Case Study

Building a Top-Grade Compliance System with Next-gen Technology for a Gen-Z Digital Bank

THE CLIENT

A leading Singapore-based Digital Bank

Our client, a trailblazing digital bank launched in 2022, is reshaping Singapore's banking landscape. Fast emerging as a Gen Z bank, it provides hyper-personalized support, evolving with customers' changing banking needs and expectations. It caters to the unbanked and underserved, including entrepreneurs, gig economy workers, and early-jobbers.

Their journey has been marked by tremendous growth and a commitment to financial inclusion. The fast growth has also come with unique AML and fraud-related risks that it is looking to address with Tookitaki’s compliance platform.

THE CHALLENGE

Meeting Stringent Regulatory Requirements to Launch Digital Banking Services in a Timely Manner

As a new entrant to the digital banking space, our client faced a unique set of challenges. The rules were clear: ensure full compliance with the Monetary Authority of Singapore (MAS) before their digital bank takes its maiden voyage.

To keep pace with the rapidly evolving landscape, they needed to onboard new transaction monitoring scenarios at lightning speed..

Flexibility

The bank’s compliance team needed a system which they could configure ‘on the fly’ to meet local red flags

Scalability

Rapid onboarding of new transaction monitoring scenarios in response to evolving AML patterns and regulations.

Data Readiness

Need for end-to-end testing, however there was a lack of source data.

THE SOLUTION

A Future-ready ‘Community-driven Compliance Model’

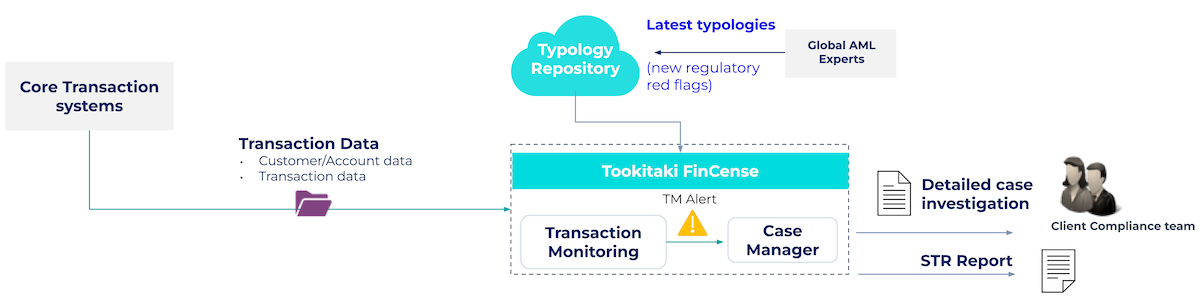

To navigate these formidable challenges, our client embarked on a transformational journey to create a robust and scalable financial crime solution. Partnering with Tookitaki, they deployed our powerful FinCense, an end-to-end financial crime compliance operating system.

Key Features

Capturing Hidden Risks

Ability to detect intricate, hidden AML risks from available data using typologies within the AFC Ecosystem

Custom Scenarios

Ability to customise typologies using ‘No-code’ Typology Design Studio to meet specific local risk requirements

Faster Scenario Onboarding

Fully automated simulation mode and threshold tuning to deploy new typologies in days instead of months

Powerful Detection Engine

A robust with dynamic segmentation capabilities to detect hidden risky behaviour

Scalable Investigation

Powerful Case Manager with in-built automation to completely streamline the investigation and reporting processes

Built-in SAR Process

Built-in Suspicious Activity Report template which covered most fields required by the Monetary Authority of Singapore

THE RESULTS

This strategic collaboration empowered the digital bank to build a robust transaction monitoring system in compliance with MAS requirements. The system launch also met the stringent timelines requirements needed for a successful business go-live.

“For a new business like ours, Tookitaki's FinCense has been a perfect partner to help us effectively manage our compliance needs. The entire project was seamless given the scale of the project and the complexities involved. We are looking to replicate the success in Malaysia."

VP, Compliance | Digital Banking