Best Practices for Effective Transaction Screening in Financial Firms

In today’s fast-paced financial landscape, financial institutions are under increasing pressure to comply with regulations and prevent financial crimes such as money laundering and terrorist financing. One of the key tools used by financial institutions to achieve this is transaction screening. In this article, we will explore the best practices for effective transaction screening in financial institutions.

Understanding Transaction Screening and Transaction Monitoring

Before we dive into best practices, it’s important to understand the difference between transaction screening and transaction monitoring.

Transaction Screening

Transaction screening is the process of screening transactions against a list of known individuals, entities, and countries that are sanctioned or involved in illegal activities. This list is often provided by regulatory bodies such as the Office of Foreign Assets Control (OFAC) in the United States or the Financial Action Task Force (FATF) internationally.

The goal of transaction screening is to identify and flag any transactions that may be linked to these individuals, entities, or countries for further investigation.

Transaction Monitoring

Transaction monitoring, on the other hand, is the ongoing process of monitoring customer transactions for any unusual or suspicious activity. This involves analyzing transactional data and customer behaviour to identify patterns and anomalies that may indicate potential financial crimes.

While transaction screening is a more targeted approach, transaction monitoring is a broader and more comprehensive process that looks at all customer transactions.

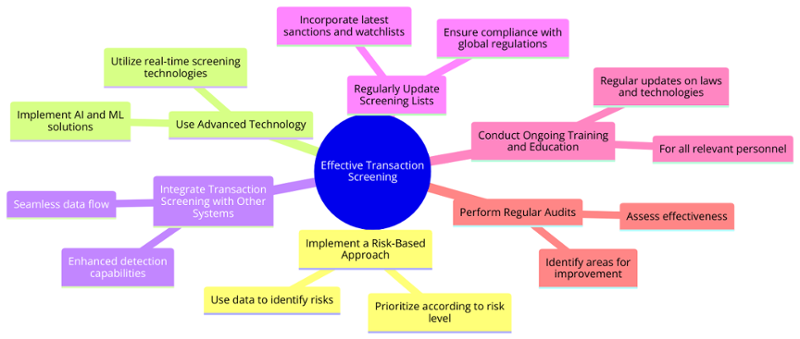

Best Practices for Effective Transaction Screening

Now that we have a better understanding of transaction screening and monitoring, let’s explore the best practices for effective transaction screening in financial institutions.

1. Implement a Risk-Based Approach

One of the key best practices for transaction screening is to implement a risk-based approach. This means that financial institutions should assess the risk associated with each customer and transaction and tailor their screening processes accordingly.

For example, high-risk customers and transactions should undergo more rigorous screening and monitoring compared to low-risk ones. This allows financial institutions to allocate their resources more efficiently and focus on the areas that pose the highest risk.

2. Use Advanced Technology

With the increasing volume and complexity of financial transactions, manual transaction screening is no longer feasible. Financial institutions should invest in advanced technology such as artificial intelligence and machine learning to automate the screening process.

These technologies can analyze large amounts of data in real-time and flag any suspicious transactions for further investigation. This not only improves the efficiency of the screening process but also reduces the risk of human error.

3. Integrate Transaction Screening with Other Systems

Transaction screening should not be a standalone process. It should be integrated with other systems such as customer relationship management (CRM) and transaction monitoring to provide a holistic view of customer activity.

This integration allows financial institutions to identify any red flags or inconsistencies in customer behavior and take appropriate action. It also helps in creating a more seamless and efficient process for both customers and employees.

4. Regularly Update Screening Lists

Sanctions lists and other screening lists are constantly changing, and financial institutions must ensure that they are using the most up-to-date versions. This requires regular monitoring and updating of screening lists to ensure that any new additions or changes are accounted for.

Failure to update screening lists can result in missed red flags and potential compliance issues. Therefore, financial institutions should have a process in place to regularly review and update their screening lists.

5. Conduct Ongoing Training and Education

Effective transaction screening requires a well-trained and knowledgeable team. Financial institutions should invest in ongoing training and education for their employees to ensure that they are up-to-date with the latest regulations and best practices.

This training should cover topics such as identifying red flags, understanding the screening process, and using screening technology effectively. Regular training and education can help employees stay vigilant and prevent potential compliance issues.

6. Perform Regular Audits

Regular audits are essential for ensuring the effectiveness of transaction screening processes. These audits should be conducted by an independent third party to provide an unbiased assessment of the screening process.

Audits can help identify any gaps or weaknesses in the screening process and provide recommendations for improvement. They also demonstrate to regulators that the financial institution is taking compliance seriously and actively working to prevent financial crimes.

Real-World Examples of Effective Transaction Screening

One example of effective transaction screening is the case of HSBC, a global bank that was fined $1.9 billion for failing to prevent money laundering. The bank had inadequate transaction screening processes in place, which allowed billions of dollars in suspicious transactions to go undetected.

In contrast, JPMorgan Chase, another global bank, has implemented advanced technology and a risk-based approach to transaction screening. This has allowed them to identify and report suspicious transactions, resulting in a significant reduction in compliance issues and fines.

Revolutionize Your Transaction Screening with Tookitaki's Advanced AI-driven Solutions

Transaction screening is a critical tool for financial institutions to prevent financial crimes and comply with regulations. By implementing a risk-based approach, using advanced technology, and regularly updating screening lists, financial institutions can improve the effectiveness of their transaction screening processes.

Tookitaki stands out in the financial compliance landscape by offering a transformative approach to transaction screening, pivotal for institutions navigating the intricate web of global financial regulations. Tookitaki's innovative platform enables real-time, AI-enhanced screening against comprehensive global watchlists, including PEP, sanctions, and adverse media. By significantly reducing false positives and ensuring over 95% accuracy in alert quality, Tookitaki not only streamlines compliance processes but also elevates operational efficiency. The result is a robust, scalable solution that adapts to the dynamic regulatory landscape, ensuring that financial institutions can confidently manage their compliance obligations while maintaining the agility needed in today's fast-paced financial environment.

Anti-Financial Crime Compliance with Tookitaki?