Compliance and financial crime prevention are vital components of the financial industry. Ensuring that financial institutions comply with regulations and prevent financial crimes such as money laundering and fraud is critical for maintaining the financial system's integrity. Traditional compliance and financial crime prevention methods involve a large amount of manual work and can be time-consuming and costly.

Automated compliance solutions can help financial institutions to address these challenges and achieve greater efficiency, accuracy, and cost-effectiveness in their compliance programs. In this blog, we will discuss the benefits of automated compliance solutions and how they can help financial institutions to prevent financial crimes. We will also explore Tookitaki's Anti-Money Laundering Suite (AMLS) solution and its unique features that make it a valuable tool for financial crime prevention.

Challenges in Traditional Compliance Approaches

Traditional approaches to compliance and financial crime prevention, while effective, are often limited in their ability to keep up with the fast-paced nature of the financial industry. They face several challenges in the current financial landscape.

- Firstly, there is a surge in regulatory pressure, which is causing financial institutions to divert more resources towards compliance efforts.

- Secondly, the increased digitalisation of financial services has created more complex challenges, especially in higher-risk operations.

- Thirdly, different regulators have different views on what is acceptable in risk prevention, adding to compliance challenges.

Moreover, manual workflows at banks and other financial institutions create several challenges such as delays, errors, and inconsistencies in processes, which can lead to potential compliance violations. As more and more banks and financial institutions move towards digitalisation, compliance challenges become more complex. The rise of fintech companies, e-wallets, payment services and digital banks creates a need for automation that traditional approaches cannot provide.

The limitations of traditional compliance approaches highlight the need for innovative solutions that can meet the growing demand for automation in financial crime prevention. Financial institutions must implement automated compliance solutions that reduce manual workflows and increase efficiency and effectiveness in compliance and financial crime prevention.

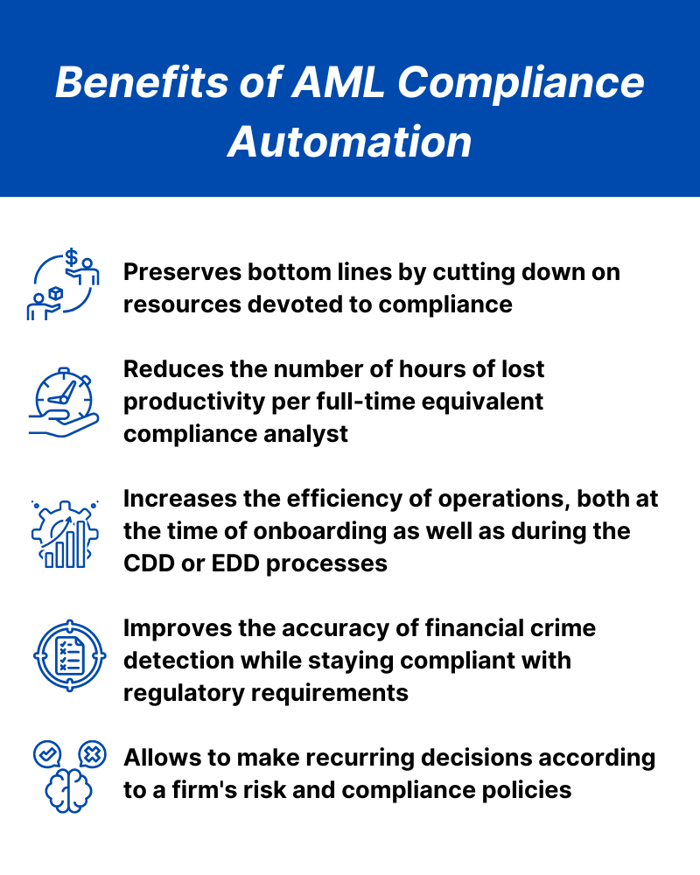

Benefits of Automated Compliance Solutions

Automation has become an increasingly important tool for financial institutions, providing various benefits, including efficiency improvements and cost reductions. A report by PwC found that automation technologies have matured and are being validated with mainstream adoption across many financial institutions, with material 30% to 40% efficiency improvements observed in some organisations.

Automated compliance solutions are also becoming increasingly popular in the financial industry due to their numerous benefits. One of the most significant advantages of these solutions is increased efficiency. Manual compliance processes can be time-consuming and prone to errors, leading to delays and additional costs. Automated solutions, on the other hand, can reduce the need for manual intervention and speed up the compliance process. This can lead to faster onboarding, more accurate risk assessments, and improved customer experience.

Another key benefit of automated compliance solutions is increased effectiveness in financial crime prevention. These solutions leverage advanced technologies such as machine learning to analyse large volumes of data and identify potential risks and anomalies. This can help banks and financial institutions to detect suspicious activity and prevent financial crimes such as money laundering, terrorist financing, and fraud. By automating compliance processes, financial institutions can also reduce the risk of regulatory fines and reputational damage.

Automated compliance solutions can also provide greater visibility and control over compliance processes. These solutions can generate real-time alerts and reports, allowing compliance teams to respond quickly to potential risks and incidents. This can also help ensure compliance processes are standardised and consistently applied across different business units and geographies.

Overall, automated compliance solutions can provide numerous benefits for financial institutions. Increasing efficiency, improving effectiveness, and providing greater visibility and control over compliance processes can help mitigate risks and ensure compliance with regulatory requirements.

AMLS Solution by Tookitaki

The Anti-Money Laundering Suite (AMLS) by Tookitaki is a proprietary end-to-end solution that modernises compliance processes for banks and fintechs. This compliance solution allows financial institutions to take a more holistic approach to managing risk and combating financial crime. It is an enterprise-wide solution built around three core modules: screening, risk scoring and transaction monitoring.

AMLS automates alerts triage, customer due diligence and enhanced due diligence reviews. This allows compliance teams to focus their efforts on high-risk customers and transactions rather than spending valuable time manually reviewing false positives.

Automation within AMLS Modules

- Smart Screening: It automatically generates risk indicators based on matching configurations and generates threshold values for rules eliminating the need of manual threshold tuning.

- Customer Risk Scoring: This module enables continuous, on demand and accurate customer risk scoring of the customer based on an automated scoring mechanism which learns from incremental data changes.

- Transaction Monitoring: This module has an automated threshold tuning feature that reduces the manual effort involved in threshold tuning by over 70%. Separately, it provides a simulation mode that automatically generates risk indicators and respective thresholds based on ingested typologies. It also features an automated UI-driven scenario testing through run instances.

- Case Manager: This module provides compliance teams with a platform to collaborate on cases and work seamlessly across teams, be it transaction monitoring, customer due diligence or screening. It comes with a host of ingenious automation built to empower your investigators. Users can configure the Case Manager to automate processes such as case creation, allocation, data gathering, etc., allowing investigators to become more effective.

Learn More: CFT Compliance in Hong Kong

Automate Your Compliance Efforts with Tookitaki's AMLS Solution

In conclusion, traditional approaches to compliance and financial crime prevention have their limitations and challenges. However, automated compliance solutions like Tookitaki's AMLS offer a range of benefits, including increased efficiency, effectiveness, and accuracy. AMLS enables financial institutions to automate various manual tasks and customise the solution to meet their specific compliance needs. We urge financial institutions to book a demo for AMLS to take their compliance and financial crime prevention efforts to the next level.

Anti-Financial Crime Compliance with Tookitaki?