Fighting Money Mules with Tookitaki’s Community-Based Approach

Money laundering is a global problem that affects all countries and industries, including financial institutions. One of the methods used to launder money is through the use of money mules. Money mules are individuals who are recruited by fraudsters to move stolen money between bank accounts, often across international borders. These individuals, often unwittingly, enable the transfer of money from victims of fraud to the perpetrators. The use of money mules is a growing problem, with the number of cases reported to authorities increasing year on year.

According to a media report, 1,239 scammers and money mules below 30 were arrested in Singapore between 2019 and 2021.

The impact of money mule activities on financial institutions can be severe, including reputational damage, financial losses, and even regulatory fines. Thus, it is crucial for financial institutions to have robust anti-money laundering (AML) compliance programmes in place to prevent and detect money mule activities. Tookitaki's community-based approach to AML compliance provides an innovative and effective solution to combat money mules.

Understanding Money Mules

Money mules are individuals who criminal organisations recruit to move money obtained through illegal means. They are often unaware that they are participating in a money laundering scheme, believing that they are simply receiving and transferring funds for someone else. Common methods used by money mules to launder money include:

- Depositing funds into personal bank accounts and then transferring them to other accounts

- Using online payment services to transfer funds to different accounts

- Transporting cash across borders

- Using digital currencies to transfer funds

Money mules can be anyone, including college students, senior citizens, and even professionals. However, they are often recruited from vulnerable populations, such as those with financial difficulties or those seeking employment opportunities.

The impact of money mule activities on financial institutions and the economy can be severe. Money mules can be used to facilitate a wide range of criminal activities, including drug trafficking, terrorism financing, and human trafficking. The use of money mules can make it difficult for law enforcement agencies to track the origins of illicit funds, making it challenging to hold criminals accountable.

To effectively combat money mule activities, financial institutions must have robust AML compliance programmes in place. Traditional AML compliance methods, such as transaction monitoring and Know Your Customer (KYC) checks, can be useful in detecting money mule activities. However, these methods alone may not be enough.

Traditional Approaches to Combating Money Mules

Financial institutions have traditionally relied on manual methods to detect and prevent money mule activities. These methods include:

- Transaction Monitoring: Banks and financial institutions monitor transactions for any unusual patterns or amounts that may indicate money laundering or money mule activities. However, these systems are rule-based and often rely on pre-defined scenarios, making them vulnerable to false positives or negatives.

- Know Your Customer (KYC): KYC is a method that involves verifying the identity of customers and assessing their risk profile. However, KYC checks can be incomplete or inaccurate, allowing money mules to go undetected.

- Employee Training: Financial institutions provide training to employees to identify and report suspicious activities. However, employees may not always have the necessary knowledge or resources to identify and report money mule activities.

The Importance of a Community-Based Approach

A community-based approach to fighting financial crimes involves sharing information and intelligence between financial institutions, regulators, law enforcement agencies and other relevant stakeholders. This enables financial institutions to detect and prevent money mule activities more effectively.

The community-based approach involves the following key elements:

- Education and awareness: Educating the public about the risks associated with money mules is critical to reducing their use. Financial institutions can work with law enforcement agencies and other stakeholders to raise awareness of the dangers of becoming involved in money mule activity.

- Collaboration: Collaboration between financial institutions, law enforcement agencies, and other stakeholders is essential to the success of any AML compliance programme. These organisations can identify and disrupt money mule activity by sharing information and working together.

- Technology: Technology plays a critical role in AML compliance. By leveraging advanced analytics on top of insights derived from the community, financial institutions can identify patterns of suspicious activity and detect potential money mule activity.

Tookitaki's AFC Ecosystem

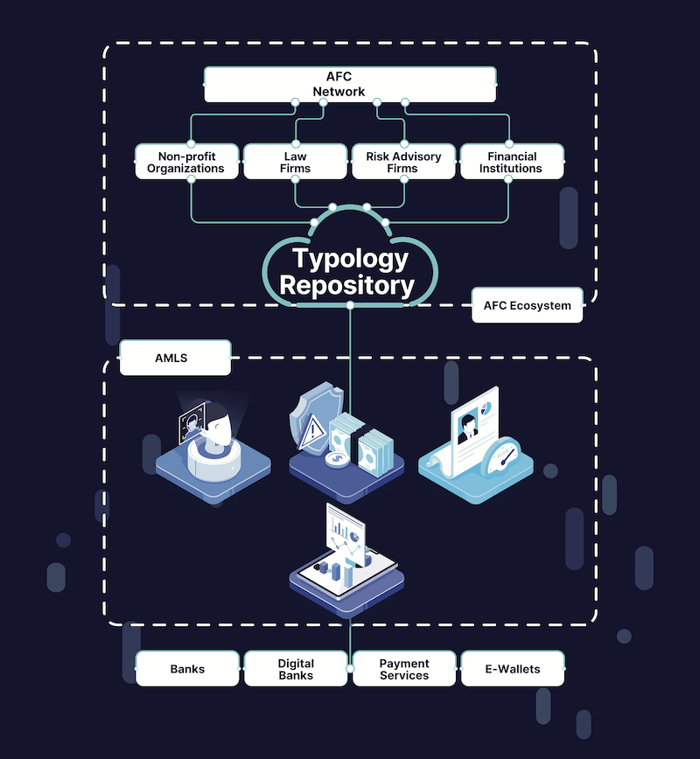

Tookitaki is a pioneer in the fight against financial crime, leveraging a unique and innovative approach that transcends traditional solutions. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work in tandem to address the limitations of siloed systems in combating money laundering.

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is a Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AMLS is a software solution deployed at financial institutions. It is an end-to-end operating system that modernises compliance processes for banks and fintechs. AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure that their AML programs remain cutting-edge.

Additionally, Tookitaki leverages federated machine learning to bridge the gap between the AFC Ecosystem and the AMLS deployed at financial institutions. Instead of sharing sensitive data, federated learning allows the AMLS to access the latest typologies from the AFC Ecosystem and execute them locally at the client's end. This unique integration enables financial institutions to stay ahead of the curve and maintain cutting-edge AML programs while preserving data privacy and security.

In summary, Tookitaki's AMLS and AFC Ecosystem stand out from traditional AML solutions by fostering a collaborative community approach and harnessing the power of federated machine learning, ensuring that financial institutions have access to the most advanced tools and knowledge to effectively detect, prevent, and combat money laundering and related criminal activities.

The Benefits of Tookitaki’s Community-Based Approach

Tookitaki's community-based approach significantly enhances the overall effectiveness and efficiency of a financial institution's AML program in several ways:

- Comprehensive Typology Repository: By fostering collaboration between financial institutions, regulatory bodies, and risk consultants, Tookitaki's AFC Ecosystem creates a collective knowledge base through a Typology Repository. This living database contains up-to-date money laundering techniques and schemes, which enables financial institutions to stay informed about emerging trends and threats.

- Enhanced Detection Accuracy: Financial institutions can better identify suspicious activities and potential money laundering risks with access to the latest typologies and schemes. This leads to improved detection accuracy and a more robust AML program.

- Reduction in False Alerts: Tookitaki's innovative technology, combined with the insights from the AFC Ecosystem, helps to minimize false positives. By accurately identifying suspicious activities, financial institutions can focus their resources on high-risk cases and reduce the operational burden of false alerts.

- Adaptive Learning: Federated machine learning enables Tookitaki's AMLS to continuously learn from the AFC Ecosystem, ensuring that the AML program remains adaptive and up-to-date with the latest trends and regulatory changes.

- Streamlined Compliance Processes: Tookitaki's AMLS modernizes compliance processes, making them more efficient and effective. This results in faster response times and allows financial institutions to maintain compliance with evolving regulations.

- Improved Collaboration: The community-based approach encourages knowledge sharing and best practices among financial institutions, regulatory bodies, and risk consultants, fostering a cooperative environment in the fight against financial crime.

Protect Your Financial Institution from Money Mule Activities

Money mules are a significant threat to financial institutions and the economy as a whole. Traditional AML compliance methods have fallen short in detecting and preventing money-mule activities, but technology is changing the game. Tookitaki's AFC Ecosystem provides a community-based approach to AML compliance that is highly effective in combating money mules and other financial crime techniques.

Financial institutions must take proactive measures to prevent money mule activities and join Tookitaki's AFC Ecosystem to protect themselves and their customers. Learn more about Tookitaki's community-based approach to AML compliance and join the fight against money mules today.

Anti-Financial Crime Compliance with Tookitaki?