Money laundering is the process of making illegally gained proceeds appear legal by channelling them through legitimate financial institutions. It is a growing threat to the financial sector, including the payment services industry in Singapore, as it facilitates criminal activities such as drug trafficking, terrorism financing, and tax evasion.

Money laundering techniques are continually evolving and becoming more sophisticated, making it challenging for traditional detection methods to keep up. Bad actors are structuring transactions to avoid reporting requirements, using multiple bank accounts or shell companies to conceal the source and destination of funds and layering funds through a series of transactions to obscure their origins.

Tookitaki's AML solutions are designed to help financial institutions, including payment service providers, combat money laundering by using advanced analytics and a community-based approach. This blog will provide an overview of how Tookitaki's AML solutions can help combat money laundering in Singapore's payment services industry.

The Payment Services Industry in Singapore

Singapore's payment services industry has seen significant growth in recent years, driven by the increasing demand for digital payment solutions. New players are entering the market regularly. According to a report by the Monetary Authority of Singapore (MAS), the total transaction value for e-payments in Singapore reached S$7.6 billion in 2020, up from S$2.26 billion in 2017. However, with growth comes increased risk, making it more critical than ever to have robust anti-money laundering (AML) procedures in place.

The payment services industry in Singapore is regulated by the Payment Services Act (PSA), which was introduced in 2020 to regulate payment service providers and ensure they have the necessary controls in place to detect and prevent money laundering. The PSA aims to strengthen the regulatory framework for payment service providers and ensure the security and resilience of Singapore's payment systems.

The payment services industry is critical to Singapore's economy as it facilitates transactions between individuals and businesses. It is crucial to combat money laundering in the industry to maintain the financial system's integrity and prevent criminal activities.

Payment services providers in Singapore must comply with the regulatory requirements set out in the PSA, which includes implementing effective AML measures to mitigate the risks of money laundering and terrorism financing. Failure to comply with the regulatory requirements can result in heavy fines and reputational damage for payment service providers.

Traditional Methods of Combating Money Laundering

Traditional methods of detecting and preventing money laundering in the payment services industry are seemingly ineffective in countering today's increasingly sophisticated and tech-enabled money laundering methods. Traditional customer due diligence, transaction monitoring, and suspicious activity reporting methods have limitations, with financial institutions struggling to keep up with the increasing volume of transactions. With stricter regulatory requirements and scrutiny, payment service providers might find it challenging to proceed with customer acquisition and expand their business while ensuring compliance.

Traditional methods of AML compliance are often time-consuming and expensive to implement. They also require manual effort and are prone to human errors, which can lead to false positives or negatives. Moreover, these methods are reactive in nature and can only detect money laundering after it has occurred.

The Emergence of Technology in Combating Money Laundering

With the rise of digital payments, payment service providers are now more vulnerable to money laundering risks. Therefore, the need for advanced and innovative solutions to combat financial crimes has become crucial.

The emergence of technology has provided an opportunity to combat money laundering more effectively in the payment services industry. Technology has revolutionised the way money laundering is detected and prevented. New-age regulatory technology (Regtech) providers can help detect and prevent money laundering by quickly identifying suspicious patterns and behaviours. By automating many existing AML compliance workflows, payment service providers can reduce the risk of human error and free up resources for other critical tasks.

Technologies such as Artificial Intelligence (AI) and Machine Learning (ML) can analyse large volumes of data and detect patterns that may indicate suspicious activity. These technologies can also learn from past transactions and adapt to new risks, making them more effective over time. Data analytics can help payment service providers to identify patterns and trends in transaction data, enabling them to detect suspicious activity more quickly and accurately.

The use of technology in combating money laundering has many advantages. It is faster, more accurate, and less expensive than traditional methods. It can also reduce false positives and negatives and provide real-time alerts to prevent illicit transactions from occurring. With the help of advanced technologies, payment service providers can stay ahead of money launderers and protect their businesses.

Tookitaki's AML Solutions for the Payment Services Industry in Singapore

Tookitaki is a global leader in financial crime prevention, dedicated to building a safer and more secure world through innovative technology, strategic collaboration, and a distinctive community-based approach. Since its inception in 2015, it has been on a mission to transform the battle against financial crime by dismantling siloed AML approaches and uniting the community through its groundbreaking Anti-Money Laundering Suite (AMLS) and Anti-Financial Crime (AFC) Ecosystem.

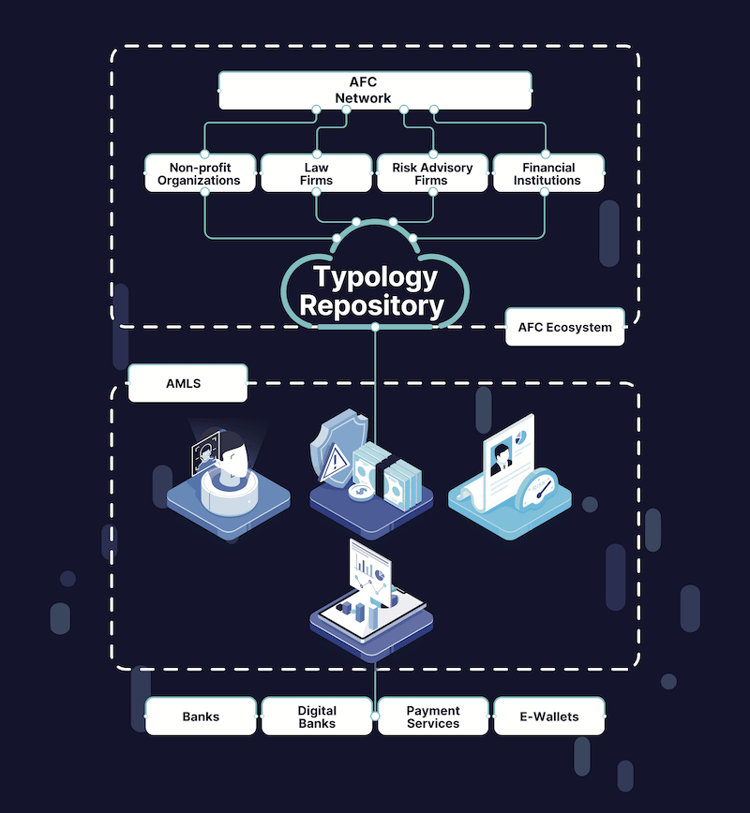

The AFC Ecosystem is a community-based platform that facilitates sharing of information and best practices in the battle against financial crime. Powering this ecosystem is the Typology Repository, a living database of money laundering techniques and schemes. This repository is enriched by the collective experiences and knowledge of financial institutions, regulatory bodies, and risk consultants worldwide, encompassing a broad range of typologies from traditional methods to emerging trends.

The AMLS is an end-to-end operating system that modernises compliance processes for banks and fintechs, providing comprehensive risk coverage, enhanced detection accuracy, and significantly reduced false alerts. The AMLS collaborates with the AFC Ecosystem through federated machine learning. This integration allows the AMLS to extract new typologies from the AFC Ecosystem, executing them at the clients' end to ensure their AML programs remain cutting-edge.

The AMLS also includes the following useful modules that can address various AML compliance processes of payment service providers in Singapore.

- Transaction Monitoring: The Transaction Monitoring module is designed to detect suspicious patterns of financial transactions that may indicate money laundering or other financial crimes. It utilises powerful simulation modes for automated threshold tuning, allowing AML teams to focus on the most relevant alerts and improve their efficiency. The module also includes a built-in sandbox environment, which allows financial institutions to test and deploy new typologies in a matter of minutes. This feature enables AML teams to quickly adapt to new money laundering techniques and stay ahead of the criminals.

- Smart Screening: The Smart Screening module detects potential matches against sanctions lists, PEPs, and other watchlists. It includes 50+ name-matching techniques and supports multiple attributes such as name, address, gender, date of birth, and date of incorporation. It covers 20+ languages and ten different scripts and includes a built-in transliteration engine for effective cross-lingual matching. This module is highly configurable, allowing it to be tailored to the specific needs of each financial institution.

- Dynamic Risk Scoring: The Dynamic Risk Scoring solution is a flexible and scalable customer risk ranking program that adapts to changing customer behaviour and compliance requirements. This module creates a dynamic, 360-degree risk profile of customers. It enables financial institutions to uncover hidden risks and opens up new business opportunities.

- Case Manager: The Case Manager provides compliance teams with the platform to collaborate on cases and work seamlessly across teams. It comes with a host of automation built to empower investigators. Financial institutions can configure the Case Manager to automate case creation, allocation, data gathering, and so on, allowing investigators to become more effective.

Tookitaki's unique community-based approach and cutting-edge technology empower financial institutions to effectively detect, prevent, and combat money laundering and related criminal activities, resulting in a sustainable AML program.

Final Thoughts

The payment services industry in Singapore is highly regulated, and payment service providers must take measures to combat money laundering. Non-compliance can have severe consequences for payment service providers, including fines, reputational damage, and loss of business. Traditional methods of combating financial crimes are still prevalent, but the emergence of technology has opened up new opportunities to enhance the effectiveness of AML programs.

With Tookitaki's AML solutions, payment service providers can leverage technology to mitigate money laundering risks and comply with regulatory requirements. Tookitaki's solutions can identify and mitigate money laundering risks, reducing financial crime risk. To learn more about how Tookitaki's AML solutions can help your payment services business, contact us today to book a demo.

Anti-Financial Crime Compliance with Tookitaki?