The latest financial crime fine figures from governance and risk consultancy firm Kroll revealed that global financial watchdogs are turning their attention from large banks to smaller financial institutions such as cryptocurrency firms and other FinTechs.

According to Kroll’s annual Global Enforcement Review 2022, the value of fines issued by regulators across the world for financial crime compliance failings reached a new low of US$2.25 billion in 2021, compared to US$4.68 billion in 2020.

Details of Financial Crime Fines 2021

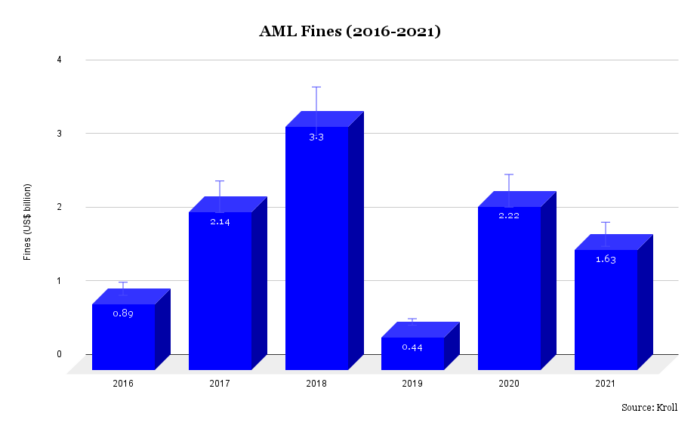

Fines related to anti-money laundering lapses were US$1.63 billion, down from US$2.22 billion in 2020. Meanwhile, fines related to bribery declined to US$608 million in 2021 from US$2.43 billion in 2020. Fines related to sanctions compliance were US$18.9 million in 2021, compared with US$27 million in the previous year.

Despite a fall in the value of fines, the number of fines levied rose to 67 in 2021, compared with 56 in 2020. Of the total 67 fines in 2021, there were 55 fines related to money laundering, followed by 8 for sanctions non-compliance and 4 for bribery.

Increasing Regulatory Oversight on Cryptocurrency Firms

In line with the increased global interest in cryptocurrencies, regulators are seemingly focused more on AML control failings of such firms. In 2021, U.S. regulators imposed further fines for AML-related infringements on cryptocurrency businesses.

In a notable development, a cryptocurrency exchange in the country was fined US$100 million by the U.S. Financial Crimes Enforcement Network (FinCEN).

“Now that AML-related concerns and failings have resulted in many large banks being sanctioned, regulators are beginning to pay increased attention to other areas of financial services,” said Malin Nilsson, Managing Director, Financial Services Compliance and Regulation at Kroll.

Key AML Failings

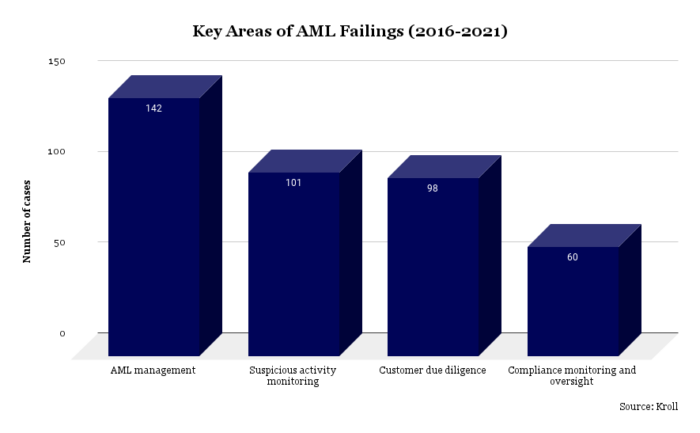

The latest data highlighted four key areas of AML failings from 2016-2021, which regulators across the world have consistently identified through the fines they imposed. These key areas are AML management, suspicious activity monitoring, customer due diligence, and compliance monitoring and oversight.

The U.S. Dominance in AML Fines Falters

In 2021, the U.S. made up 36% of AML-related fines globally, indicating that the country’s historical dominance in terms of the value of fines has become a thing of the past.

In yet another shift of trends, the Netherlands joined the top table of countries imposing major fines for AML failings in 2021. This was due to a fine of US$578 million by the Dutch regulator on one of its major banks.

Meanwhile, the Financial Conduct Authority (FCA) of the UK imposed four AML fines totalling US$441 million in 2021. The amount accounts for 58% of the total value of all penalties imposed by the UK regulator in 2021.

How Tech Can Help Financial Institutions Manage AML Compliance

When it comes to AML compliance, financial institutions are often troubled by regulatory uncertainties, complex money laundering techniques, outdated compliance systems, scarcity of skilled compliance staff and inefficient allocation of staff. A shortfall in any of these areas might lead to enforcement actions including hefty fines.

With modern technologies such as artificial intelligence and machine learning at the forefront, compliance departments can address many of these issues effectively. With proper implementation, these technologies can bring in a paradigm shift in the way financial institutions approach financial crimes and compliance risk at large.

This is an area where machine learning-powered platforms like Tookitaki can add value. Our end-to-end AML/CFT analytics solution, the Anti-Money Laundering Suite (AMLS), can create next-generation compliance programmes, encompassing key processes such as transaction monitoring, AML screening and customer due diligence on a single platform.

The suite comprises our Transaction Monitoring, Dynamic Risk Review, Smart Screening and Case Management solutions under one roof for all your AML needs. AMLS achieves new levels of accuracy and speed by providing the industry's only shared typology platform, allowing our clients to break through silos and benefit from the industry's collective AML insights. This enables everyone to join forces in the fight against financial crime.

Digital banks and FinTechs across the globe are building agile and scalable compliance programmes using AMLS, making us a partner of choice. We are leading AML initiatives at some of the key digital banks in Asia, the U.S. and Europe.

To learn more about our AML compliance solutions, speak to one of our experts today.

Anti-Financial Crime Compliance with Tookitaki?