Fraud targeting governments’ pandemic-related welfare programs have seen criminals exploiting these schemes ever since countries started helping their citizens and businesses. If reports are correct, fraudsters benefit immensely from the US government’s strategies to aid businesses affected by the COVID-19 pandemic. Also, they are making use of popular online investment platforms as a convenient way to launder money. According to a CNBC report, citing law enforcement officials, more than US$100 million in stolen COVID relief funds have gone through four investment platforms – Robinhood, TD Ameritrade, E-Trade and Fidelity – since Congress passed the CARES Act in March 2020.

The US government’s rapid roll-out of the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) has been criticised as the “financial crime bonanza act of 2021”, with the programs marred with problems. The PPP allows eligible small businesses and other organisations to receive loans with a maturity of two years and an interest rate of one per cent. The EIDL program provides economic relief to small businesses that are currently experiencing a temporary loss of revenue. Inadequate controls have been cited for aiding possible fraud totalling billions of dollars. The officials noted that new-age digital investment platforms are easy options “to dump the money into by setting up accounts with stolen identities”.

This article explores the fraudsters’ schemes to benefit from government programs and clean those funds illegally. Also, we look into the technology options these investment platforms could use to counter financial crime and ensure robust AML/CFT compliance.

Learn More: Latest AML Fine Figures

Typology involving online investment platforms

The fraud and money laundering scheme works as below:

- Criminals steal a business owner’s identity and apply for EIDL.

- Once they get the funds, the criminals again use stolen identity information such as date of birth and social security number to open an investment account at an online investment platform.

- In some cases, criminals use synthetic identity, a fictitious social security number tied to a real person or mules who are part of the scheme.

- Then, criminals would transfer EIDL funds from bank accounts to accounts opened with online investment platforms.

- A short time later, the funds are moved from online investment accounts using ACH reversal.

CNBC’s sources noted that criminals are taking advantage of the more straightforward sign-up process for online investment accounts as well as the relative anonymity compared with regular bank account. One of the officials cited by CNBC said they are “investigating several cases where Robinhood had been used by criminals to launder PPP funds and EIDL funds”. In one of the cases, a fraudster stole the identity of a local resident and was able to receive US$28,000 in EIDL funds, obtained using fraudulent information for a nonexistent business with 60 employees. The fraudster later opened an account with Robinhood and attempted to transfer most of the money from a bank account using a stolen identity. Then the fraudster reversed the transfer three days after opening the account using an ACH reversal.

Considerable Amounts Being Diverted to New Avenues

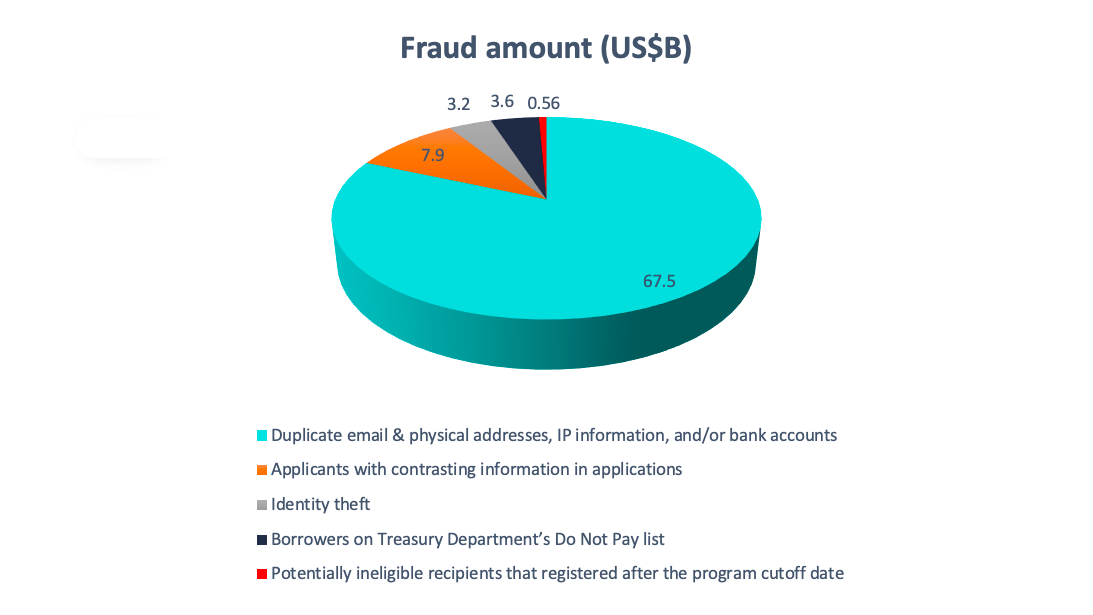

CNBC sources said criminals are using all the different platforms because of the sheer volume of the stimulus package and the amount of money. The PPP and EIDL programs have fraud identified worth US$84 billion, out of which only US$626 million have been seized or forfeited by the Department of Justice, according to the US House Select Subcommittee on the Coronavirus Crisis. The Subcommittee also noted that Financial institutions filed over 41,000 Suspicious Activity Reports related to potential PPP and EIDL fraud during May-October 2020 alone.

PPP & EIDL Fraud by Type

Source: US House Select Subcommittee on the Coronavirus Crisis

Source: US House Select Subcommittee on the Coronavirus Crisis

The PPP established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act was a prime target for fraud due to its limited oversight and easy eligibility criteria. The program's original allocation of US$349 billion was depleted in just 13 days. Once the relief programs’ weak controls became evident, the US Department of Treasury and the Department of Justice (DOJ) realised that they would need to take an aggressive approach to prevent fraud and started auditing applications and prosecuting wrongdoers. The charges on those people caught by law enforcement include bank fraud, mail fraud, wire fraud, money laundering, and making false statements to financial institutions. In 2020, the DOJ charged over 100 people for fraudulently seeking loans and other payments under the CARES Act.

Importance of Sustainable AML Compliance Programs within Online Investment Platforms

The online investment platforms, named in the CNBC report, claimed they are “laser-focused on preventing fraud” and have a “range of safeguards and multiple layers of security in place for detecting fraudulent accounts and subsequent transactions” as in the case of other financial institutions. However, their AML/CFT measures’ effectiveness is in question, especially in the pandemic’s new status quo. To remain trustworthy, these platforms need to mitigate money laundering risks through effective and sustainable compliance programs.

A proper AML Compliance Program enables a financial institution to identify and respond to terrorist financing and money laundering risks by introducing a risk-based approach in various key processes such as Know Your Customer (KYC), Customer Due Diligence (CDD), Screening and Transaction Monitoring.

Tookitaki’s end-to-end AI-powered AML operating system, the Anti-Money Laundering Suite (AMLS), powered by the AFC Ecosystem is intended to identify hard-to-detect money laundering techniques. Available as a modular service across the three pillars of AML activity – Transaction Monitoring, AML Screening for names and transactions and Customer Risk Scoring – the solution has the following features to aid in detecting money laundering.

- The World’s most extensive repository of AML typologies provides real-world AML red flags to keep our underlying machine learning detection model updated with the latest money laundering techniques globally.

- Advanced data analytics and dynamic segmentation to detect unusual patterns in transactions

- Risk scoring based on matching with watchlist databases or adverse media

- Visibility on customer linkages and related scores to provide a 360-degree network overview

- Constantly updating risk scoring, which learns from incremental data changes

Our solution has been proven to be highly accurate in identifying high-risk customers and transactions. For more details on our AMLS solution and its ability to identify various money laundering techniques, don't hesitate to contact us.

Anti-Financial Crime Compliance with Tookitaki?