AML Transaction Monitoring in Singapore: Challenges and Best Practices

Money laundering, a global menace, distorts economic statistics, facilitates corruption, and disrupts the financial system's smooth functioning. Anti-Money Laundering (AML), as a term, refers to a set of policies, laws, and regulations established to prevent the practice of generating income through illicit actions. It has become a critical facet of a comprehensive compliance program within financial institutions around the globe.

Central to AML initiatives is transaction monitoring, an essential compliance function that tracks customer transactions in real-time or retrospectively to identify unusual patterns or behaviors. It aims to detect and halt any suspicious transactions that could indicate money laundering activities. Transaction monitoring can include a host of procedures such as tracking customer transactions, assessing their risk profiles, and performing due diligence.

In the context of Singapore, a major financial hub, AML transaction monitoring takes on added significance. The country's bustling financial sector, featuring a complex web of domestic and international transactions, is an attractive playground for potential money launderers. Consequently, the Monetary Authority of Singapore (MAS) strongly emphasises stringent AML controls, including effective transaction monitoring practices.

The aim is twofold: to preserve Singapore's reputation as a clean and trusted financial hub, and to safeguard its financial institutions from the potentially devastating effects of being unwittingly used as conduits for money laundering. As we delve deeper into the intricacies of AML transaction monitoring, we will uncover its challenges and explore the best practices shaping its future in Singapore.

The AML Landscape in Singapore

AML Regulations and Standards in Singapore

The legal framework surrounding Anti-Money Laundering (AML) in Singapore is robust and comprehensive. At its core lie the provisions of the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA), and the Terrorism (Suppression of Financing) Act (TSOFA). These acts have given the regulatory authorities substantial powers to prevent and prosecute money laundering and related offences.

The guidelines issued by the Monetary Authority of Singapore (MAS), notably the MAS Notice 626, set forth a detailed list of mandatory AML procedures for banks. These include customer due diligence, continuous transaction monitoring, and timely reporting of suspicious transactions.

Internationally, Singapore adheres to the recommendations of the Financial Action Task Force (FATF), a global standard-setter in the fight against money laundering and terrorist financing. It's worth noting that Singapore underwent a mutual evaluation by the FATF in 2016 and has since made significant progress in strengthening its AML/CFT regime.

Role of the Monetary Authority of Singapore (MAS) in Regulating AML Practices

The Monetary Authority of Singapore (MAS), as the country's central bank and financial regulatory authority, plays a pivotal role in the AML landscape. One of its core functions is to oversee and enforce AML and Counter Financing of Terrorism (CFT) regulations.

MAS sets the AML standards, issues guidelines, and supervises financial institutions' compliance under its purview. It employs a risk-based approach, focusing its resources on areas where the risks of money laundering and terrorist financing are the highest.

In addition, MAS also conducts regular inspections of financial institutions to assess their compliance with AML regulations, providing feedback and requiring them to remediate any identified shortcomings. On a broader level, MAS collaborates with law enforcement agencies, regulatory authorities, and other stakeholders both locally and internationally to contribute to the global fight against money laundering.

The MAS's role extends beyond regulation and enforcement. As a proactive authority, MAS frequently engages with the financial industry to raise AML/CFT awareness and foster a strong compliance culture. It organises regular AML/CFT seminars and provides platforms for dialogue and discussion, contributing to Singapore's well-informed and vigilant financial sector.

Challenges in AML Transaction Monitoring

Complexity of Financial Crimes and Money Laundering Techniques

Financial crimes, including money laundering, are growing increasingly intricate and sophisticated. Criminals exploit emerging technologies, diverse financial instruments, and cross-border transactions to evade detection. The vast array of financial products and services offered by modern financial institutions presents numerous opportunities for illicit activities. Furthermore, the increasing use of digital transactions and cryptocurrencies only adds to the complexity, making it challenging for traditional AML transaction monitoring systems to detect suspicious activities effectively.

Traditional Methods of Transaction Monitoring and Their Limitations

Traditional transaction monitoring systems, which often rely heavily on predefined rules, face significant challenges in detecting evolving money laundering patterns. They struggle with high false-positive rates, leading to unnecessary workloads for compliance teams. They may also miss unusual transactional behaviour that falls outside of the pre-set rules, allowing potentially suspicious activities to go unnoticed.

Moreover, these systems often operate in silos and fail to consider the broader context of customer behaviour. Without the ability to synthesize and analyze information from various sources, they lack the ability to generate a holistic view of customer activity and risk.

Keeping up with Changing Regulations and Standards

Regulatory environments are dynamic, reflecting the evolving nature of financial crimes and societal expectations. In Singapore, where the AML regulations are robust and comprehensive, financial institutions are expected to keep abreast of regulatory changes and ensure that their practices are in line with the latest MAS guidelines. The cost and complexity of adapting transaction monitoring systems to comply with changing regulations represent a significant challenge for many institutions.

The Impact of These Challenges on Financial Institutions and Their Customers

The challenges of AML transaction monitoring have wide-reaching implications for financial institutions and their customers. High rates of false positives not only drain resources but can also lead to delayed transactions and a negative customer experience. Furthermore, failure to detect and report suspicious activities effectively can result in severe regulatory penalties for financial institutions, including hefty fines and reputational damage. These challenges underscore the need for more effective and efficient approaches to AML transaction monitoring.

The Role of Regtech in Addressing AML Challenges

Introduction to Regulatory Technology (Regtech)

Regulatory Technology, commonly known as Regtech, is an emerging field that combines information technology and regulatory processes to enhance regulatory efficiency and compliance. Regtech can revolutionize AML transaction monitoring by introducing automation, data analysis, and real-time monitoring capabilities, thereby addressing many of the challenges faced by traditional methods.

The Role of AI and Machine Learning in Enhancing Transaction Monitoring Processes

One of the key technological advancements underpinning Regtech is the use of Artificial Intelligence (AI) and Machine Learning (ML). These technologies can drastically improve the efficiency and accuracy of transaction monitoring systems. By learning from historical data and identifying complex patterns, AI-powered systems can reduce false positives, uncover hidden risks, and detect evolving money laundering tactics that may otherwise go unnoticed.

Furthermore, AI and ML can assist in predictive analysis, allowing financial institutions to identify potential risks and suspicious activities before they materialize. These systems stay relevant even as financial crimes and regulatory environments evolve by continually learning and adapting to new data.

By adopting Regtech solutions like Tookitaki's AML Suite, financial institutions in Singapore can overcome the challenges of AML transaction monitoring, remain compliant with MAS regulations, and safeguard the integrity of their operations.

Best Practices for AML Transaction Monitoring

Leveraging Technology and AI for Effective Transaction Monitoring

In the digital age, leveraging technology is no longer a choice, but a necessity. This holds especially true for AML transaction monitoring. AI-driven technology solutions, such as those offered by Regtech firms like Tookitaki, can drastically improve efficiency and accuracy, allowing for real-time detection of suspicious activity and reducing false positives. An AI-enhanced system can identify patterns and relationships that human analysts might miss, and can adapt to evolving patterns of financial crime.

Continuous Training and Education in AML Practices

Even the best technology cannot replace a well-trained human workforce. Regular education and training on AML practices, emerging trends in money laundering, and regulatory changes are critical to ensure that all staff members are equipped to play their part in AML compliance. The training should be updated regularly to reflect the evolving landscape of financial crime and the latest advancements in AML technology.

Regular Reviews and Audits to Ensure Compliance with Regulations

Compliance with AML regulations is not a one-time exercise, but an ongoing process. Regular internal and external audits should be conducted to assess the effectiveness of AML procedures, identify gaps, and make necessary improvements. Regular reviews also ensure that the institution stays current with changing regulations and complies with the stringent standards set by regulatory bodies such as the Monetary Authority of Singapore (MAS).

Incorporating a Risk-Based Approach to Transaction Monitoring

Rather than adopting a one-size-fits-all approach, institutions should implement a risk-based approach to AML transaction monitoring. This means prioritizing resources and efforts based on the level of risk associated with each transaction, customer, or geographical area. AI and ML technologies can assist in this process by analyzing vast amounts of data and identifying high-risk areas that require closer scrutiny.

Adhering to these best practices will ensure compliance with AML regulations and contribute to the overall integrity and reputation of financial institutions in Singapore. By harnessing the power of technology and maintaining a well-trained workforce, institutions can stay ahead of money launderers and play their part in maintaining the security of Singapore's financial system.

Tookitaki's Approach to AML Transaction Monitoring

An Overview of Tookitaki's Regtech Solutions

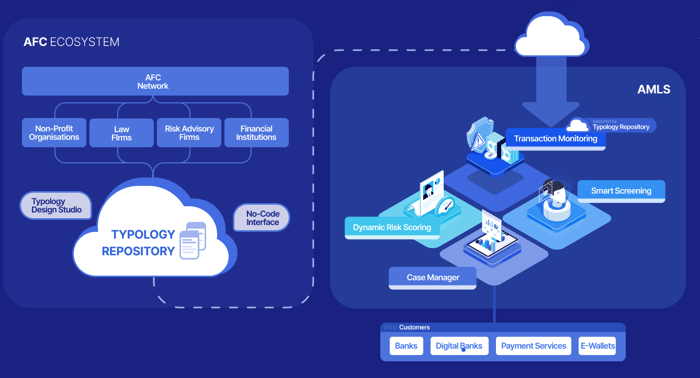

Tookitaki is at the forefront of harnessing AI and machine learning in the realm of Regtech, providing innovative solutions designed to revolutionize AML detection, prevention and management. With a deep understanding of the challenges financial institutions face in the complex and constantly evolving world of AML compliance, Tookitaki has developed a comprehensive suite of solutions designed to make AML efforts more efficient, effective, and compliant with regulations. It provides solutions, including Transaction Monitoring, Smart Screening and Dynamic Risk Scoring, to address the AML requirements of banks and fintech companies in an all-encompassing manner.

Unique Features and Benefits of Tookitaki’s Transaction Monitoring

Tookitaki’s Transaction Monitoring solution sets itself apart with an array of unique features designed to meet the diverse needs of financial institutions. The suite offers 100% risk coverage and access to the latest typologies, courtesy of its global AML SME network. With the built-in sandbox environment, it allows institutions to test and deploy new typologies in days, rather than months.

In addition, Tookitaki's AML Suite provides automated threshold tuning, thereby reducing the manual effort involved in threshold tuning by over 70%. It leverages superior detection techniques representing real-world red flags, providing a second line of defence against new risks and threats.

Tookitaki also provides a secondary scoring feature that prioritizes alerts generated by the primary Transaction Monitoring system into high, medium, and low-quality levels. This enhances alert management, enabling investigators to focus on high-risk alerts and ensuring a swift and efficient response to potential threats.

The Role of AI and Machine Learning in Tookitaki’s AML Suite

AI and machine learning are at the heart of Tookitaki's approach to AML transaction monitoring. The AI-driven detection engine uses a combination of rules and machine learning to identify suspicious transactions, providing a highly accurate risk score that improves alert yield.

Furthermore, the suite's self-learning capabilities allow it to capture changes in data sets over time, adapt to new typologies, and respond to rule or threshold changes without the need to rebuild, retrain, or recreate models. This makes the AML Suite a dynamic, responsive, and intelligent tool for AML compliance.

Through its innovative use of technology, Tookitaki is transforming the landscape of AML transaction monitoring in Singapore, enabling financial institutions to navigate compliance challenges with confidence and efficiency.

The Future of AML Transaction Monitoring in Singapore

As we continue to grapple with the increasingly sophisticated techniques used in financial crimes, the role of advanced Regtech solutions in Singapore will become increasingly crucial. The implementation of solutions like Tookitaki's AML Suite promises to bring about a significant positive impact on the AML landscape.

These technology-driven solutions can enhance the efficiency of transaction monitoring, reduce manual efforts, improve risk detection accuracy, and ensure regulatory compliance. As more and more financial institutions embrace these advanced solutions, we can expect a significant decrease in financial crimes and money laundering activities.

The future of AML transaction monitoring in Singapore looks promising, as it continues evolving with technological advancements and regulatory norms. The trend is leaning towards a more proactive and preemptive approach powered by AI and machine learning. These intelligent systems will improve at predicting and preventing financial crimes, thereby ensuring a more secure financial environment in Singapore.

We can also expect to see further regulatory emphasis on the use of Regtech solutions in AML compliance, as regulators acknowledge the advantages of technology in managing complex AML challenges.

Embracing advanced technology is key to staying a step ahead in the fight against financial crimes. We encourage you to explore Tookitaki's innovative AML Suite further. Get in touch with us for more information, or to book a demo, and see firsthand how our solutions can revolutionize your AML transaction monitoring practices.

Anti-Financial Crime Compliance with Tookitaki?