When the UK Financial Conduct Authority (FCA) announced criminal proceedings against NatWest in March 2021 for anti-money laundering (AML) compliance lapses, the 55% state-owned bank became the first in the country to face such a fate. Recently, NatWest pleaded guilty to failings in AML compliance and is expected to face a fine amounting to hundreds of millions of pounds.

The bank, which was bailed out during the financial crisis, is no stranger to penalties related to its business practices. However, the case teaches a number of lessons to Europe’s financial sector in general and AML compliance professionals in particular.

In this article, we will go into the specifics of the case, explore the AML shortcomings of the bank and suggest how banks and financial institutions can effectively address similar situations.

Case details

NatWest’s AML problems are in connection with one of its customers named Fowler Oldfield, a century-old jeweller. Fowler Oldfield’s business was shut down in 2016 following a police raid, and court proceedings which revealed that the jeweller was running a multimillion-pound money laundering scheme.

Fowler Oldfield had a number of accounts with NatWest. According to the FCA, NatWest failed to adhere to AML requirements in relation to these accounts between 8 November 2012 and 23 June 2016. The jeweller deposited about £365 million in its Natwest accounts over five years, including £264 million in cash.

Despite the large amount of cash, the bank’s staff failed to report it as suspicious. Fowler Oldfield was expecting only £15million per year for its sales at the time of opening accounts.

NatWest pleaded guilty to its AML control failures earlier in October, admitting three counts of failing to properly monitor the £365 million deposited.

The FCA, which sued the bank, was calling for a fine of £340 million. NatWest, which set aside £254 million in the third quarter for its litigation expenses, expects the fine to be reduced by a third as it pleaded guilty.

The final penalty will be decided in December during the bank’s sentence hearing.

NatWest’s Reponse

In a statement admitting its breaches of regulations, NatWest’s CEO, Alison Rose, said: “We deeply regret that NatWest failed to adequately monitor and therefore prevent money laundering by one of our customers between 2012 and 2016. NatWest has a vital part to play in detecting and preventing financial crime and we take extremely seriously our responsibility to prevent money laundering by third parties.”

The bank added that it continues with its efforts to strengthen its prevention systems and capabilities as “financial crime continues to evolve”. NatWest said it has invested almost £700m in the last five years including upgrades to transaction monitoring systems, automated customer screening and new customer due diligence solutions.

“We work tirelessly with colleagues, other banks, industry bodies, law enforcement, regulators and governments to help find collaborative solutions to this shared challenge. These partnerships are crucial to counter the significant and evolving threat of financial crime to society,” Rose noted.

Weak controls

In its plea, NatWest stated that its failures “included weaknesses in some of the bank’s automated systems as well as certain shortcomings in adherence to monitoring and investigations procedures.” The FCA said it would not take action against any current or former employees of the bank.

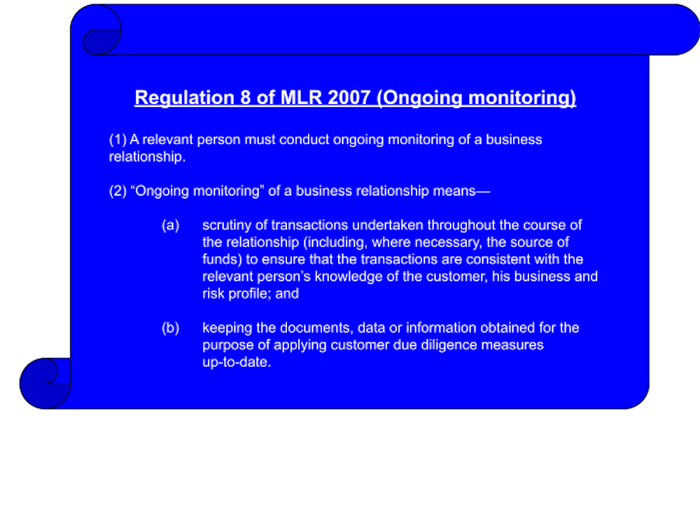

Going into the details of the case, NatWest failed to comply with regulations 8(1), 8(3) and 14(1) of the UK’s Money Laundering Regulations 2007 (MLR 2007). These regulations required the bank to determine and conduct risk sensitive ongoing monitoring of its customers for the purposes of preventing money laundering.

The problem of deposits

The problem of deposits

The FCA prosecutor Clare Montgomery QC told the court that when Fowler Oldfield was on boarded by NatWest, its anticipated turnover was £15 million per year. However, the now-defunct jeweller deposited £365 million in about five years. Fowler Oldfield was found to have deposited up to £1.8 million a day.

“The turnover of Fowler Oldfield was predicted to be £15 million per annum. It was agreed that the bank would not handle cash deposits. However, it deposited £365 million, with around £264 million in cash,” she stated.

Learn More: Bank Secrecy Act

The need for dynamic AML systems

From the details that come to light, it is evident that the bank’s transaction monitoring, customer due diligence systems and controls were lacklustre.

Legacy rules-based transaction monitoring systems, which are static in nature, lead to time-consuming processes and fail to detect complex financial crime instances. It leaves AML teams with mounting numbers of false positive alerts and backlogs of cases, requiring officers to solve them manually. This can mean a high-risk case can sit there for weeks going undetected, leaving you exposed to risk.

When it comes to customer due diligence and ongoing monitoring, most of the current customer risk rating models are not robust to capture the complexities of modern-day customer risk management of financial institutions. Customer risk ratings are either carried out manually or are based on rudimental data models that use a limited set of pre-defined risk parameters. This leads to inadequate coverage of risk factors which vary in number and weightage from customer to customer.

Furthermore, the information for most of these risk parameters is static and collected when an account is opened. Often, information about customers is not updated in the required format and frequency. Adding to this, the static nature of the risk parameters fails to capture the changing behaviour of customers and dynamically adjust the risk ratings, exposing financial institutions to emerging threats.

This is where the importance of Regtech comes in , which makes use of technologies such as artificial intelligence and machine learning in detecting money laundering activities possible. The need of the hour for financial institutions is dynamic AML control systems that adapt to situations when financial crime continues to evolve.

The Importance of Tookitaki solutions in AML compliance

Tookitaki’s award-winning Anti Money Laundering Suite (AMLS) is an end-to-end, AI-based AML operating system. With its unique features, the self-adaptive machine learning solution helps banks and financial Institutions to build comprehensive risk-based AML compliance programmes.

As part of AMLS, we offer a robust Transaction Monitoring Solution, which is equipped with a one-of-a-kind Typology Repository that collates intelligence on new financial crime techniques from our AML expert partners across the globe. We integrate new money laundering patterns into machine learning models with a single click and bolster your compliance programmes with several thousands of risk indicators.

Separately, our Customer Risk Scoring (CRS) solution empowers financial institutions’ customer due diligence and ongoing monitoring programmes with unmatched features. Powered by advanced machine learning, the solution provides an effective and scalable customer risk rating mechanism by dynamically identifying relevant risk indicators across a customer’s activity map and scoring customers into three risk tiers – High, Moderate and Low.

CRS has been developed with advanced ongoing self-learning to evolve based on what is happening within specific client portfolios, business policies and industry trends. The solution comes with a powerful analytics layer that includes actionable insights and easy explanations for business users to make faster and more informed decisions.

Want to find out more about a comprehensive solution that can save your business’ reputation?

To discuss how your business can benefit, contact Tookitaki today. Our team of experts are on hand to answer all your questions.

Anti-Financial Crime Compliance with Tookitaki?