AML Compliance Risks and Mitigation Strategies for UAE Businesses

The United Arab Emirates (UAE) is a global business hub with a rapidly growing economy. However, as with any thriving financial centre, it also faces significant risks associated with money laundering and terrorist financing. AML (Anti-Money Laundering) compliance risks pose a threat to the integrity of the UAE's financial system. They can result in severe reputational, legal, and financial consequences for businesses operating in the region.

Given the potential risks and the stringent regulatory environment, it is crucial for businesses in the UAE to prioritize AML compliance and establish robust mitigation strategies. Implementing effective measures to prevent money laundering and terrorist financing safeguards businesses from legal and reputational damage and contributes to the overall stability and integrity of the UAE's financial system. By proactively addressing AML compliance risks, businesses can protect their operations, maintain trust with customers and partners, and ensure long-term sustainability.

In the following sections, we will delve deeper into the specific AML compliance risks faced by businesses in the UAE and explore mitigation strategies that can help mitigate these risks effectively. We will also discuss how innovative technology solutions, such as those offered by Tookitaki, can play a crucial role in enhancing AML compliance efforts and reducing the associated risks.

AML Compliance Risks in the UAE

Common AML Risks Faced by Businesses in the UAE

The UAE, being a global financial hub, faces various AML compliance risks that businesses need to be aware of and address proactively. Some of the common AML risks faced by businesses in the UAE include:

- High-Value Transactions: The UAE's status as a major trading and financial center attracts large-scale transactions, making it vulnerable to money laundering activities that seek to conceal illicit funds within legitimate transactions.

- Trade-Based Money Laundering: The UAE's significant trade volume and international business ties create opportunities for criminals to exploit trade transactions for money laundering purposes, such as under or over-invoicing, false documentation, or misrepresentation of goods.

- Cash Intensive Industries: The UAE's hospitality, real estate, and luxury sectors are known for their high cash flow. This cash-intensive nature can attract money laundering activities as criminals seek to legitimize illicit funds by channeling them through these industries.

Impact of Non-Compliance on Businesses and the Economy

Non-compliance with AML regulations can have far-reaching consequences for businesses operating in the UAE and the broader economy. Some of the key impacts of non-compliance include:

- Reputational Damage: AML violations can tarnish a company's reputation, leading to a loss of trust from customers, partners, and stakeholders. This can result in a significant decline in business opportunities and long-term financial losses.

- Legal and Regulatory Consequences: Non-compliance with AML regulations can lead to severe penalties, fines, and legal actions imposed by regulatory authorities. Businesses found guilty of non-compliance may face operational restrictions, license revocation, or even criminal prosecution.

- Economic Stability: Money laundering activities undermine the stability of the UAE's financial system and the overall economy. By facilitating the flow of illicit funds, non-compliant businesses contribute to an environment that fosters corruption, weakens market integrity, and hampers economic growth.

To effectively address these risks and safeguard businesses, it is essential to implement robust AML compliance measures.

Regulatory Framework in the UAE

Overview of AML Regulations and Laws in the UAE

The UAE has established a robust regulatory framework to combat money laundering and terrorist financing activities. The key AML regulations and laws in the UAE include:

- Federal Decree-Law No. 20 of 2018: This law, commonly known as the UAE Anti-Money Laundering Law, provides a comprehensive framework for the prevention and detection of money laundering and terrorist financing. It sets out the obligations and responsibilities of various entities, including financial institutions, designated non-financial businesses and professions (DNFBPs), and reporting entities.

- Central Bank of the UAE (CBUAE) Guidelines: The CBUAE issues guidelines and circulars that provide detailed instructions on AML compliance requirements for banks and financial institutions operating in the UAE. These guidelines cover customer due diligence, reporting obligations, risk assessment, and internal controls.

- Financial Action Task Force (FATF) Recommendations: The UAE is an active member of the FATF, an international standard-setting body for AML and counter-terrorism financing. The UAE aligns its AML regulations with the FATF Recommendations to ensure consistency and international cooperation in combating financial crimes.

Compliance Requirements for Businesses Operating in the UAE

Businesses operating in the UAE are subject to specific compliance requirements to address AML risks effectively. Some of the key compliance requirements include:

- Customer Due Diligence (CDD): Businesses must establish robust procedures for identifying and verifying the identity of their customers. This includes collecting relevant information, conducting risk assessments, and ongoing monitoring of customer transactions.

- Suspicious Transaction Reporting: Businesses must report any suspicious transactions or activities that may indicate money laundering or terrorist financing. Timely and accurate reporting is crucial to aid law enforcement agencies in their investigations.

- Internal Controls and Training: Businesses should establish and maintain internal control systems to ensure compliance with AML regulations. This includes implementing adequate policies, procedures, and training programs to educate employees on AML obligations and promote a culture of compliance.

By adhering to the regulatory framework and fulfilling compliance requirements, businesses operating in the UAE can mitigate AML risks effectively and contribute to a more secure and stable financial environment. In the next section, we will explore mitigation strategies and best practices that businesses can adopt to enhance their AML compliance efforts in the UAE.

Mitigation Strategies for AML Compliance

Customer Due Diligence and KYC Procedures

Implementing robust customer due diligence (CDD) and Know Your Customer (KYC) procedures is essential for businesses in the UAE to mitigate AML compliance risks. Key strategies in this area include:

- Collecting and verifying customer information: Businesses should gather comprehensive information about their customers, such as identification documents, business details, and beneficial ownership information. This helps establish the legitimacy of customer relationships and enables risk assessment.

- Enhanced due diligence for high-risk customers: Implementing enhanced due diligence measures for customers who pose a higher risk, such as politically exposed persons (PEPs) or customers from high-risk jurisdictions, helps mitigate potential AML risks. This may involve conducting additional verification checks and ongoing monitoring.

Transaction Monitoring and Suspicious Activity Reporting

Effective transaction monitoring and reporting suspicious activities are crucial components of AML compliance. Strategies in this area include:

- Implementing transaction monitoring systems: Businesses should employ advanced technologies to monitor customer transactions and identify any unusual or suspicious activities. Automated transaction monitoring systems can help detect patterns, anomalies, and red flags associated with money laundering or terrorist financing.

- Timely reporting of suspicious activities: Establishing clear procedures for reporting suspicious activities to the appropriate authorities is crucial. This ensures that suspicious transactions are promptly identified, investigated, and reported, contributing to the overall effort to combat financial crimes.

Training and Awareness Programs for Employees

Educating and raising awareness among employees about AML regulations and best practices is vital to ensure a culture of compliance. Key strategies include:

- Regular AML training sessions: Conducting regular training programs to educate employees about AML regulations, red flags, and reporting obligations helps them understand their role in preventing money laundering and terrorist financing.

- Internal reporting channels: Providing employees with channels to report any suspicious activities they may come across within the organisation encourages a proactive approach to AML compliance. This fosters a culture of compliance and encourages employees to be vigilant in detecting and reporting potential risks.

Enhanced Risk Assessment and Ongoing Monitoring

Continuously assessing and monitoring AML risks is essential to stay ahead of evolving threats. Strategies in this area include:

- Risk-based approach: Adopting a risk-based approach to AML compliance allows businesses to focus their resources on high-risk areas and customers. This involves conducting regular risk assessments, identifying risk factors, and implementing appropriate mitigation measures based on the level of risk.

- Ongoing monitoring and review: Regularly monitoring customer relationships, transactions, and internal controls helps ensure that AML compliance measures remain effective over time. Conducting periodic reviews and audits enables businesses to identify any gaps or weaknesses and take corrective actions promptly.

By implementing these mitigation strategies, businesses in the UAE can enhance their AML compliance efforts, reduce the risk of financial crimes, and contribute to a more secure and transparent business environment.

In the next section, we will explore how Tookitaki's AML compliance solutions can further support businesses in mitigating AML risks and strengthening their compliance practices.

The Role of Technology in AML Compliance

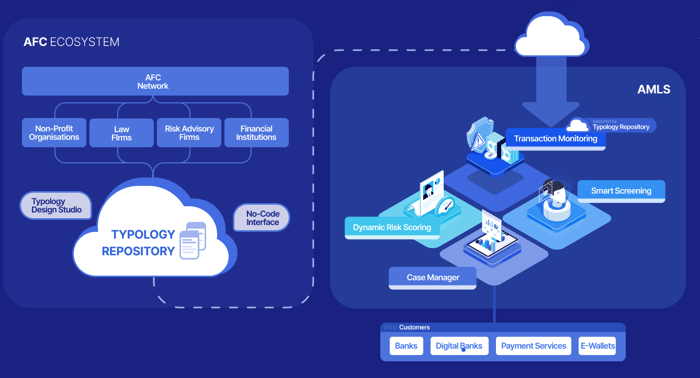

Tookitaki is leading the charge in the fight against financial crime with its Anti-Money Laundering Suite and Anti-Financial Crime (AFC) Ecosystem. Its unique community-based approach, powered by federated machine learning, breaks down the siloed approach used by criminals to evade traditional solutions. This results in a more effective AML program with a wider coverage of risk, sharper detection, and fewer false alerts.

Tooktiaki’s approach starts with our AFC ecosystem which is a community-based platform to share information and best practices in the fight against financial crime. The AFC ecosystem is powered through our Typology Repository which is a live database of money laundering techniques and schemes called typologies. These typologies are contributed by financial institutions, regulatory bodies, risk consultants, etc around the world by sharing their own experiences and knowledge of money laundering. The repository includes a wide range of typologies, from traditional methods such as shell companies and money mules, to more recent developments such as digital currency and social media-based schemes.

The AMLS, on the other hand, is a software deployed at financial institutions, which collaborates with the AFC Ecosystem through federated machine learning. The AMLS extracts the new typologies from the AFC Ecosystem and executes the typologies at the customers' end, ensuring that their AML programs stay ahead of the curve.

The AMLS includes several modules such as Transaction Monitoring, Smart Screening, Dynamic Risk Scoring, and Case Manager. These modules work together to provide a comprehensive compliance solution that covers all aspects of AML including detection, investigation, and reporting.

- The Transaction Monitoring module is designed to detect suspicious patterns of financial transactions that may indicate money laundering or other financial crimes. It utilizes powerful simulation modes for automated threshold tuning, which allows AML teams to focus on the most relevant alerts and improve their overall efficiency.

- The Smart Screening module is designed to detect potential matches against sanctions lists, PEPs, and other watchlists. It includes 50+ name matching techniques, supports multiple attributes such as name, address, gender, date of birth, and date of incorporation.

- The Dynamic Risk Scoring solution is a flexible and scalable customer risk ranking program that adapts to changing customer behavior and compliance requirements.

- The Case Manager provides compliance teams with the platform to collaborate on cases and work seamlessly across teams. It comes with a host of automations built to empower investigators.

The Way Forward

In this blog, we explored the AML compliance risks faced by businesses in the UAE and discussed various mitigation strategies. We highlighted the importance of implementing effective customer due diligence, transaction monitoring, employee training, and risk assessment practices to ensure compliance with AML regulations. By understanding and addressing these risks, businesses can safeguard their reputation, protect themselves from financial losses, and contribute to a secure and stable financial ecosystem in the UAE.

As AML regulations become increasingly complex and dynamic, businesses in the UAE need robust technology solutions to stay ahead of emerging risks and ensure effective compliance. Tookitaki's AML compliance solutions offer advanced AI-powered analytics, risk-based approaches, automated transaction monitoring, and enhanced detection accuracy. By leveraging these solutions, businesses can streamline their compliance processes, improve risk management capabilities, and enhance their ability to identify and prevent financial crimes.

Tookitaki invites businesses in the UAE to experience the power of our AML compliance solutions firsthand. By booking a demo, you can explore how our innovative technology can help you strengthen your AML practices, improve detection accuracy, and streamline compliance workflows. Take the next step towards effective risk management and compliance by booking a demo of Tookitaki's AML solutions today.

Anti-Financial Crime Compliance with Tookitaki?

%20(1)%20(1).webp)