The LGPD and Its Impact on AML Compliance in Brazil: All You Must Know

The LGPD (Lei Geral de Proteção de Dados), Brazil's comprehensive data protection law, has gained significant attention since its implementation. It aims to protect individual's personal data and establish guidelines for its processing by organizations. In a digital era where data privacy is paramount, the LGPD has far-reaching implications for various sectors, including anti-money laundering (AML) compliance.

AML compliance is crucial for financial institutions to detect and prevent money laundering and terrorist financing activities. However, the intersection of AML compliance and data protection under the LGPD introduces new challenges and considerations. Balancing the need for effective AML measures while safeguarding individuals' data privacy requires a careful understanding of the LGPD's impact on AML practices in Brazil.

Understanding the LGPD

Key Principles of the LGPD

The LGPD is based on key principles regulating personal data processing in Brazil. These principles include transparency, purpose limitation, data minimization, accuracy, storage limitation, security, and accountability. Organizations must ensure that they handle personal data in a manner that respects these principles. They need to be transparent with individuals about data processing purposes, collect only the necessary data, keep the data accurate and up to date, store it securely, and be accountable for their data processing practices.

Impact of the LGPD on Data Processing for AML Compliance

The LGPD has a significant impact on data processing for AML compliance purposes. Financial institutions need to be aware of their obligations under the LGPD when collecting, processing, and storing personal data for AML activities. They must obtain valid consent from individuals, clearly communicate the purpose of data processing, and handle the data in a secure manner.

It is crucial for organizations to establish appropriate data retention policies to ensure compliance with the LGPD's storage limitation principle. Furthermore, financial institutions should implement measures to detect and mitigate data breaches, as data protection and security are paramount under the LGPD.

Complying with the LGPD while fulfilling AML obligations requires a comprehensive understanding of the law's requirements and implementing appropriate measures. Financial institutions need to align their AML compliance processes with the principles and requirements of the LGPD.

This involves conducting data protection impact assessments, establishing data protection policies and procedures, training employees on data protection principles, and ensuring ongoing compliance through regular audits and reviews. By integrating AML compliance and data protection measures, organizations can effectively navigate the regulatory landscape and protect the privacy rights of individuals while combatting money laundering and financial crimes.

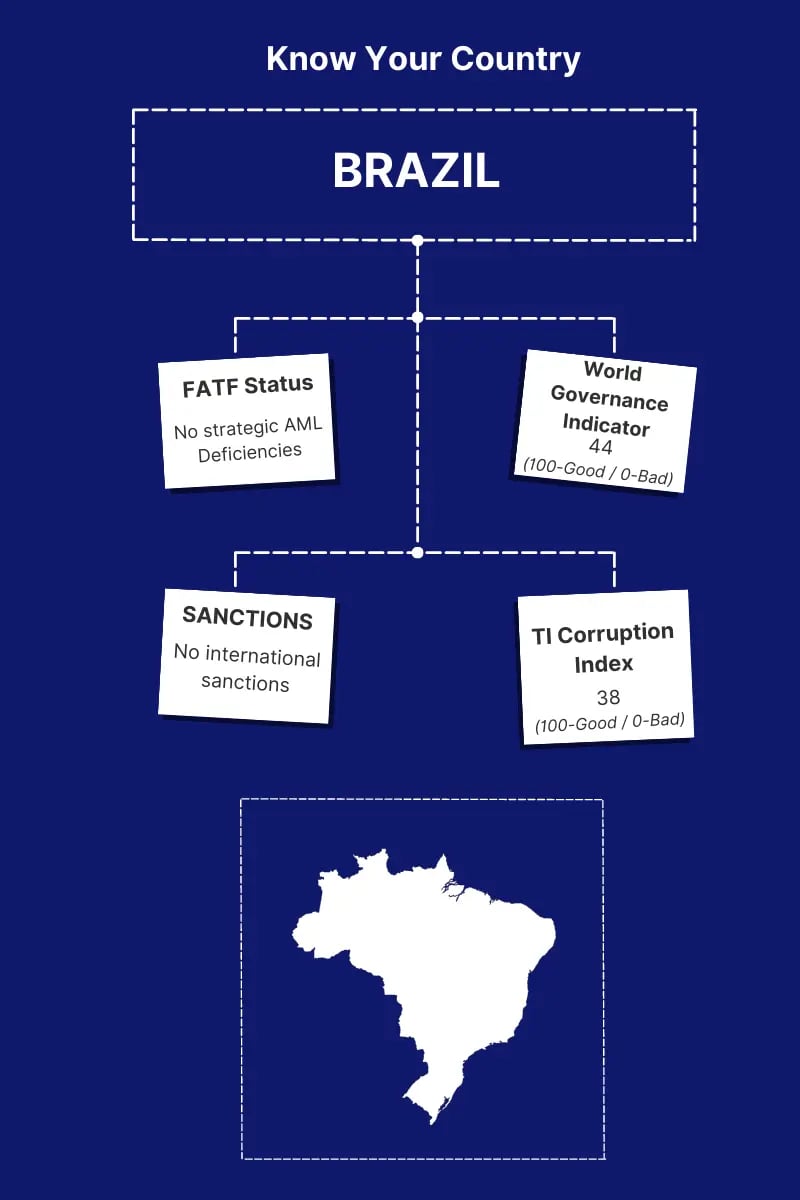

AML Compliance Landscape in Brazil

Regulatory Framework for AML Compliance in Brazil

Brazil has established a robust regulatory framework to combat money laundering and terrorist financing. The country's primary legislation governing AML compliance is Law No. 9.613/1998, commonly known as the Anti-Money Laundering Law. Additionally, Brazil has implemented various resolutions and regulations issued by the Central Bank of Brazil, the Brazilian Securities and Exchange Commission, and other regulatory bodies. These regulations outline the obligations and requirements for financial institutions in terms of customer due diligence, reporting suspicious transactions, and implementing effective AML programs.

Challenges Faced by Financial Institutions in Implementing Effective AML Strategies

Financial institutions in Brazil encounter several challenges in implementing effective AML strategies. These challenges include:

- Complexity of the Regulatory Environment: The AML regulatory landscape in Brazil is complex, with multiple regulations and guidelines that financial institutions must navigate. Staying updated with regulatory changes and ensuring compliance with various obligations can be demanding.

- Data Management and Integration: Financial institutions must collect, manage, and integrate vast amounts of customer data to conduct due diligence and monitor transactions effectively. Ensuring this data's accuracy, security, and privacy while complying with the LGPD adds an additional layer of complexity.

- Technology and Resources: Implementing robust AML systems and technologies requires significant investments in resources in terms of technology infrastructure and skilled personnel. Financial institutions must balance operational efficiency and compliance costs while leveraging advanced technologies to enhance their AML capabilities.

- Collaboration and Information Sharing: AML compliance requires effective collaboration and information sharing between financial institutions, regulatory authorities, and law enforcement agencies. Establishing strong partnerships and ensuring efficient communication channels can be challenging, particularly when dealing with a wide range of stakeholders.

Overcoming these challenges requires a proactive and comprehensive approach to AML compliance. Financial institutions can benefit from leveraging advanced technologies and solutions, such as those provided by Tookitaki, to streamline their AML processes, enhance data management capabilities, and ensure compliance with both AML regulations and the LGPD. By addressing these challenges head-on, financial institutions can strengthen their AML strategies and contribute to the integrity and stability of Brazil's financial system.

Intersection of LGPD and AML Compliance

Implications of the LGPD on AML Compliance Practices in Brazil

Implementing the LGPD in Brazil has significant implications for AML compliance practices. The LGPD introduces comprehensive data protection principles and requirements that financial institutions must adhere to when processing personal data for AML purposes. This includes obtaining valid consent, ensuring transparency in data processing, implementing adequate security measures, and respecting individuals' rights over their personal data. Financial institutions must assess their AML compliance programs and align them with the LGPD's principles to ensure they meet both AML and data protection obligations.

Challenges and Opportunities in Aligning AML Practices with Data Protection Requirements

Aligning AML practices with data protection requirements presents both challenges and opportunities for financial institutions in Brazil. Some of the challenges include:

- Balancing AML and Data Protection Objectives: Financial institutions must balance their AML objectives of detecting and preventing financial crimes and the data protection objectives of safeguarding individuals' privacy rights. This requires careful consideration and implementation of effective measures in combating money laundering while respecting data protection principles.

- Data Subject Rights and Consent: The LGPD grants individuals certain rights over their personal data, such as the right to access, rectify, and delete their information. Financial institutions must establish processes to handle data subject requests and ensure that they have valid consent for processing personal data for AML purposes.

- Data Security and Confidentiality: AML compliance often involves collecting and analysing sensitive personal data. Financial institutions must implement robust data security measures to protect against unauthorized access, breaches, and misuse of this data. Compliance with the LGPD's security requirements is essential to maintain data integrity and confidentiality.

However, aligning AML practices with data protection requirements also presents opportunities for financial institutions. By adopting a privacy-by-design approach, they can enhance their AML programs with privacy-enhancing technologies and data protection measures. This can lead to increased customer trust, improved reputation, and enhanced compliance with both AML and data protection regulations.

Financial institutions can benefit from utilizing advanced AML compliance solutions that integrate data protection measures to navigate these challenges and leverage the opportunities. Tookitaki's AML solutions offer features that enable financial institutions to align their AML practices with the LGPD requirements. By leveraging these solutions, financial institutions can effectively mitigate financial crime risks while ensuring compliance with data protection regulations, ultimately contributing to a more secure and privacy-respecting financial ecosystem in Brazil.

Key Considerations for AML Compliance under the LGPD

Ensuring AML Compliance while Adhering to the LGPD

Financial institutions in Brazil need to consider specific measures to ensure AML compliance while adhering to the LGPD. Some key considerations include:

- Data Privacy Impact Assessments (DPIAs): Conducting DPIAs is crucial to identify and assess the risks associated with processing personal data for AML purposes. Financial institutions should evaluate the necessity and proportionality of data processing, identify potential risks to data subjects' rights and freedoms, and implement appropriate measures to mitigate these risks.

- Data Subject Rights and Consent Management: Financial institutions must establish robust mechanisms to handle data subject rights requests, such as access, rectification, and deletion. They should provide clear information about the purpose, legal basis, and duration of data processing, and obtain valid consent when required. Implementing effective consent management systems and processes will help ensure compliance with the LGPD's requirements.

- Data Minimization and Retention: Financial institutions should apply data minimization principles by collecting and processing only the necessary personal data for AML purposes. They should establish data retention policies that align with legal requirements and the purpose for which the data is collected. Regularly reviewing and deleting outdated or unnecessary data helps minimize data protection risks.

Importance of Data Privacy Impact Assessments and Data Subject Rights in AML Processes

Data privacy impact assessments (DPIAs) play a crucial role in the intersection of AML and data protection. Conducting DPIAs helps financial institutions identify and assess the potential impact of AML processes on individuals' privacy rights. By conducting DPIAs, institutions can ensure that their AML practices align with the LGPD's requirements and mitigate any risks to data subjects' rights and freedoms.

Additionally, data subject rights are paramount in AML processes. Financial institutions must respect individuals' rights to access, rectify, and delete their personal data used for AML purposes. Upholding data subject rights demonstrates compliance with the LGPD and promotes transparency, trust, and accountability in AML compliance efforts.

By prioritizing data privacy impact assessments and data subject rights, financial institutions can balance effective AML compliance and the protection of individuals' privacy rights under the LGPD. Implementing robust data protection measures, such as encryption, access controls, and data anonymization techniques, further strengthens the safeguards for personal data in AML processes.

Tookitaki's AML solutions can assist financial institutions in addressing these key considerations. By incorporating data privacy impact assessments and providing mechanisms to manage data subject rights, Tookitaki's solutions help ensure compliance with the LGPD while enhancing AML practices. This enables financial institutions to navigate the complexities of AML compliance in Brazil's evolving regulatory landscape and maintain a strong commitment to data protection and privacy.

Leveraging Technology for LGPD-Compliant AML Compliance

Technological Solutions for Meeting AML and LGPD Requirements

Financial institutions can leverage advanced technological solutions to meet both AML and LGPD requirements. Some key technological solutions include:

- AI-Powered Compliance Systems: AI-powered systems, such as those offered by Tookitaki, can assist financial institutions in automating AML compliance processes while ensuring data privacy. These systems leverage machine learning algorithms to analyze vast amounts of data, detect suspicious activities, and generate accurate risk assessments. These systems can effectively balance AML compliance and data protection by incorporating privacy-enhancing technologies.

- Data Encryption and Anonymization: Implementing strong encryption techniques and anonymizing personal data are essential for protecting sensitive information. Encryption ensures that data remains secure and confidential during transmission and storage, while anonymization techniques can help de-identify personal data to maintain privacy while still enabling effective analysis for AML purposes.

Benefits of Technology-Driven Approaches in AML Compliance

Adopting technology-driven approaches in AML compliance offers several benefits for financial institutions:

- Enhanced Detection and Risk Assessment: Advanced technologies, such as AI and machine learning, can significantly improve the accuracy and efficiency of detecting suspicious activities and assessing AML risks. These technologies can analyze vast amounts of data in real-time, identify patterns, and generate alerts for potential money laundering activities, enabling proactive risk mitigation.

- Streamlined Compliance Processes: Technology-driven solutions automate manual processes, reducing financial institutions' compliance burden. By leveraging automation, institutions can streamline customer due diligence, transaction monitoring, and reporting processes, increasing operational efficiency and cost savings.

- Improved Data Privacy and Protection: Implementing robust technological solutions allows financial institutions to establish strong data privacy and protection measures. Encryption, anonymization, and access controls safeguard sensitive personal data, ensuring compliance with LGPD requirements. By enhancing data privacy, institutions can build trust with customers and maintain a strong reputation in the market.

- Enhanced Regulatory Compliance: Technology-driven approaches enable financial institutions to stay up-to-date with evolving AML and data protection regulations. These solutions can adapt to changing regulatory requirements and seamlessly incorporate updates, ensuring ongoing compliance with AML and LGPD obligations.

Tookitaki's AI-powered AML solutions are designed to assist financial institutions in achieving LGPD-compliant AML practices. By leveraging advanced technologies, these solutions enhance detection accuracy, streamline compliance processes, and prioritize data privacy. Financial institutions can effectively navigate the complex landscape of AML compliance in Brazil, ensuring adherence to LGPD requirements and achieving robust protection against financial crimes.

Conclusion

The LGPD has brought significant implications for AML compliance practices in Brazil, requiring financial institutions to navigate the intersection of data protection and anti-money laundering. Adhering to the LGPD while maintaining effective AML practices is crucial for institutions to ensure regulatory compliance and protect the privacy of individuals.

Financial institutions must recognize the importance of addressing data protection requirements while upholding robust AML practices. Striking a balance between data privacy and effective AML measures is key to building customer trust, mitigating financial risks, and maintaining regulatory compliance.

Tookitaki's advanced technological solutions offer a way forward for financial institutions to achieve LGPD-compliant AML compliance. Institutions can streamline compliance processes, enhance detection accuracy, and protect sensitive data by leveraging AI-powered systems, encryption techniques, and privacy-enhancing technologies. It is imperative for financial institutions to stay informed, adapt their AML strategies, and explore Tookitaki's technology to navigate the evolving landscape of AML compliance in Brazil and ensure LGPD compliance.

Take the next step towards LGPD-compliant AML compliance in Brazil with Tookitaki's innovative solutions. Contact us today to learn more about how our technology can help your institution achieve regulatory compliance, protect data privacy, and effectively combat money laundering.

Anti-Financial Crime Compliance with Tookitaki?