Working with other interested parties, including the American Bankers Association, a group of money services businesses (MSBs) published a best-practices guide for MSBs on anti-money laundering and Bank Secrecy Act compliance on 11th May.

MSBs include credit card firms, investment advisers, mutual funds, insurance companies, loan providers, and finance companies. Guidance for virtual currency and fintech enterprises is also included in the best practices, acknowledging their incorporation into the financial services ecosystem and the associated AML duties.

MSB industry members gathered input from regulators, law enforcement agencies, banks, and policymakers to develop a set of guidelines that represent the MSB industry's views on responsible approaches to MSB AML/CFT compliance. These guidelines recognise that an MSB's compliance requirements should be considered and applied in light of the risk associated with the size, services, goods offered, geographic footprint, and business strategy of the company.

The Goal of the Guidance

This comprehensive set of Best Practices for AML Best Practices for money services businesses was started by MSB industry members and is the result of a multi-sector initiative with two purposes.

The first, to refine MSB AML/CFT compliance standards to safeguard the financial system, and the second, to address the challenge of forced de-risking (the cancellation of banking services to entire business lines, rather than on a case-by-case basis).

Access to banking services is essential for all MSBs. To combat forced de-risking of MSBs, the authors believe that banks will be incentivised to offer services to MSBs that follow these Best Practices. In fact, banks and banking associations were instrumental in the development of the MSB Best Practices.

MSBs are also on the rise, indicating increased consumer and industry demand for vital, helpful, and innovative products and services in the United States and around the world.

State-licensed MSBs, according to CSBS, handle more than $1.8 trillion in transactions annually and are an important part of the financial services market for banks, commercial customers, and consumers. As a result, the trade associations participating in developing the best practices are committed to reviewing, updating, and implementing them regularly in order to keep up with the changing needs of the marketplace and larger financial system.

The AML Best Practices

Building an Effective AML Programme

MSBs, through their respective AML programmes, play a key role in safeguarding the financial system from illicit use. To this end, FinCEN has issued regulations requiring MSBs to implement an appropriate risk-based AML programme designed to effectively address their specific money laundering and terrorist financing risks, while complying with the Bank Secrecy Act. The following are the pillars of building an effective compliance programme:

-

- Assessing AML risk based on both quantitative and qualitative information

- Development and implementation of its AML programme with proper staffing, internal controls, training and independent testing

- Ensuring a strong companywide commitment to a culture of compliance

Know Your Customer/Transactor

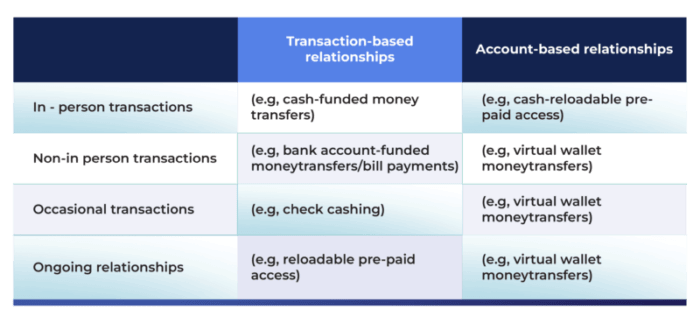

MSBs operate a variety of business models that may be categorised by two relationship types: transaction-based relationships, and account-based relationships. These two relationship types may be further divided into subcategories: in-person transactions, non-in-person transactions, occasional transactions, and ongoing relationships (see illustrative chart below).

The suggested practices here are:

-

- Apart from facilitating payments, consumer information collected by MSBs should be used to address fraud, sanctions screening, money laundering risks, and obligations to ensure consumer protection.

- MSBs should independently determine if their business models target occasional transactions or account-based relationships. They must develop risk-based tools that are reasonably designed for their respective business model.

- MSBs should establish risk-based scenarios that will trigger consumer due diligence and enhanced due diligence.

- They should implement controls based on consumer activity or profile and conduct transaction monitoring and consumer monitoring.

Know Your Agent and Counterparties

As part of an overall AML programme, an MSB should establish risk-based policies, procedures, and practices to identify agents and counterparties with which it conducts business. These agents and counterparties include but are not limited to direct agents, network agents, sub-agents, intermediaries, processors, and referrals. These policies, procedures, and practices should be implemented under applicable laws and regulations as well as industry guidance, including the Financial Action Task Force Guidance on a Risk-Based Approach for Money Service Businesses, 2009 and FinCEN Interpretive Guidance 2004-01- Anti-Money Laundering Program Requirements for Money Services Businesses with Respect to Foreign Agents or Foreign Counterparties.

Reporting and Monitoring

An adequate BSA/AML programme must provide for a system of internal controls reasonably designed to prevent, detect, and report potential illicit activity. Regulatory reporting is a visible demonstration of an effective programme. In this regard, in addition to relying on independent reviews and internal controls, MSBs can use similar industry peers’ AML monitoring and reporting volumes as possible indicators of their AML programme’s maturity.

Information Sharing

Section 314 of the USA PATRIOT Act of 2001 establishes mechanisms for cooperative sharing of information between financial institutions, law enforcement agencies, and regulators. The regulations provide a safe harbour from liability to institutions participating in the information-sharing programme under Section 314(b). The ability to share information assists agencies to deter, detect, and investigate activities potentially related to money laundering and terrorist financing. In addition to using information-sharing tools to communicate with external parties (law enforcement, regulatory agencies, and other financial institutions), MSBs should implement ways for internal departments to share information.

How Can Tookitaki Help MSBs?

Our award-winning FinCense is an end-to-end AML operating system, unlike any other RegTech player in the industry

The suite comprises our Transaction Monitoring, Customer Risk Scoring, Smart Screening and Case Management solutions under one roof for all your AML needs. Unlike traditional rules-based systems, we have a typology repository. This is a database of financial crime patterns (called typologies) that are scaling rapidly through contributions by an entire community of contributors beyond us and our clients.

To learn more about our AML solution and its unique features that help financial institutions build comprehensive AML compliance programmes, book a meeting with one of our experts today.

Anti-Financial Crime Compliance with Tookitaki?