合規即服務 (CaaS)

使合規變得更快、更具可擴展性和安全性re

合規必須更快地回應

合規成本每年上升 15%-20%,主要由於資源成本和高基礎設施成本所致。

為快速成長的公司量身定制

完整的風險覆蓋

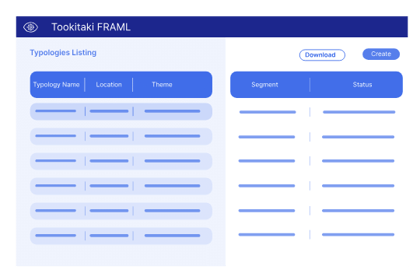

下載由全球專家網絡分享的最新反洗錢和交易欺詐見解,並在 24 小時內以全自動模擬模式快速測試和部署場景,無需額外費用。

無縫擴展

使用強大的現代數據工程技術堆棧無縫處理數十億筆交易,橫向擴展。

無需前期資本支出

獲得由 Tookitaki 維護的包含基礎設施的全面管理支持。免費獲得產品版本升級和新功能訪問。

這對您意味著什麼?

100%

風險覆蓋

(行業平均:50-60%)

200

每秒交易

(行業平均:50 TPS)

<4

上線週數

CaaS 的獨特之處?

行業最智能的欺詐和反洗錢平台

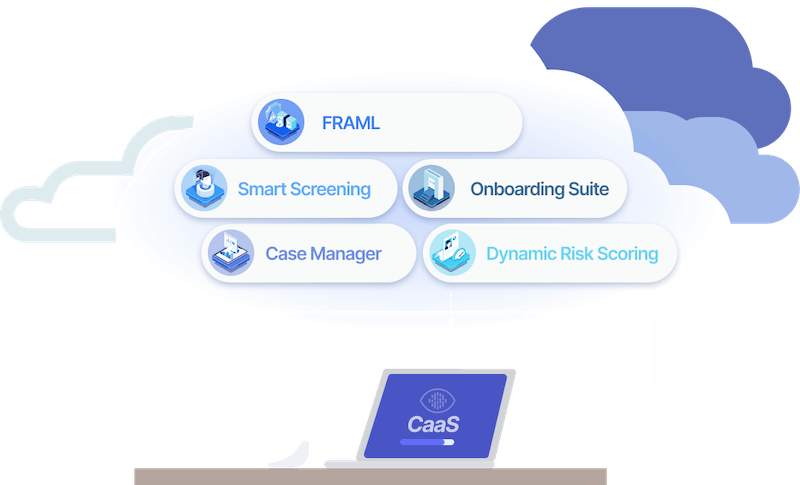

獲得端到端操作系統的全面保護,滿足所有合規要求,防止金融犯罪。

免費的最新風險覆蓋

從 AFC 生態系統免費獲取新興類型,讓您領先於新興的欺詐和反洗錢威脅。

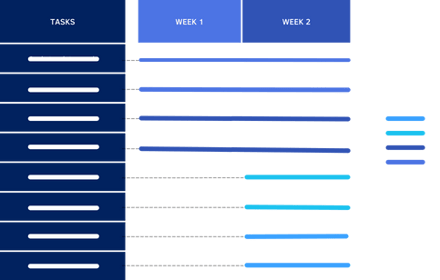

更快的上市時間

中央托管的基於雲的交付。通過 API 無縫集成,<4 週內上線,而不是幾個月。

實時和可擴展架構

橫向可擴展的現代數據工程堆棧,處理數十億筆交易,每秒交易率超過 200 TPS,平台可用性為 99.9%。

數據隱私和保護

SOC 2 合規的多層次安全控制,確保您的敏感數據在每個步驟中都得到保護。

.png?width=440&height=280&name=data%20privacy%20(1).png)

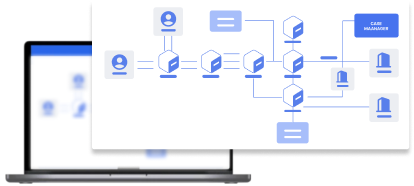

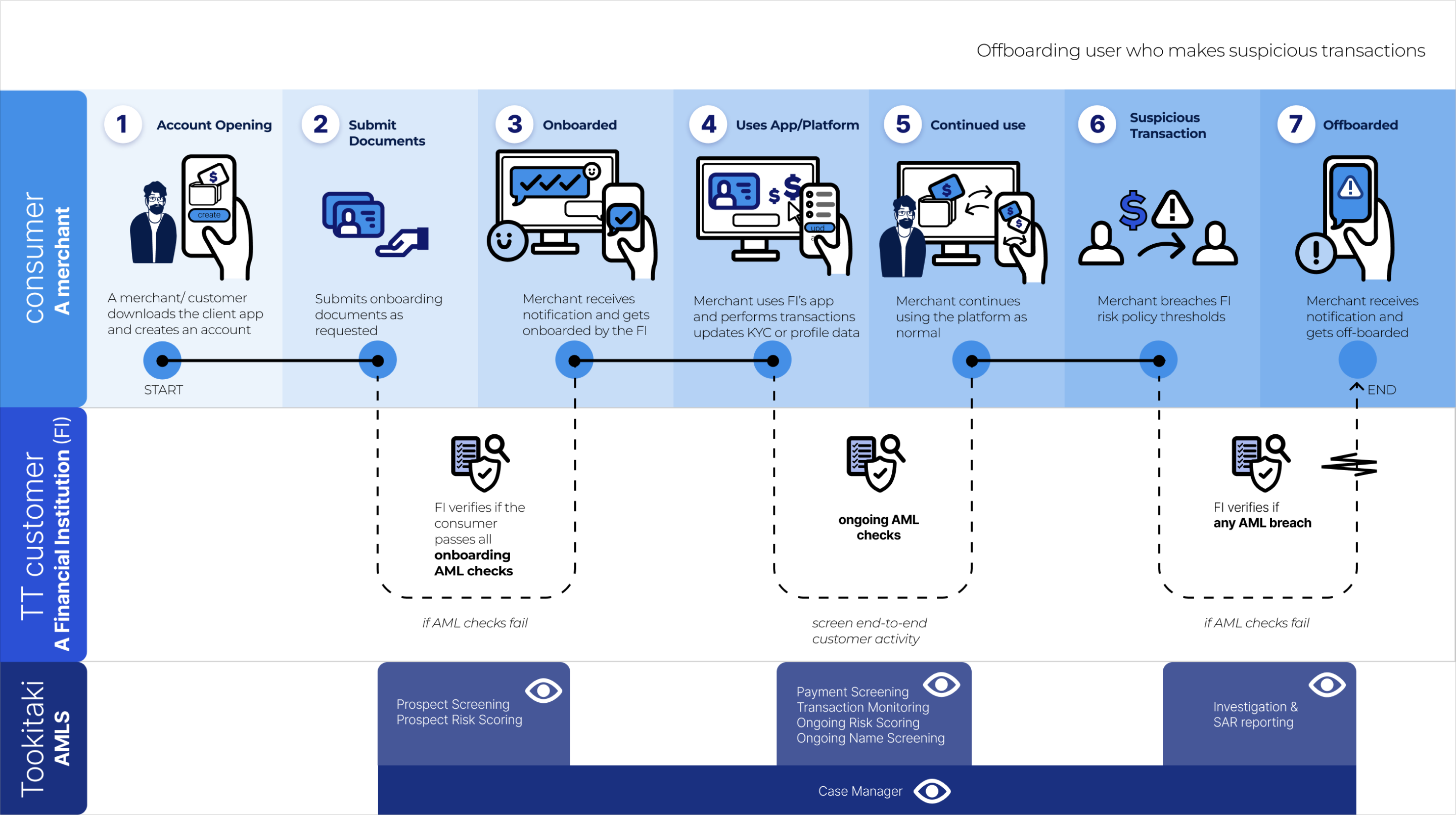

AMLS Solution

Tookitaki's AMLS is an end-to-end operating system that helps financial institutions detect and prevent financial crimes. It includes several modules such as Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML including detection, investigation and reporting.

我們的思想領導指南

Dynamic Risk Rating: The AI-Powered Future of CDD

Navigating Screening Challenges: Part 2

How does AMLS help you?

Scale Up Faster

The detection component of our AMLS called “Intelligent Alert Detection (IAD)” is an end-to-end suite of primary AML compliance solutions that work together seamlessly to protect your business from onboarding and ongoing AML risks without needing a large compliance team.

Reduce Your Compliance Cost

AMLS can also serve as a secondary AML compliance solution that will help your compliance team to sift through the large alert volumes generated by your primary AML compliance solution, identify false positives and focus on high priority risk alerts.