Singapore is known for its top-notch AML/CFT regime created through up-to-date legislation, stringent policy and uncompromising supervision to safeguard against the abuse of the city state’s financial system for criminal activities. The country’s central bank and financial regulator the Monetary Authority of Singapore (MAS) has recently published a guidance paper, setting out its “supervisory expectations of sound practices” for carrying out the vital transaction monitoring (TM) process in an efficient manner.

The paper was released after a series of thematic AML/CFT inspections related to effectiveness and efficiency of existing TM frameworks and processes. Inspections to identify the best practices and pitfalls with regard to AML/CFT programs at banks started from the fourth quarter of 2016 and continued till the second quarter of 2018. Even though the paper findings are derived from inspections at banks, yet its best practices with appropriate modifications are applicable to other financial institutions (FIs), according to the watchdog.

TM is an important process and key control in anti-money laundering and countering the financing of terrorism (AML/CFT) policies and procedures of financial institutions. They currently use various systems to monitor customers’ transactions, but the effectiveness of these systems is questionable. An effective transaction monitoring system, according to MAS, should enable FIs to detect and assess whether transactions pose suspicion when considered against customers’ respective backgrounds and profiles. In addition, it should facilitate the holistic reviews of customer transactions over periods of time to monitor for any unusual or suspicious trends/patterns that may take place. Tuning current rules-based AML systems to facilitate these features may not be impossible, but that would be one of the most painstaking jobs with the increasing volume of transactions and their associated complexity. Machine learning, which provides systems with the ability to automatically learn and improve from experience without being explicitly programmed, can be applied in this problem area. The result will be sustainable, efficient and effective compliance programs.

Notable points from MAS

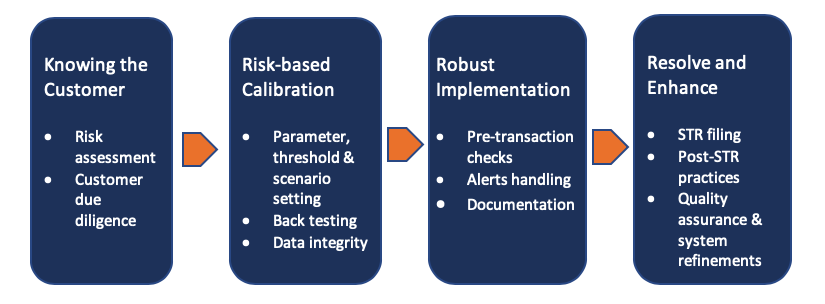

An effective transaction monitoring system should have four key elements. They are:

• A well-calibrated framework to face dynamic risks and varied and voluminous transactions

• Robust risk awareness and competent staff excising sound judgment

• Meaningful integration of TM systems and frameworks

• Active oversight by board and senior management

In short, MAS calls for a sustainable framework that can easily adapt to changing risk environment, strong governance and effective investigation process as the key pillars of an effective AML/CFT risk management program. “When properly executed, TM allows FIs to gain deeper insights into their customers’ profiles and behaviors and strengthen their risk-based allocation of resources to tackling higher risk areas,” MAS says. On the other hand, TM lapses from the part of financial institutions can be severe, “implicating these FIs and Singapore’s financial system as a refuge or conduit for illicit funds,” MAS warns.

Given below is the TM process chain proposed by MAS:

Source: MAS

If FIs are using rules-based AML systems to handle the above processes, especially the system calibration and implementation, what awaits them is an increasingly tougher task. Configuring these systems in view of specific risks, contexts and needs would be a tedious task, especially for bigger FIs with an increased volume and variance of transactions. MAS agrees that there is no one-size-fits-all approach to configuring TM rules. The watchdog cautions that FIs should ensure these rules are developed and calibrated in view of the risks they face, such as from their customer types, range of products, types of business activities, geographical exposures, cross-border nature and so forth. The cases that are given by MAS highlight the flows with regard to threshold setting at banks. In one case, the regulator found that the thresholds set by a bank for its premium and private banking segments were at least double the AUM that the bank expected these customers to have. In another case, MAS found a bank’s scenario for detecting pass-through payments to be of limited effectiveness. The scenario triggered alerts based on cumulative credit and debit amounts over a pre-defined lookback period, which could have precipitated failures by the bank in flagging potential 1:1 pass-through transactions within a predefined margin.

The central bank admits that ensuring the quality, accuracy and consistency of staff’s handling of TM alerts generated is a fundamental challenge with TM systems. While most FIs have policies and procedures in place for handling alerts and other ML/TF red flags, a consistent finding from MAS’ inspections is that FIs need to improve on the timeliness and quality of their staff’s alerts clearance and documentation. False alerts generated by current rules-based systems consume the majority of compliance analysts’ time today. Over 95% of alerts generated by these systems are closed as false positives in the first phase of review. This humongous nature of the false alerts leads to huge backlogs and massive ageing of alerts, limiting the efficiency of the staff.

Machine learning can ensure efficient TM programs

Machine learning-powered AML systems such as Tookitaki’s Anti-Money Laundering Suite (AMLS), which offers dedicated modules for transaction monitoring and name screening, can play an effective role in developing a well-calibrated framework, as regulators tighten their AML policies. A proven solution, AMLS can improve operational efficiency, mitigate the risk of money laundering and significantly reduce the cost of compliance. To address the frequent threshold tuning and scenario setting issues, AMLS uses machine learning techniques to automatically learn suspicious patterns from historical data and triage alerts into high, medium, and low-risk buckets for quick and efficient alerts disposition. The solution can reduce false alerts by 40-60% and detect new ‘suspicious’ patterns missed by the rules system.

As a concluding note, MAS is also encouraging FIs to use new technology and data analytics to improve their TM outcomes. The central bank’s encouragement for new technology can also found in its recently released Fairness, Ethics, Accountability & Transparency, or FEAT, Principles for the responsible use of artificial intelligence and data analytics. As a RegTech player, Tookitaki appreciates such positive views on new technology and believes that AI/ML can push the boundaries of current AML/CFT programs and make them effective and efficient in evolving risk environment. FIs need to look beyond the rules-based system and manual threshold tuning, as increasing and complex transactions will require processing powers beyond the human brain.

Anti-Financial Crime Compliance with Tookitaki?