Money laundering is a complex financial crime that affects economies worldwide. It's a process that criminals use to make illicit funds appear legitimate.

Understanding the stages of money laundering is crucial. It helps in detecting and preventing this crime.

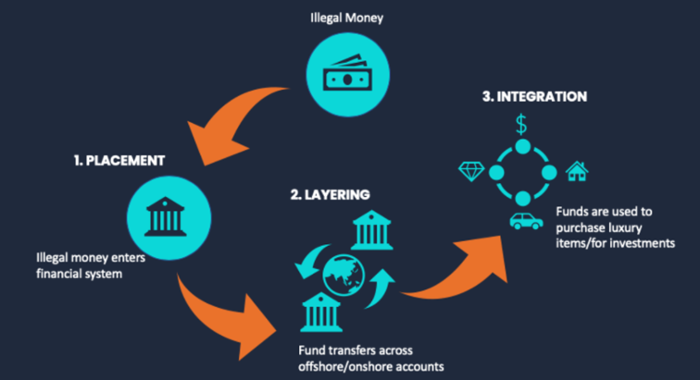

This article will delve into the three stages of money laundering. These are placement, layering, and integration.

We'll provide examples for each stage. This will give you a clearer picture of how money laundering works in practice.

We'll also discuss the role of financial institutions in combating this crime.

By the end of this article, you'll have a comprehensive understanding of money laundering stages. This knowledge is vital for finance professionals, legal experts, and anyone interested in financial crimes.

What is Money Laundering?

Money laundering is a financial crime. It involves making illegally-gained proceeds appear legal. The United Nations Office on Drugs and Crime (UNDOC) defines money laundering as “the method by which criminals disguise the illegal origins of their wealth and protect their asset bases, so as to avoid the suspicion of law enforcement agencies and prevent leaving a trail of incriminating evidence.”

Criminals use a series of complex transactions to hide the origin of these funds. The goal is to make the funds seem as if they came from legitimate sources.

Money laundering is not just a single act. It's a process that involves three stages: placement, layering, and integration. Each stage serves a specific purpose in the overall scheme.

Understanding these stages is crucial. It helps in detecting and preventing money laundering. It also aids in the prosecution of those involved in this crime.

Why Money Laundering Matters

Money laundering is a serious global issue. It's not just a problem for the financial sector, but for society as a whole.

This crime fuels other illegal activities, such as drug trafficking and terrorism. It also undermines the integrity of financial institutions and systems.

Moreover, money laundering can distort economies. It can lead to loss of tax revenue and create market instability. Understanding its stages is a step towards combating this crime.

The 3 Stages of Money Laundering Overview

Money laundering is a complex process. It involves three main stages: placement, layering, and integration.

Each stage serves a specific purpose in the laundering process. They are:

- Placement: Introducing illicit money into the financial system.

- Layering: Concealing the origins of the money through complex transactions.

- Integration: Merging the laundered money back into the legitimate economy.

The stages of money laundering are represented in the image below.

Please note that some of these steps may not be there in some money laundering cases. For example, non-cash proceeds that are already in the financial system need not be placed.

Stage 1: Placement

The placement stage is the initial step in money laundering. It involves the introduction of illicit funds into the financial system.

This stage is risky for criminals. It's where they are most likely to be detected. Large cash deposits or frequent transactions can raise suspicion.

To avoid detection, criminals use various methods. They might break down large amounts of cash into smaller deposits. This is known as smurfing.

Another method is currency exchanges. Criminals might exchange one currency for another to confuse the trail of money.

Placement Examples

Let's consider a drug dealer with a large amount of cash. He might deposit small amounts into different bank accounts. This is an example of smurfing.

Or consider a criminal who buys expensive items with illicit cash. He then sells these items, depositing the proceeds into a bank account. This is another example of placement.

Stage 2: Layering

The second stage of money laundering is layering. This stage involves creating complex layers of financial transactions. The aim is to obscure the origin of the funds.

Criminals use various techniques in this stage. They might make multiple transfers between different accounts. They might also purchase and sell assets to create a confusing paper trail.

Shell companies are often used in this stage. These are companies that exist only on paper. They have no real business operations or assets.

Layering Techniques

Consider a criminal who transfers money between different bank accounts. He might use accounts in different countries. This makes it harder for authorities to trace the money.

Or consider a criminal who uses a shell company. He transfers illicit funds to the company's account. The company then makes 'legitimate' transactions with the money. This is another example of layering.

Stage 3: Integration

The final stage of money laundering is integration. This is where the laundered money is returned to the criminal. It now appears to come from a legitimate source.

Integration often involves investment in legal businesses. The laundered money can be used to purchase assets. These assets can then be sold, with the proceeds appearing legitimate.

Another method is loans. A criminal might arrange for a loan to be given to him from his own laundered money.

Integration Examples

Consider a criminal who invests laundered money in a legitimate business. He might buy property or shares in a company. The profits from these investments appear to be legitimate earnings.

Or consider a criminal who arranges a loan from his own laundered money. The loan repayments are made with illicit funds. But the repayments appear to be legitimate income.

The Role of Financial Institutions in AML

Financial institutions play a crucial role in anti-money laundering (AML) efforts. They are often the first line of defense against money laundering.

Banks and other financial institutions have systems in place to detect suspicious activities. These include large cash deposits, frequent transactions, and complex transfer patterns. When such activities are detected, they are reported to the authorities. This helps in the identification and prosecution of money laundering activities.

Consequences of Money Laundering

Money laundering has far-reaching consequences. It distorts economic data, fuels corruption, and undermines the integrity of financial institutions.

Moreover, it facilitates other criminal activities by providing a safe haven for illicit funds. This can lead to social instability and economic inequality. The fight against money laundering is therefore crucial for maintaining economic stability and social justice.

Case Studies Highlighting Money Laundering Stages

To better understand the 3 stages of money laundering, let's look at some real-world examples. These case studies illustrate how criminals exploit the financial system to launder illicit funds.

One notable case involved a major global bank that was fined for failing to prevent money laundering. Criminals deposited large amounts of cash in multiple small transactions, a classic example of the placement stage. They then moved the money around through complex transactions across different accounts and countries, demonstrating the layering stage. Finally, the laundered money was used to purchase legitimate assets, completing the integration stage.

Another case involved a high-profile political figure who used shell companies to hide illicit funds. The money was first placed into the financial system through the purchase of luxury goods. It was then layered through a series of transactions involving offshore companies. Finally, the laundered money was integrated back into the economy through investments in legitimate businesses.

These cases underscore the importance of vigilance and robust anti-money laundering measures in financial institutions. They also highlight the need for ongoing education and training to detect and prevent such activities.

Conclusion: The Importance of AML Efforts

Understanding the 3 stages of money laundering is crucial in the fight against financial crime. It equips us with the knowledge to detect suspicious activities and take appropriate action.

The role of anti-money laundering (AML) efforts cannot be overstated. From financial institutions to individuals, we all have a part to play in ensuring the integrity of our financial system. By staying vigilant and adhering to AML regulations, we can help deter criminals and protect our economies from the damaging effects of money laundering.

As money laundering becomes increasingly sophisticated, financial institutions must employ advanced technologies to prevent, detect and manage financial crime effectively and efficiently. Tookitaki is an award-winning provider of AML compliance solutions.

If your financial institution is looking to optimise its AML compliance operations with the help of leading-edge solutions, contact us today and book a demo.

Anti-Financial Crime Compliance with Tookitaki?