Thailand's financial sector, burgeoning with digital banks, e-wallets, lending businesses, and payment companies, faces an imperative demand for robust AML compliance. The escalating sophistication of financial crimes necessitates state-of-the-art AML systems, emphasizing an urgent need for solutions that not only detect but effectively curtail such illicit activities. In this arena, Tookitaki emerges as a game-changer.

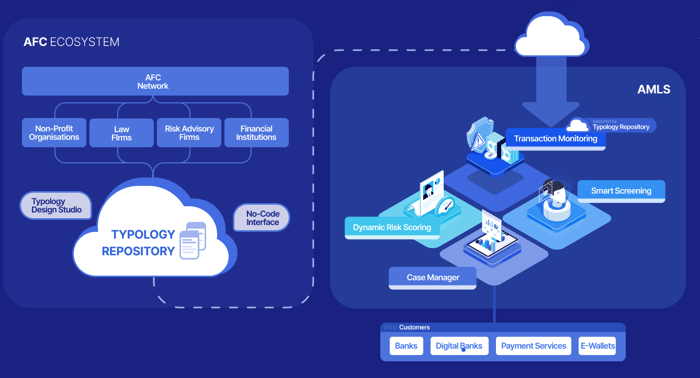

Tookitaki, with its cutting-edge Anti-Money Laundering Suite (AML Suite) and Anti-Financial Crime (AFC) Ecosystem, delivers AML compliance solutions designed to fortify the defences of banks and fintech businesses. The company's mission, since its inception, has been to battle financial crime dynamically. It pioneers in deconstructing conventional, siloed AML strategies, substituting them with a united community approach.

The AML Suite, an all-encompassing operating system, revolutionizes compliance processes for financial institutions, offering comprehensive risk coverage, enhanced detection accuracy, and a drastic reduction in false alerts. This system seamlessly collaborates with the AFC Ecosystem, an assembly of experts dedicated to discovering concealed money trails that evade traditional detection methods.

Aided by the prowess of federated machine learning, Tookitaki ensures that financial institutions consistently stay ahead in their AML programs. This fusion of technology and expertise creates an effective framework for detection, prevention, and combat against money laundering and associated criminal activities. The outcome is a sustainable AML program, providing robust protection for financial institutions against financial crime.

The Landscape of AML Regulation in Thailand

The landscape of Anti-Money Laundering (AML) regulation in Thailand is complex, encompassing a wide array of laws and regulations, many of which have seen significant changes and updates in recent years. The regulations are governed by several national and international bodies, focusing on prevention, detection, and penalties for non-compliance.

The role of financial institutions, such as digital banks, e-wallets, lending businesses, and payment companies, in this regulatory landscape is significant. As conduits of financial transactions, they are on the frontline of efforts to detect, report, and prevent money laundering activities. They are mandated to comply with AML regulations, which include implementing customer due diligence measures, monitoring and reporting suspicious transactions, maintaining comprehensive records, and providing training to staff on AML compliance.

Bound by regulatory measures, these institutions must ensure robust systems are in place to identify and mitigate money laundering risks. Their efficacy in doing so directly impacts the broader goal of preventing financial crimes, preserving the financial system's integrity, and combating threats to national security. Therefore, the implementation of advanced AML compliance solutions becomes a critical component of their operational strategy.

Through the deployment of Tookitaki's AML Suite, these entities can efficiently navigate the regulatory landscape, enhance their risk management efforts, and ensure optimal compliance with the AML regulations in Thailand. The Suite assists in streamlining the compliance processes, improving risk coverage, and providing enhanced detection accuracy while significantly reducing false alerts. This, in turn, leads to better resource allocation and ensures a more effective response to the ever-evolving landscape of money laundering threats.

The Challenges of AML Compliance in Thailand

The task of AML compliance poses several challenges for Thai financial institutions. With ever-evolving tactics used by money launderers, these institutions face constant pressure to upgrade their systems, enhance the training of their staff and ensure their processes are compliant with the changing regulatory landscape.

- A core challenge is the issue of siloed operations. This results in compartmentalised information and insufficient sharing between different teams and systems, leading to blind spots in the detection process. This, coupled with outdated or inefficient technology, can increase the risk of missed detections or false alerts, causing an unnecessary drain on resources.

- Moreover, there's a growing challenge of handling the sheer volume and complexity of data. The increasing number of transactions and their growing complexity necessitates sophisticated systems that can handle large data volumes and extract meaningful insights for effective risk management.

- The role of compliance officers is also crucial and challenging, as they need to be familiar with the latest AML regulations and apply them accurately within their operational environment. The challenge amplifies with the onus to keep pace with the frequent updates in regulatory norms and the introduction of new laws.

- Detecting and preventing money laundering is of utmost importance, given the severe consequences of non-compliance, which include hefty penalties, loss of reputation and potential operational risks. Effective detection helps prevent criminal activities, safeguard the integrity of financial systems and protect institutions from unwittingly becoming a conduit for illicit funds.

This highlights the need for innovative AML compliance solutions that offer comprehensive coverage, enhance detection accuracy and reduce false alerts. The revolutionary Anti-Money Laundering Suite (AML Suite) offered by Tookitaki meets these needs by offering an end-to-end operating system to modernise compliance processes for banks and fintechs. Combining this with the Anti-Financial Crime (AFC) Ecosystem results in a powerful tool to combat the challenges of AML compliance in Thailand.

Tookitaki’s Revolutionary Approach to AML Compliance

Tookitaki's approach to AML compliance is grounded in a unique community-based strategy that is revolutionary within the industry. It signifies a shift from the traditional siloed model to a collective approach, empowering financial institutions to enhance their capabilities in detecting, preventing, and combatting money laundering. This unification of forces, leveraging shared expertise and tools, translates to a more effective and sustainable AML program.

The AML Suite lies at the heart of Tookitaki's compliance process modernisation. It serves as an end-to-end operating system for banks and fintechs, reshaping the financial service industry's perception and approach towards AML compliance. Financial institutions can build comprehensive risk-based anti-money laundering programs with this award-winning, self-adaptive machine learning solution. Another groundbreaking feature of Tookitaki's approach is the Anti-Financial Crime (AFC) Ecosystem. This expert community is committed to unearthing concealed money trails that evade traditional detection methods. The AML Suite and the AFC Ecosystem work in synergy, powered by federated machine learning, offering financial institutions an edge over evolving criminal tactics and regulatory changes. This ecosystem extends beyond institutional boundaries, strengthening collective defence against financial crime.

The AML Suite has three core modules: smart screening solutions, dynamic risk scoring, and transaction monitoring. It provides extensive risk coverage, enhanced detection accuracy, and notably reduces false alerts, overcoming challenges prevalent in conventional systems.

In addition, the Case Manager module, an integral part of the AML Suite, provides a seamless interface for managing alerts. It ensures efficient handling of alerts generated by the system, prioritizing them at a customer level and aiding in accurate and timely suspicious activity reporting.

Each module of Tookitaki's AMLS synergistically contributes to a potent defense against money laundering, making it one of the best AML software for banks. Its end-to-end design unifies various aspects of AML compliance, from screening and risk scoring to monitoring and case management. Doing so propels financial institutions to the forefront of anti-money laundering efforts.

Tookitaki's community-based approach and innovative tools, namely the AFC Ecosystem and AML Suite, redefine AML compliance. They equip financial institutions to detect anomalies in financial transactions, improve AML reporting, and effectively manage compliance risks. The result is a transformational solution to the challenges of AML compliance in Thailand and beyond.

Tookitaki’s Role in Thailand's AML Compliance Future

In the context of Thailand's financial regulatory framework, Tookitaki's AMLS aligns perfectly. Thai regulations mandate robust and comprehensive AML controls in financial institutions. The end-to-end operating system offered by Tookitaki, with its holistic risk coverage and a significant reduction in false alerts, meets these requirements effectively. The platform's ability to detect and prevent money laundering makes it an asset in a regulatory environment that prioritises financial integrity and crime prevention.

With Tookitaki, the future of AML compliance in Thailand appears promising. The AFC Ecosystem, a community of experts driven by federated machine learning, sets a new standard in fighting financial crime. It uncovers hidden money trails that conventional methods miss, ensuring financial institutions stay ahead in their AML programs. As Thailand's financial sector continues to evolve, Tookitaki's AMLS can be a powerful ally in maintaining a high AML compliance and integrity standard.

Final Thoughts

Tookitaki is transforming AML compliance in Thailand by modernising the process and breaking down siloed approaches. Its AMLS provides comprehensive risk coverage, enhanced detection accuracy, and reduced false alerts. Its unique community-based approach and use of federated machine learning make it an essential tool in the fight against financial crime. The success of Tookitaki's AMLS in the Thai market has set a precedent, demonstrating that innovative technology can significantly improve AML compliance.

Considering the capabilities and proven results of Tookitaki's AMLS, Thai financial institutions would be well-served by considering this technology for their AML compliance needs. The AMLS not only helps meet regulatory requirements but also increases operational efficiency and reduces costs associated with false alerts. The future-proof nature of the AMLS, with its capacity to adapt to evolving financial crime patterns, is another crucial advantage. As such, it's time for Thai financial institutions to consider Tookitaki’s innovative AML solutions, and we encourage them to book a demo with us.

Anti-Financial Crime Compliance with Tookitaki?