Anti-money laundering (AML) compliance is a critical aspect of banking operations worldwide. In the United Arab Emirates (UAE), where the financial sector is a key driver of the economy, AML compliance is particularly important. UAE banks are subject to stringent regulations and face high levels of risk due to their exposure to international markets. To ensure compliance and mitigate risks, banks need to implement effective AML compliance management systems. In this blog post, we will discuss the advantages of AML compliance management systems for UAE banks and how Tookitaki, a leading provider of compliance solutions, can help.

AML Compliance Management Systems Explained

An AML compliance management system is a set of processes, policies, and procedures that a bank has in place to detect, prevent, and mitigate the risks associated with financial crime.

These systems are designed to ensure that banks comply with the relevant regulations and laws, including the UAE Central Bank's AML regulations.

AML compliance management systems are essential for banks because they help to identify and mitigate the risks associated with financial crimes such as money laundering and terrorist financing. By implementing an effective AML compliance management system, banks can avoid financial and reputational damage caused by regulatory fines, lawsuits, and loss of public trust.

The Advantages of AML Compliance Management Systems for UAE Banks

AML compliance management systems offer several benefits to UAE banks, including:

Increased efficiency in detecting and reporting suspicious transactions

AML compliance management systems use advanced technologies such as artificial intelligence (AI) and machine learning (ML) to analyze large volumes of data and identify patterns that could indicate suspicious transactions. By automating these processes, banks can detect potential money laundering activities faster and more accurately than with manual methods. This helps to prevent financial crime, protect the bank's reputation, and comply with regulations.

Reduction of false positives and false negatives

Traditional AML compliance methods often generate large numbers of false positives or alerts that are flagged as suspicious but turn out to be legitimate transactions. This can be time-consuming and costly to investigate. On the other hand, false negatives occur when actual suspicious transactions are missed. AML compliance management systems help to reduce false positives and false negatives by using more advanced risk-based methodologies and data analysis techniques.

Enhanced risk management and mitigation

AML compliance management systems provide banks with a comprehensive and proactive approach to risk management. By analyzing data in real time, banks can identify emerging risks and take appropriate action to mitigate them before they escalate. This helps to protect the bank from reputational and financial losses and ensures compliance with regulations.

Improved regulatory compliance and reputation management

Compliance with AML regulations is critical for banks to maintain their reputation and avoid penalties or sanctions. AML compliance management systems help banks to stay up-to-date with the latest regulations and provide a documented trail of compliance to regulators. This helps to improve the bank's reputation and reduce the risk of fines or legal action.

Cost savings through automation and optimization of compliance processes

Manual AML compliance processes can be time-consuming and costly. AML compliance management systems help to automate many of these processes, reducing the time and resources required. This can lead to significant cost savings for banks, which can be reinvested in other areas of the business.

Improved Customer Experience

AML compliance management systems can improve the customer experience by reducing the number of false positives. False positives occur when legitimate customer transactions are flagged as suspicious, leading to delays and inconvenience for the customer. By using advanced technology to analyze customer data, AML compliance management systems can reduce the number of false positives, improving the customer experience.

Competitive Advantage

Implementing an AML compliance management system can provide a competitive advantage for banks. By demonstrating their commitment to compliance and risk management, banks can enhance their reputation and gain a competitive advantage in the market. This can lead to increased customer loyalty, new business opportunities, and improved financial performance.

How Tookitaki Can Help UAE Banks with AML Compliance Management

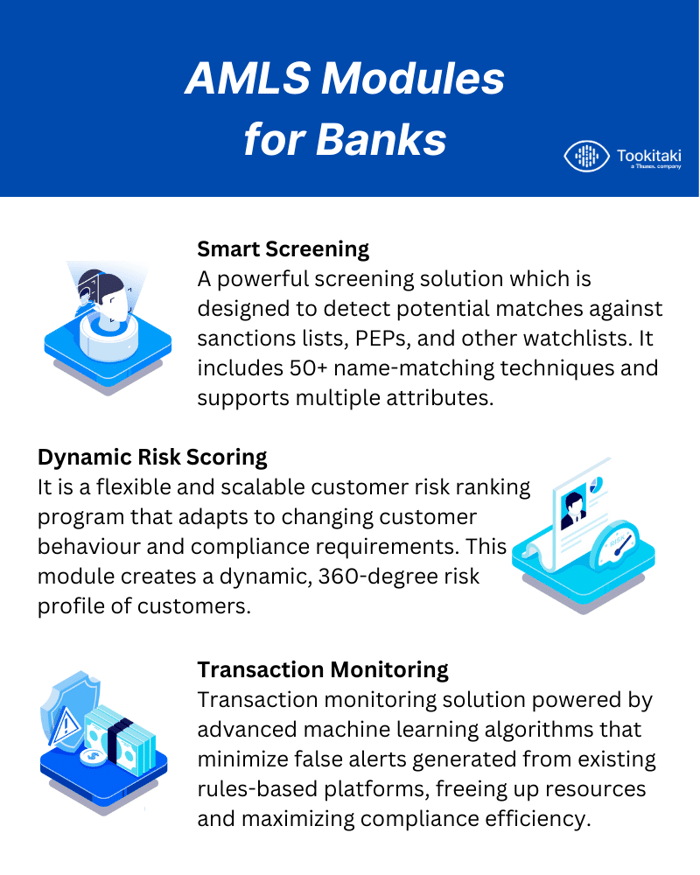

Tookitaki is a leading provider of machine learning-powered AML compliance solutions. Its solution, the Anti-Money Laundering Suite (AMLS), uses advanced algorithms to analyze data from multiple sources and identify suspicious transactions and activities within a bank with superior accuracy. The platform is designed to be flexible and scalable, allowing banks to customize it to their specific needs and requirements.

AMLS' advanced machine learning algorithms minimize false alerts generated from a bank’s existing rules-based platforms, freeing up resources and maximizing compliance efficiency. With transaction monitoring, smart screening and dynamic risk scoring modules, banks have a comprehensive view of their transactions and customers, helping them detect and prevent financial crimes.

Final Thoughts

By detecting, preventing, and mitigating the risks associated with financial crime, banks can avoid financial and reputational damage caused by regulatory fines, lawsuits, and loss of public trust. AML compliance management systems provide many advantages, including improved detection and prevention of financial crime, streamlined compliance processes, enhanced risk management, improved customer experience, and competitive advantage. Banks that implement an effective AML compliance management system can gain a competitive advantage in the market and improve their financial performance.

If you're a UAE bank looking to improve your AML compliance management and mitigate risks, Tookitaki's AML solution can help. Book a demo today to see how our platform can automate your compliance processes, reduce false positives, and enhance your risk management. Our flexible and scalable solution allows you to stay ahead of emerging risks and comply with regulations more efficiently.

Anti-Financial Crime Compliance with Tookitaki?