Understanding the Meaning of KYC and its Difference with AML

In the regulatory compliance space, the terms KYC and AML are often used interchangeably and are seen as the same thing. However, this is far from the truth, as both KYC and AML differ greatly in their meaning, especially in a regulatory context. The full forms of AML and KYC are Anti Money Laundering and Know Your Customer, respectively.

In order to address the growing problem of money laundering, both national and international bodies around the world provide guidelines for the finance industry. These impose certain screening and monitoring processes on all financial institutions so that the financial system is safeguarded from abuse by criminals. These AML checks in general are called AML-KYC compliance programs. However, KYC is a standalone process and there are separate KYC rules to be followed by financial institutions.

In order to successfully comply with anti-money laundering regulations, financial institutions must understand their AML and KYC obligations and develop effective AML-KYC compliance programmes.

Understanding AML

Anti-money laundering (AML) refers to the overall, broader measures and processes that financial institutions and governments use in order to prevent and combat financial crimes, specifically money laundering and terrorist financing. AML regulations are dictated by international bodies such as the United Nations Office on Drugs and Crime (UNODC) and Financial Action Task Force (FATF), regional bodies like the Financial Crimes Enforcement Network (FinCEN) and The Financial Industry Regulatory Authority (FINRA) in the US, as well as local governments and bodies.

The AML policy forms part of the broader, complete AML compliance program of a financial institution.

KYC and money laundering

Know Your Customer or KYC is a fundamental process in any financial institution’s anti-money laundering program. It is defined as the process through which these institutions gather information on their clients and verify their identities. This greatly helps them to adequately assess the risk associated with each client. For example, all customers of a bank must be verified before they can use services such as checking accounts and credit cards. Fintech companies are mandated to gather ample, verifiable information on their client and their identity in order to determine their legitimacy before beginning any business activities.

What is the difference between AML and KYC?

The difference between AML and KYC primarily lies in the notion that AML is an umbrella term for the full range of regulatory processes that firms must implement in order to carry out businesses legitimately. On the other hand, KYC (Know Your Customer) is a smaller component of AML that consists of firms verifying their customers’ identities. It is one of the steps in the larger AML compliance process.

A lot of financial institutions often get confused between KYC and AML, blur the lines between the two processes, and are subject to disciplinary action by regulatory bodies as a result. They can be fined or even sentenced to prison time based on the severity of the offence.

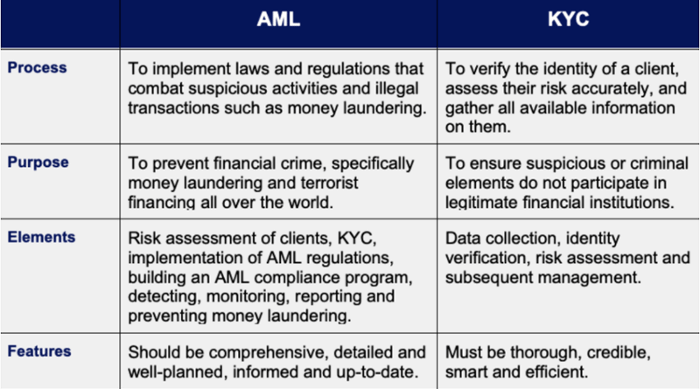

The key differences between KYC and AML are given in the following table.

How KYC and AML are connected

KYC and AML are deeply interconnected processes. KYC is the first step in the implementation of an AML programme or policy. It is the process through which the client’s identity is verified. The objective of KYC checks is to understand the clients, their demographics and financial dealings on a deeper level, in order to effectively manage AML risks. In general KYC involves the following processes:

- Customer Due Diligence or CDD: It is the basic process of verifying customer identity either physically or through electronic means. It is applicable to all customers of a business.

- Enhanced Due Diligence or EDD: It is a more advanced KYC procedure that is used primarily for high-risk customers. These customers are generally more prone to being involved in financial crimes, including money laundering and terrorist financing, hence the need for more thorough verification and sometimes more verification after onboarding.

Other elements in AML compliance

In addition to KYC, the AML compliance process involves the following elements:

- Risk-based AML policies

- Ongoing risk assessment and ongoing monitoring

- AML compliance training programs for staff

- Internal controls and internal audits

Importance of KYC and AML in banking

Both KYC and AML both play an integral role in a bank’s regulatory compliance. And to top it off, they are both risk-based approaches as well. They also share some common features such as client identification and risk management. But it is important to always bear in mind that these processes are not the same and serve varied functions. This will help banks to find the right professionals and team to take up each task — AML or KYC — and do it justice.

The prevention and implementation of anti-money laundering require an in-depth knowledge of a lot of factors. From the inner workings of the finance industry to an understanding of local, regional, national and international anti-money laundering regulations and rules, a successful AML professional must have a skill set beyond that of KYC.

Regtech for KYC – AML compliance

Apart from having skilled professionals, financial institutions should also invest in effective software solutions to run their AML compliance programmes successfully. Many of the current AML-KYC solutions are not robust to capture the complexities of modern-day customer risk management. Customer AML risk ratings are either carried out manually or are based on models that use a limited set of pre-defined risk parameters. This leads to inadequate coverage of risk factors which vary in number and weightage from customer to customer.

Further, the information for most of these risk parameters is static and collected when an account is opened. Often, information about customers is not updated in the required format and frequency. The current models do not consider all the touchpoints of a customer’s activity map and inaccurately score customers, failing to detect some high-risk customers and often misclassifying thousands of low-risk customers as high risk.

Misclassification of customer risk leads to unnecessary case reviews, resulting in excessive costs and customer dissatisfaction. Adding to this, the static nature of the risk parameters fails to capture the changing behaviour of customers and dynamically adjust the risk ratings, exposing financial institutions to emerging threats.

Using artificial intelligence and machine learning

Today, modern technologies like AI and machine learning are getting widespread attention for their ability to improve business processes and regulators are encouraging banks to adopt innovative approaches to combat money laundering. In the area of AML compliance, the need of the hour is a sophisticated technology that can capture changing customer behaviour through proper identification of risk indicators and continuously update customer profiles as underlying activities change. There are various Regtech solutions that can ensure proper AML-KYC compliance in a sustainable manner.

Tookitaki’s solutions for AML – KYC compliance

Tookitaki developed an end-to-end AML-KYC compliance platform called the Anti-Money Laundering Suite (AMLS). It offers multiple solutions catering to the core AML activities such as transaction monitoring, name screening, transaction screening and customer risk scoring. Powered by advanced machine learning, AMLS addresses the market needs and provides an effective and scalable AML compliance solution.

To know more about our AML solution and its unique features, please contact us.

Anti-Financial Crime Compliance with Tookitaki?