Money laundering refers to converting illegal or "dirty" money earned through criminal activities, such as drug trafficking, human trafficking, and corruption, into "clean" money that can be used without suspicion of its illegal origins. Money laundering can have serious consequences, including the facilitation of further criminal activities, the destabilization of financial systems, and the distortion of economic development.

In Egypt, the issue of money laundering is of significant concern. As a country with a strategic geographical location, a growing economy, and a large informal sector, Egypt is vulnerable to various forms of financial crime, including money laundering. The government and financial institutions must take necessary measures to address this issue and safeguard the financial system's integrity.

The Landscape of Money Laundering in Egypt

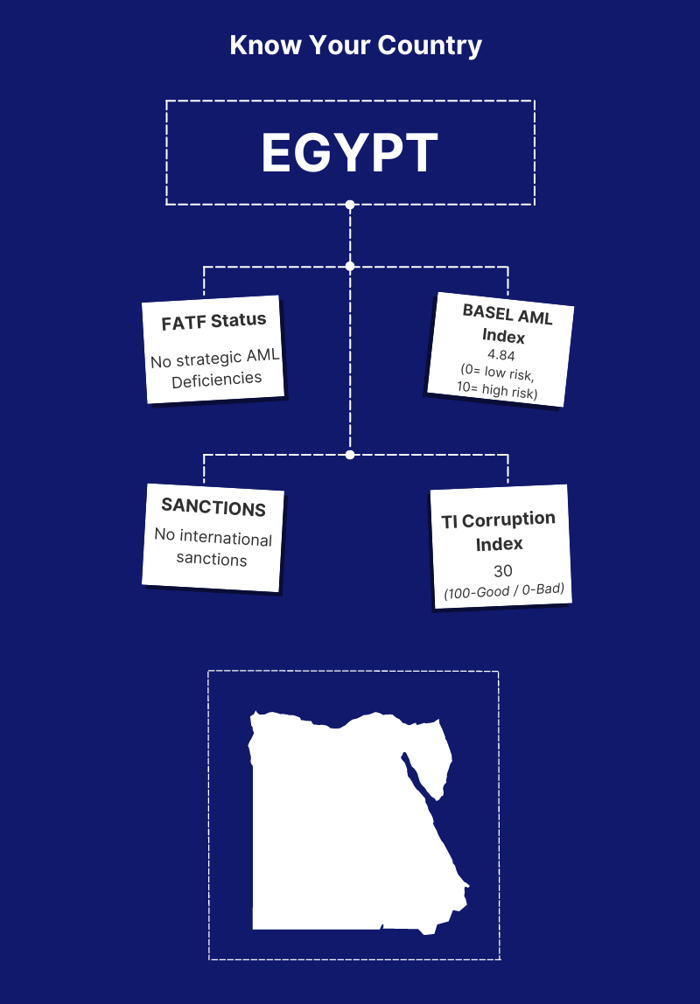

The issue of money laundering in Egypt has been a growing concern. According to the Financial Action Task Force (FATF), Egypt faces challenges, including illicit funds generated through corruption, drug trafficking, and organized crime, fuelling money laundering activities in the country.

Due to its significant informal, cash-based economy, Egypt remains vulnerable to financial risks. It's estimated that up to two-thirds of the population does not have bank accounts, while the informal economy accounts for about 40 per cent of the GDP, leading to the widespread use of cash.

The central bank and the Federation of Egyptian Banks have introduced measures to incentivize individuals and small businesses to join the formal financial sector to promote financial inclusion. To this end, the National Council for Payments (NCP) was established in February 2017 to limit cash usage, encourage the adoption of electronic payment methods, and integrate citizens and businesses into the banking system. The FIU has also issued regulations for mobile payments, resulting in a significant increase in mobile payment accounts, with 9 million accounts currently in use in Egypt.

The Legal Framework for Combating Money Laundering in Egypt

The Central Bank of Egypt plays a vital role in combating money laundering in Egypt, ensuring that financial institutions comply with AML regulations. Several laws and regulations are in place in Egypt to combat money laundering, including:

- Law No. 80 of 2002 on Combating Money Laundering (as amended)

- Executive Regulations of Law No. 80 of 2002 on Combating Money Laundering and Terrorism Financing

- Anti-Money Laundering Unit's (AMLU) guidelines on a risk-based approach and customer due diligence (CDD)

- Decree No. 8 of 2019 on the rules and procedures for combating money laundering and terrorist financing for non-profit organizations

To ensure compliance with AML regulations, financial institutions in Egypt must implement measures such as customer due diligence, screening, risk-based approach, and transaction monitoring. Financial institutions must establish risk-based policies, procedures, and controls to prevent money laundering and terrorist financing. This includes:

- Customer Due Diligence (CDD): Financial institutions must identify and verify the identity of their customers and beneficial owners of companies opening accounts. They must also understand customer relationships' nature and purpose to develop risk profiles.

- Screening: Financial institutions must screen customers against various watch lists to ensure they are not dealing with individuals or entities involved in money laundering or terrorist financing.

- Risk-based approach: Financial institutions must adopt a risk-based approach to identify, assess, and manage money laundering and terrorist financing risks.

- Transaction Monitoring: Financial institutions must monitor customer transactions to detect and report suspicious activity.

Non-compliance with AML regulations in Egypt can result in severe penalties, including imprisonment and fines. Financial institutions must comply with all relevant regulations to avoid legal consequences and reputational damage.

How Financial Institutions Can Combat Money Laundering in Egypt

Combatting money laundering requires concerted efforts from all stakeholders, including financial institutions. Financial institutions can be crucial in preventing and detecting money laundering in Egypt by implementing effective anti-money laundering (AML) programs. Here are some ways financial institutions can combat money laundering in Egypt:

- Implementing Effective AML Programs: Financial institutions should develop and implement effective AML programs to prevent and detect money laundering activities. A robust AML program includes policies and procedures for customer due diligence, transaction monitoring, and suspicious activity reporting. Financial institutions should ensure that their AML programs are tailored to meet the specific risks associated with doing business in Egypt.

- Best Practices for Preventing and Detecting Money Laundering: Financial institutions should adopt best practices for preventing and detecting money laundering. These include ongoing monitoring of customer activity, staff training and awareness, conducting risk assessments, and enhanced due diligence for high-risk customers and transactions.

- The Role of Technology in AML Programs: Financial institutions can leverage technology to improve their AML programs. Advanced analytics, artificial intelligence (AI), and machine learning can help financial institutions identify suspicious activity more quickly and accurately. These technologies can also automate compliance processes, making them more efficient and cost-effective.

- Collaboration with Law Enforcement: Financial institutions should collaborate with law enforcement agencies to combat money laundering in Egypt. This includes sharing information and intelligence on suspicious activity and cooperating with law enforcement investigations.

By adopting these practices, financial institutions can play a critical role in combatting money laundering in Egypt and promoting a more transparent and sustainable financial system.

How Tookitaki Can Help Financial Institutions in Egypt

Tookitaki is a leading provider of AML solutions that help financial institutions worldwide to enhance their compliance with AML regulations. The company's Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem work together to address the shortcomings of siloed systems in the fight against money laundering.

Tooktiaki’s approach starts with our AFC ecosystem, which is a community-based platform to share information and best practices in the fight against financial crime. The AFC ecosystem is powered through our Typology Repository, a live database of money laundering techniques and schemes called typologies. These typologies are contributed by financial institutions, regulatory bodies, risk consultants, etc., worldwide by sharing their own experiences and knowledge of money laundering. The repository includes many typologies, from traditional methods such as shell companies and money mules to recent developments such as digital currency and social media-based schemes.

The AMLS, on the other hand, is a software suite deployed at financial institutions which collaborates with the AFC Ecosystem through federated machine learning. The AMLS extracts the new typologies from the AFC Ecosystem and executes them at the customers' end, ensuring their AML programs stay ahead of the curve. The AMLS covers a range of AML functions, such as customer due diligence, customer risk scoring, transaction monitoring, and suspicious activity reporting.

The AML solutions offered by Tookitaki can help financial institutions in Egypt to automate their AML processes, reduce the risk of false positives, and increase the efficiency of their AML programs. By leveraging advanced analytics, Tookitaki's solutions can identify patterns and trends in customer behaviour, which can help financial institutions to detect and prevent money laundering. Additionally, Tookitaki's solutions are highly scalable and customizable, which means they can be tailored to meet the specific needs of each financial institution.

The Importance of AML Efforts in Egypt: Closing Thoughts

Combating money laundering in Egypt requires a coordinated effort from financial institutions, regulatory bodies, and technology providers. To effectively combat this problem, financial institutions must implement effective AML programs and adhere to best practices in preventing and detecting money laundering. Technology solutions, such as those offered by Tookitaki, can play a critical role in assisting financial institutions in their AML efforts by providing advanced analytics, machine learning algorithms, and improved detection of suspicious activities.

We encourage financial institutions in Egypt to try Tookitaki's AML solutions and experience the benefits of automated detection, reduced false positives, and increased efficiency in their AML programs.

Anti-Financial Crime Compliance with Tookitaki?