Screen Every Payment in Real-Time with Precision

Protect your organisation from sanctions and financial crime risks with Tookitaki’s Payments Screening solution. Detect, screen, and prevent illicit transactions in real time, ensuring compliance and safeguarding your reputation.

Detecting and Preventing Fraud at Scale

5 Billion+

Transactions Monitored

400 Million+

Accounts Monitored

2 Million+

Alerts Processed

Partners Who Trust Us?

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

- |

-

.png?width=318&height=199&name=Customer%20Logos%20(1).png)

- |

-

- |

-

- |

-

- |

Screening Payments is Demanding

Multiple Watchlists

Complex Matching

Scaling for Global Transactions

Make Payments Seamless and Secure With FinCense

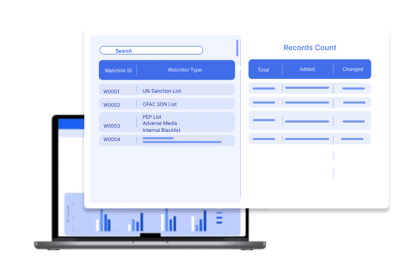

Exhaustive Watchlist Coverage

Screen payments against a comprehensive range of watchlists, including sanctions, PEPs, adverse media, and more. Tookitaki’s solution allows you to integrate and manage your own watchlists seamlessly for complete coverage.

Accurate Detection in Real Time

Achieve up to 90% accuracy with advanced detection algorithms that use 12 name-matching techniques across multiple customer attributes. Our multi-stage matching system reduces false positives and ensures high-risk payments are identified instantly.

Seamless Scalability Across Borders

Monitor and screen payments globally in real time, with support for 24 languages and 14 scripts. Tookitaki’s scalable infrastructure adapts to the demands of cross-border transactions, ensuring compliance across multiple jurisdictions as your business grows.

What Does This Mean For You?

90%

False Positive Reduction

(Industry average: 50%)

What Makes Smart Payments Screening Unique?

Comprehensive Watchlist Integration

- Screen against a wide range of watchlists, including sanctions, Politically Exposed Persons (PEPs), adverse media, and internal lists.

- Seamlessly integrate external watchlists or your own custom lists to create a unified screening platform.

- Ensure up-to-date compliance with real-time updates from regulatory authorities and data providers.

Advanced AI-Powered Matching in Real Time

- Employ AI-driven fuzzy and advanced text analytics to identify potential matches despite data discrepancies like misspellings, nicknames, and formatting differences.

- Use multi-pass screening to reduce false positives by 90% and ensures no true hits are missed.

- Leverage 'no-translation' cross-lingual matching to seamlessly compare names across languages.

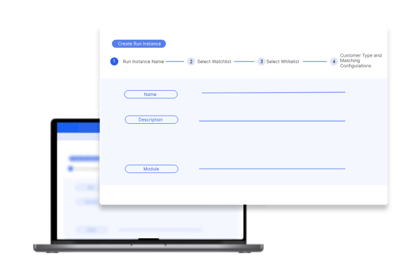

Built-in Sandbox

- Built-in sandbox to test and deploy new screening configurations on an ongoing basis reducing effort by 70%.

- Automatically generate matching thresholds, across attributes like names, addresses, and dates of birth.

- Configure the precision and recall of the AI models by tuning 49 different parameters to optimise model performance and accuracy.

Scalable Multilingual and Multi-Jurisdictional Support

- Screen across multiple jurisdictions with support for 24 languages and 14 scripts, ideal for global organizations handling cross-border transactions.

- Scale horizontally to handle high transaction volumes as your organization grows.

.png?width=440&height=280&name=Group%2016068%20(1).png)

Efficient Case Management and Alert Prioritisation

- Utilise an intuitive case management system to prioritise, track, and investigate alerts efficiently.

- Investigate all watchlist matches of a customer in a single view with priority focus on high risk matches thus speeding up investigations.

- Streamline investigation through automated case assignment, escalation, and task management, cutting investigation time by up to 50% and enabling rapid response to high-risk cases.

What Do Our Customers Say?

-

Traditional Bank

-

Digital Bank

-

Payments

-

E-Wallet

Traditional Bank

Compliance Office of a Singapore Bank

-

50%

reduction in false positives -

~45%

reduction in overall compliance cost -

Digital Bank

For a new business like ours, Tookitaki's FinCense has been a perfect partner to help us effectively manage our compliance needs.

Digital Bank Client

.png?width=220&height=416&name=Group%2014246%20(1).png)

-

100%

Risk coverage for transactions

-

50%

Reduction in time to onboard to new scenario -

Payments

FinCense's ability to detect AML and fraud risk accurately in real time allows us to maintain the performance of the system at scale. It has been a game-changer for us.

Payment Services Client

.png?width=220&height=416&name=Group%2014246%20(2).png)

-

70%

Reduction in effort on threshold tuning and scenario testing -

90%

Reduction in false positives -

E-Wallet

Tookitaki helped us simplify our compliance operations by providing us with a single platform that effectively manages all fraud and AML processes.

E-Wallet Client

-

90%

Accuracy in high-quality alerts -

50%

Reduction in time to onboard to new scenario -

Our Thought Leadership Guides