Smurfing in Money Laundering and How Tookitaki Can Mitigate It

Money laundering is a serious problem that has plagued the financial industry for decades. According to a report by the United Nations Office on Drugs and Crime (UNODC), the estimated amount of money laundered globally in one year is 2-5% of global GDP, or $800 billion - $2 trillion. To combat this problem, financial institutions (FIs) use a variety of methods, but criminals continue to find new ways to launder money. This blog will focus on a common money laundering technique, smurfing, and how Tookitaki's AFC Ecosystem can mitigate it.

Understanding Smurfing: A Common Money Laundering Technique

Smurfing, also known as structuring, is a technique used by criminals to evade detection by breaking up large sums of money into smaller amounts. The name comes from the use of "smurfs" or individuals who deposit these smaller amounts into various bank accounts to avoid arousing suspicion. Smurfing often involves the use of multiple bank accounts, credit cards, or shell companies to evade detection and scrutiny

The following are some examples of how smurfing works:

- A criminal might divide a large sum of money into smaller amounts and deposit them into multiple bank accounts.

- A criminal might use multiple individuals to deposit small amounts of money into different bank accounts.

- A criminal might use prepaid debit cards to make multiple small transactions.

While smurfing itself is not illegal, it is mostly used to facilitate other criminal activities such as tax evasion, terrorism financing, and drug trafficking. The consequences of smurfing for financial institutions can be severe. Banks that fail to detect smurfing transactions can face regulatory fines and reputational damage. Furthermore, money laundering can facilitate other criminal activities, such as drug trafficking and terrorism.

The Three Stages of Smurfing are:

Placement: This is when the smurfs introduce the dirty money into the financial system using techniques such as structured deposits or small amounts of cash to avoid detection.

Layering: The smurfs try to distance the money from its criminal origins by moving it through a series of transactions using shell companies or offshore accounts to make it more difficult to trace the funds.

Integration: The smurfs attempt to legitimise the funds by investing them in legitimate businesses or assets.

Smurfing and Its Impact on Industries

Smurfing can impact any industry where large sums of cash are exchanged such as financial institutions and the real estate market. In the banking sector, smurfing can be used to launder money obtained through criminal activity, making it difficult for banks to track the origins of the funds and raising the risk of fraud and other financial crimes. In the real estate market, smurfing can be used to purchase property anonymously or to avoid paying taxes on the sale. Smurfing can seriously impact organisations and reporting entities targeted by criminals for money laundering purposes, leading to increased scrutiny from regulators, heavy fines or even the loss of licenses.

How Tookitaki's AFC Ecosystem Can Help Detect Money Laundering Techniques

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work in tandem to address the limitations of siloed systems in combating money laundering.

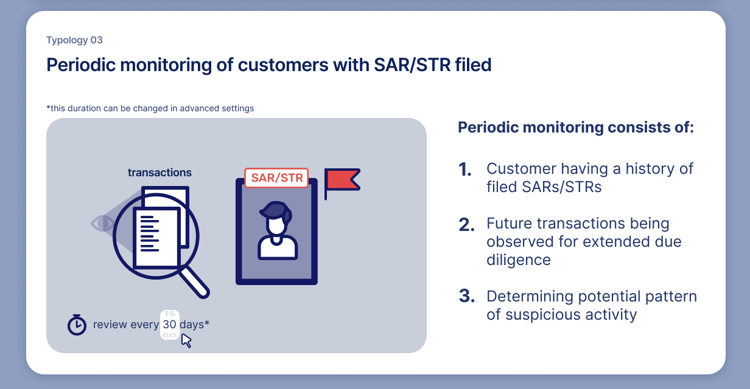

The AFC Ecosystem is a community-based platform that facilitates the sharing of information and best practices in the battle against financial crime. Powering this ecosystem is the Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies, including smurfing and many other money laundering techniques.

An illustration of a typology within Tookitaki's AFC Ecosystem is given below:

The AMLS, a software solution deployed at financial institutions, collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their transaction monitoring remains cutting-edge.

Join Tookitaki's AFC Ecosystem

Techniques such as smurfing can be difficult to detect and prevent without the right tools and technology. Tookitaki's AFC Ecosystem and AMLS combined can help financial institutions combat smurfing and other money laundering techniques effectively. Tookitaki's AML solutions can help financial institutions to detect and prevent smurfing by providing typology-powered transaction monitoring, risk-based approach and better customer risk profiling. We encourage financial institutions to join Tookitaki's AFC Ecosystem and understand its potential in fighting financial crimes.

Anti-Financial Crime Compliance with Tookitaki?