Integrating AFC Intelligence into AML Software: The Tookitaki Benefit

The Financial Action Task Force (FATF) emphasizes the importance of information sharing among financial institutions to combat money laundering and terrorism financing. In its report titled Stocktake on Data Pooling, Collaborative Analytics and Data Protection, the international agency, noted that with technological advances financial institutions can analyse large amounts of structured and unstructured data and identify patterns and trends more effectively. In July 2022, the FATF released another report into data sharing between private institutions with the goal of helping jurisdictions.

“A single financial institution has only a partial view of transactions and sees one small piece of what is often a large, complex puzzle. Criminals exploit this information gap by using multiple financial institutions within or across jurisdictions to layer their illicit financial flows. As a result, it is increasingly difficult for individual financial institutions to detect these illicit activities,” says the FATF.

Recently, there has been an increased emphasis on data and information-sharing approaches among regulators and financial institutions in FATF member countries. In this context, Tookitaki, a leading provider of AML compliance solutions, pioneered an approach of integrating Anti-Financial Crime (AFC) intelligence into AML software to enhance the detection and prevention of financial crimes. This blog will discuss why integrating AFC intelligence into AML software is crucial and how Tookitaki delivers this technology to its clients.

Benefits of Integrating AFC Intelligence into AML Software

Integrating AFC intelligence into AML software can provide numerous benefits for financial institutions, including improved accuracy in detecting suspicious activity, faster and more efficient detection and investigation, improved compliance with regulatory requirements, and enhanced risk management.

Improved accuracy in detecting suspicious activity

Integrating AFC intelligence into AML software can improve the accuracy of detecting suspicious activity by providing advanced analytics capabilities, such as machine learning and artificial intelligence, to identify patterns and anomalies in transaction data. This can help financial institutions better detect and prevent financial crimes, such as money laundering and terrorist financing.

Faster and more efficient detection and investigation

By leveraging AFC intelligence, financial institutions can streamline their detection and investigation processes, reducing the time and resources required to identify and investigate suspicious activity. This can enable them to respond more quickly to potential threats and better manage risk.

Improved compliance with regulatory requirements

Integrating AFC intelligence into AML software can help financial institutions meet regulatory requirements and stay up to date with evolving AML/CFT regulations. This is particularly important given the increasing regulatory scrutiny and the ever-evolving nature of financial crimes.

Enhanced risk management

Integrating AFC intelligence can improve a financial institution's risk management capabilities by providing real-time monitoring and alerting, enabling them to identify and respond to potential threats in a timely manner. This can help mitigate financial crime risk and protect the institution's reputation.

Overall, integrating AFC intelligence into AML software is an important step towards building a more effective and robust AML/CFT program. It can help financial institutions stay ahead of the ever-evolving threat landscape and ensure they meet regulatory requirements while managing risk effectively.

Challenges of Integrating AFC Intelligence into AML Software

While integrating AFC intelligence into AML software offers significant benefits for financial institutions, it also presents a number of challenges that must be addressed. Data privacy, technology limitations, and competition between financial institutions are common challenges associated with inter-organizational information sharing.

In addition to those challenges, data quality and availability are critical considerations when integrating AFC intelligence into AML software. Accurate and up-to-date data is essential for effective AML compliance, and many financial institutions struggle with managing the large volume of data required for such efforts. Moreover, ensuring the scalability and flexibility of the solution is important, particularly as financial institutions expand their operations and enter new markets.

Addressing these challenges requires careful planning and execution. Financial institutions should work closely with their technology partners to ensure that their AFC intelligence tools are properly integrated into their AML software and that data quality and availability are maintained. Additionally, institutions should carefully monitor their AFC systems to ensure that they generate accurate alerts and reduce false positives. Integrating AFC intelligence into AML software can deliver significant benefits for financial institutions with the right approach.

How Tookitaki Delivers AFC Intelligence

Tookitaki, founded in 2015, is revolutionizing financial crime detection and prevention for banks and fintechs through our Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem. Our unique community-based approach addresses the silos used by criminals to bypass traditional solutions, resulting in a sustainable AML program with holistic risk coverage, sharper detection, and fewer false alerts.

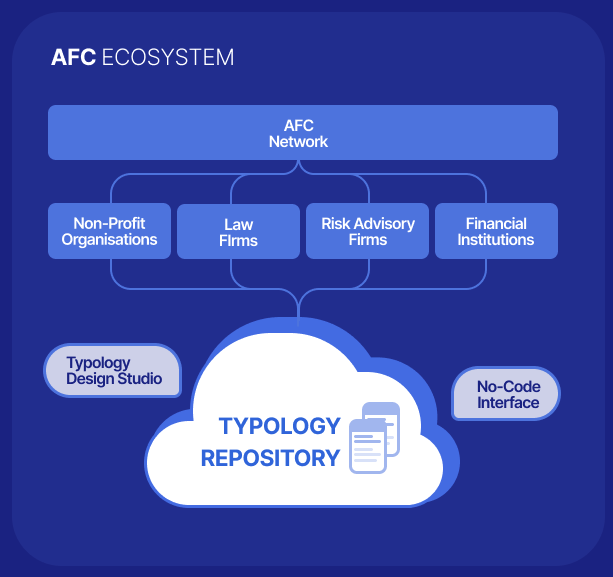

The AFC Ecosystem is designed to work alongside AMLS to provide a comprehensive solution for financial institutions. One of the key features of the AFC Ecosystem is the Typology Repository, which contains a vast collection of typologies and scenarios of known financial crimes. These typologies have been developed by a team of experts who have extensive experience in AML compliance and financial crimes. By leveraging the Typology Repository, organizations can identify potential financial crimes based on known patterns and scenarios and take proactive measures to prevent them.

A typology is a specific money laundering technique or scheme. By sharing typologies in the repository, financial institutions can learn about new and emerging threats, and adapt their AML programs accordingly. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes. Financial institutions can contribute to the repository by sharing their own experiences and knowledge of money laundering. This allows the community of financial institutions to work together to tackle financial crime by sharing information and best practices.

The AFC ecosystem also includes a 'no code' user interface, allowing financial institutions to easily create and share typologies. This means that even non-technical staff can contribute to the repository, making it a more collaborative and effective tool for the community. Additionally, the ecosystem includes powerful analytics and visualization tools that help financial institutions to understand and analyze the data in the repository. This allows them to identify patterns and trends in money laundering activity and develop more effective detection and prevention strategies.

Benefits of Tookitaki’s AFC Ecosystem and AMLS

Tookitaki's AMLS and AFC Ecosystem offer financial institutions a comprehensive solution for detecting and preventing financial crime, delivering a range of benefits that can improve compliance and prevent financial crime. These platforms provide sharper detection capabilities, improved collaboration through the AFC ecosystem, better compliance support, and increased efficiency through automation.

Specifically, Tookitaki's proprietary technology can help financial institutions detect patterns and anomalies indicative of financial crime, providing the ability to uncover hidden money trails and stay ahead of criminals. The AFC ecosystem offers a platform for institutions to share knowledge and collaborate on fighting financial crime. The Typology Repository enables sharing of information on common money-laundering techniques and typologies, making detecting and preventing such activities easier.

Tookitaki's AMLS and AFC platforms also support regulatory compliance with the necessary tools and automation to help financial institutions meet AML regulations and avoid penalties and fines. Additionally, the platforms automate many of the manual tasks associated with AML and financial crime detection, resulting in increased efficiency and cost savings for financial institutions.

Join Tookitaki's AFC Ecosystem and See a Demo of AFC-Integrated AML Software

Tookitaki's AFC Ecosystem offers financial institutions a comprehensive solution to tackle financial crime, with features such as the Typology Repository that allows institutions to share information on common money-laundering techniques and typologies, and proactively detect financial crime patterns leveraging AMLS.

Financial institutions are encouraged to join Tookitaki's AFC Ecosystem and consider a demo of our AMLS software that integrates AFC intelligence. By leveraging advanced technologies and community-based approaches, financial institutions can improve their compliance and prevent financial crime, ultimately protecting themselves and their customers from the negative impact of financial crime.

Anti-Financial Crime Compliance with Tookitaki?