6 Key Customer Screening Factors for Effective AML Risk Management

In today's complicated financial world, it is crucial to have strong measures in place to combat money laundering. Customer screening is a vital tool for reducing money laundering risks and meeting regulatory obligations. Financial institutions can detect and stop potential money laundering activities by considering Important customer screening criteria. This article explores some critical customer screening elements, offering valuable information on building an effective framework for managing money laundering risks.

Understanding Customer Screening for AML Risk

Customer screening is a vital process that enables financial institutions to assess the risk profile of their clients, decide on the business relationship and detect any suspicious activities. Institutions can safeguard themselves against potential AML threats by implementing comprehensive customer screening protocols. The following essential components of customer screening play a crucial role in AML compliance:

Customer Behaviour and Transaction Patterns

The diligent observation of customer conduct and the careful analysis of transaction patterns play a vital role in detecting dubious activities. Anomalous transaction amounts, regular instances of substantial cash deposits or withdrawals, irregular transaction types, and excessive transfers to high-risk jurisdictions can indicate potential money laundering endeavours.

Geographic Risk

The process of geographic risk assessment entails meticulously examining the jurisdictions implicated in a customer's transactions. Specific regions characterised by deficient anti-money laundering (AML) controls, elevated levels of corruption, or a track record of financial misconduct present a heightened level of risk. By thoroughly scrutinising the geographical dimensions of a customer's activities, financial institutions can better understand their susceptibility to AML risks.

Customer Profile and Background

Comprehending the profile and background of a customer assumes paramount importance in ensuring screening effectiveness. The collection of pertinent information, including their profession, origins of wealth, affiliations within the business realm, and political involvements, aids in assessing their level of risk. It is imperative to conduct enhanced due diligence measures when dealing with politically exposed persons (PEPs) and individuals associated with industries prone to heightened risks.

Source of Funds

Thoroughly scrutinising the origin of funds assumes utmost significance in the identification of possible money laundering endeavours. The process involves verifying the authenticity and legitimacy of income sources, including inheritance, investments, business revenues, or any other financial inflows, to ensure the customer's funds are free from any association with illicit activities.

Third-Party Relationships

Conducting a comprehensive evaluation of a customer's affiliations with external entities is paramount in meticulous customer screening. Gaining insights into the nature of these connections, such as joint accounts, shared financial interests, or associations with high-risk entities, facilitates a comprehensive assessment of the overall risk exposure. By delving into the intricacies of these relationships, financial institutions can enhance their ability to identify potential vulnerabilities and proactively manage associated risks.

Red Flags from External Data Sources

Harnessing the power of external data sources, including publicly available records and comprehensive watchlists, offers an extensive array of valuable information that significantly enriches the process of customer screening. This proactive approach allows financial institutions to uncover potential red flags that demand heightened attention. Examples of such red flags encompass criminal records, adverse media, or any association with sanctioned entities. By subjecting these indicators to rigorous scrutiny, institutions can bolster their ability to detect and mitigate potential risks effectively.

Customer Due Diligence

To effectively mitigate AML risks, robust customer due diligence (CDD) processes should be implemented. Key elements of CDD include:

Identity Verification

Ensuring precise identification and meticulous verification of customer information assumes paramount importance. The process entails thorough scrutiny of personal identification documents, meticulous verification of addresses, and the implementation of comprehensive measures for enhanced identity checks whenever deemed necessary. By adopting these rigorous practices, financial institutions can establish a robust foundation for customer screening, mitigating potential risks and reinforcing the integrity of their operations.

Risk Categorization

The process of categorising customers into distinct risk profiles based on their respective risk levels serves as a catalyst for implementing customised monitoring and mitigation strategies. Financial institutions can precisely allocate resources and tailor their due diligence efforts by stratifying customers based on their risk profiles.

High-risk customers demand intensified scrutiny through enhanced due diligence measures, while low-risk customers undergo standard screening protocols. This meticulous categorisation empowers institutions to effectively manage risks, strengthen their compliance frameworks, and safeguard the integrity of their operations.

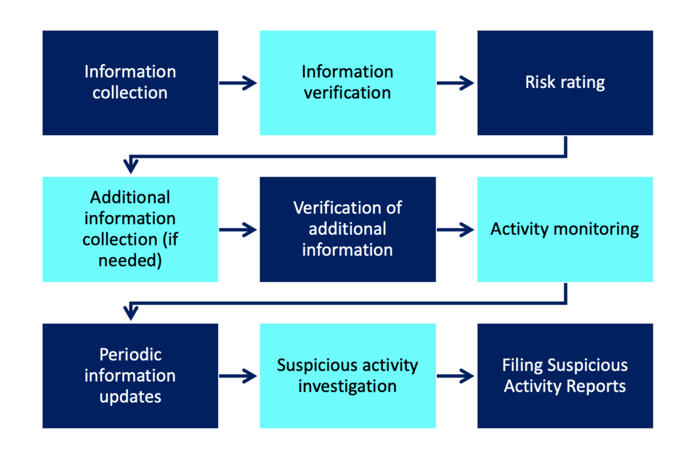

CDD Process

Transaction Monitoring and Analysis

Continuous monitoring of customer transactions is essential to identify suspicious patterns and activities. Financial institutions can effectively track and analyze customer transactions by employing sophisticated transaction monitoring systems, detecting any anomalies or red flags. Key aspects of transaction monitoring include:

Real-Time Transaction Surveillance

By harnessing the power of cutting-edge technologies, financial institutions can leverage the capabilities of state-of-the-art systems for real-time transaction monitoring. These advanced monitoring systems enable institutions to detect and identify potentially suspicious activities in a prompt and efficient manner.

Using such advanced technologies enhances the institution's ability to stay vigilant, ensuring the timely identification and mitigation of potential risks. With real-time transaction monitoring systems in place, financial institutions can proactively safeguard against fraudulent transactions and protect the integrity of their operations.

Pattern Recognition and Analysis

By leveraging the power of advanced data analytics and employing sophisticated pattern recognition techniques, financial institutions can effectively uncover intricate transaction patterns that serve as potential indicators of money laundering activities. Institutions can proactively identify and scrutinize irregular behaviours through meticulous analysis of transactional data, such as the structuring of transactions and other suspicious activities. These data-driven insights enable institutions to stay one step ahead in the fight against financial crime, strengthening their ability to detect and mitigate potential risks while upholding the integrity of their operations.

Threshold Monitoring

Establishing transactional thresholds and implementing robust monitoring mechanisms to track deviations from standard patterns empowers financial institutions to effectively flag and thoroughly investigate potentially suspicious transactions. By closely monitoring transactions that surpass predefined thresholds, institutions can swiftly identify and raise alerts regarding unusual high-value transactions, frequent cash deposits, or rapid movement of funds. These flagged activities act as crucial triggers for initiating in-depth investigations and additional scrutiny, ensuring that any potential risks or illicit activities are promptly addressed and mitigated.

Continuous Monitoring and Review

To maintain a robust AML risk management system, customer screening necessitates consistent monitoring and review to ensure its effectiveness. The following practices are essential for maintaining robust AML risk management:

Periodic Customer Reviews

Engaging in periodic reviews of customer profiles and diligently scrutinising their activities are pivotal in identifying any pertinent changes or updates that might impact their risk profile. This comprehensive review process entails reevaluating risk categorisations, meticulously verifying the accuracy and relevance of customer information, and subsequently updating due diligence measures to align with the evolving risk landscape.

By consistently staying attuned to customer profiles and proactively adapting risk mitigation strategies, financial institutions can effectively manage risks, ensure compliance with regulatory standards, and maintain the integrity of their operations.

Enhanced Monitoring for High-Risk Customers

Given the elevated risk factors associated with high-risk customers, it becomes imperative to institute enhanced monitoring protocols specifically tailored to their unique circumstances. By implementing more frequent and comprehensive monitoring measures that are specifically designed for these customers, financial institutions can proactively detect and respond to any potential suspicious activities in a timely manner.

This heightened level of scrutiny serves as a robust safeguard, enabling institutions to effectively manage risks, maintain regulatory compliance, and preserve the integrity of their operations.

Training and Awareness Programs

Ensuring a continuous training and awareness program is paramount in equipping staff members with the necessary knowledge and understanding of the ever-evolving landscape of AML risks and best practices in customer screening. By providing regular updates on emerging trends, new regulations, and real-life case studies, financial institutions can foster a culture of AML compliance that is consistently reinforced and strengthened.

These ongoing educational initiatives empower staff members to stay abreast of the latest developments, enabling them to adapt and align their practices with regulatory requirements proactively. By prioritising continuous training and fostering a strong AML compliance culture, institutions can effectively mitigate risks, protect their reputation, and uphold the highest standards of integrity and transparency.

Conclusion

Effective customer screening is essential to a robust AML risk management framework. By understanding and implementing the key factors for customer vetting discussed in this article, financial institutions can proactively identify and mitigate AML risks. Monitoring customer behaviour and transaction patterns, assessing geographic risks, scrutinising customer profiles and backgrounds, verifying the source of funds, evaluating third-party relationships, and leveraging external data sources all contribute to adequate customer vetting.

Combined with rigorous customer due diligence, transaction monitoring, and continuous monitoring practices, financial institutions can maintain a strong defence against money laundering threats. Ensuring compliance with regulatory requirements and prioritising AML risk management ultimately protects the institution and the financial system's integrity.

Ready to revolutionise your customer screening and risk-scoring processes? Book a demo now to experience the power of Tookitaki's cutting-edge Smart Screening and Dynamic Risk Scoring solutions. Discover how our advanced AI-driven technology can help you enhance compliance, mitigate risks, and optimise operational efficiency. Don't miss out on this opportunity to transform your financial institution's screening capabilities. Schedule your demo today and unlock the future of intelligent risk management with Tookitaki.

Frequently Asked Questions (FAQs)

Q1: What is customer screening in AML risk management?

A1: Customer screening is the process of evaluating the risk profile of clients to detect potential money laundering activities and ensure compliance with anti-money laundering regulations.

Q2: What are some red flags to look out for during customer screening?

A2: Red flags include unusual transaction amounts, frequent large cash deposits or withdrawals, inconsistent transaction types, transfers to high-risk jurisdictions, and associations with sanctioned entities or individuals with criminal records.

Q3: Why is continuous monitoring important in customer screening?

A3: Continuous monitoring allows for the timely detection of any suspicious activities or changes in customer behavior, enabling institutions to mitigate potential AML risks more effectively.

Q4: How does customer due diligence contribute to customer screening?

A4: Customer due diligence involves verifying customer identities, categorizing their risk levels, and conducting thorough assessments of their profiles, backgrounds, and sources of funds, providing crucial information for effective customer screening.

Q5: Why is training and awareness important in AML risk management?

A5: Training and awareness programs help educate staff members about AML risks, regulatory requirements, and best practices, fostering a culture of compliance and strengthening the institution's overall AML risk management efforts.

Anti-Financial Crime Compliance with Tookitaki?