Case Study

De-risking Business Growth from 'Regulatory Risk’ for an E-Wallet

THE CLIENT

One of the top 4 wallet and payment apps in the Philippines

The client serves as the go-to all-in-one money app for millions of Filipinos, empowering a new generation of financial achievers to boldly pursue their financial goals. It caters to over one million customers with a comprehensive financial solution.

They are also the nation's largest merchant payment processor, seamlessly integrating omni-channel payment solutions and digital banking services. Powered by Digital Banking Business, their offerings include high-interest business deposit accounts and a range of credit products for both enterprises and customers.

THE CHALLENGE

Scaling compliance operations to support exponential growth while ensuring complete coverage of regulatory requirements

The client needed to swiftly expand their compliance operations to keep pace with exponential growth.

Accomplishing this required not just growth in scale but also a strategic approach to ensure comprehensive risk coverage, business growth and regulatory reputation.

Rapid Scaling

The need to rapidly expand compliance operations to match the pace of their exponential business growth.

Mitigating Regulatory Risk

Achieving comprehensive risk coverage was essential to gain regulator trust, given their status as a rapidly growing fintech.

Scalable AML Solution

An AML solution that could scale in tandem with their expanding volumes and ensure cost-effective implementation.

THE SOLUTION

Comprehensive risk coverage with a scalable compliance solution

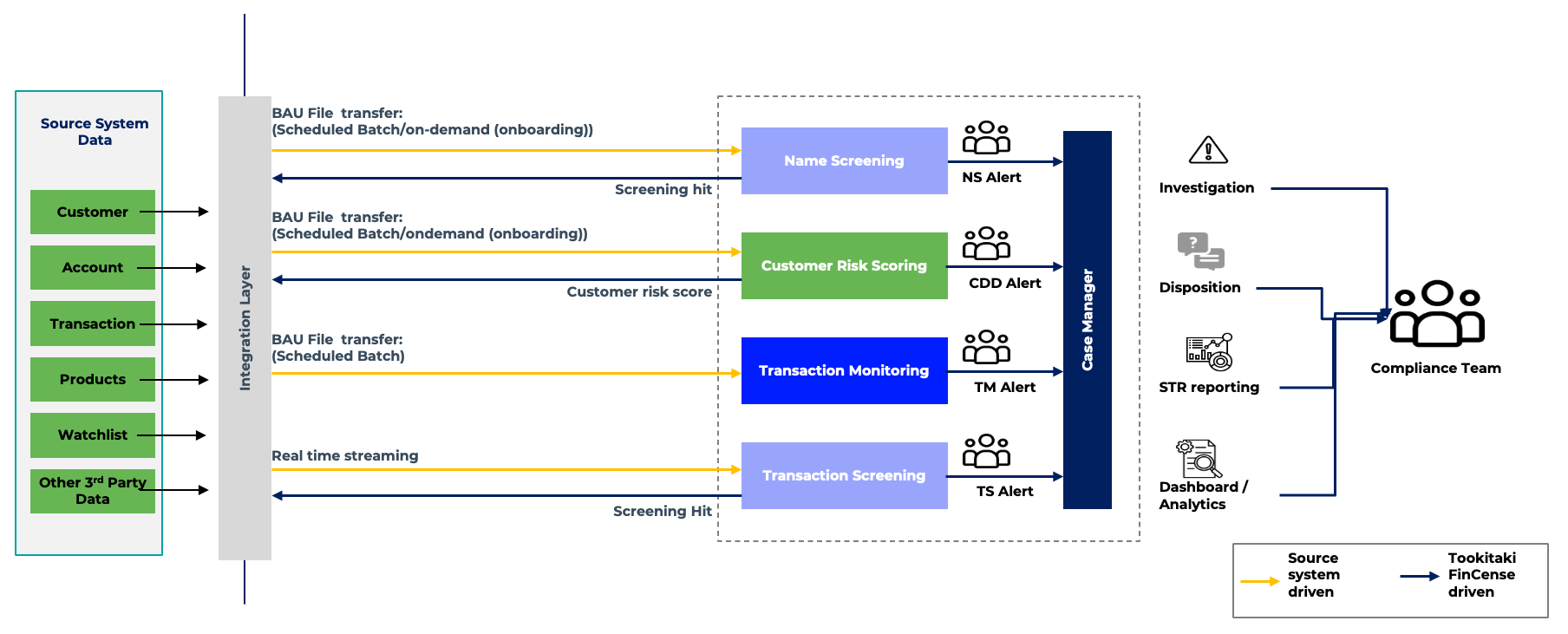

In response to the strategic challenges, our client embarked on a journey to establish a strong and scalable financial crime solution. They leveraged the 'Community driven Compliance Model’ of Tookitaki’s FinCense and the AFC Ecosystem.

Key Features

Access to the AFC Ecosystem

Access to a global network, empowering clients with expansive compliance intelligence.

Out-of-the-Box Scenarios

The AFC Ecosystem offers a repository of pre-defined typologies for immediate setup.

Customer Screening

Advanced name screening capabilities to streamline customer screening and elevate risk assessment.

360º Customer Risk View

Robust customer risk scoring solution to strategically prioritise high-risk customers.

Streamlined Investigation

Powerful Case Manager providing a strategic 360º customer view for better workflow management.

Operational Flexibility

FinCense allows global settings to configure case statuses, aligning operational needs with strategic goals.

THE RESULTS

The client's strategic approach to AML compliance delivered significant benefits. They improved their ability to respond swiftly to evolving financial crime threats and regulatory changes. Implementing Tookitaki's FinCense reduced ongoing maintenance costs, enabling the client to allocate resources strategically in alignment with their long-term vision.

“It was critical for us to comply with the BSP requirements in time to meet the business demands. Also, Tookitaki helped us simplify our compliance operations by providing with a single platform that effectively manages all AML processes."

Head of Compliance