Compliance officers play a vital role in ensuring financial institutions comply with the various regulatory requirements related to anti-money laundering (AML) programs. These professionals are responsible for developing, implementing, and monitoring policies and procedures that prevent money laundering, terrorist financing, and other illegal activities.

In recent years, there has been an increased focus on AML compliance in the financial industry, with regulators worldwide imposing stricter requirements on financial institutions. Compliance officers are crucial in meeting these requirements and ensuring that their organizations operate responsibly and ethically.

Tookitaki can assist compliance officers in AML programs by providing innovative solutions that leverage cutting-edge technologies. These solutions enable compliance officers to analyze large volumes of data and identify potential money laundering risks more efficiently and effectively. This improves the overall effectiveness of AML programs and reduces the time and resources required to perform AML compliance activities.

The Role of Compliance Officers in AML Programs

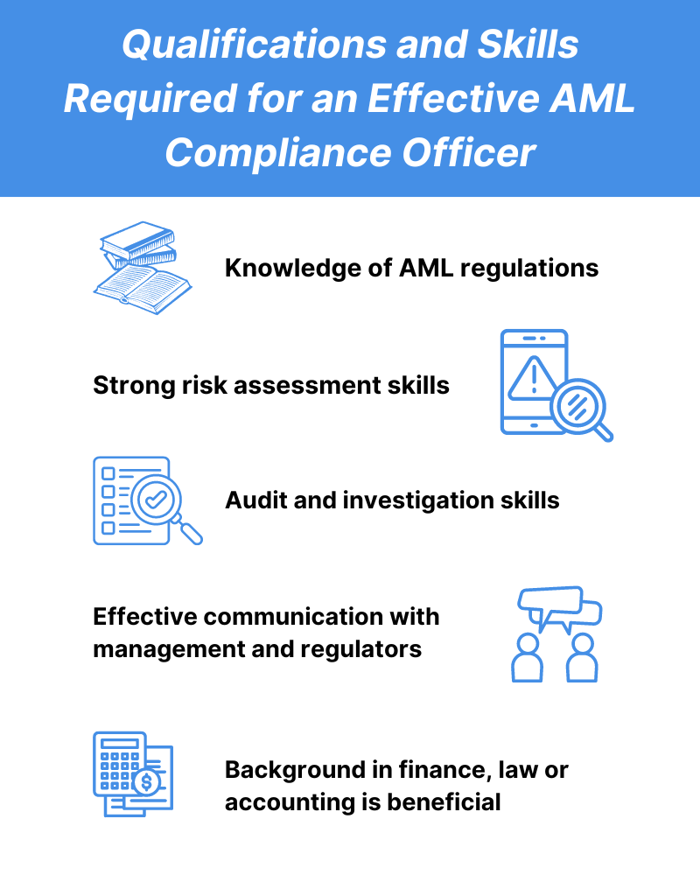

The role of Compliance Officers in AML Programs is crucial to preventing and detecting financial crimes such as money laundering and fraud. Compliance Officers are responsible for managing, supervising and enforcing the anti-money laundering operations of the organization they work for. They are the last line of defense in identifying financial crimes and ensuring compliance with government regulations.

Their responsibilities include:

- Developing and implementing AML policies and procedures

- Training employees on AML requirements and best practices

- Conducting risk assessments and identifying suspicious activity

- Monitoring and reporting suspicious activity to relevant authorities

- Conducting investigations into potential AML violations

Compliance officers have their work cut out for them when accomplishing these objectives. They must keep up with constantly evolving regulatory requirements and oversee internal due diligence initiatives to ensure their customers and transactions are not associated with illicit activities. This makes for a complex and challenging task requiring many tools and resources.

How Tookitaki Can Assist Compliance Officers in AML Programs

Tookitaki is a software company that provides AML solutions to financial institutions. The company offers several solutions to assist compliance officers in their roles in AML programs. These solutions include:

Smart Screening: This solution detects potential matches against sanctions lists, PEPs, and other watchlists. It includes 50+ name-matching techniques and supports multiple attributes such as name, address, gender, date of birth, and date of incorporation. It covers 20+ languages and 10 scripts and includes a built-in transliteration engine for effective cross-lingual matching.

Transaction Monitoring: This solution is designed to detect suspicious patterns of financial transactions that may indicate money laundering or other financial crimes. It utilizes powerful simulation modes for automated threshold tuning, allowing AML teams to focus on the most relevant alerts and improve their efficiency. The module also includes a built-in sandbox environment, which allows financial institutions to test and deploy new typologies in minutes.

Customer Risk Scoring: This solution is a flexible and scalable customer risk ranking program that adapts to changing customer behavior and compliance requirements. Powered by advanced machine learning, this module creates a dynamic, 360-degree risk profile of customers. It enables financial institutions to uncover hidden risks and opens up new business opportunities.

Case Management: This solution assists compliance officers in managing and resolving AML cases. It provides a centralised platform for case management, enabling users to track cases from initial detection to final resolution.

AFC Ecosystem

The Anti-Financial Crime (AFC) Ecosystem is a separate platform developed by Tookitaki to aid in the fight against financial crime. It is designed to work alongside Tookitaki's Anti-Money Laundering Suite (AMLS) to provide a comprehensive solution for financial institutions. One of the key features of the AFC ecosystem is the Typology Repository. This is a database of money laundering techniques and schemes that have been identified by financial institutions around the world. Financial institutions can contribute to the repository by sharing their own experiences and knowledge of money laundering. This allows the community of financial institutions to work together to tackle financial crime by sharing information and best practices.

By utilizing these solutions, compliance officers can benefit in several ways. Firstly, these solutions can reduce the workload of compliance officers by automating several AML processes. This allows compliance officers to focus on more complex tasks, such as investigating potential AML cases. Additionally, these solutions can improve the accuracy of AML programs by reducing false positivesand ensuring that potential AML cases are identified promptly. Furthermore, using advanced analytics can help compliance officers identify previously unknown patterns of suspicious activity, improving the effectiveness of AML programs.

Final Thoughts

Did you know that in a recent survey by a top consulting firm, 96% of financial institutions believed that having effective AML and counter-terrorism financing (CTF) programs in place would enhance their customers' trust in the financial system? It just goes to show how vital compliance officers are in ensuring a robust and resilient financial system.

Utilizing technology like Tookitaki's AML solutions is critical for organizations to effectively manage their AML programs, reduce risk and comply with evolving regulations. Compliance officers can significantly benefit from these solutions to automate manual processes, identify and mitigate risks, and better protect their organizations from financial crimes. Contact Tookitaki today to learn more about our AML solutions and how they can assist your organization in its AML program.

Anti-Financial Crime Compliance with Tookitaki?