電子書

準確篩查客戶和交易,跨語言

實時準確篩查客戶和交易,涵蓋制裁、PEP、負面媒體和其他監控名單,支持超過22種語言。

我們的影響(年度

5 Billion+

監控超過50億筆交易

400 Million+

監控超過4億個賬戶

2 Million+

處理超過200萬個警報

信任我們的合作夥伴

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

篩查是分散的

監控名單

需要篩查的多個監控名單,如制裁名單、PEP、負面媒體和內部監控名單。

匹配

名稱匹配的變化,如暱稱、首字母和拼寫問題非常複雜,導致高誤報率。

擴展

跨境交易迅速增長,需要滿足多個司法管轄區的篩查要求。

通過智能篩查改進檢測

1

全面覆蓋

利用 Tookitaki 的監控名單數據獲得廣泛覆蓋,並可選擇集成您現有的監控名單。

2

實時準確檢測

使用12種名稱匹配技術在7個客戶屬性上實現90%的實時檢測準確率,具有多階段匹配機制和跨語言匹配功能。

3

無縫擴展

實時篩查多個地區的交易,對照制裁名單和監控名單,覆蓋22種語言和10種書寫系統。

這對您意味著什麼?

90%

誤報減少

(行業平均:50%)

智能篩查的獨特之處

準確且有效的篩查

使用7個參數實時評分每個匹配,通過多階段方法和12種以上匹配技術準確處理名稱變化,並使用“無翻譯”跨語言匹配,將誤報減少90%。

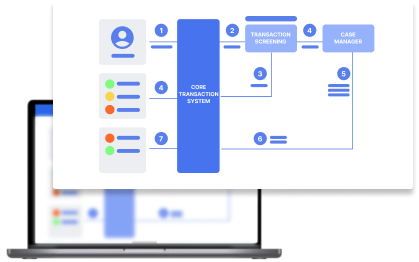

實時交易篩查

實時篩查數十億筆國內和跨境支付,對照任何監控名單,具有高吞吐量。

.png?width=440&height=280&name=Group%2016068%20(1).png)

無縫擴展

通過覆蓋22種語言和10種書寫系統的篩查,實現業務的全球擴展。

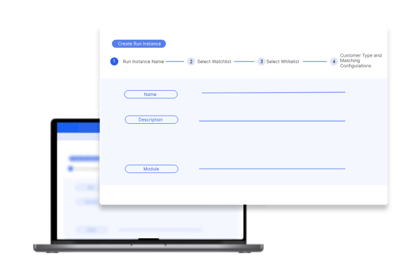

可配置設計

內置沙箱,可通過幾次點擊持續測試和部署新的篩查配置,將工作量減少70%。

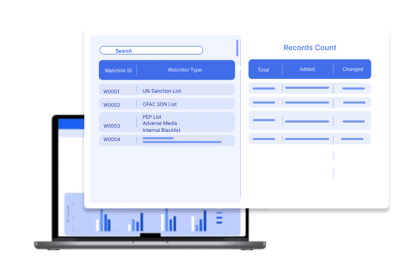

預打包的監控名單數據

使用預打包的監控名單數據,或集成您現有的監控名單或內部名單數據以擴展覆蓋範圍。

What Do Our Customers Say?

-

Traditional Bank

-

Digital Bank

-

Payments

-

E-Wallet

Traditional Bank

Client Testimonial

The area of AML requires constant vigilance and continual enhancement. The use of RegTech such as Tookitaki’s FinCense enables us to augment our ability to identify actionable alerts and minimise false positives. These sharpen the accuracy and effectiveness of our AML risk management.

Compliance Office of a Singapore Bank

-

50%

reduction in false positives -

~45%

reduction in overall compliance cost -

Digital Bank

Client Testimonial

.png?width=220&height=416&name=Group%2014246%20(1).png)

For a new business like ours, Tookitaki's FinCense has been a perfect partner to help us effectively manage our compliance needs.

Digital Bank Client

.png?width=220&height=416&name=Group%2014246%20(1).png)

-

100%

Risk coverage for transactions

-

50%

Reduction in time to onboard to new scenario -

Payments

Client Testimonial

.png?width=220&height=416&name=Group%2014246%20(2).png)

FinCense's ability to detect AML and fraud risk accurately in real time allows us to maintain the performance of the system at scale. It has been a game-changer for us.

Payment Services Client

.png?width=220&height=416&name=Group%2014246%20(2).png)

-

70%

Reduction in effort on threshold tuning and scenario testing -

90%

Reduction in false positives -

E-Wallet

Client Testimonial

Tookitaki helped us simplify our compliance operations by providing us with a single platform that effectively manages all fraud and AML processes.

E-Wallet Client

-

90%

Accuracy in high-quality alerts -

50%

Reduction in time to onboard to new scenario -

我們的思想領導指南