In recent years, Malaysia has witnessed a significant surge in digital banking, a clear testament to the evolving banking preferences of consumers and the increasing sophistication of technology. This new banking landscape is not just reshaping financial services in Malaysia but is also revolutionizing how monetary transactions are carried out.

As digital banks gain traction, ensuring stringent anti-money laundering (AML) measures has become imperative. Digital banks, just like their traditional counterparts, are targets for money laundering activities due to the large volume of transactions they process. Ensuring their operations are free from illicit financial activities is paramount for maintaining integrity and trust in the banking ecosystem.

In this context, the Financial Action Task Force's (FATF) 40 Recommendations, globally endorsed standards to combat money laundering and terrorist financing, provide crucial guidance. These recommendations underscore the importance of robust AML frameworks that can detect and report suspicious activities and prevent such transactions from occurring.

Adherence to these standards has become even more pertinent with the rise of digital banks, as the digital nature of their operations presents both unique challenges and opportunities in ensuring robust AML compliance. In the following sections, we will delve deeper into the role of digital banks in Malaysia's financial ecosystem and the unique hurdles and prospects they face in preventing money laundering.

Malaysia's Digital Banking Boom: A Paradigm Shift in the Financial Ecosystem

Digital Banking: An Unprecedented Growth

The financial ecosystem in Malaysia is witnessing a seismic shift, primarily fueled by the rise of digital banks. The convergence of technology and banking services has democratized access to financial products, thereby transforming the traditional banking landscape. From a relatively nascent phase a few years ago, digital banking in Malaysia has skyrocketed, commanding a significant share of the country's banking transactions.

This growth trajectory can be attributed to several factors, including advancements in fintech, an increasing internet-savvy population, and changing customer preferences for convenient and contactless banking options. The government's progressive policies and regulatory support have also significantly fostered this digital banking environment.

The Digital Edge: Why Digital Banks are Gaining Popularity

Digital banks have carved a niche for themselves by offering distinct advantages over traditional banking systems. The primary benefit lies in their seamless, round-the-clock banking services, significantly enhancing customer convenience. Customers can carry out transactions, apply for financial products, or access financial advice, all at the tap of a screen.

Moreover, digital banks often provide superior user experiences with personalized services, streamlined processes, and minimal bureaucracy. They leverage advanced analytics to understand customer behaviour, offering tailored financial solutions that match individual needs and circumstances. This customer-centric approach, coupled with the potential for lower fees due to reduced operational costs, has made digital banks increasingly popular among the Malaysian populace.

However, as these digital banks grow in number and scale, the challenge of maintaining robust AML measures looms large. The following sections delve into how digital banks are navigating these waters to ensure compliance with global AML standards.

Upholding Global Standards: FATF's 40 Recommendations and Digital Banks in Malaysia

A Brief Primer on FATF's 40 Recommendations

The Financial Action Task Force (FATF), an intergovernmental body, sets the gold-standard for combating money laundering, terrorist financing, and other related threats to the integrity of the global financial system. Central to FATF's framework are its 40 Recommendations, which provide a comprehensive and consistent approach to tackling these financial crimes.

These Recommendations, revised and updated periodically to stay relevant to the evolving financial landscape, cover various aspects. They encompass preventive measures for financial institutions, such as customer due diligence, record-keeping, and reporting of suspicious transactions. They also include measures to enhance transparency and accountability of financial transactions and frameworks for countries to cooperate on these matters at an international level.

FATF's 40 Recommendations: The Digital Banks' Compliance Journey

Digital banks in Malaysia, like their traditional counterparts, are bound by the FATF's 40 Recommendations. Ensuring compliance with these guidelines is both a regulatory mandate and a trust-building measure for these emerging entities.

Digital banks are leveraging technology and data to meet these compliance requirements. For instance, robust KYC (Know Your Customer) processes enabled by digital technologies facilitate efficient customer due diligence, a key aspect of the FATF guidelines. Advanced AI-powered analytics allow these banks to monitor transactions in real-time and flag suspicious activities, enabling them to report any anomalies promptly.

However, the road to full compliance is filled with challenges, particularly due to these banks' digital and borderless nature. The evolving tactics of financial criminals further complicate these hurdles. But with every challenge comes an opportunity, and digital banks are exploring new ways to leverage technology in their fight against money laundering. The subsequent sections will delve into these unique challenges and opportunities.

Navigating the Maze: Unique Challenges in Tackling Money Laundering in Digital Banks

Unmasking the Challenges in the Digital Space

While digital banks are reshaping the financial landscape with their innovative offerings, they also face unique challenges in their fight against money laundering. Unlike traditional banking, where interactions often occur face-to-face, digital banks operate in an entirely virtual environment. While convenient, this absence of physical contact provides a fertile ground for financial criminals to operate under the guise of anonymity.

Some of the primary challenges that digital banks face include:

- Identity Verification: In the absence of in-person verification, digital banks must rely on digital identity proofing methods, which may be susceptible to fraud if not robustly designed and implemented.

- Cross-border Transactions: Digital banks often facilitate cross-border transactions, complicating the detection of suspicious activities due to differing regulatory environments and potential jurisdictional issues.

- Sophisticated Money Laundering Techniques: Financial criminals are becoming more sophisticated, employing tactics like layering and smurfing that exploit the digital and borderless nature of online banking.

The Digital Quandary: Complexities of AML in the Digital Age

The digital nature of transactions adds an extra layer of complexity to AML efforts. The high volume and rapid pace of digital transactions make manual monitoring virtually impossible. Furthermore, while digital transactions leave a data trail, the sheer amount of data can be overwhelming, and vital signals of suspicious activity could get lost in the noise.

Moreover, while being part of the solution, digital technologies can also be part of the problem. Innovations like cryptocurrencies, while promising, can also be misused for money laundering due to their pseudo-anonymous nature and lack of centralised regulation.

While these challenges are daunting, they are not insurmountable. Emerging technologies offer promising solutions to address these challenges, and digital banks are at the forefront of integrating these into their operations.

Digital banks are embracing cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning (ML) to augment their AML efforts. These technologies offer significant advantages in processing vast amounts of data, identifying patterns, and detecting anomalies that might signal money laundering.

This proactive and technologically-advanced approach adopted by digital banks is setting a new standard in the fight against money laundering. However, the fight is far from over, and digital banks must continue to evolve their strategies to stay ahead of the curve. The next section explores the future of AML efforts in digital banking.

Leveraging AML Solutions: The Need for Technological Aid in the Fight Against Money Laundering

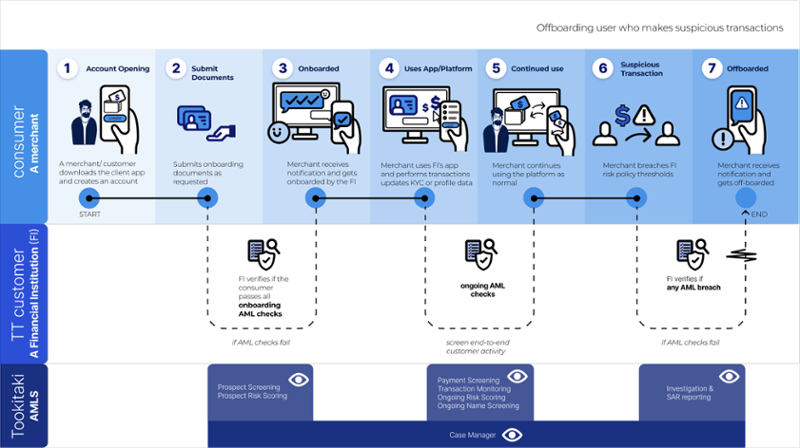

In an increasingly digital banking environment, technology is a key ally in combating money laundering. Comprehensive AML solutions like Tookitaki's AML Suite are proving instrumental in aiding digital banks to ensure compliance, detect suspicious transactions, and prevent financial crimes.

Tookitaki's AML Suite brings to the table advanced capabilities powered by machine learning that are fine-tuned to the needs of digital banks. The suite improves upon traditional rule-based systems, providing dynamic and automated solutions that evolve with changing patterns of financial crimes.

The Power of Tookitaki's AML Suite: Key Features and Benefits

Tookitaki's AML Suite boasts of an array of features designed to meet the specific challenges posed by digital banking:

1. Staying Ahead of Regulations

Financial regulations are constantly evolving, and it can be challenging for digital banks to keep up with the latest requirements. Tookitaki's AMLS is designed to stay ahead of these regulations, with regular updates and enhancements that help digital banks navigate the complex regulatory landscape and maintain compliance. Additionally, Tookitaki's collaboration with the AFC community brings extensive expertise to the table, ensuring that digital banks are always up-to-date on the latest best practices and trends in the field.

2. Maximizing Efficiency

Digital banks operate in a fast-paced environment and need to be agile to stay competitive. Tookitaki's AMLS helps digital banks maximize efficiency by providing a comprehensive suite of compliance solutions under one platform. This includes transaction monitoring, smart screening, and customer risk scoring, allowing digital banks to identify and mitigate financial crime risks efficiently. With the ability to automate processes such as case creation, allocation, and data gathering, digital banks can avoid wasting valuable resources on false alerts and focus on genuine risks.

3. Unlocking Hidden Risks

Tookitaki's AMLS provides access to a community-based platform where FinTechs can share information and best practices. This can help FinTechs uncover hidden risks and stay ahead of the competition. Additionally, the platform provides access to a wealth of data and insights, which can be used to inform strategic decision-making and improve overall performance.

4. Enhanced Customer/Prospect Risk Scoring

Tookitaki's AMLS uses advanced machine learning algorithms to create a dynamic, 360-degree risk profile of customers and prospects. This allows digital banks to make data-driven decisions and detect hidden risks that would go unnoticed.

5. Streamlined Investigation Processes

Tookitaki's AMLS provides a platform for compliance teams to collaborate on cases and work seamlessly across teams. Automating processes such as case creation, allocation, and data gathering empowers investigators and streamlines the investigation process.

Digital banks employing Tookitaki's AML Suite can enjoy enhanced security, improved compliance, reduced risk, and greater efficiency in their AML efforts.

A Digital Banking Future: The Imperative of Robust AML Practices

In conclusion, the rise of digital banks in Malaysia brings with it new opportunities and challenges in the fight against money laundering. It emphasizes the need for robust AML practices, adherence to international standards such as FATF's 40 recommendations, and most importantly, the leveraging of advanced technology to ensure efficient and effective AML compliance.

Tookitaki's AML Suite is positioned as a powerful ally for digital banks in their AML efforts, offering a suite of features that enable real-time, data-driven decision-making, adaptive learning, and comprehensive regulatory compliance. We encourage all digital banks, regulatory bodies, and financial institutions to explore Tookitaki's AML Suite, to understand its capabilities and envision how it can elevate their AML compliance and fight against financial crime.

Anti-Financial Crime Compliance with Tookitaki?