports that will be extremely useful in criminal and regulatory investigations and proceedings.

The Director of FinCEN has been given the responsibility of implementing, administering, and enforcing compliance with the BSA and its regulations.

Collection, Analysis, and Dissemination of Data

The following are FinCEN's duties and responsibilities in terms of central data collection, analysis, and dissemination in support of government and financial industry partners:

- Supporting, coordinating, and analysing data regarding compliance examination functions delegated to other Federal regulators

- Managing the collection, processing, storage, dissemination, and protection of data filed under its reporting requirements

- Maintaining a government-wide access service to its data, and networking users with overlapping interests

- Supporting law enforcement investigations and prosecutions

- Synthesising data to recommend internal and external allocation of resources to areas of greatest financial crime risk

- Sharing information and coordinating with foreign financial intelligence units (FIUs) on AML/CFT efforts

- Conducting analysis to support policymakers; law enforcement, regulatory, and intelligence agencies; FIUs; and the financial industry

The Importance of FinCEN

FinCEN says the basic concept underpinning its core activities is "follow the money." The agency looks to track the financial trails of criminals as they try to launder criminal proceeds or try to spend their ill-gotten money. It collects information from the financial industry, which is mandated to file suspicious transactions and activities with the agency. By using this information, law enforcement agencies investigate financial crimes and hold various criminals such as fraudsters, tax evaders, drug traffickers and financiers of terrorist activities accountable.

BSA Forms and FinCEN

In order to ensure robust BSA/AML compliance, financial institutions are required to keep detailed records of suspicious activities. They must maintain a log of purchases of monetary instruments including travellers’ checks and cashiers’ checks of between US$3,000 –10,000. The log should have verified the identities of purchasers with the aggregated value of their transactions.

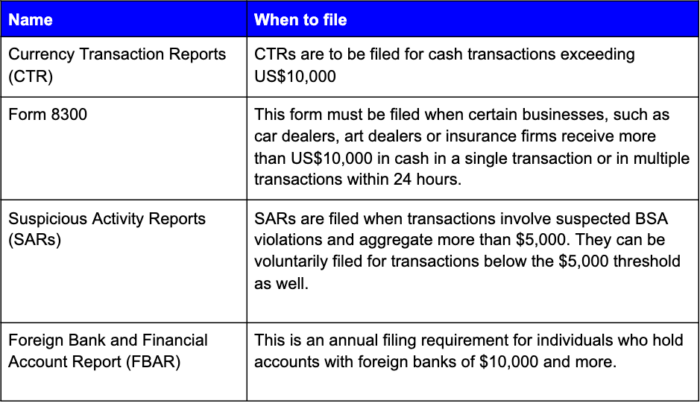

The BSA also mandates financial institutions to do a number of reporting and filings with FinCEN when they encounter potential AML activities. These obligations are detailed in the following table.

Most of these reports can be filed electronically, using FinCEN’s BSA e-Filing system. Organisations are required to submit a formal application to FinCEN to obtain access to the e-Filing system.

FinCEN Forms

Businesses and people are mandated to file a number of BSA reports with FinCEN in a stipulated format. FinCEN discontinued paper reports from March 31, 2013 and now accepts only electronic filing of Suspicious Activity Reports (SARs), Currency Transaction Reports (CTRs), Registration of Money Services Business (RMSBs), and Designation of Exempt Person Reports (DOEPs).

Tookitaki and AML compliance

Tookitaki has developed an end-to-end AML compliance platform called the Anti-Money Laundering Suite (AMLS). It offers multiple solutions catering to the core AML activities such as transaction monitoring, name screening, transaction screening and customer risk scoring. It helps detect suspicious activities and transactions, enabling financial institutions to report them to regulators including FinCEN in a timely manner. Powered by advanced machine learning, AMLS addresses the market needs and provides an effective and scalable BSA/AML compliance solution.

To learn more about our AML solution and how it can help you stay FinCEN compliant, speak to one of our AML experts today.

Anti-Financial Crime Compliance with Tookitaki?