Money laundering is a serious issue in Malaysia, the third-largest economy in Southeast Asia. It has been a cause for concern for the government, financial institutions, and the public at large. The act of money laundering involves disguising the origins of illegally obtained funds so that they appear to have come from legitimate sources. This practice not only undermines the integrity of the financial system but also has serious consequences for the economy and society as a whole. In this blog, we will explore the causes and consequences of money laundering in Malaysia and suggest effective ways to prevent it. By understanding the nature and scope of the problem, we can take steps to combat money laundering and uphold the integrity of Malaysia's financial system.

Causes of Money Laundering in Malaysia

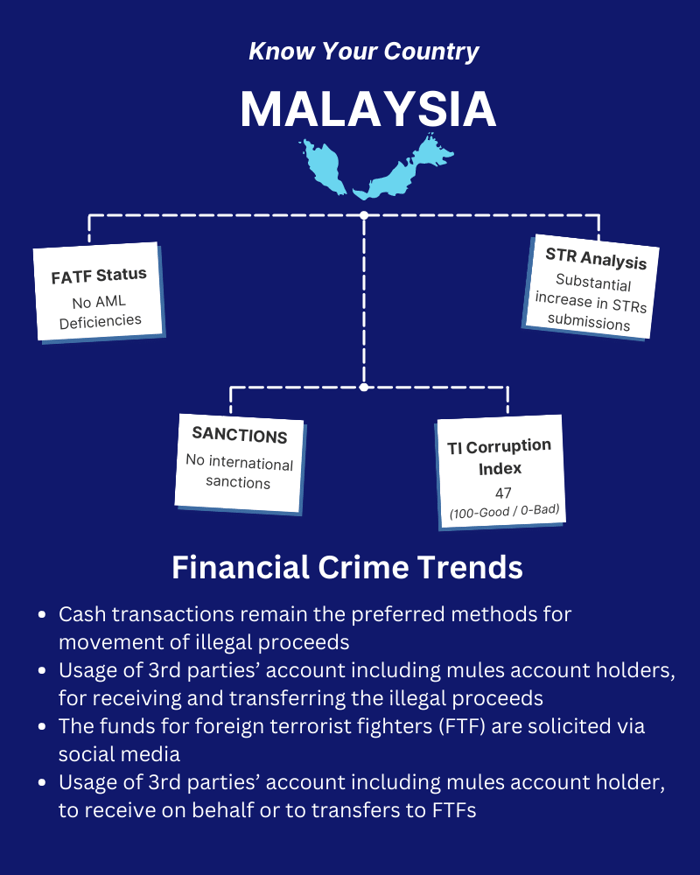

In Malaysia, there are several factors that contribute to the prevalence of money laundering. Firstly, the economic and financial conditions in Malaysia play a significant role in facilitating money laundering. Due to the country's high economic growth rate and the presence of a large informal economy, there is a significant amount of cash circulating in the country. This makes it easier for criminals to launder their proceeds of crime.

Secondly, weaknesses in the regulatory framework of Malaysia also contribute to the prevalence of money laundering. Although the country has implemented several measures to combat money laundering, there is still room for improvement in terms of effectiveness and implementation.

Studies have shown that there is a significant difference between the perceived importance level and the actual level of anti-money laundering measures adopted by banks in Malaysia.

Consequences of Money Laundering in Malaysia

Money laundering can have several negative consequences on the economy and financial systems of Malaysia. One of the primary consequences of money laundering is its negative impact on the economy. Money laundering damages financial sector institutions, which are critical for economic growth. It promotes crime and corruption that slow economic growth and reduces efficiency in the real sector of the economy. The worst impact of money laundering is that it also damages the development of the legitimate private sector.

Successful money laundering encourages criminal activities and undermines the integrity of the entire society, which in turn undermines democracy and the rule of law. If money laundering is not dealt with effectively, there will be negative social and political effects.

Finally, money laundering can lead to the destabilization of financial institutions and systems. The adverse consequences of money laundering are generally described as reputational, operational, and risk concentration. They are interrelated, and each financial consequence, such as loss of profitable businesses, liquidity problems through fund withdrawals, cessation of correspondent banking services, research costs, fines, and asset seizures, can lead to the destabilization of financial institutions and systems.

Therefore, it is crucial to enforce AML/CFT legislation, implement robust anti-money laundering programs, and ensure that financial institutions are taking appropriate measures to prevent and detect money laundering activities.

Prevention of Money Laundering in Malaysia

The prevention of money laundering in Malaysia is regulated by the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA). The act has been revised and renamed as Anti-Money Laundering and Anti-Terrorism Financing Act 2001 (Act 613) which came into force on March 6, 2007.

Financial institutions are required to comply with AML/CFT regulations and guidelines issued by the relevant authorities in Malaysia. Effective implementation of AML measures by financial institutions is crucial in preventing money laundering in Malaysia. The success of AML prevention measures is highly dependent on the support from expert staff, top management, technology infrastructure, and existence of political influence. Compliance with AML/CFT regulations is necessary to prevent financial institutions from being used as a conduit for money laundering activities.

Financial institutions in Malaysia should also effective AML compliance solutions to prevent money laundering activities. The use of these solutions can assist financial institutions in identifying and reporting suspicious activities, as required by AML/CFT regulations.

Tookitaki and AML Compliance in Malaysia

Tookitaki is a leading provider of AML compliance solutions that help banks, financial institutions, and fintechs effectively detect and prevent money laundering. The company provides a comprehensive suite of solutions that improve the effectiveness and efficiency of AML compliance process, including customer due diligence, transaction monitoring, and suspicious activity reporting.

Tookitaki Anti-Money Laundering Suite (AMLS) is the company's flagship product, and it is designed to help banks and financial institutions comply with AML regulations in an efficient and effective manner. The solution comprises several modules that work together to provide a complete AML compliance solution. These modules are:

- Smart Screening: This module is designed to detect potential matches against sanctions lists, PEPs, and other watchlists. It includes 50+ name matching techniques, supports multiple attributes such as name, address, gender, date of birth, and date of incorporation. It is highly configurable, allowing it to be tailored to the specific needs of each financial institution.

- Dynamic Risk Scoring: This module is a flexible and scalable customer and prospect risk ranking program that adapts to changing customer behavior and compliance requirements. It creates a dynamic, 360-degree risk profile of customers, enabling financial institutions to not only uncover hidden risks but also open up new business opportunities.

- Transaction Monitoring: The Transaction Monitoring module is designed to detect suspicious patterns of financial transactions that may indicate money laundering or other financial crimes. It utilizes powerful simulation modes for automated threshold tuning, which allows AML teams to focus on the most relevant alerts and improve their overall efficiency. The module also includes a built-in sandbox environment, which allows financial institutions to test and deploy new typologies in a matter of minutes.

- Case Management: This module provides compliance teams with the platform to collaborate on cases and work seamlessly across teams. It comes with a host of automations built to empower investigators.

The Anti-Financial Crime (AFC) Ecosystem is a separate platform developed by Tookitaki to aid in the fight against financial crime. The Ecosystem aims to provide a platform for stakeholders to share knowledge and best practices, as well as to develop and implement innovative solutions to combat money laundering and terrorist financing. It is designed to work alongside Tookitaki's AMLS to provide a comprehensive solution for financial institutions.

Transform Your AML Compliance Program in Malaysia

AML compliance remains a critical challenge for financial institutions in Malaysia due to the increasing number of money laundering activities in the country. However, by leveraging Tookitaki’s innovative AML solutions, they can improve compliance outcomes while reducing costs. Tookitaki's AMLS solution provides various modules that allow banks and fintechs to identify, investigate, and report suspicious activities effectively.

Financial institutions in Malaysia are encouraged to book a demo of Tookitaki's AML compliance solutions and experience the benefits firsthand. By leveraging innovative solutions, financial institutions can stay ahead of money launderers while complying with regulatory requirements.

Anti-Financial Crime Compliance with Tookitaki?