AML Reporting in the Philippines: Trends and Future Prospects

In an increasingly globalized world, financial systems are under constant scrutiny to prevent illicit activities such as money laundering and terrorist financing. A key component in the battle against these illegal activities is Anti-Money Laundering (AML) reporting, a crucial process that helps regulators identify suspicious financial transactions and take appropriate action. This blog will delve into the importance of AML reporting, its current state in the Philippines, and the future prospects shaping this critical area of financial regulation.

AML reporting is more than just a regulatory requirement; it serves as a first line of defence in protecting the integrity of financial systems. By identifying and flagging potentially suspicious activities, AML reporting assists in detecting, preventing, and prosecuting financial crimes. It safeguards the financial sector from being exploited for illicit purposes and plays a significant role in maintaining public trust in the financial system.

In the Philippines, AML reporting is governed by the Anti-Money Laundering Act (AMLA) and is overseen by the Bangko Sentral ng Pilipinas (BSP). The existing AML reporting framework requires banks and other financial institutions to monitor transactions, maintain appropriate records, and promptly report any suspicious activities. Despite the comprehensive regulations in place, the AML reporting landscape in the Philippines faces numerous challenges, including the need for more efficient reporting processes and the integration of new technologies for more effective detection of illicit activities.

This blog aims to examine the trends and future prospects for AML reporting in the Philippines. It seeks to highlight the recent regulatory changes, their potential impact on financial institutions, and how these institutions can effectively navigate the evolving landscape of AML reporting. Through this exploration, we hope to contribute to the ongoing dialogue about the future of AML reporting in the Philippines and its crucial role in safeguarding the integrity of the country's financial system.

AML Reporting in the Philippines: The Current Scenario

As we delve into the state of AML reporting in the Philippines, it's essential to understand the existing framework, the role of the regulatory body, and the challenges that this sector currently faces.

The Existing AML Reporting Framework

The Anti-Money Laundering Act (AMLA) forms the backbone of the Philippines' AML reporting framework. Under this Act, banks and other financial institutions are required to:

- Conduct customer due diligence: Financial institutions must identify and verify the identity of their customers, understand the nature of their business, and assess the risk they pose.

- Maintain records: Detailed records of all transactions must be kept for five years. These records should be sufficient to facilitate the reconstruction of individual transactions, provide evidence for the prosecution of criminal activity, and assist with the bank's internal audit and high-risk account management.

- Report suspicious transactions: All transactions deemed suspicious, regardless of the amount involved, must be reported to the Anti-Money Laundering Council (AMLC).

- Report covered transactions: Transactions exceeding PHP 500,000 (or its equivalent in foreign currency) within one banking day must also be reported to the AMLC.

The Role of the Bangko Sentral ng Pilipinas (BSP)

The Bangko Sentral ng Pilipinas (BSP) plays a pivotal role in AML reporting in the Philippines. It supervises banks and other financial institutions to ensure compliance with the AMLA. It also issues circulars that provide guidelines on AML policies and procedures. This includes the identification and management of risks, the establishment of an internal AML control system, and the regular training of personnel. The BSP is empowered to impose sanctions for non-compliance and can conduct regular examinations to assess an institution's AML controls.

Challenges in AML Reporting

Despite the robust regulatory framework, AML reporting in the Philippines faces several challenges:

- Technology integration: Many financial institutions are still in the process of fully integrating technology into their AML reporting processes. This can lead to inefficiencies and increase the chances of human error.

- Data quality: Accurate AML reporting relies on the quality of data collected. Outdated or incorrect customer information can hinder effective monitoring and reporting.

- Regulatory compliance: Keeping up with changing regulations can be a significant challenge for many institutions. Non-compliance can result in hefty penalties and reputational damage.

- Training and capacity building: Ensuring that employees understand AML regulations and are trained to detect and report suspicious activities is a continuous challenge.

Understanding these challenges is the first step towards improving AML reporting in the Philippines. In the following sections, we will discuss recent regulatory changes and the future of AML reporting in the country.

Recent Developments in AML Reporting in the Philippines

The landscape of Anti-Money Laundering reporting in the Philippines is undergoing significant change. In a move to strengthen the country's AML regime, the Bangko Sentral ng Pilipinas (BSP) has released a draft circular outlining proposed amendments to the existing ML, TF, and PF risk reporting for banks and non-bank financial institutions. These proposed changes aim to increase the transparency and accountability of financial institutions in identifying and reporting financial crime risks.

Understanding the Proposed Amendments

The proposed changes put forward by the BSP are far-reaching and could potentially reshape how financial institutions handle ML, TF, and PF risk reporting. Here's a detailed exploration of these changes:

- 24-Hour Notification Requirement: The amendments require supervised financial institutions (BSFIs) to notify the central bank within 24 hours from the “date of knowledge of any significant ML/TF/PF risk event.” This means that BSFIs, which include banks and fintech companies such as digital banks, payment services and e-wallets, must be prepared to identify and report any significant risks related to ML/TF/PF swiftly.

- Annual Reporting Package: Another major proposed change is the requirement for covered entities to submit an annual anti-money laundering/countering terrorism and proliferation financing reporting package (ARP). The ARP must be submitted to the BSP within 30 banking days after the end of the reference year. This package is designed to provide the BSP with a comprehensive overview of an institution's AML/CFT/CPF measures, risk assessments and controls, customer due diligence procedures, transaction monitoring systems, and suspicious activity reports (SARs) filed during the year.

Implications for Financial Institutions

These changes are likely to have several implications for financial institutions:

- Increased Operational Requirements: The new reporting requirements will necessitate a quicker turnaround for identifying and reporting risk events. Financial institutions may need to invest in advanced transaction monitoring systems to identify risks in real-time and report them within the stipulated 24-hour window.

- Enhanced Compliance Obligations: The requirement to submit an annual ARP will place additional compliance obligations on financial institutions. They will need to develop a systematic way of compiling the ARP that includes all the necessary details about their AML/CFT/CPF measures.

- Stricter Supervision: With the BSP receiving more frequent and detailed reports, financial institutions can expect stricter supervision and potentially more rigorous examinations of their AML/CFT/CPF controls.

In the upcoming sections, we'll explore how financial institutions can navigate these changes and maintain compliance with the evolving AML regulations.

Impact of the New AML Reporting Requirements

The proposed amendments to the AML reporting requirements in the Philippines are set to have a profound impact on the operations and compliance functions of financial institutions. As we dive deeper into the implications, we see both challenges and opportunities emerging for these institutions and the broader AML regime in the Philippines.

Operational Impact on Financial Institutions

Real-time Risk Identification: The requirement for BSFIs to report any significant ML/TF/PF risk event within 24 hours necessitates the ability to identify risks in real-time. This will likely push financial institutions to enhance their risk identification and reporting capabilities, possibly incorporating advanced technologies such as AI and machine learning.

- Increased Compliance Burden: The requirement to submit an ARP annually will increase the compliance burden on financial institutions. They will need to establish processes for compiling the necessary data and ensure that it is complete and accurate. This may involve revisiting their data management systems and possibly investing in technology solutions that can automate parts of the process.

- Enhanced Training and Culture: Given the increased reporting requirements, there will be a need for appropriate training of staff to understand and manage these new obligations. This could lead to a stronger compliance culture within organizations as they adapt to the heightened regulatory expectations.

Implications for the AML Regime in the Philippines

- Greater Transparency: With more frequent and detailed reporting, there will be greater transparency in the financial system. This could help regulators like the BSP to better understand the risk landscape and take more effective steps to mitigate ML/TF/PF risks.

- Increased Accountability: The proposed changes could also lead to increased accountability of financial institutions for their AML/CFT/CPF controls. This could potentially raise the bar for compliance across the sector and discourage non-compliance.

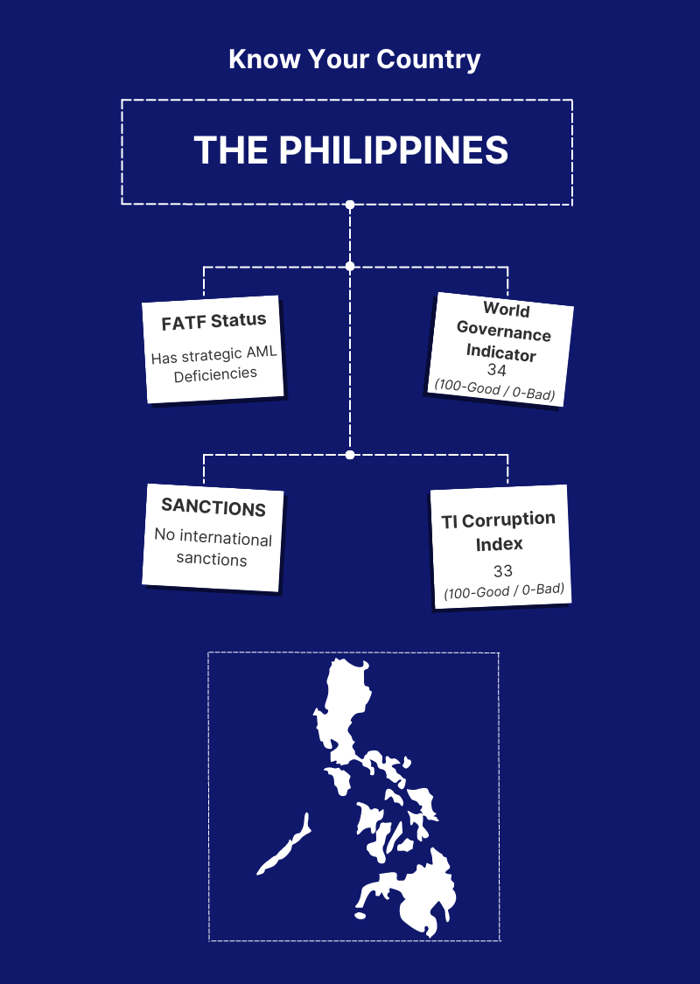

- Strengthened AML Framework: On a broader level, these amendments are an important step towards strengthening the AML regime in the Philippines. They align with international best practices and could help the country improve its standing with global bodies like the Financial Action Task Force (FATF).

As we move towards a future of enhanced AML reporting requirements, financial institutions will need to adapt and evolve. In the following section, we will discuss strategies that they can adopt to navigate these changes effectively.

Future Prospects for AML Reporting in the Philippines

As we look ahead, the landscape of AML reporting in the Philippines is poised for significant evolution. The recent proposed amendments by BSP are just the starting point for a future that could be marked by advanced technologies, increased transparency, and tighter regulations. Let's dive deeper into these predicted trends and the potential benefits and challenges they bring.

Predicted Trends in AML Reporting

- Technological Advancements: The new reporting requirements will likely drive financial institutions to adopt advanced technologies such as artificial intelligence and machine learning. These technologies can enable real-time risk identification and automation of compliance processes, helping institutions meet the stringent timelines set by the BSP.

- Collaborative Efforts: In response to the heightened regulatory expectations, we could see an increase in collaborative efforts within the financial sector. Institutions might join forces to share best practices, develop industry-wide solutions, and engage in collective advocacy.

- Risk-Based Approach: With the BSP's increased focus on understanding and mitigating ML/TF/PF risks, financial institutions will likely move towards a more risk-based approach to AML compliance. This approach involves identifying and assessing risks and tailoring controls accordingly, which can lead to more effective risk management.

Potential Benefits and Challenges

Each of these trends brings potential benefits and challenges:

- Benefits: Technological advancements can streamline compliance processes and improve risk identification, potentially saving time and resources. Collaborative efforts can lead to industry-wide improvements and stronger advocacy. The risk-based approach, meanwhile, can enhance the effectiveness of AML controls and help institutions avoid regulatory penalties.

- Challenges: While technology can automate many processes, it also requires significant investment and poses risks such as cybersecurity threats. Collaboration, though beneficial, can be challenging to coordinate and may raise issues related to data privacy. The risk-based approach, although more effective, is also more complex to implement than rule-based approaches and requires a good understanding of the institution's risk profile.

Navigating the Changing Landscape of AML Reporting

As the AML reporting landscape in the Philippines undergoes transformation, financial institutions must be proactive and strategic to effectively navigate the changes. Here are some key considerations and recommendations for adapting to the new AML reporting requirements.

Understanding the New Requirements

First and foremost, institutions must fully understand the new AML reporting requirements. This involves carefully reviewing the proposed amendments, consulting with legal and compliance experts, and participating in BSP’s consultations and training sessions. A clear understanding of the requirements is the foundation for effective compliance.

Risk Assessment and Management

Institutions should also revamp their risk assessment and management procedures. The proposed changes emphasize the importance of identifying and managing ML/TF/PF risks. Institutions should therefore ensure they have robust systems for risk assessment, including procedures for identifying high-risk customers and transactions, and for mitigating these risks.

Investing in Technology and Innovation

Technology will play a crucial role in facilitating compliance with the new AML reporting requirements. Innovative solutions can automate the compliance process, enabling institutions to quickly identify and report significant ML/TF/PF risk events. AI and machine learning, for instance, can be used to analyze vast amounts of data and detect suspicious activities that may not be easily identifiable by humans.

Investing in technology, however, is not just about buying the latest software. It also involves integrating the technology into the institution's operations and training staff to use it effectively. Institutions should therefore develop a technology implementation plan that includes staff training and ongoing support.

Collaborating and Sharing Best Practices

Finally, institutions can benefit from collaborating and sharing best practices. This could involve forming partnerships with other institutions to develop joint solutions, or participating in industry forums to share experiences and learn from others. Such collaboration can lead to more effective and efficient compliance strategies.

Looking Ahead: Embracing the Future of AML Reporting in the Philippines

As we wrap up our deep dive into the evolving landscape of AML reporting in the Philippines, let's recap some of the main points we've covered:

- The Bangko Sentral ng Pilipinas (BSP) has proposed critical amendments to the AML reporting framework to enhance the transparency and accountability of financial institutions in identifying and reporting ML/TF/PF risks.

- These changes aim to fortify the AML regime in the Philippines, having implications for the operations and compliance efforts of financial institutions.

- We've also explored the future trends of AML reporting in the country, emphasizing the potential benefits and challenges that these trends could bring.

- Lastly, we discussed how financial institutions can navigate these changes, emphasizing the importance of understanding the new requirements, effective risk management, leveraging technology, and collaborative efforts.

The future of AML reporting in the Philippines is bright, albeit not without its challenges. As the landscape continues to evolve, financial institutions that stay informed, adapt, and embrace innovation will be best positioned to meet these challenges head-on.

At Tookitaki, we understand the significance of these changes and the need for financial institutions to stay ahead. Our AML transaction monitoring solution is designed to automate and streamline the compliance process, making it easier for you to identify and report suspicious activities in a timely manner.

If you're a covered financial institution in the Philippines looking to bolster your AML reporting capabilities, we encourage you to book a demo of Tookitaki’s AML Suite. Our solution can help you navigate the changing landscape, ensure compliance, and contribute to the integrity and stability of the financial sector in the Philippines.

Anti-Financial Crime Compliance with Tookitaki?