In the dynamic world of Fintech, maintaining compliance with anti-money laundering (AML) regulations remains a crucial aspect of operations. With the increasing complexity of financial transactions and the growing sophistication of illicit activities, staying ahead of the curve is more challenging than ever.

As a vibrant hub for Fintech innovation, the Philippines has seen a significant surge in digital transactions. While this advancement opens up opportunities for financial inclusion and economic growth, it also poses new challenges in terms of AML compliance. Fintechs are now required to navigate a complex regulatory environment, manage high volumes of transactions, and detect increasingly subtle patterns of suspicious activity.

Enter Tookitaki's AML Monitoring Software, a groundbreaking solution that combines artificial intelligence (AI) and comprehensive risk detection methodologies. This software is designed to help Philippine Fintechs meet and exceed AML compliance requirements, safeguarding their operations against potential threats. In this blog, we'll delve deeper into the features of this software and how it is poised to revolutionize AML monitoring for Fintechs in the Philippines. Stay tuned to learn how your organization can leverage Tookitaki's AML Monitoring Software to optimize compliance, enhance security, and maintain a competitive edge in the fast-paced Fintech landscape.

The Challenge of AML Compliance for Fintechs in the Philippines

Unique AML Challenges for Fintechs

Fintechs in the Philippines face unique challenges in maintaining AML compliance. As digital platforms, they handle a large volume of transactions that can potentially span across borders. This makes it difficult to monitor and identify suspicious activities. The sheer scale of transactions, the speed at which they occur, and the diversity of payment methods add to the complexity. Moreover, Fintechs often target unbanked or underbanked populations who may lack traditional forms of identification, posing additional obstacles for Know Your Customer (KYC) procedures.

Inadequacy of Traditional AML Solutions

Traditional AML solutions, typically rules-based systems, may struggle to keep up with the dynamism and complexity inherent in Fintech operations. They are often inflexible, unable to adapt quickly to new types of fraud or changes in money laundering tactics. Moreover, these systems tend to generate a high number of false positives, leading to inefficiencies and slowing down transaction processing times. For Fintechs, this can result in a poor customer experience, something they cannot afford in a highly competitive market.

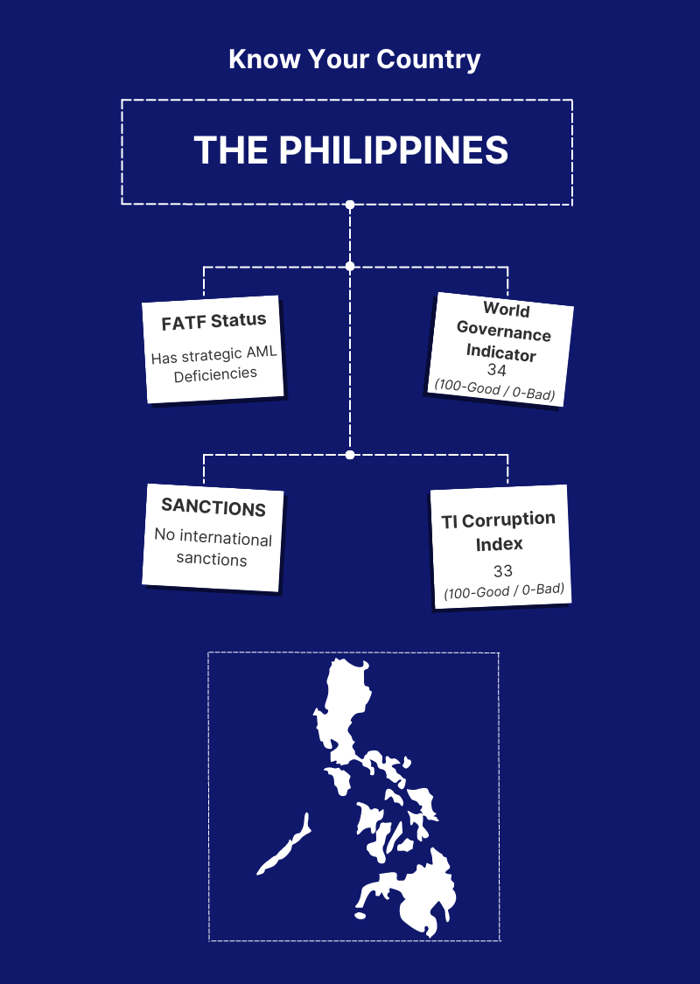

Regulatory Environment in the Philippines

The regulatory environment in the Philippines has been evolving to accommodate the rise of Fintechs while ensuring robust AML controls. The Bangko Sentral ng Pilipinas (BSP), the country's central bank, has been proactive in updating and implementing regulations that both encourage Fintech innovation and uphold stringent AML standards. However, this dynamic regulatory landscape can be hard for Fintechs to navigate, especially given the speed at which they operate and innovate.

In summary, the unique nature of Fintech operations, the limitations of traditional AML solutions, and the evolving regulatory environment in the Philippines combine to create a challenging AML compliance landscape for Fintechs. Within this context, the need for a new, more adaptable, and efficient AML solution becomes evident.

Tookitaki's AML Monitoring Software: A Detailed Overview

Comprehensive and Adaptive Features

Tookitaki's Anti-Money Laundering Suite (AMLS) is an advanced, AI-powered solution designed to address the unique challenges faced by Fintechs. At its core, the AMLS features a robust transaction monitoring solution that leverages the power of artificial intelligence and a first-of-its-kind industry-wide typology repository to provide comprehensive risk detection and efficient alert management.

Key features of Tookitaki's Transaction Monitoring solution include:

- 100% risk coverage: The software provides access to the latest typologies leveraging the expertise of a global AML Subject Matter Expert (SME) network. This ensures comprehensive risk detection and evolves in tandem with the ever-changing landscape of financial crimes.

- A built-in sandbox environment: This feature allows financial institutions to test and deploy new typologies in a matter of days, not months, drastically reducing the time to operationalization.

- Automated threshold tuning: This innovative feature has reduced the manual effort involved in threshold tuning by over 70%, resulting in significant efficiency gains.

- Superior Detection: Tookitaki's software leverages typologies that represent real-world red flags, enhancing its ability to detect new suspicious cases not detected by other systems. Tookitaki's solution uses an innovative parsing technique that automatically decomposes typologies into multiple smaller risk indicators. This process allows the system to automatically generate thresholds and detect deviations in customer behaviour at a granular level.

Meeting the Unique Needs of Fintechs

Tookitaki's AMLS was designed with the needs of Fintechs at the forefront. It provides a second line of defence against risks and threats, a feature particularly useful for Fintechs that handle a high volume of transactions.

The software also features an intelligent risk indicator engine that uses a combination of supervised and unsupervised machine learning to generate highly accurate risk scores. This eliminates the need for manual triage of all alerts, reducing false positives and enabling investigators to focus on high-risk alerts.

In summary, Tookitaki's AMLS offers a comprehensive, innovative, and adaptable AML solution tailored to meet the unique needs of Fintechs in the Philippines. By leveraging cutting-edge AI technology and a deep understanding of the AML landscape, Tookitaki's software provides an efficient and effective way to navigate the complex world of AML compliance.

Why Tookitaki's AML Monitoring Software is a Game Changer

Impactful Benefits for Fintechs

Tookitaki's AMLS offers numerous benefits for Fintechs, particularly those operating in the Philippines' rapidly evolving regulatory environment. Its unique features, combined with the ability to adapt to changing conditions and threats, make it a powerful tool for compliance teams.

- Reduced false positives: By leveraging machine learning, Tookitaki's software significantly reduces false positives, a common problem in transaction monitoring. This allows compliance teams to focus their efforts on the most suspicious activities, improving efficiency and reducing operational costs.

- Automated processes: The software offers automation in key areas such as threshold tuning and alert prioritization, freeing up valuable time and resources for other critical tasks.

- Adaptability: One of the standout features of Tookitaki's AMLS is its ability to learn and adapt to new typologies, rule changes, and shifts in data distribution. This ensures that the software stays relevant and effective, even as financial crimes evolve.

- Compliance Assurance: The software's comprehensive risk coverage and efficient alert management ensure that Fintechs can meet their AML compliance obligations effectively. This is particularly important in the Philippines, where regulatory scrutiny is intensifying.

Real-World Impact

Tookitaki's AMLS has already made significant impacts in various sectors. For example, in a global bank in the Asia Pacific region, Tookitaki's software enabled faster detection of suspicious cases than traditional rules-based systems, reducing inefficiencies and false positives. This led to a dramatic improvement in the efficacy of money laundering detection efforts, highlighting the real-world effectiveness of Tookitaki's solution.

In another example, a multinational retail bank was able to automate costly, time-consuming manual customer onboarding processes by leveraging Tookitaki's solution, reducing alerts requiring manual investigation by 86%. This resulted in substantial cost savings through process automation, demonstrating the software's potential to improve efficiency and reduce operational costs.

In conclusion, Tookitaki's AMLS is truly a game-changer for Fintechs in the Philippines. By providing comprehensive risk coverage, reducing false positives, automating key processes, and adapting to changing threats, it helps Fintechs navigate the complex AML landscape with confidence and efficiency.

The Role of Tookitaki's Software in the Future of Fintechs in the Philippines

Driving Transformation in the Fintech Sector

As the Fintech sector in the Philippines continues to grow and mature, the role of sophisticated AML solutions like Tookitaki's will become even more pivotal. Compliance will remain a critical concern as regulators continue to tighten oversight and scrutiny of Fintech activities. In this scenario, the AI-driven, adaptable AML solution offered by Tookitaki can serve as a robust tool to help Fintechs meet their regulatory obligations.

Tookitaki's software offers a scalable solution that can grow with the Fintech, ensuring that as transaction volumes and complexities increase, the software can handle the escalated demand. This scalability makes Tookitaki's solution a sustainable choice for Fintechs planning for long-term growth.

Furthermore, by reducing false positives and improving alert management, Tookitaki's solution can help Fintechs build trust with regulators and the public. This could be crucial in driving broader adoption of Fintech solutions in the Philippines.

Future Trends in AML Compliance for Fintechs

Looking ahead, several trends are likely to shape the AML compliance landscape for Fintechs in the Philippines:

- Increasing regulatory scrutiny: As the Fintech sector grows, so does the risk of money laundering and other financial crimes. Regulators are likely to respond by increasing scrutiny and introducing more stringent regulations. Tools like Tookitaki's AMLS, which offers comprehensive risk coverage and efficient alert management, will be crucial for Fintechs to navigate this evolving regulatory landscape.

- Adoption of AI and machine learning: AI and machine learning technologies are set to play a more prominent role in AML compliance. These technologies can analyze vast amounts of data to identify suspicious patterns and trends, making them highly effective for detecting financial crimes. Tookitaki's AI-driven solution positions it at the forefront of this trend.

- Rise of alternative payment methods: As alternative payment methods gain more acceptance, Fintechs will need to address their unique AML challenges. Tookitaki's adaptable software could be an important tool for managing these emerging risks with its ability to learn and adjust to new typologies and rule changes.

Embracing the Future: The Power of Tookitaki's AML Software for Fintechs in the Philippines

In this blog, we've delved into the unique AML challenges faced by Fintechs in the Philippines and underscored why traditional AML solutions may not suffice. We've explored the dynamic regulatory environment and the need for an AML solution that can adapt and grow with evolving needs.

Tookitaki's AML Monitoring Software stands out as a game-changer in this landscape. Its AI-driven approach, the ability to reduce false positives, and adaptability to unique needs make it a powerful tool for Fintechs. Real-world examples from businesses globally underline the potential of Tookitaki's AML software to enhance AML compliance and ultimately drive business success.

As we look to the future of Fintechs in the Philippines, Tookitaki's software is poised to play a critical role. With trends such as increasing regulatory scrutiny, AI and machine learning adoption, and the rise of digital currencies, the need for robust, adaptable AML solutions will only grow.

If you're a Fintech in the Philippines, we encourage you to consider Tookitaki's AML monitoring software. This solution is designed with your unique needs in mind and can equip you to meet the AML compliance challenges of today and tomorrow.

Don't just take our word for it. We invite you to book a demo of Tookitaki's AML monitoring software. Experience firsthand how it can revolutionize your approach to AML compliance, reduce operational costs, and prepare your business for the future. Don't wait—take the first step towards enhanced AML compliance today.

Anti-Financial Crime Compliance with Tookitaki?