How Financial Crime Typologies Can Help Combat Money Laundering

Money laundering is a serious financial crime that poses a significant threat to the integrity of the global financial system. It is estimated that billions of dollars are laundered every year through a variety of methods, including the use of shell companies, money mules, and digital currency. Financial institutions have a vital role to play in combating money laundering, and one of the most effective tools they have at their disposal is the use of financial crime typologies. In this blog, we will explore what financial crime typologies are and how they can help in the fight against money laundering.

What Are Financial Crime Typologies?

Typologies are specific methods or schemes that are used for money laundering and other financial crimes. They are identified and catalogued by financial institutions and regulatory authorities to help combat financial crime. By understanding and sharing information about these typologies, financial institutions can stay ahead of emerging threats and adapt their compliance operations accordingly.

The Typology Repository, a database of known typologies maintained by Tookitaki's Anti-Financial Crime Ecosystem, is a prime example of how financial institutions can collaborate and share information to combat money laundering.

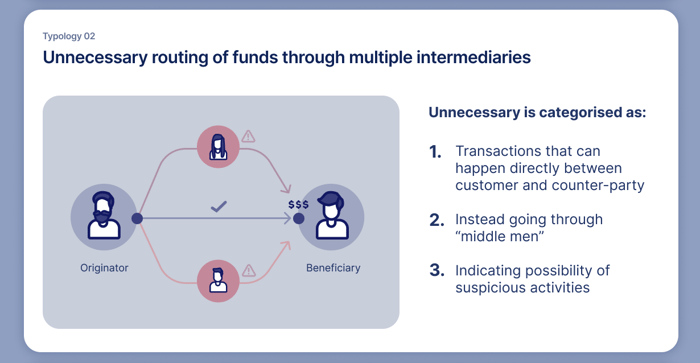

A typology from the repository is pictured below:

How Can Financial Crime Typologies Help in Compliance Operations?

Financial institutions can use financial crime typologies to improve their compliance operations in several ways. By understanding the typologies used by criminals, institutions can identify suspicious activity more effectively and develop more robust risk assessment and due diligence procedures. This can help institutions to detect and prevent money laundering before it occurs.

Additionally, sharing information about typologies with other institutions and regulatory authorities can help to identify patterns and trends in financial crime, allowing for more effective responses and the development of best practices. By working together, financial institutions can stay ahead of emerging threats and make it more difficult for criminals to evade detection.

How to Implement Financial Crime Typologies in Compliance Operations

Implementing financial crime typologies in a compliance program is a critical step towards improving AML effectiveness. One example of a platform that offers a comprehensive typology repository is the AFC Ecosystem by Tookitaki. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes.

The AFC ecosystem also includes a 'no code' user interface, which allows financial institutions to easily create and share typologies. This means that even non-technical staff can contribute to the repository, making it a more collaborative and effective tool for the community. By sharing typologies in the repository, financial institutions can learn about new and emerging threats, and adapt their AML programs accordingly.

How Does Tookitaki Make Use of Typologies

Tookitaki’s proprietary AML compliance solution, FinCense, is designed to make the best of use typologies through its Transaction Monitoring module. The Transaction Monitoring module is designed to detect suspicious patterns of financial transactions that may indicate money laundering or other financial crimes.

The module easily ingests typologies and utilizes powerful simulation modes for automated threshold tuning, allowing for quick adaptation to new money laundering techniques. Additionally, the module includes a built-in sandbox environment, which allows financial institutions to test and deploy new typologies in a matter of minutes.

Best practices for implementing financial crime typologies:

-

Understand your institution's risk profile: Before implementing any typologies, it's essential to understand the risk profile of your institution. This includes identifying the types of products and services offered, the customer base, geographic location, and regulatory requirements.

-

Tailor typologies to your institution's needs: Once you have identified the institution's risk profile, it's crucial to tailor the typologies to meet the institution's specific needs. This involves selecting typologies that are relevant to the institution's risk profile and customizing them based on the institution's data and transaction patterns.

By using Tookitaki's Typology Repository and Transaction Monitoring module, AML teams can quickly adapt to new money laundering techniques and stay ahead of the criminals. Financial institutions may tailor typologies to meet their specific needs and risk profile.

The Future of Financial Crime Typologies

As financial crime evolves, so too must our approach to combating it. One emerging trend in financial crime is the use of advanced technologies such as artificial intelligence and machine learning. These technologies can enable criminals to create more sophisticated money laundering schemes that are harder to detect using traditional methods. One way for financial institutions across the globe to proactively address this problem and stay ahead of emerging threats is to collaborate and share information and best practices.

Looking to the future, we can expect financial crime typologies to become even more important in the fight against money laundering. The Typology Repository can act as a powerful tool that can help financial institutions stay ahead of emerging threats. As more financial institutions contribute to the typology repository and share their knowledge and experiences, the repository will become an even more comprehensive resource for detecting and preventing financial crime.

Stay Ahead of Financial Crime with Community-sourced Typologies and Tookitaki's FinCense

Financial crime typologies are an essential tool for combating money laundering and other financial crimes. We encourage financial institutions to explore Tookitaki's FinCense, which is powered by a vast library of community-sourced typologies. With the help of this tool, financial institutions can better detect and prevent financial crime, making it more difficult for criminals to evade detection and continue their illicit activities.

Anti-Financial Crime Compliance with Tookitaki?