In today's global financial landscape, Anti-Money Laundering (AML) compliance plays a crucial role in ensuring the financial system's integrity. As a major player in the international economy, Brazil is no exception to the need for robust AML measures. With the increasing sophistication of financial crimes, it has become imperative for banks and fintechs in Brazil to adopt comprehensive and efficient AML compliance solutions.

Enter Tookitaki, a trusted and leading provider of innovative AML compliance solutions. With a deep understanding of the challenges faced by financial institutions in Brazil, Tookitaki offers a suite of advanced tools and technologies to enhance AML compliance processes while reducing costs and improving overall efficiency.

By leveraging Tookitaki's cutting-edge solutions, financial institutions in Brazil can strengthen their AML programs and stay ahead of the ever-evolving regulatory landscape. Let's delve into the features and advantages of Tookitaki's solutions and discover how they can help enhance quality and reduce costs in AML compliance for banks and fintechs operating in Brazil.

Challenges of AML Compliance in Brazil

Complex Regulatory Landscape

Brazil has a robust regulatory framework for AML compliance, including laws, regulations, and guidelines set by regulatory authorities such as the Central Bank of Brazil and the Financial Activities Control Council (COAF). Financial institutions in Brazil must navigate through multiple regulatory requirements, reporting obligations, and the need to stay updated with the ever-changing regulations. Compliance with local laws and international standards, such as the Financial Action Task Force (FATF) recommendations, adds further complexity to the AML landscape in Brazil.

Increasing Need for Effective AML Solutions

Money laundering activities and financial crimes continue to pose significant threats to the financial system in Brazil. Criminal organizations constantly adapt their techniques to exploit vulnerabilities, making it crucial for financial institutions to implement sophisticated AML solutions. The increasing volume and complexity of financial transactions and the emergence of digital banking and fintech businesses have heightened the need for more efficient and effective AML compliance measures.

Costs and Resource-Intensive Nature of Traditional AML Approaches

Traditional AML compliance methods often involve manual processes, extensive paperwork, and reliance on human expertise, leading to high operational costs and resource-intensive workflows. The sheer volume of data to be analyzed, including customer profiles, transactions, and external data sources, poses a significant challenge for compliance teams. Manual processes are time-consuming and prone to errors, resulting in inefficiencies, increased false positives, and additional costs associated with investigations and remediation efforts.

In light of these challenges, financial institutions in Brazil are seeking innovative solutions that can streamline AML compliance processes, enhance detection capabilities, and reduce costs. Tookitaki's advanced AML compliance solutions address these pain points and provide a comprehensive approach to help banks and fintechs in Brazil overcome these challenges effectively.

Tookitaki's AML Suite for Banks and Fintechs

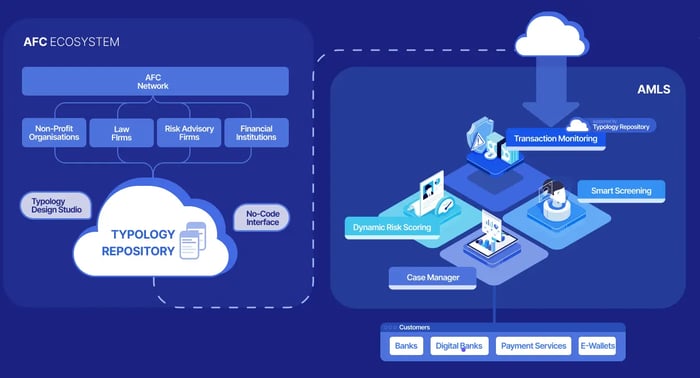

Tookitaki offers a comprehensive AML Suite that caters to the specific needs of banks and fintechs in Brazil. This suite is designed to provide end-to-end solutions, streamlining AML compliance processes and empowering financial institutions to detect and prevent financial crimes effectively.

Benefits of End-to-End Operating Systems

The AML Suite operates as an end-to-end operating system, covering various stages of the compliance process, from initial screening to ongoing monitoring and case management. By having a cohesive and integrated system, banks and fintechs can achieve a seamless workflow, eliminate data silos, and ensure consistent compliance across different modules. The end-to-end approach enhances operational efficiency, reduces manual efforts, and facilitates a more holistic view of AML compliance, enabling financial institutions to stay ahead of evolving risks.

Modules within the AML Suite

Smart Screening Solutions

- Prospect Screening: This module enables real-time screening capabilities for prospect onboarding. By leveraging smart, AI-powered fuzzy identity matching, it reduces regulatory compliance costs and exposure to risk. Prospect Screening helps financial institutions detect and prevent financial crime by screening potential customers against various watchlists, including sanctions lists, PEP databases, and adverse media. The solution provides efficient and streamlined screening processes, reducing false positive hits and assisting compliance specialists in various scenarios.

- Name Screening: Tookitaki's Name Screening solution utilizes machine learning and Natural Language Processing (NLP) techniques to accurately score and distinguish true matches from false matches across names and transactions, in real-time and batch mode. The solution supports screening against sanctions lists, PEPs, adverse media, and local/internal blacklists, ensuring comprehensive coverage. With 50+ name-matching techniques, support for multiple attributes like name, address, gender, and a built-in transliteration engine, Name Screening provides razor-sharp matching accuracy. The state-of-the-art real-time screening architecture reduces held transactions and improves straight-through processing (STP) for a seamless customer experience.

Dynamic Risk Scoring

- Prospect Risk Scoring: Prospect Risk Scoring (PRS) is a powerful solution that enables financial institutions to onboard prospects with reduced regulatory compliance costs and risk exposure. By defining a set of parameters that correspond to the rules, PRS offers real-time risk scoring capabilities. Financial institutions can leverage PRS to take initial scope, including factors such as address, nationality, gender, occupation, monthly income, and more, into account for risk scoring. The configurable scores for risk categories allow financial institutions to streamline the prospect onboarding process, make informed decisions, and mitigate risks effectively.

- Customer Risk Scoring: Tookitaki's Customer Risk Scoring (CRS) is a core module within the AML Suite, powered by advanced machine learning. CRS provides scalable customer risk rating by dynamically identifying relevant risk indicators across a customer's activity. The solution offers a 360-degree customer risk profile, continuous on-demand risk scoring, and perpetual KYC for ongoing due diligence. With actionable insights based on customer risk scores, financial institutions can make accelerated and informed decisions, ensuring effective risk mitigation.

Transaction Monitoring

Tookitaki's Transaction Monitoring solution is the most comprehensive in the industry, utilizing a first-of-its-kind industry-wide typology repository and AI capabilities. It provides comprehensive risk detection and efficient alert management, offering 100% risk coverage and the ability to detect new suspicious cases. The solution includes automated threshold management, reducing the manual effort involved in threshold tuning by over 70%. With superior pattern-based detection techniques, leveraging typologies that represent real-world red flags, Transaction Monitoring helps financial institutions safeguard against new risks and threats effectively.

Case Manager

The Case Manager within Tookitaki's AML Suite provides compliance teams with a collaborative platform to work seamlessly on cases. The Case Manager includes automation that empowers investigators by automating processes such as case creation, allocation, and data gathering. Financial institutions can configure the Case Manager to improve operational efficiency, reduce manual efforts, and enhance overall effectiveness in managing and resolving cases.

Tookitaki's AML Suite offers a comprehensive range of modules and functionalities, enabling banks and fintechs in Brazil to enhance AML compliance, streamline processes, and mitigate financial crime risks effectively.

Advantages of Tookitaki's Solutions for AML Compliance in Brazil

Enhanced Detection Accuracy

- Tookitaki's advanced AI-powered solutions significantly enhance detection accuracy, enabling financial institutions in Brazil to identify and prevent suspicious activities more effectively.

- By leveraging machine learning and data analytics, the solutions can detect complex patterns and anomalies that may indicate potential money laundering or financial crimes.

- Enhanced detection accuracy helps minimize false negatives and promptly identifies suspicious activities, strengthening AML compliance efforts.

Reduced False Alerts and Manual Efforts

- Traditional AML systems often generate a high number of false alerts, which require manual review and investigation, leading to inefficiencies and increased costs.

- Tookitaki's solutions leverage intelligent algorithms and advanced analytics to reduce false alerts, allowing compliance teams to focus on high-risk cases requiring further investigation.

- By minimizing false alerts, financial institutions can optimize their resources, improve operational efficiency, and allocate their compliance personnel more effectively.

Compliance with Brazilian Regulatory Requirements:

- Tookitaki's AML solutions are designed to meet the specific regulatory requirements of the Brazilian financial landscape.

- The solutions are aligned with the regulatory frameworks established by authorities such as the Central Bank of Brazil and COAF, ensuring compliance with local AML regulations and guidelines.

- Financial institutions using Tookitaki's solutions can have confidence in their compliance efforts, knowing that they adhere to the necessary regulatory standards.

Streamlined Processes and Increased Efficiency

- Tookitaki's AML Suite streamlines compliance processes through automation and integration, reducing manual interventions and improving overall operational efficiency.

- By automating tasks such as data gathering, risk scoring, and alert prioritization, the solutions enable compliance teams to work more efficiently and make informed decisions promptly.

- The streamlined processes enhance collaboration, communication, and workflow management, facilitating effective AML compliance practices within financial institutions.

Cost Reduction and Resource Optimization

- Traditional AML compliance approaches often involve significant costs associated with manual efforts, investigations, and remediation.

- Tookitaki's solutions help financial institutions optimize their resources by reducing manual interventions, streamlining workflows, and automating repetitive tasks.

- Financial institutions can achieve cost reductions by minimizing false alerts, improving operational efficiency, and enhancing overall compliance effectiveness while maintaining a robust AML compliance framework.

Tookitaki's solutions provide several advantages for AML compliance in Brazil, including enhanced detection accuracy, reduced false alerts, compliance with local regulations, streamlined processes, and cost reduction. These advantages empower financial institutions to strengthen their AML programs, mitigate risks, and effectively meet the evolving challenges of financial crime.

Leveraging Tookitaki's Solutions for Enhanced AML Compliance in Brazil

In the face of increasing financial crime risks and evolving regulations, financial institutions in Brazil must prioritize robust AML compliance measures. Leveraging Tookitaki's solutions empowers banks and fintechs to enhance their AML programs, improve detection capabilities, and mitigate risks effectively. By adopting Tookitaki's advanced AI-powered solutions, financial institutions can streamline compliance processes, reduce costs, and ensure compliance with Brazilian regulatory standards.

We encourage readers to explore Tookitaki's offerings in more detail to understand how their AML solutions can benefit their specific compliance needs. By visiting Tookitaki's website or contacting our team, financial institutions can gain further insights into the features, functionalities, and potential impact of Tookitaki's solutions.

To experience the power of Tookitaki's AML solutions firsthand, we invite readers to book a demo tailored to their organization's needs. By requesting a demo, financial institutions can witness how Tookitaki's solutions can enhance their AML compliance efforts and address specific challenges. For further information, inquiries, or to discuss specific requirements, readers can reach out to Tookitaki's team directly through their website or by contacting their dedicated representatives.

By leveraging Tookitaki's comprehensive AML solutions, financial institutions in Brazil can bolster their compliance frameworks, improve detection accuracy, and effectively combat financial crimes while reducing costs and resource utilization. Request a demo or reach out to Tookitaki today to embark on a journey towards enhanced AML compliance.

Anti-Financial Crime Compliance with Tookitaki?