The Importance of AML Compliance for Saudi Arabia's Economic Growth

Money laundering is a pervasive issue with significant socio-economic implications. At its core, it is the process of making illegally gained proceeds appear legal. It typically involves three steps: placement, layering, and integration. This clandestine activity can destabilize the economy by creating artificial inflation, disrupting market equilibriums, fostering corruption, and undermining the integrity of financial institutions. Beyond the financial sector, money laundering can distort economic data, making it challenging to formulate effective economic policies and fiscal regulations. Moreover, it erodes social and political structures, fuels criminal activities, and can eventually lead to a decline in economic growth.

As one of the most dynamic economies in the Middle East, Saudi Arabia has seen tremendous growth over the past few decades. However, the threat of money laundering, often linked to illegal activities such as corruption, drug trafficking, and terrorism, is a concern that cannot be overlooked.

Anti-Money Laundering (AML) compliance plays a crucial role in safeguarding Saudi Arabia's economic growth. By establishing stringent controls to prevent, detect, and report money laundering activities, AML compliance can help preserve the integrity of the nation's financial system. It further enhances investor confidence, attracts foreign investment, and positions Saudi Arabia as a secure and reliable market for global commerce.

Moreover, AML compliance demonstrates Saudi Arabia's commitment to international AML standards, which is crucial in the global fight against financial crime. Therefore, it is not just an operational necessity for financial institutions but also a strategic imperative for the nation's overall economic growth and stability.

Money Laundering Scenario in Saudi Arabia

Prevalence of Money Laundering Issues in Saudi Arabia

Money laundering in Saudi Arabia is a pressing issue, driven primarily by the nation's vast wealth, its status as the world's leading oil exporter, and the presence of a significant informal economy. The country is an attractive destination for illicit funds, often associated with corruption, smuggling, and financial fraud. In addition, given its geopolitical location, Saudi Arabia also faces issues related to terrorism financing, which is intrinsically linked to money laundering.

Despite concerted efforts to strengthen the anti-money laundering framework, Saudi Arabia continues to grapple with complex money laundering schemes. These involve diverse actors, from organized crime groups and illicit businesses to corrupt officials, complicating detection and mitigation efforts.

How Money Laundering Affects the Saudi Arabian Economy

Money laundering has a profound and multifaceted impact on the Saudi Arabian economy.

- Firstly, it undermines the integrity and stability of the financial system. Laundered money that infiltrates legitimate business operations can distort supply and demand, creating artificial inflation and destabilizing market equilibrium.

- Secondly, money laundering erodes public trust in financial institutions and the broader economic system. This mistrust can lead to decreased investment and economic stagnation.

- Thirdly, money laundering often correlates with other illicit activities like corruption and crime, which further deteriorates social and economic structures. These activities discourage foreign investment and economic diversification – two key goals of Saudi Arabia's Vision 2030 strategic plan for economic development.

- Lastly, the resources spent on identifying, investigating, and prosecuting money laundering cases impose a significant financial burden. These resources could otherwise be invested in productive sectors of the economy. Consequently, the fight against money laundering is not just about law enforcement; it is an economic necessity for Saudi Arabia's sustained growth and prosperity.

Regulatory Landscape in Saudi Arabia

Saudi Arabia's AML Regulatory Framework

Its robust regulatory framework reflects Saudi Arabia's commitment to combating money laundering. Over the years, the country has taken significant steps to enhance its AML/CFT (Anti-Money Laundering/Counter Financing of Terrorism) regime.

The Saudi Arabian Monetary Authority (SAMA), the kingdom's central bank, plays a critical role in enforcing AML regulations. SAMA has issued comprehensive rules and guidelines to financial institutions to identify, prevent, and report suspicious activities. The AML Law of 2017 and its corresponding Rules Governing Anti-Money Laundering and Combating Terrorist Financing, issued in 2018, are key legislative components that reflect international AML standards.

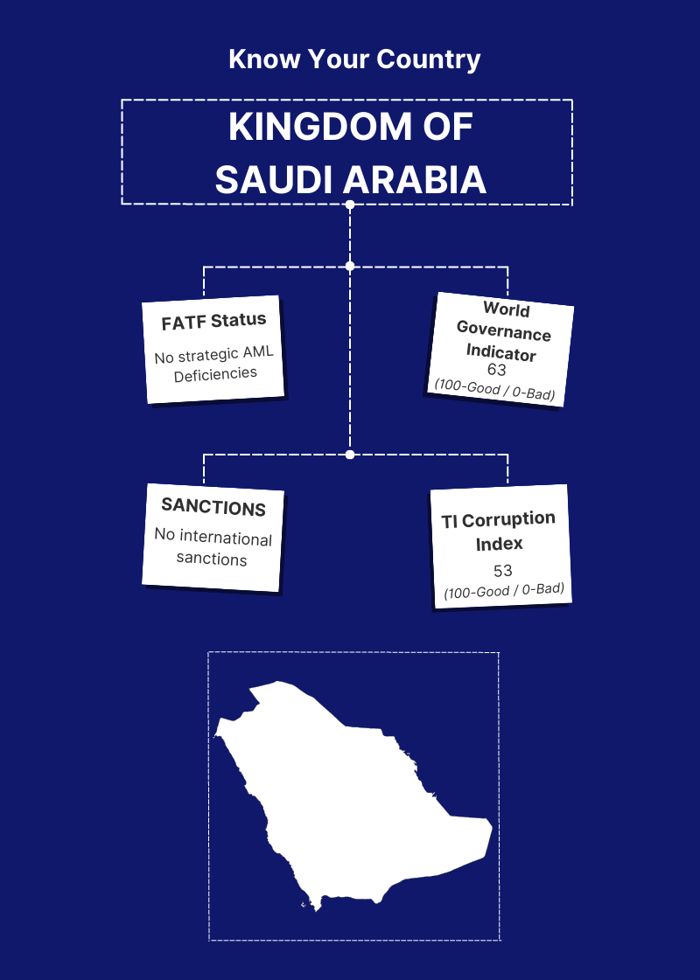

The Financial Action Task Force (FATF) also significantly shapes Saudi Arabia's AML regulations. As a member of the FATF, Saudi Arabia is committed to implementing the FATF's 40 recommendations to combat money laundering and terrorist financing.

Compliance Requirements for Financial Institutions

Financial institutions operating in Saudi Arabia are required to comply with a range of AML obligations. Key among these are the requirements to establish and maintain effective customer due diligence (CDD) procedures, implement ongoing transaction monitoring systems, and report suspicious transactions to the Financial Investigation Unit (FIU).

Institutions must also have a comprehensive AML risk assessment process in place to identify, assess, and manage money laundering risks. This extends to appointing a Compliance Officer responsible for overseeing the institution's AML compliance program.

Furthermore, regular employee training on AML regulations and procedures is mandatory. This ensures that all employees are equipped to recognize and report suspicious activities, further bolstering the institution's AML defences.

Penalties for non-compliance can be severe, including significant fines, the revocation of licenses, and criminal charges for individuals involved in money laundering activities. Thus, adherence to these regulations is crucial not only for maintaining the integrity of individual institutions but also for safeguarding the economic stability of Saudi Arabia as a whole.

The Role of AML Compliance in Economic Growth

How AML Compliance Contributes to Economic Stability

AML compliance plays a significant role in ensuring economic stability. By detecting, preventing, and mitigating the risks associated with money laundering, it safeguards the financial system's integrity and contributes to the economy's overall health.

Money laundering can distort economic data, making it challenging to make accurate assessments and forecasts. Masking the true sources of wealth and the nature of financial transactions can result in economic decisions based on misleading data. Effective AML controls help to ensure that financial transactions are transparent, which is crucial for accurate economic analysis and policy-making.

Furthermore, money laundering can also cause a disproportionate allocation of resources, as criminals might focus investments in sectors where their illicit gains are less likely to attract attention. This can lead to economic distortions and instability. Robust AML compliance programs can help deter such activities, leading to a more balanced and stable economy.

The Effect of AML Compliance on Investor Confidence and Foreign Investments

AML compliance directly impacts investor confidence and foreign investments – two pivotal factors for economic growth. A robust AML regime signifies a country's commitment to maintaining a transparent and clean financial system. This can boost investor confidence as it reduces the risk associated with their investments.

Foreign investors, in particular, are increasingly conscious about the AML frameworks of the countries they invest in. The presence of a strong AML regime can be a critical determining factor for foreign direct investments (FDI). Countries with effective AML systems are more likely to attract FDI, which can spur economic growth.

Moreover, the global economy is interconnected, and countries often need to meet certain AML standards to facilitate international trade and financial transactions. By adhering to international AML standards, Saudi Arabia can continue participating actively in the global economy, thereby driving its economic growth.

Tookitaki’s AML Compliance Solution and its Relevance for Saudi Arabia

Overview of Tookitaki's AML Solutions

Founded in 2015, Tookitaki aims to create safer societies by tackling the root cause of money laundering. As a global leader in financial crime prevention software, the company revolutionises the fight against financial crime by breaking the siloed AML approach and connecting the community through its two distinct platforms: the Anti-Money Laundering (AML) Suite and the Anti-Financial Crime (AFC) Ecosystem. Tookitaki's unique community-based approach empowers financial institutions to effectively detect, prevent, and combat money laundering and related criminal activities, resulting in a sustainable AML program with holistic risk coverage, sharper detection, and fewer false alerts.

The AML Suite is an end-to-end operating system that modernises compliance processes for banks and fintechs. In parallel, the AFC Ecosystem serves as a community of experts dedicated to uncovering hidden money trails that traditional methods cannot detect. Powered by federated machine learning, the AML Suite collaborates with the AFC Ecosystem to ensure that financial institutions stay ahead of the curve in their AML programs.

The AMLS includes several modules such as Transaction Monitoring, Smart Screening, Dynamic Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution covering all AML aspects, including detection, investigation, and reporting.

How Tookitaki’s solution can assist Saudi Arabian financial institutions

In a rapidly growing economy like Saudi Arabia's, where the risk of money laundering is increasing, Tookitaki’s AML compliance solution offers an essential tool for financial institutions. Its AI-powered capabilities can help these institutions effectively navigate the complex AML landscape in Saudi Arabia.

Tookitaki's AML Suite can assist in meeting the stringent AML regulations set forth by Saudi Arabia's regulatory bodies, ensuring compliance and mitigating the risk of penalties. It also provides a comprehensive risk view, making it easier for institutions to identify and manage potential risks.

Furthermore, by implementing a robust and efficient AML compliance program like Tookitaki's AML Suite, Saudi Arabian financial institutions can reinforce their commitment to maintaining a clean financial system. This can boost investor confidence and attract more foreign investments, further driving the growth of the Saudi Arabian economy.

Advancing Economic Growth through AML Compliance: The Road Ahead for Saudi Arabia

A well-regulated financial system is the backbone of a prosperous and stable economy. Saudi Arabia's progress and growth are intrinsically linked to its commitment to maintaining stringent AML compliance. As financial institutions adopt advanced compliance measures, they not only safeguard their operations from illicit activities but also contribute to the broader economic growth of the nation. The increased transparency, reduced financial crimes, and enhanced investor confidence, all fueled by effective AML compliance, can stimulate economic activity and solidify Saudi Arabia's position in the global financial landscape.

In an era marked by complex financial crimes, traditional compliance systems might not be sufficient. Financial institutions in Saudi Arabia need to consider adopting advanced AML compliance solutions like Tookitaki's AML Suite. With its AI-driven capabilities, Tookitaki's solution offers a comprehensive and efficient approach to combating money laundering. By embracing such cutting-edge technology, financial institutions can reinforce their commitment to AML compliance, contributing significantly to the economic development of Saudi Arabia. Hence, it's time for these institutions to take a proactive step towards strengthening their AML compliance measures.

Anti-Financial Crime Compliance with Tookitaki?