The Link between Money Laundering and Cybercrime in Saudi Arabia

The Kingdom of Saudi Arabia has witnessed a notable increase in the prevalence of money laundering and cybercrime activities. These illicit activities pose significant threats to the country's financial system, national security, and the overall economy. As such, authorities, financial institutions, and regulatory bodies have recognised the need to examine the interconnectedness of these activities closely.

Understanding the link between money laundering and cybercrime is crucial for developing effective strategies and countermeasures. Cybercriminals often exploit money laundering techniques to hide the proceeds generated through illicit cyber activities such as hacking, fraud, or ransomware attacks. By comprehending this connection, authorities and financial institutions can enhance their detection and prevention efforts, disrupt criminal networks, and safeguard the financial system's integrity.

Understanding Money Laundering and Cybercrime

Money Laundering and its Methods

Money laundering involves the process of disguising the origins of illegally obtained funds to make them appear legitimate. This process typically consists of three stages: placement, layering, and integration. Various methods, such as structuring transactions, using shell companies, or engaging in trade-based schemes, are employed to facilitate money laundering activities.

Overview of Cybercrime and its Impact

Cybercrime refers to illegal activities conducted in the digital realm, targeting computer systems, networks, or individuals. It encompasses many offences, including hacking, identity theft, online fraud, ransomware attacks, etc. The impact of cybercrime can be significant, leading to financial losses, compromised personal information, reputational damage, and disruptions to critical infrastructure.

Organizations in Saudi Arabia and the UAE were prime targets for cyberattacks in the Gulf Cooperation Council countries from mid-2021 to mid-2022, according to a report by cybersecurity firm Group-IB.

Ransomware encrypts files, blocking access until a ransom is paid, with non-compliance resulting in data exposure or deletion. The research found that the GCC witnessed 42 ransomware attacks during the specified period, with the UAE and Saudi Arabia being the primary targets. According to the report, the energy, telecoms, IT, and manufacturing sectors were the most vulnerable.

Cybercrime receives strict penalties from the Saudi Ministry of Interior and the Communications and Information Technology Commission. Sanctions are enforced for offences such as identity theft, defamation, electronic piracy, email theft, and various illegal acts. Nonetheless, the effectiveness of these penalties has been limited in deterring online attackers.

Cybercriminals who are determined to breach computer systems, pilfer information and disrupt businesses are often deemed technologically more advanced than those tasked with combating them. According to a survey, around 45 per cent of IT experts in the GCC acknowledged that their organizations experienced at least one known IT security incident in the past year.

Money Laundering and Cybercrime Landscape in Saudi Arabia

Current State of Money Laundering and Cybercrime in Saudi Arabia

The Kingdom of Saudi Arabia faces significant money laundering and cybercrime challenges. These illicit activities have become increasingly sophisticated, threatening the country's financial system, economy, and national security. It is crucial to analyze the current landscape to devise effective countermeasures.

Prevalence and Impact of Illicit Activities in Saudi Arabia

Statistics and trends reveal the alarming prevalence and impact of money laundering and cybercrime in Saudi Arabia. These illicit activities result in financial losses, compromised personal information, and reputational damage to individuals, businesses, and the nation as a whole. Understanding the scale of the problem helps identify the urgency for comprehensive measures.

Regulatory Measures and Initiatives to Combat Money Laundering and Cybercrime

Saudi Arabian authorities have taken robust regulatory measures and implemented initiatives to effectively combat money laundering and cybercrime. These efforts include stringent AML laws, cybersecurity regulations, and collaborations with international organizations. Saudi Arabia aims to prevent, detect, and prosecute these illicit activities by establishing a strong legal framework and fostering partnerships.

Analyzing the money laundering and cybercrime landscape in Saudi Arabia provides insights into the challenges faced by the country and the importance of implementing proactive measures. The prevalence of these activities underscores the necessity of regulatory actions and collaborative efforts to protect the financial system's integrity and ensure cybersecurity.

The Link between Money Laundering and Cybercrime

Connection and Symbiotic Relationship

There exists a significant connection and symbiotic relationship between money laundering and cybercrime. Cybercriminals often employ money laundering techniques to convert the proceeds obtained through illicit cyber activities into legitimate-looking funds. This collaboration between cybercrime and money laundering allows criminals to disguise the origins of their ill-gotten gains, making it difficult to trace and detect their illicit activities.

This convergence creates a complex challenge for law enforcement agencies and financial institutions in detecting and combating these intertwined criminal activities. Understanding money laundering and cybercrime dynamics is vital to developing effective preventive measures and implementing robust AML (Anti-Money Laundering) and cybersecurity frameworks. By exploring the intersection between these two illicit activities, we can gain valuable insights into the methods used by criminals and enhance our ability to safeguard against their harmful effects.

Exploitation of Financial Systems for Money Laundering

Numerous examples and case studies demonstrate how cybercriminals exploit financial systems for money laundering purposes. They may utilize sophisticated methods such as cryptocurrency transactions, online payment systems, or fraudulent bank transfers to obfuscate the illicit origins of their funds. These tactics allow cybercriminals to legitimize their proceeds, enabling them to enjoy illicit gains without raising suspicion.

Challenges Faced by Financial Institutions

Resecurity, a California-based cybersecurity firm, earlier detected a surge in malicious activities targeting individuals and businesses of major Saudi Arabian financial institutions. The spike in cybercrime occurred during Q2 2022, coinciding with the Holy Month of Ramadan, when security teams and anti-fraud departments may have limited resources. Fraudsters employed high-quality phishing kits and mobile applications to steal customer credentials, using fake recruitment websites and a "money mules" network for money laundering. The stolen amounts ranged from SAR 20,000 to 70,000, strategically divided to avoid detection and bypass anti-fraud measures.

The evolving nature of cybercrime and the increasing sophistication of money laundering techniques pose obstacles to traditional detection methods. Rapidly changing technologies and using anonymizing tools further complicate the identification of illicit financial transactions. Financial institutions must continuously adapt their AML systems and enhance their capabilities to address these challenges effectively.

Tookitaki's Solutions for Combating Money Laundering and Cybercrime

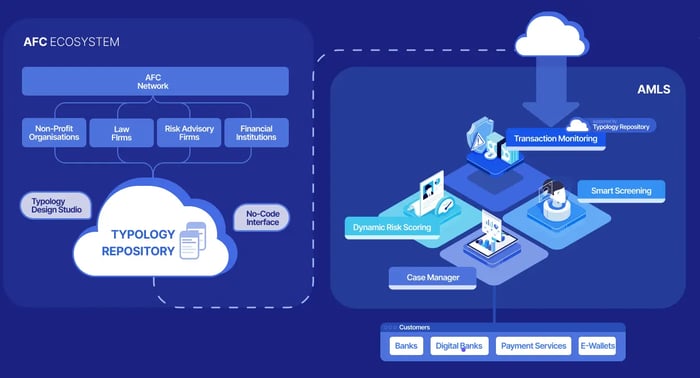

Tookitaki's AML Suite: A Bespoke Solution for Financial Institutions

Tookitaki's AML Suite is uniquely designed to cater to the complex needs of Saudi Financial Institutions. The software uses AI and ML to offer an automated, adaptive, and efficient compliance management system. This cutting-edge suite lets financial institutions quickly identify, investigate, and report suspicious activities, helping them adhere to AML regulations and secure their platforms.

Modules within the AML Suite

Smart Screening Solutions

- Prospect Screening: This module enables real-time screening capabilities for prospect onboarding. By leveraging smart, AI-powered fuzzy identity matching, it reduces regulatory compliance costs and exposure to risk.

- Name Screening: Tookitaki's Name Screening solution utilizes machine learning and Natural Language Processing (NLP) techniques to accurately score and distinguish true matches from false matches across names and transactions in real-time and batch mode. The solution supports screening against sanctions lists, PEPs, adverse media, and local/internal blacklists, ensuring comprehensive coverage.

Dynamic Risk Scoring

- Prospect Risk Scoring: Prospect Risk Scoring (PRS) is a powerful solution that enables financial institutions to onboard prospects with reduced regulatory compliance costs and risk exposure. By defining a set of parameters that correspond to the rules, PRS offers real-time risk-scoring capabilities.

- Customer Risk Scoring: Tookitaki's Customer Risk Scoring (CRS) is a core module within the AML Suite powered by advanced machine learning. CRS provides scalable customer risk rating by dynamically identifying relevant risk indicators across a customer's activity. The solution offers a 360-degree customer risk profile, continuous on-demand risk scoring, and perpetual KYC for ongoing due diligence.

Transaction Monitoring

Tookitaki's Transaction Monitoring solution is the most comprehensive in the industry, utilizing a first-of-its-kind industry-wide typology repository and AI capabilities. It provides comprehensive risk detection and efficient alert management, offering 100% risk coverage and the ability to detect new and emerging money laundering techniques and their predicate offences, including cybercrime.

The solution includes automated threshold management, reducing the manual effort involved in threshold tuning by over 70%. With superior detection techniques, leveraging typologies representing real-world red flags, Transaction Monitoring helps financial institutions safeguard against new risks and threats effectively.

Case Manager

The Case Manager within Tookitaki's AML Suite provides compliance teams with a collaborative platform to work seamlessly on cases. The Case Manager includes automation that empowers investigators by automating case creation, allocation, and data-gathering processes. Financial institutions can configure the Case Manager to improve operational efficiency, reduce manual efforts, and enhance overall effectiveness in managing and resolving cases.

Tookitaki's commitment to innovation and its comprehensive solutions make them a valuable ally in the fight against money laundering and cybercrime. By leveraging their advanced technology and machine learning capabilities, financial institutions in Saudi Arabia can enhance their AML efforts, protect their customers, and maintain the financial system's integrity.

Benefits of Utilizing Tookitaki's Solutions

Enhanced Detection Accuracy and Reduced False Positives

By implementing Tookitaki's solutions, financial institutions can benefit from enhanced detection accuracy in identifying money laundering and cybercrime activities. The advanced algorithms and machine learning capabilities ensure that suspicious transactions and patterns are accurately identified, minimizing false positivesand enabling more focused investigations.

Streamlined Processes and Increased Operational Efficiency

Tookitaki's solutions streamline AML and financial crime detection processes, increasing operational efficiency for financial institutions. The automated workflows, advanced analytics, and intelligent, alert prioritization features optimize resource allocation, allowing compliance teams to focus on high-risk cases. This leads to faster response times, improved decision-making, and overall operational effectiveness.

Compliance with Saudi Arabian Regulatory Requirements

Utilizing Tookitaki's solutions ensures compliance with Saudi Arabian regulatory requirements for AML and cybersecurity. The solutions are designed to align with local regulations and industry standards, providing financial institutions with the necessary tools to meet their obligations effectively. By implementing Tookitaki's solutions, organizations can demonstrate their commitment to combating money laundering and cybercrime while adhering to regulatory guidelines.

By leveraging Tookitaki's solutions, financial institutions in Saudi Arabia can achieve enhanced detection accuracy, streamline their processes, and meet regulatory requirements. These benefits contribute to a robust and proactive approach to combating money laundering and cybercrime, safeguarding the financial system, and protecting customers from illicit activities.

Importance of Proactive Measures to Combat Illicit Activities

The connection between money laundering and cybercrime in Saudi Arabia highlights the need for a comprehensive approach to combat these illicit activities. The symbiotic relationship between these two threats poses significant risks to the financial system, national security, and overall economy. Understanding this link is essential for developing effective strategies and countermeasures.

Taking proactive measures is vital to combat money laundering and cybercrime effectively. Financial institutions and authorities must stay ahead of evolving tactics employed by criminals. Financial institutions can enhance their detection and prevention capabilities by implementing advanced technologies and solutions, disrupting illicit networks and safeguarding the financial ecosystem.

Tookitaki offers state-of-the-art solutions specifically designed to address the challenges posed by money laundering and cybercrime. Financial institutions must leverage Tookitaki's innovative technology, advanced analytics, and machine learning capabilities to strengthen their AML and financial crime detection efforts. By partnering with Tookitaki, organizations can stay ahead of emerging risks and protect themselves and their customers from illicit activities.

We invite readers to explore Tookitaki's comprehensive range of solutions for AML and financial crime detection. Visit their website to learn more about their innovative technology, industry expertise, and success stories. Contact Tookitaki to request a personalized demo and discover how their solutions can strengthen your organization's defence against money laundering and cybercrime.

Taking proactive measures and leveraging advanced solutions is crucial in the fight against money laundering and cybercrime. By working together and adopting robust technologies, we can create a safer and more secure financial landscape in Saudi Arabia and beyond.

Anti-Financial Crime Compliance with Tookitaki?