Kickbacks have long been a controversial practice that has a significant impact on corporate ethics and compliance. Understanding the nature of kickbacks is crucial to grasp their effects on businesses. In this article, we will delve into the definition and types of kickbacks, explore the legal perspective surrounding this issue, and examine how kickbacks intersect with corporate ethics.

Understanding Kickbacks: A Brief Overview

Definition and Types of Kickbacks

A kickback refers to the illegal practice of offering or accepting bribes in exchange for providing favorable treatment or services. This unethical activity takes various forms, including monetary payments, gifts, favors, or even entertainment. Kickbacks can occur in numerous industries, such as healthcare, construction, and finance.

A critical distinction must be made between legitimate business referrals and kickbacks. While a referral might involve offering a percentage of a sale to an intermediary, kickbacks involve an element of corruption and deceit. These illegal schemes aim to influence decision-making processes in favor of parties involved in the kickback exchange.

For example, in the healthcare industry, kickbacks can take the form of pharmaceutical companies providing incentives to doctors to prescribe their drugs over others. This not only compromises the integrity of medical professionals but also jeopardizes patient care by prioritizing financial gain over the best treatment options.

In the construction industry, kickbacks can occur when contractors receive undisclosed payments or gifts from suppliers in exchange for awarding them lucrative contracts. This not only undermines fair competition but also leads to inflated project costs and compromised quality.

The Legal Perspective on Kickbacks

The legal framework around kickbacks varies across jurisdictions, but they are universally regarded as illegal and unethical practices. Statutory laws and regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the U.K. Bribery Act, aim to combat kickbacks by establishing anti-bribery measures and imposing severe penalties for non-compliance.

Furthermore, government agencies and regulatory bodies play a pivotal role in enforcing these laws, conducting investigations, and prosecuting those involved in kickback schemes. The legal consequences for corporations and individuals engaged in kickbacks can range from significant fines and reputational damage to imprisonment.

For instance, in recent years, there have been high-profile cases where multinational corporations have faced substantial fines and legal repercussions for engaging in kickback schemes. These cases serve as a strong deterrent and highlight the commitment of authorities to combat corruption and maintain a level playing field for businesses.

It is crucial for organizations to establish robust internal controls and compliance programs to prevent and detect kickback schemes. These programs typically include policies, training, and monitoring mechanisms to ensure employees and business partners adhere to legal and ethical standards.

In conclusion, kickbacks are not only illegal but also undermine fair competition, compromise integrity, and erode public trust. Governments, regulatory bodies, and organizations must work together to combat this unethical practice and promote transparency, accountability, and ethical conduct in all industries.

The Intersection of Kickbacks and Corporate Ethics

How Kickbacks Undermine Ethical Standards

Kickbacks erode the ethical fabric within organizations, compromising integrity and fairness. When individuals engage in such practices, they prioritize personal gain over objectivity and the best interests of the company. This undermines the trust between employees, tarnishes the reputation of the organization, and devalues the contributions of talented and ethical team members.

Moreover, kickbacks create a toxic work environment where ethical decision-making takes a backseat. Employees might feel pressured to participate in kickbacks to secure business opportunities, perpetuating a cycle of corruption. This erosion of ethics ultimately leads to a decline in employee morale, productivity, and overall corporate culture.

The Role of Corporate Culture in Encouraging or Discouraging Kickbacks

Corporate culture plays a significant role in shaping employee behavior. Companies that prioritize and foster a culture of integrity, transparency, and accountability are less likely to have issues with kickbacks. By embracing an ethical framework, organizations can deter individuals from engaging in corrupt practices, as the consequences and reputational risks become clearer.

Leadership must actively promote an atmosphere that encourages employees to report suspicious activities and commend ethical behavior. Establishing robust internal controls and whistleblower mechanisms also helps to detect and address kickbacks effectively.

In contrast, companies that fail to prioritize ethics and neglect to establish a strong corporate culture are more susceptible to kickbacks. Without clear guidelines and a commitment to integrity, employees may feel that engaging in corrupt practices is acceptable or even necessary for career advancement. This can lead to a culture of secrecy and mistrust, where unethical behavior becomes the norm rather than the exception.

In conclusion, kickbacks have a detrimental impact on corporate ethics and can severely damage the reputation and success of an organization. By fostering a culture of integrity, transparency, and accountability, companies can effectively discourage kickbacks and promote ethical behavior among their employees. It is crucial for organizations to prioritize ethics and establish robust mechanisms to detect, address, and prevent kickbacks.

The Influence of Kickbacks on Corporate Compliance

Kickbacks and Compliance Policies

Corporate compliance policies are vital tools in combating kickbacks within organizations. These policies outline standards of behavior, prohibit unethical practices, and establish protocols for reporting and investigating misconduct. By explicitly addressing kickbacks, companies can create a compliance framework that aligns with legal requirements and industry best practices.

One important aspect of compliance policies is the inclusion of clear guidelines on how to identify and report potential kickback schemes. This empowers employees to recognize red flags and take appropriate action, ensuring that unethical behavior is swiftly addressed. Additionally, compliance policies can provide specific examples of kickbacks to enhance employees' understanding of what constitutes a violation.

Training programs and regular communication on compliance policies are crucial for employees to understand their role in preventing kickbacks. This educational approach ensures that individuals are aware of the consequences of engaging in such activities and empowers them to speak out against unethical behavior. Moreover, these programs can also educate employees on the potential warning signs of kickbacks, enabling them to be proactive in identifying and preventing such practices.

The Consequences of Non-compliance Due to Kickbacks

Non-compliance resulting from kickbacks can have severe repercussions for corporations. Aside from legal and financial consequences, such as fines and legal fees, companies may face reputational damage that takes years to repair. The loss of public trust and damaged relationships with clients, suppliers, and shareholders can have a lasting negative impact on a company's operations and future success.

Moreover, the consequences of non-compliance can extend beyond financial and reputational harm. Regulatory authorities may impose additional scrutiny, sanctions, or even disqualify companies from participating in government tenders or contracts. This not only affects the company's current projects but also limits its future growth opportunities. It is crucial for organizations to understand that the impact of kickbacks goes beyond immediate penalties and can have long-term implications on their overall business strategy.

In order to mitigate these consequences, companies should take a proactive approach to combatting kickbacks. This includes conducting regular internal audits to identify any potential vulnerabilities and implementing robust internal controls to prevent kickback schemes from occurring. By prioritizing compliance and actively working to prevent kickbacks, companies can protect their legal standing, reputation, and financial stability.

Mitigating the Impact of Kickbacks

Strategies for Preventing Kickbacks

Preventing kickbacks requires a multi-faceted approach that involves policies, leadership commitment, and a strong compliance culture. Companies should implement robust due diligence processes when selecting business partners, suppliers, and employees to reduce the risk of exposure to kickback activities.

Selective contracting and frequent supplier evaluations help establish a transparent and competitive environment that discourages kickbacks. Routine audits and internal investigations also play a crucial role in detecting and addressing potential kickback schemes, ensuring timely intervention.

Moreover, fostering a culture of transparency and accountability within the organization can act as a powerful deterrent against kickbacks. Encouraging open communication channels and providing regular training on ethical standards can empower employees to recognize and resist situations that may lead to kickback requests. By promoting a culture of integrity and honesty, companies can create a united front against corrupt practices.

The Role of Leadership in Curbing Kickbacks

Leadership commitment is key to effectively mitigating the impact of kickbacks. Executives must set the tone from the top by adhering to high ethical standards and consistently communicating the zero-tolerance stance on kickbacks. When ethical behavior is rewarded and recognized, employees are more likely to align their actions accordingly.

Furthermore, leaders should lead by example in upholding ethical principles and integrity in all business dealings. By actively engaging with employees at all levels and demonstrating a commitment to ethical decision-making, leaders can instill a sense of trust and accountability throughout the organization. This hands-on approach not only deters individuals from engaging in kickback schemes but also fosters a culture of responsibility and ethical leadership.

The Long-Term Effects of Kickbacks on Corporations

Financial Implications of Kickbacks

The financial impact of kickbacks extends beyond immediate costs. Engaging in kickback schemes can result in inflated contract prices, misallocated resources, and reduced competitiveness. These adverse effects erode profitability, limit growth opportunities, and hinder sustainable business development.

For example, when kickbacks are involved, contract prices tend to be higher than they should be. This means that corporations end up paying more for goods or services than they would have without the kickback arrangement. This not only affects their bottom line but also puts them at a disadvantage compared to competitors who are not engaged in such practices.

In addition, kickbacks can lead to the misallocation of resources within a corporation. Instead of allocating resources based on merit or efficiency, decisions may be influenced by kickbacks, resulting in suboptimal outcomes. This can hinder a company's ability to innovate, invest in research and development, or pursue other growth opportunities.

Moreover, the reduced competitiveness caused by kickbacks can have long-lasting effects. When a corporation is known for engaging in unethical practices, it may find it difficult to attract top talent or secure partnerships with reputable suppliers. This can further limit their ability to grow and succeed in the long term.

Furthermore, the financial implications of kickbacks go beyond the immediate costs. Potential legal battles and regulatory fines can place an additional burden on company finances. Rebuilding trust and repairing a damaged reputation can be costly endeavors, requiring significant investments in marketing, public relations, and corporate social responsibility initiatives.

Reputation and Trust: The Intangible Costs of Kickbacks

The intangible costs of kickbacks are equally significant. A tainted reputation stemming from involvement in kickbacks can have far-reaching consequences, affecting relationships with customers, suppliers, employees, and shareholders. Such damage to trust may undermine long-standing partnerships and hinder the acquisition of new clients or talented professionals.

For instance, customers may lose faith in a corporation that has been implicated in kickback schemes. They may question the integrity of the products or services offered, leading to a decline in sales and market share. Suppliers may also be hesitant to continue doing business with a company that has a tarnished reputation, potentially disrupting the supply chain and increasing costs.

Internally, kickbacks can erode employee morale and trust. When employees witness unethical behavior within their organization, it can create a toxic work environment and lead to decreased productivity. Talented professionals may be reluctant to join a company with a reputation for engaging in kickbacks, limiting the pool of qualified candidates and hindering the company's ability to attract top talent.

Rebuilding trust and regaining a positive reputation demand substantial effort, time, and resources. Companies must engage in open dialogue with stakeholders, communicate remedial actions taken, and demonstrate unwavering commitment to ethical conduct to restore confidence in their business practices.

In conclusion, the impact of kickbacks on corporate ethics and compliance is profound and far-reaching. Understanding the definition, types, and legal perspective of kickbacks enables organizations to better address this issue. By prioritizing corporate ethics, implementing robust compliance policies, and fostering a culture of integrity, companies can mitigate the negative effects of kickbacks on their reputation, financial stability, and long-term success.

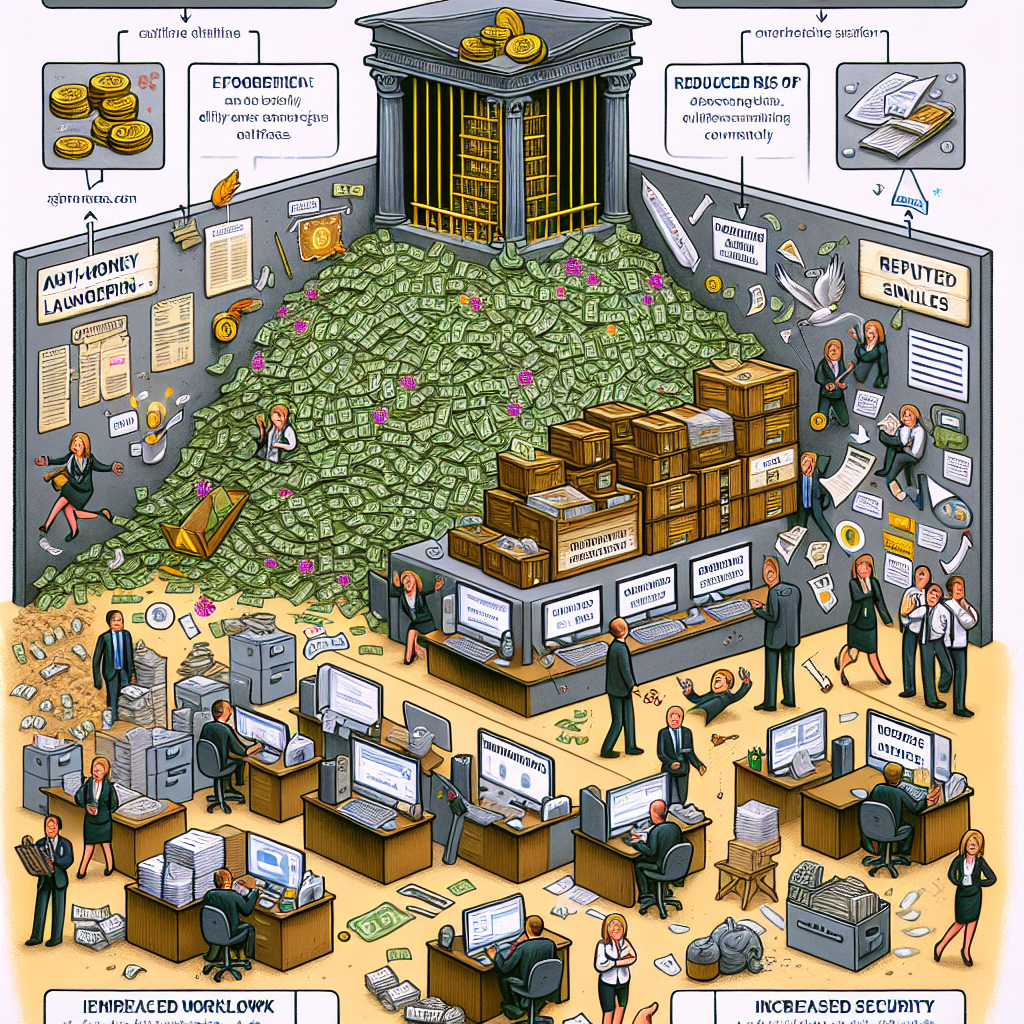

If your organization is committed to upholding the highest standards of corporate ethics and compliance, Tookitaki's FinCense is here to fortify your efforts against financial crimes, including kickbacks. Our comprehensive suite of anti-money laundering and fraud prevention tools is designed to seamlessly integrate with your AFC Ecosystem, leveraging the power of federated learning to stay ahead of unique financial crime attacks.

With Tookitaki's FinCense, you can accelerate customer onboarding, maintain rigorous compliance, and enhance your FRAML management processes. Our Smart Screening, Customer Risk Scoring, Smart Alert Management (SAM), and Case Manager tools work in concert to provide fewer, higher-quality alerts and a 360-degree customer risk profile, driving operational efficiency and strengthening your compliance program. Don't let kickbacks tarnish your reputation and financial stability. Talk to our experts today and take a proactive step towards a more secure and ethical business environment.

Anti-Financial Crime Compliance with Tookitaki?

Related Terms

Recent Posts